Investment

Mining Investment Opportunities in Africa – Africa Global Funds

Mining Investment Opportunities in Africa

Word count: 862

The largely untapped and unrealized potential that Africa is blessed with has been a magnet that has attracted and continues to attract mining investors to the continent.

The spotlight has been firmly focused on Ghana after it was crowned the largest gold producer in Africa in 2019. The predictions for gold production are not waning and it is expected that the production will not only meet but exceed this peak principally due to AngloGold Ashanti’s 30 million ounce mine being restarted and the continuation of production even during the ominous Covid-19 pandemic.

From a regulatory view, the Government of Ghana’s attention has been concentrated on the Minerals Income Investment Fund that allows for the creation of a fund to receive and invest royalties received from mineral resources. The royalties received are envisaged to be invested through a somewhat contested special purpose vehicle, Agyapa Royalties Ltd, that is anticipated to be listed on the London Stock Exchange.

South Africa has consistently been recognized as a key contributor to the mining sector in Africa and it was noted that South Africa not only weathered the Covid-19 storm impressively but also proved to be resilient in the face of the worldwide adversity. It was recorded that the total revenue generated by the South African mining industry for the year ending June 30, 2020 grew by 4% with gold mining companies enjoying an increase of 35% in revenue. Chrome, iron ore, platinum and manganese have all seen prices either holding or increasing – notably iron ore.

In an effort to enable the mining industry to better plan for its future, the South African Government implemented the Broad-Based Socio Economic Empowerment Charter for the Mining and Minerals Industry in 2018. The law governing mining in South Africa has otherwise not undergone any material changes with the most noteworthy being the Amendments to the Mineral and Petroleum Resources Development Regulations.

The Democratic Republic of Congo’s mining legislation, on the other hand, has undergone an immense transformation with the promulgation of the new mining code in March 2018. The codes’ most significant modifications relate to the reduced duration for which an exploration permit and mining permit are granted. The concept of “strategic substances” has also been introduced with taxes ranging from 2% to 10% being imposed for this genre of substances. Furthermore, a royalty of 10% must be paid to a fund that is dedicated to future generations. With regard to contractors, the codes contain requirements that make it mandatory for the contractors to be Congolese and owned by Congolese shareholders includes reference to cobalt which is used in electric batteries; coltan which is to power electronic devises and germanium which is necessary in making transistors. While the new regime may seem onerous, it should be borne in mine that these strategic substances found in the DRC are not readily available in other areas and the demand for these substances are growing. Having regard to this, compliance with the requirements may be well worth the effort.

In Zimbabwe, platinum and platinum group metals are taking center stage with Great Dyke Investments (GDI) opening a $500m platinum mine in Darwendale. Together with the Zimplats and Unki mines, the GDI mine is projected to assist Zimbabwe in reaching its $12bn mining industry by 2023. Despite its infamous challenges, Zimbabwe (with the second greatest chrome and platinum resource in the world after South Africa) and appears to be emerging as a potential source of investment in Africa.

Appropriately, Zimbabwe repealed its outdated mining laws and introduced new mining legislation in 2018 in an attempt to lure investors. While revised law prevents foreign entities from having a majority shareholding in a mining operation, this restriction does not apply to diamond and platinum mining operations.

Similarly, Tanzania recently overhauled its mining legislation, however, this overhaul was primarily aimed at increasing state revenues from natural resources. In 2017, Tanzania banned the export of unprocessed ores and imposed a 1% clearing fee on all minerals exported from the country, a requirement for the Tanzanian Government to own at least 16% in all mining projects.

Tanzania enjoys fourth place in terms of gold production in Africa and has deposits of rare-earth metals, iron ore and gemstones.

In compliance with this legislation, the Tanzanian Government had a 16% stake in a joint venture with Barrick Gold Corp. and received a dividend of $40m from the arrangement. Expectedly and in accordance with the amended laws, the Tanzanian Government will base all future arrangements with major mining companies on the Barrick model and this will include AngloGold Ashanti Ltd.

