Indian Railways, a government entity, announced an increase in ticket prices in December. Its eroding finances apparently left it no choice. Complaints about rising air fares have been circulating since the collapse of Jet Airways last April. India’s mobile-phone operators have raised tariffs sharply after losing a court battle with the government over licence fees and spectrum charges. Despite a collapse in sales, vehicle prices are rising, a result of costly new regulations. Rajiv Bajaj, managing director of Bajaj Auto, a motorcycle-maker, has complained that the government “is killing the industry”.

Economy

India’s economy risks swapping stagnation for stagflation – The Economist

MUMBAI’S CHEFS were quick to spot the latest threat facing India’s economy. As they foraged for ingredients in Crawford market, where hawkers sell fruit, vegetables and other kitchen staples, they began hearing prices quoted not per kilogram, but per quarter-kilo—a forlorn attempt to mask price increases. Returning from a recent shopping spree, one prominent chef checked off the items rising sharply in price: tomatoes, cabbages, aubergines, fish, spices—almost every ingredient, in fact, in the Indian cookbook.

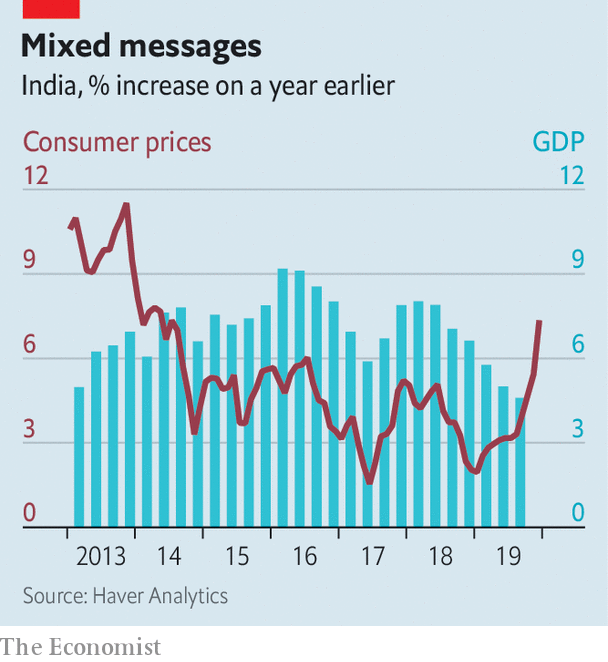

The hawkers had some plausible excuses. The weather has been erratic, and delivery systems unreliable. But although an increase in inflation was widely foreseen, the severity of it was not. Consumer prices rose by over 7.3% in December, compared with a year earlier, the biggest jump since July 2014. Onion prices, up by 328%, contributed 2.1 percentage points to the headline figure all by themselves.

But India’s inflation is not only or everywhere an onion phenomenon. A Mumbai tea-vendors’ association recently recommended a price rise because of the increased cost of sugar and tea leaves, as well as the gas that fuels vendors’ stoves. The National Pharmaceutical Pricing Authority allowed sharply higher charges for 21 drugs, including treatments for leprosy, malaria and tuberculosis, which were in short supply because prices had failed to cover rising costs.

This miscellany of misery will complicate the government’s efforts to fight an economic slowdown. India’s GDP grew by only 4.5% in the third quarter compared with a year earlier. That figure would have been as low as 3.1% were it not for a hurried government-spending spree. Yet another splurge is expected in the budget on February 1st. But any increase in demand could prompt an offsetting response from the Reserve Bank of India (RBI), the central bank. It may choose to prolong stagnation so as to avoid the uglier scenario of stagflation.

Stagflation usually begins with a setback to supply, such as India’s unseasonal rains. These misfortunes both lower output (the “stag” part of the phenomenon) and lift costs (the “flation” part). But once prices have increased sufficiently to reflect the scarcer supply, they should in principle stop rising. Some economists expect inflation to begin falling as soon as February. After all, core inflation, which excludes food and fuel prices, remains below 4%.

The problem is that before inflation disappears, Indians may start believing it will stay, making it more likely to persist. In most rich countries that have adopted inflation-targeting, headline inflation usually falls back into line with core measures, which reflect the strength of demand better. But in India the opposite is true. Core inflation usually converges towards the headline number, which reflects more accurately the drain on people’s pockets.

The RBI’s inflation-targeting framework, which it adopted in 2015, was supposed to fight this tendency. It was meant to convince people that the central bank’s inflation target of 4% was a better guide to future inflation than the prices quoted at Crawford market and other emporiums across the country. But the framework has “yet to be fully tested”, according to a recent lecture by Raghuram Rajan, the former RBI governor who introduced it. Mumbai’s chefs will hope it passes the thorough examination it will now undergo.■

This article appeared in the Finance and economics section of the print edition under the headline “India’s economy risks swapping stagnation for stagflation”

Economy

B.C.’s debt and deficit forecast to rise as the provincial election nears

VICTORIA – British Columbia is forecasting a record budget deficit and a rising debt of almost $129 billion less than two weeks before the start of a provincial election campaign where economic stability and future progress are expected to be major issues.

Finance Minister Katrine Conroy, who has announced her retirement and will not seek re-election in the Oct. 19 vote, said Tuesday her final budget update as minister predicts a deficit of $8.9 billion, up $1.1 billion from a forecast she made earlier this year.

