Economy

Biden heads for Congress clash over how to fix COVID-era economy – BNN

President-elect Joe Biden’s big-spending blueprint for a U.S. economy still battling the pandemic is set to meet pushback from Congress, where his party failed to win sweeping control.

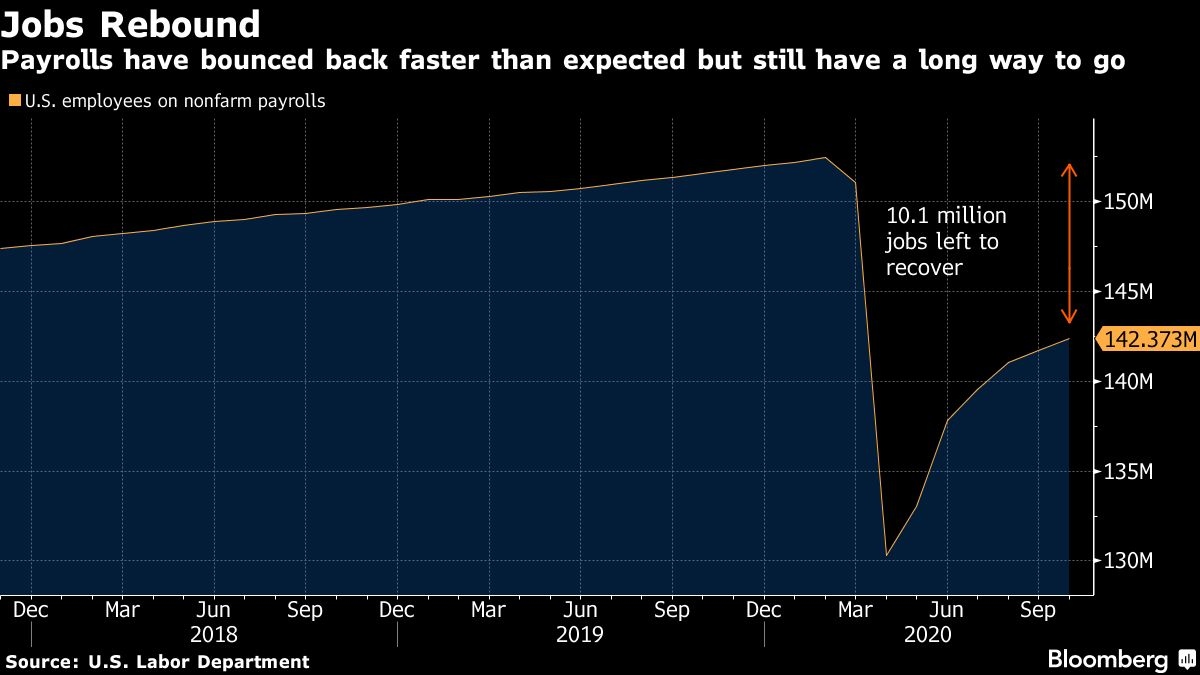

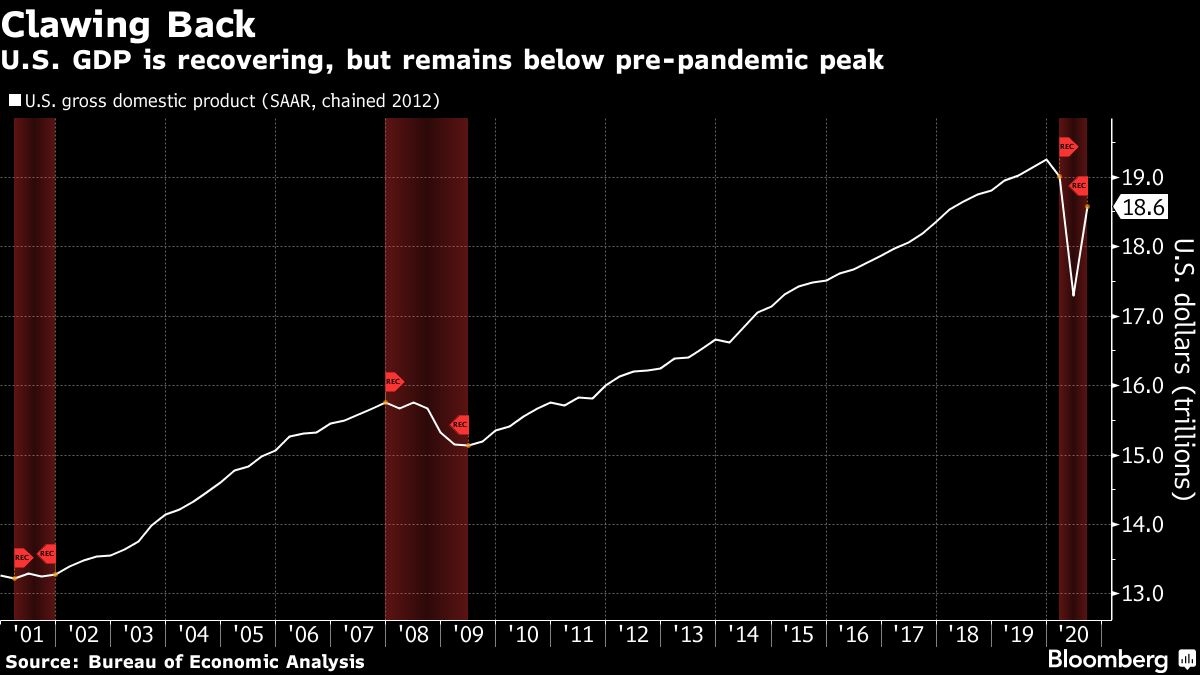

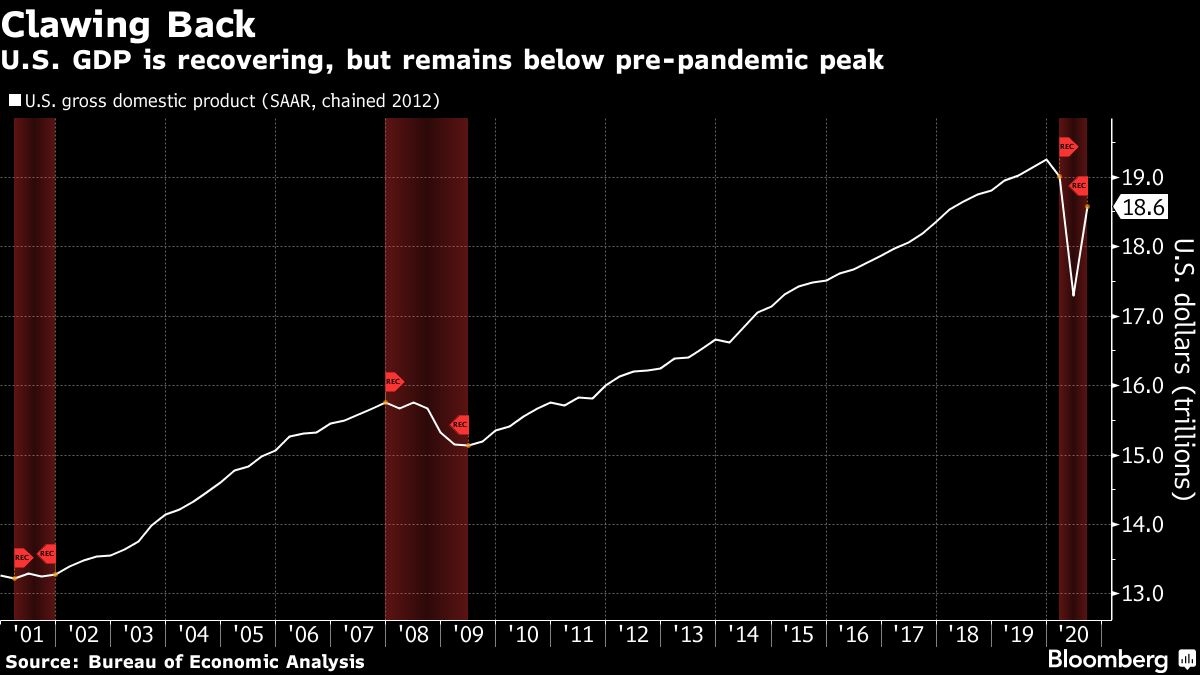

Biden is poised to enter office in January after campaigning for trillions of dollars in additional fiscal stimulus to battle the economic fallout from COVID-19. There are still 10 million fewer jobs than in February and the economy is about 3.5 per cent smaller than before the crisis.

He’s vowed to extend enhanced unemployment benefits, which could provide an immediate boost to demand from those most likely to spend. He also wants to invest in infrastructure, green energy and childcare, which he argues will increase hiring and help economic growth in the long term, too.