Mali, as Africa’s third largest gold producer, has followed suit and proposed its new but unenforced Mining Code. The draft Mining Code is believed to introduce a number of changes including placing an obligation on the titleholder to contribute to two new mining funds, a Local Development Mining Fund and a Fund for the Financing of Geological and Mining Research, with an amount equal to 0.25% of the monthly turnover before tax or the value of the products extracted during the month in question being contributed to the former fund.

Investment

3 Stocks to Invest $30,000 in Right Now – Yahoo Finance

Tech stocks have a long reputation for providing consistent and significant gains over the long term, proven by the Nasdaq-100 Technology Sector’s 395% rise over the last 10 years.

The industry’s ever-expanding nature is driven by reliable demand for upgrades to various hardware and software products. So, it’s unsurprising that investing mogul Warren Buffett’s holdings company, Berkshire Hathaway, has dedicated more than 40% of its portfolio to tech stocks. Meanwhile, Berkshire’s holdings posted a compound annual gain of nearly 20% between 1965 and 2023.

As a result, it could be worth following suit and making a sizable long-term investment in the high-growth sector. So, here are three stocks to invest $30,000 in right now — $10,000 for each.

1. Advanced Micro Devices

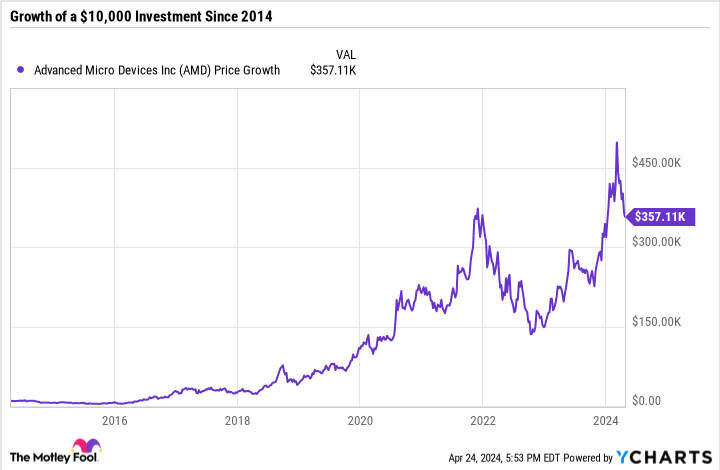

Advanced Micro Devices (NASDAQ: AMD) business has exploded over the last decade, taking on a leading role in the chip market.

A decade ago, the company was on the brink of bankruptcy, bleeding money alongside mounting debt. Then, in 2014, Lisa Su became AMD’s CEO, triggering one of the most impressive turnarounds in the tech market’s history.

The launch of its Ryzen line of central processing units (CPUs) in 2017 has been a major growth catalyst, with AMD’s CPU market share rising from 18% in the first quarter of 2017 to 33% in 2024. The company has gradually chipped away Intel‘s share, which fell from 82% to 64% in the same period.

Shares in AMD have soared 3,500% over the last 10 years. As a result, an investment of $10,000 in AMD’s stock in 2014 would be worth more than $357 billion today.

Of course, past growth doesn’t always indicate what’s to come. However, the company has an exciting outlook that could deliver major gains over the next 10 years. AMD is investing heavily in artificial intelligence (AI), launching new AI graphics processing units (GPUs) this year and investing in AI personal computers.

The AI market hit nearly $200 billion last year and is projected to reach nearly $2 trillion by 2030. Alongside positions in other areas of tech, such as cloud computing, video games, and consumer PCs, AMD will likely continue benefiting from the tailwinds of tech for years.

Consequently, an investment of $10,000 in AMD’s stock over the next decade could deliver significant gains.