Conroy said she acknowledges “challenges” facing B.C., including three consecutive deficit budgets, but expected improved economic growth where the province will start to “turn a corner.”

The $8.9 billion deficit forecast for 2024-2025 is followed by annual deficit projections of $6.7 billion and $6.1 billion in 2026-2027, Conroy said at a news conference outlining the government’s first quarterly financial update.

Conroy said lower corporate income tax and natural resource revenues and the increased cost of fighting wildfires have had some of the largest impacts on the budget.

“I want to acknowledge the economic uncertainties,” she said. “While global inflation is showing signs of easing and we’ve seen cuts to the Bank of Canada interest rates, we know that the challenges are not over.”

Conroy said wildfire response costs are expected to total $886 million this year, more than $650 million higher than originally forecast.

Corporate income tax revenue is forecast to be $638 million lower as a result of federal government updates and natural resource revenues are down $299 million due to lower prices for natural gas, lumber and electricity, she said.

Debt-servicing costs are also forecast to be $344 million higher due to the larger debt balance, the current interest rate and accelerated borrowing to ensure services and capital projects are maintained through the province’s election period, said Conroy.

B.C.’s economic growth is expected to strengthen over the next three years, but the timing of a return to a balanced budget will fall to another minister, said Conroy, who was addressing what likely would be her last news conference as Minister of Finance.

The election is expected to be called on Sept. 21, with the vote set for Oct. 19.

“While we are a strong province, people are facing challenges,” she said. “We have never shied away from taking those challenges head on, because we want to keep British Columbians secure and help them build good lives now and for the long term. With the investments we’re making and the actions we’re taking to support people and build a stronger economy, we’ve started to turn a corner.”

Premier David Eby said before the fiscal forecast was released Tuesday that the New Democrat government remains committed to providing services and supports for people in British Columbia and cuts are not on his agenda.

Eby said people have been hurt by high interest costs and the province is facing budget pressures connected to low resource prices, high wildfire costs and struggling global economies.

The premier said that now is not the time to reduce supports and services for people.

Last month’s year-end report for the 2023-2024 budget saw the province post a budget deficit of $5.035 billion, down from the previous forecast of $5.9 billion.

Eby said he expects government financial priorities to become a major issue during the upcoming election, with the NDP pledging to continue to fund services and the B.C. Conservatives looking to make cuts.

This report by The Canadian Press was first published Sept. 10, 2024.

Note to readers: This is a corrected story. A previous version said the debt would be going up to more than $129 billion. In fact, it will be almost $129 billion.

The Canadian Press. All rights reserved.

Economy

Mark Carney mum on carbon-tax advice, future in politics at Liberal retreat

NANAIMO, B.C. – Former Bank of Canada governor Mark Carney says he’ll be advising the Liberal party to flip some the challenges posed by an increasingly divided and dangerous world into an economic opportunity for Canada.

But he won’t say what his specific advice will be on economic issues that are politically divisive in Canada, like the carbon tax.

He presented his vision for the Liberals’ economic policy at the party’s caucus retreat in Nanaimo, B.C. today, after he agreed to help the party prepare for the next election as chair of a Liberal task force on economic growth.

Carney has been touted as a possible leadership contender to replace Justin Trudeau, who has said he has tried to coax Carney into politics for years.

Carney says if the prime minister asks him to do something he will do it to the best of his ability, but won’t elaborate on whether the new adviser role could lead to him adding his name to a ballot in the next election.

Finance Minister Chrystia Freeland says she has been taking advice from Carney for years, and that his new position won’t infringe on her role.

This report by The Canadian Press was first published Sept. 10, 2024.

The Canadian Press. All rights reserved.

Economy

Nova Scotia bill would kick-start offshore wind industry without approval from Ottawa

HALIFAX – The Nova Scotia government has introduced a bill that would kick-start the province’s offshore wind industry without federal approval.

Natural Resources Minister Tory Rushton says amendments within a new omnibus bill introduced today will help ensure Nova Scotia meets its goal of launching a first call for offshore wind bids next year.

The province wants to offer project licences by 2030 to develop a total of five gigawatts of power from offshore wind.

Rushton says normally the province would wait for the federal government to adopt legislation establishing a wind industry off Canada’s East Coast, but that process has been “progressing slowly.”

Federal legislation that would enable the development of offshore wind farms in Nova Scotia and Newfoundland and Labrador has passed through the first and second reading in the Senate, and is currently under consideration in committee.

Rushton says the Nova Scotia bill mirrors the federal legislation and would prevent the province’s offshore wind industry from being held up in Ottawa.

This report by The Canadian Press was first published Sept. 10, 2024.

The Canadian Press. All rights reserved.

-

Sports24 hours ago

Sports24 hours agoCanada’s Stakusic, partner Savinykh lose in doubles quarterfinals at Guadalajara Open

-

News4 hours ago

News4 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News3 hours ago

News3 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News4 hours ago

News4 hours agoNova Scotia adopts bill declaring domestic violence in the province an epidemic

-

News13 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News14 hours ago

News14 hours agoReggie Bush was at his LA-area home when 3 male suspects attempted to break in

-

News3 hours ago

News3 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News14 hours ago

News14 hours agoCanadanewsmedia news September 12, 2024: Air Canada pilot strike looms, BC transit strike talks resume