FREDERICTON – New Brunswick‘s finance minister says the province recorded a surplus of $500.8 million for the fiscal year that ended in March.

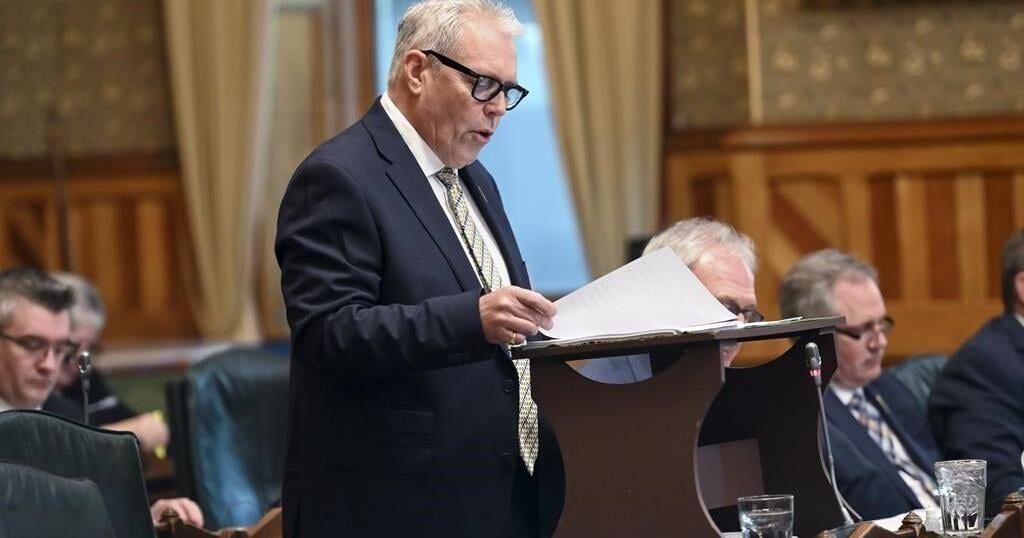

Ernie Steeves says the amount — more than 10 times higher than the province’s original $40.3-million budget projection for the 2023-24 fiscal year — was largely the result of a strong economy and population growth.

The report of a big surplus comes as the province prepares for an election campaign, which will officially start on Thursday and end with a vote on Oct. 21.

Steeves says growth of the surplus was fed by revenue from the Harmonized Sales Tax and federal money, especially for health-care funding.

Progressive Conservative Premier Blaine Higgs has promised to reduce the HST by two percentage points to 13 per cent if the party is elected to govern next month.

Meanwhile, the province’s net debt, according to the audited consolidated financial statements, has dropped from $12.3 billion in 2022-23 to $11.8 billion in the most recent fiscal year.

Liberal critic René Legacy says having a stronger balance sheet does not eliminate issues in health care, housing and education.

This report by The Canadian Press was first published Sept. 16, 2024.