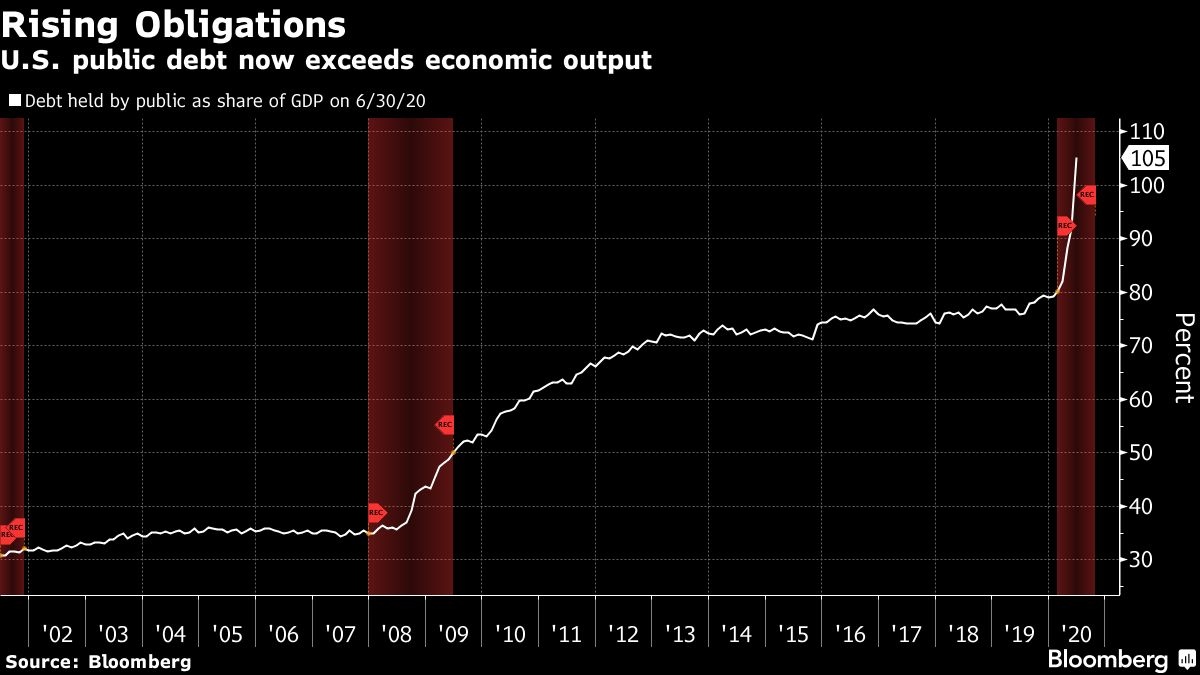

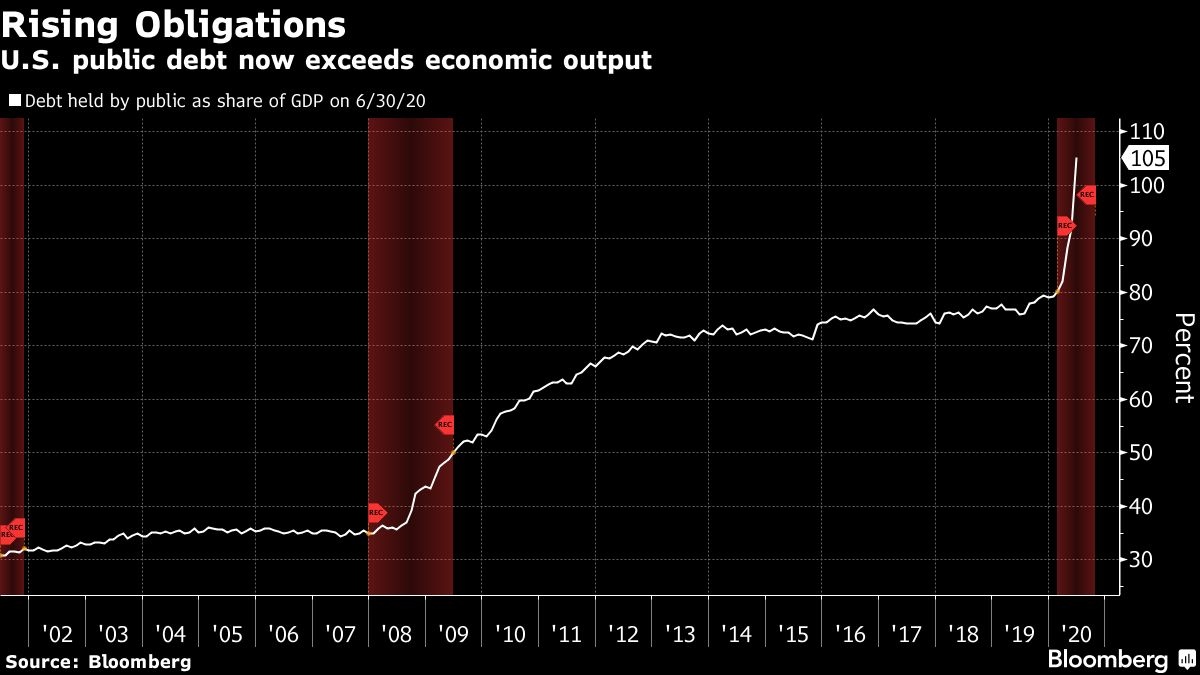

But Biden’s agenda risks running into immediate skepticism from the new Congress, where control may hinge on runoff elections in Georgia. Lawmakers on the right could seek to stall or limit the scope of Biden’s plans just as they did when he was vice president under President Barack Obama, likely balking at running up debt even further and raising taxes on companies.

