Reporting by Steve Scherer; Editing by Mark Porter

Economy

Bank of Canada seen holding rates steady after economy shrank in Q2

OTTAWA, Sept 6 (Reuters) – The Bank of Canada on Wednesday is expected to keep rates on hold at a 22-year high of 5% after the economy unexpectedly shrank in the second quarter, analysts said.

The central bank hiked rates by a quarter point in both June and July, and then said it was prepared to raise rates again to tame inflation that has remained above the bank’s 2% target for 27 months.

While the economy turned negative in the second quarter, inflation has been stubborn, unexpectedly rising to 3.3% in July as core measures remained well above 3%.

“The Bank of Canada has the cover in the GDP data to stay on pause with a hawkish bias,” Derek Holt, vice president of economics at Scotiabank, said in a note.

The decision will be announced at 10 am ET (1400 GMT). Governor Tiff Macklem will deliver a speech and hold a press conference on Thursday.

Canada’s Liberal Prime Minister Justin Trudeau’s support has sagged amid high inflation as his Conservative rival, Pierre Poilievre, hammered him for feeding inflation with government spending and driving up rates during a housing crisis.

The second-quarter 0.2% annualized gross domestic product decline was far lower than the Bank of Canada’s (BoC’s) forecast for 1.5% annualized GDP growth, a sign the economy could have already entered a recession.

“The path forward looks bleak,” Tiago Figueiredo, an economist at Desjardins Group, said in a note.

Money markets sharply trimmed bets for an interest rate increase after the growth figures were published and now are pricing in a less than 7% chance for one, compared with 23% before.

Thirty-one of 34 economists polled by Reuters between Aug. 24-30 expect no change to the central bank’s overnight rate at the meeting.

Inflation hit a four-decade high of 8.1% last year, and the BoC has hiked 10 times since March 2022 to try to get it back down to target.

But core inflation measures are inching down slowly, and a wealth of data is due out before the bank next meets to discuss rates in October.

“I’m unsure that rate hikes are done,” Holt said. “Recent data affords the opportunity to buy some time.”

Economy

S&P/TSX composite gains almost 100 points, U.S. stock markets also higher

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

Statistics Canada reports wholesale sales higher in July

OTTAWA – Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $82.7 billion in July.

The increase came as sales in the miscellaneous subsector gained three per cent to reach $10.5 billion in July, helped by strength in the agriculture supplies industry group, which rose 9.2 per cent.

The food, beverage and tobacco subsector added 1.7 per cent to total $15 billion in July.

The personal and household goods subsector fell 2.5 per cent to $12.1 billion.

In volume terms, overall wholesale sales rose 0.5 per cent in July.

Statistics Canada started including oilseed and grain as well as the petroleum and petroleum products subsector as part of wholesale trade last year, but is excluding the data from monthly analysis until there is enough historical data.

This report by The Canadian Press was first published Sept. 13, 2024.

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in the base metal and energy sectors, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 172.18 points at 23,383.35.

In New York, the Dow Jones industrial average was down 34.99 points at 40,826.72. The S&P 500 index was up 10.56 points at 5,564.69, while the Nasdaq composite was up 74.84 points at 17,470.37.

The Canadian dollar traded for 73.55 cents US compared with 73.59 cents US on Wednesday.

The October crude oil contract was up $2.00 at US$69.31 per barrel and the October natural gas contract was up five cents at US$2.32 per mmBTU.

The December gold contract was up US$40.00 at US$2,582.40 an ounce and the December copper contract was up six cents at US$4.20 a pound.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports16 hours ago

Sports16 hours agoDolphins will bring in another quarterback, while Tagovailoa deals with concussion

-

Sports18 hours ago

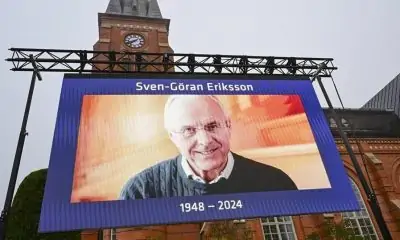

Sports18 hours agoDavid Beckham among soccer dignitaries attending ex-England coach Sven-Goran Eriksson’s funeral

-

News18 hours ago

News18 hours agoVancouver Whitecaps cautious of lowly San Jose Earthquakes

-

Sports12 hours ago

Sports12 hours agoEdmonton Oilers sign defenceman Travis Dermott to professional tryout

-

News18 hours ago

News18 hours agoAlberta town adopts new resident code of conduct to address staff safety

-

Tech14 hours ago

Tech14 hours agoUnited Airlines will offer free internet on flights using service from Elon Musk’s SpaceX

-

Sports4 hours ago

Sports4 hours agoKirk’s walk-off single in 11th inning lifts Blue Jays past Cardinals 4-3

-

News16 hours ago

News16 hours agoUnifor says workers at Walmart warehouse in Mississauga, Ont., vote to join union