2. Amazon

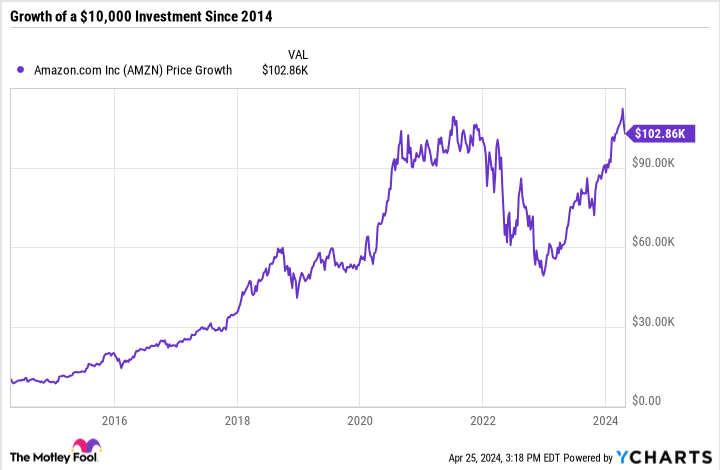

It’s impossible to deny Amazon‘s (NASDAQ: AMZN) potent role in tech. Thanks to its popular e-commerce site, the company has built up immense brand loyalty worldwide. Amazon’s retail site is available in over 20 countries and ships to more than 100 nations.

The success of Amazon’s e-commerce business has seen annual revenue climb 546% since 2014, with operating income skyrocketing by more than 20,000%.

Amazon’s meteoric rise is primarily owed to its lucrative Prime membership. Its subscription-based model bundles multiple services, including free expedited shipping on its retail site, video streaming, music, gaming, and more. Including multiple services makes consumers less likely to unsubscribe, leading to a global subscriber count above 230 million.

Shares in Amazon have risen 926% since 2014, meaning an investment of $10,000 back then would be worth over $102,000 today. And the company could potentially beat that growth over the next 10 years.

In addition to consistent retail growth, Amazon is rapidly expanding in AI and cloud computing. On April 25, the company announced plans to invest $11 billion to build data centers in Indiana to grow Amazon Web Services (AWS).

The company is on a promising growth path, and if you have the means, it could be worth an investment of $10,000 this month. However, a smaller investment is still worth considering.

3. Apple

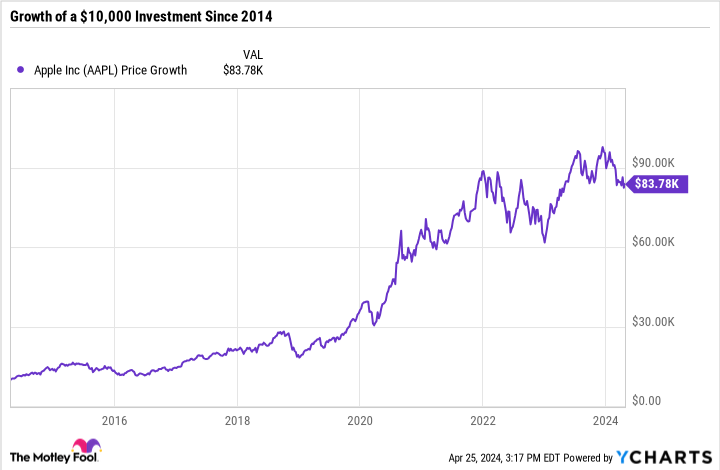

Apple (NASDAQ: AAPL) is easily one of the most successful companies in tech history. Its market cap of $2.6 billion makes it the world’s second-most-valuable company (only after Microsoft). Meanwhile, Apple’s vast and loyal user base has allowed it to achieve leading market shares in multiple product categories.

However, the company has stumbled over the last year. Macroeconomic headwinds led to repeated quarters of revenue declines in 2023. Apple’s Q1 2024 seemed to break the streak, with revenue rising 2% year over year.

Meanwhile, the tech giant’s free cash flow hit $107 billion, significantly more than Microsoft, Amazon, or Alphabet. The considerable difference could suggest Apple is best equipped to keep investing in its business and come back strong in the coming years.

Apple’s stock has increased by 738% over the last decade. Consequently, a $10,000 investment in its shares 10 years ago would be worth nearly $84,000 today.

