WASHINGTON – Donald Trump’s second administration is filling up with some of his most loyal supporters and many of the people landing top jobs have been critical of Prime Minister Justin Trudeau and security at Canada’s border.

One expert says there are not many Canadian allies, so far, in the president-elect’s court.

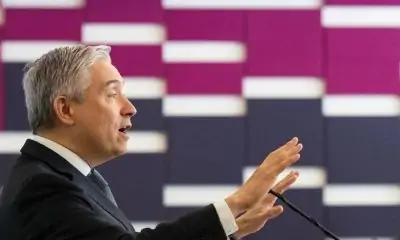

“I don’t see a whole lot of friends of Canada in there,” said Fen Hampson, a professor of international affairs at Carleton University in Ottawa and co-chair of the Expert Group on Canada-U.S. Relations.

As the Republican leader starts making crucial decisions about his administration, designations for foreign policy and border positions have sent signals to Canada, and the rest of the world, about America’s path forward.

Trump campaigned on imposing a minimum 10 per cent across-the-board import tariff. A Canadian Chamber of Commerce report suggests that would shrink the Canadian economy, resulting in around $30 billion per year in economic costs.

The president-elect is also critical of giving aid to Ukraine in its war against Russian aggression and has attacked the United Nations, both things the Liberal government in Canada strongly backs.

Trump tapped Mike Waltz to be national security adviser amid increasing geopolitical instability, saying in a statement Tuesday that Waltz “will be a tremendous champion of our pursuit of Peace through Strength!”

Waltz, a three-term congressman from Florida, has repeatedly slammed Trudeau on social media, particularly for his handling of issues related to China.

He also recently weighed in on the looming Canadian election, posting on X that Conservative Leader Pierre Poilievre was going to “send Trudeau packing in 2025” and “start digging Canada out of the progressive mess it’s in.”

Like Trump, Waltz has been critical of NATO members that don’t meet defence spending targets — something Canada is not doing, and won’t do for years.

Trudeau promised to meet the target of spending the equivalent of two per cent of GDP on defence by 2032.

Immigration and border security were a key focus for Republicans during the election and numerous key appointees have their eyes to the north.

It’s been reported that Florida Sen. Marco Rubio, a vocal critic of China, is expected to be named Secretary of State.

Rubio has pointed to concerns at the Canada-U.S. border. He recently blasted Canada’s move to accept Palestinian refugees, claiming “terrorists and known criminals continue to stream across U.S. land borders, including from Canada.”

Trump’s choice for ambassador to the United Nations, New York Congresswoman Elise Stefanik, has also focused on the border with Canada.

Stefanik, as a member of the Northern Border Security Caucus, called for Homeland Security to secure the border, claiming there had been an increase in human and drug trafficking.

“We must protect our children from these dangerous illegal immigrants who are pouring across our northern border in record numbers,” she posted on X last month.

Stefanik has little foreign policy experience, but Trump described her as a “smart America First fighter.” She repeatedly denounced the UN, saying the international organization is antisemitic for its criticism of Israel’s bombardment of Gaza.

U.S. media reports say longtime Trump loyalist Kristi Noem, South Dakota’s governor, has been chosen to run Homeland Security. She was on the shortlist to be vice-president until controversy erupted over an anecdote in her book about shooting a dog.

“She doesn’t seem to have very warm feelings (toward Canada),” Hampson said

Last year, she claimed to be having conversations with a Canadian family-owned business looking to relocate to her state because of COVID-19 pandemic restrictions.

But Noem has also said that the Canada-U.S.-Mexico Agreement, negotiated under the first Trump administration, was “a major win.”

The trilateral agreement is up for review in 2026.

Robert Lighthizer, Trump’s former trade representative , has been an informal adviser for the president-elect’s transition and Deputy Prime Minister Chrystia Freeland said they remain in contact.

He has been touted by analysts as an option for several jobs in Trump’s second administration, including a return to the trade file, though Hampson said he is unlikely to go back to the trade representative role.

Hampson said there are still significant questions about how sweeping the tariffs could be and if there will be carve-outs for industries like energy. Trump and his team may also hang the tariff threat over upcoming trade negotiations.

“Is he going to stick us with a tariff Day 1 or shortly after?” Hampson asked.

Some experts have called for Canada to remain calm and focus on opportunities rather than fears. Others have called for bold action and creative thinking.

Canada revived a cabinet committee on Canada-U.S. relations a little more than 24 hours after Trump’s win was secured.

Trudeau said Tuesday in Fredericton that under the first Trump presidency, Canada successfully negotiated the trilateral trade deal by demonstrating that the country’s interests and economies are aligned.

“That is going to continue to be the case,” he said.

This report by The Canadian Press was first published Nov. 13, 2024.