B.C.’s housing sales downturn deepened in October as interest rate hikes and economic uncertainty sidelined potential buyers.

Real eState

B.C. real estate: Housing sales slump, but prices not declining in all markets

|

|

The sales slow down means prices are also taking a hit.

“Sales activity remains slow across the province and inventories appear to be plateauing,” said BCREA chief economist Brendon Ogmundson in a news release. “While prices have fallen from peak levels reached in early 2022, average prices have recently levelled off.”

While monthly industry reports show sales and prices falling, some real-time gauges of median prices show sharper falls.

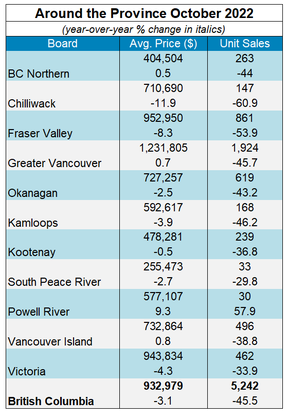

And even in areas such as Powell River that were outliers and showed a significant year-on-year price increase of 9.3 per cent, according to benchmark prices used by real estate boards, real estate agents on the ground say that prices are now falling as buyers face tougher conditions.

“Our prices are falling like all other markets in the province,” said Warren Behan, a Powell River-based real estate agent.

Another real estate agent in Powell River said the area had been behind in prices for many years. In the spring of 2021 and even until earlier this year, buyers from other areas, who had cashed out of their properties elsewhere, came to Powell River.

Now, he is noticing that many deals are “subject to sale” of another property. He said there are still “outside” buyers, but it’s mostly local ones who are downsizing or moving.

Behan said the market has always had a mix of local buyers and ones from elsewhere. He said that with a low number of total sales, it’s easy for a relatively small number to skew percentage increases.

The steepest year-on-year sales decline for October was 61 per cent in Chilliwack where year-on-year prices for all property types fell by 11.9 per cent. The next sharpest decrease in benchmark price was seen in the Fraser Valley where it was 8.3 per cent, according to the real estate board.

Proponents of median prices, which is the middle price in a list of sales numbers from high to low, say these can be a more accurate reflection of a market where prices are moving quickly.

The Greater Vancouver area in October posted a slight 0.7 per cent increase in benchmark price to $1,231,805 compared to the previous year, according to the real estate board.

Meanwhile, the median price for Greater Vancouver in October was $978,000, which is a decrease of 5.7 per cent compared to the previous year, according to HouseSigma.

Within Greater Vancouver, however, the median price for all properties in North Vancouver increased by 13.6 per cent and in Burnaby by 4.4 per cent and in Coquitlam by 5.8 per cent, according to HouseSigma.

chchan@postmedia.com

Real eState

B.C. woman ordered to pay over half a million dollars over real estate ‘Ponzi scheme’ – Global News

A B.C. resident has been ordered to pay over $600,000 after committing fraud through a real estate scheme.

The B.C. Securities Commission (BCSC) has ordered Cherie Evangeline White and her company Kingdom Investments to pay $626,000 in financial sanctions.

In a Monday media release, the BCSC described the fraud as “consistent with a Ponzi scheme.”

White told investors they would get a return of 10 to 30 per cent on their investments after about six months and that the housing they invested in would be provided to those in need, including people experiencing addiction, according to the BCSC.

But instead, she used the funds to buy residential properties and then flip them for profit, money she then used to pay back earlier investors, the BCSC said.

She commonly used her faith to attract investors by connecting with them on spiritual values and using faith-related imagery, according to the commission.

White also created a sense of urgency for investors, and in one case accompanied an investor to the bank to make sure they invested. Bank staff told the individual not to invest, but she convinced them to anyway, according to the BCSC.

In total Kingdom Investments distributed over $1 million in securities to 24 different investors without proper documentation and details of those investments. Investors suffered losses of about $776,000 as a result of the “fraud and illegal distribution,” the commission said.

The BCSC said White obstructed justice by failing to provide documents and information asked for by the BCSC. It also said she and her company did not show remorse for their actions or acknowledge the damage they caused.

She has been banned from participating in B.C.’s investment market unless she is the one investing in a company. Her company was banned from trading its shares or promoting the business.

More on Crime

Real eState

Moncton named best place to buy real estate – CTV News Atlantic

[unable to retrieve full-text content]

Moncton named best place to buy real estate CTV News Atlantic

Source link

Real eState

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Media20 hours ago

DJT Stock Plunges After Trump Media Files to Issue Shares

-

Business18 hours ago

FFAW, ASP Pleased With Resumption of Crab Fishery – VOCM

-

Media19 hours ago

Marjorie Taylor Greene won’t say what happened to her Trump Media stock

-

Business19 hours ago

Javier Blas 10 Things Oil Traders Need to Know About Iran's Attack on Israel – OilPrice.com

-

Politics19 hours ago

Politics19 hours agoIn cutting out politics, A24 movie 'Civil War' fails viewers – Los Angeles Times

-

Media18 hours ago

Trump Media stock slides again to bring it nearly 60% below its peak as euphoria fades – National Post

-

Art21 hours ago

It’s Time to Remove Father Rupnik’s Art – National Catholic Register

-

Real eState13 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business