Moreover, like AMD and Amazon, Apple is taking on AI head-on. Over the last year, the company has gradually added AI-driven features across its product range, with plans to overhaul its MacBook lineup to focus on AI. The company also recently acquired French AI company Datakalab, which specializes in on-device processing.

Apple’s dominating role in tech and exciting outlook could make it worth investing $10,000 in its stock, with plans to hold for at least a decade.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, and Microsoft. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

3 Stocks to Invest $30,000 in Right Now was originally published by The Motley Fool

Investment

Here's How Much a $1,000 Investment in Intel Stock 10 Years Ago Would Be Worth Today – Yahoo Canada Finance

Given Intel’s household name and status on the Dow Jones Industrial Average for a quarter century, you’d think it would have turned in a superstar performance over the last decade.

It hasn’t.

Check Out: 401(k) Growth Potential: Ways to Double Your Savings in 10 Years

Read Next: 7 Unusual Ways To Make Extra Money (That Actually Work)

So how did this one-time tech darling go so far astray from expectations? And if you had invested $1,000 in it a decade ago, how much would you have today?

A Decade of Haphazard Growth

Ten years ago, Intel closed at $26.95. As of this writing, it’s trading at $35.57.

ADVERTISEMENT

If you’re not a math whiz, that comes to a 31.98% total gain, or 3.19% average annual returns.

Oh, and if we’d had this conversation around a year ago in March 2023, Intel would have no gains at all to discuss.

Sure, Intel pays a dividend on top of that price growth. But that dividend yield has trended downward over the last decade, dropping by more than half from 3.47% to around 1.39% today. That’s not nothing — but it’s not a lot, either.

Meanwhile, if you’d invested in SPY (an index fund tracking the S&P 500), you’d be sitting pretty on a 169.15% increase in price. That comes to an average annual return of around 16.91%, not including a dividend yield that has averaged around 2% over the last decade (similar to Intel).

If you’d invested $1,000 in Intel a decade ago, you’d have bought 37.11 shares in INTC. Today those shares would be worth a whopping $1,319.85. For comparison, an investment in SPY would be worth more than twice that at $2,690.55.

Intel: Past, Present, Future

While still dominant in central processing units (CPUs) for servers and computers, Intel has been gradually losing market share to rivals like Advanced Micro Devices (AMD) and Nvidia for a while now.

Intel has suffered operational delays, executive miscues, and perhaps worst of all, missed opportunities. They famously missed out on the massive mobile device processing market. And today, they’ve fallen behind in the artificial intelligence chip race as well.

In a world that will need vast new new data processing farms to accommodate the boom in AI, Intel won’t become irrelevant any time soon. But that doesn’t mean they’re poised for a comeback either. Their competitors look far more competent in today’s technology race, and there’s little evidence that Intel has an ace up its sleeve to recover lost ground.

Read Next: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Investor beware.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Here’s How Much a $1,000 Investment in Intel Stock 10 Years Ago Would Be Worth Today

Investment

Is it too late to invest in the gold rush? – Financial Times

Standard Digital

Weekend Print + Standard Digital

$75 per month

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

-

Business3 hours ago

Anglo rejects “opportunistic” $39bn takeover bid from BHP – MINING.com

-

Economy14 hours ago

Hedge Funds Trim Bets on Oil as US Economic Data Restrain Prices – BNN Bloomberg

-

Science20 hours ago

Science20 hours agoMars probe spots "spider" shapes in Martian Inca City – Salon

-

Business9 hours ago

Gold price holding above $2350 as U.S. annual core PCE rises 2.8% in March – Kitco NEWS

-

Sports24 hours ago

Scenes from morning skate LIVE in Nashville: Canucks looking for top guns to break out in Game 3 vs Preds – Canucks Army

-

News23 hours ago

Alberta is the 4th-happiest province in Canada: study – Global News

-

Politics18 hours ago

Politics18 hours agoSophie Gregoire Trudeau on new book, split with Justin Trudeau – CTV News

-

Politics16 hours ago

Politics16 hours agoPoilievre visits convoy camp, claims Trudeau is lying about 'everything' – CBC.ca