“Presidents inherit economies, and President-elect Biden’s inheriting one that’s in trouble,” said Ryan Sweet, head of monetary policy research at Moody’s Analytics. “You have a very high unemployment rate, there’s still slack in the labor market. It’s going to take time to heal.”

Moody’s forecasts that there won’t be additional stimulus from Congress until after Biden is inaugurated, he said. Bloomberg Economics said the combination of a Biden win and divided Congress could mean direct fiscal support of US$500 billion to US$750 billion at most, meaning growth of three per cent in 2021, rather than the 3.5 per cent possible with US$1 trillion of aid.

The biggest threat to the recovery, though, isn’t one that Biden can easily control through fiscal policy. It’s containing the virus as U.S. cases climb to new daily highs and countries including France, Germany and England resume lockdowns.

Biden has said he’s willing to shut down parts of the economy as warranted to stop the spread, which would risk depressing growth. But he also supports more funding to reopen schools safely, which would free up parents for work.

To fund Biden’s proposals, the administration would be adding to the national debt while taking advantage of historically low interest rates. Biden spent decades in government warning about the dangers of budget deficits. But as president he’ll take over one of the biggest in U.S. history, and has signaled he’s in no rush to pare it back.

Biden has proposed raising corporate taxes to 28 per cent from 21 per cent, increasing income taxes for those earning more than US$400,000 and taxing capital-gains earnings the same as regular income for top earners. A split Congress, though, would create high hurdles to such moves.

The campaign has outlined a US$3.5 trillion economic program to fund his key goals:

- Shift millions of jobs into clean energy, with the goal of cutting carbon emissions.

- Boost manufacturing through incentives to buy American goods and support for high-tech research.

- Expand the availability of care for the youngest and oldest Americans, including universal preschool for three- and four-year-olds.

He’s also promised to address inequalities through his plan, saying he would provide aid for minority small-businesses owners. He’s voiced support for a US$15 federal minimum hourly wage, equal gender pay and expanded sick leave.

Biden’s White House team of economic advisers could include economists Jared Bernstein, Heather Boushey and Ben Harris, who have helped craft his economic platform during the campaign. They’ve argued that more fiscal stimulus is needed, and have done research and work on policies to fight economic inequality.

Overall, the economy has bounced back faster than expected as restaurants, stores and businesses reopened. But activity remains depressed and the rebound has been uneven — leaving lower-wage workers, women and people of color to bear the brunt of it.

Congress’s stimulus packages earlier this year propelled retail spending above pre-virus levels and Federal Reserve policies fueled a surge in home buying.

While some more aid may still be possible in coming months, Congress has already been deadlocked on the issue and a very large stimulus appears less likely after the election results.

That could put the onus on Fed Chair Jerome Powell and his colleagues to consider further ways of easing after cutting interest rates to near zero. Powell on Thursday opened the door to a possible shift in the central bank’s bond purchases in coming months, saying that more fiscal and monetary support are needed as rising Covid-19 infections cloud the outlook.

The S&P 500 Index of stocks fluctuated in recent weeks with rising virus cases, uncertainty around further aid for the economy and the election. It reached new highs amid the pandemic, bolstered by stimulus and Fed policy.

Internationally, Biden’s approach to trade will likely be less heated than Trump’s.

It’s unclear whether his administration will leave in place billions of dollars in tariffs enacted against Chinese imports. His campaign said he would seek to build a multilateral case for Beijing to change its practices from trade to human rights while his predecessor tended to act alone.

Biden is keen to reset trade relations with allies such as the European Union after Trump’s duties and hard-line stance disrupted supply chains and increased costs for many U.S. businesses.

On immigration, Biden has signaled his administration would roll back visa restrictions, arguing that sectors of the economy rely on contributions from newcomers. Powell has told lawmakers that immigration is a “key input” to the size of the labor force and to higher rates of growth.

–With assistance from Jennifer Epstein, Magan Crane, Laura Davison, Reade Pickert and Ben Holland.

Economy

China Wants Everyone to Trade In Their Old Cars, Fridges to Help Save Its Economy – Bloomberg

China’s world-beating electric vehicle industry, at the heart of growing trade tensions with the US and Europe, is set to receive a big boost from the government’s latest effort to accelerate growth.

That’s one takeaway from what Beijing has revealed about its plan for incentives that will encourage Chinese businesses and households to adopt cleaner technologies. It’s widely expected to be one of this year’s main stimulus programs, though question-marks remain — including how much the government will spend.

Economy

German Business Outlook Hits One-Year High as Economy Heals – BNN Bloomberg

(Bloomberg) — German business sentiment improved to its highest level in a year — reinforcing recent signs that Europe’s largest economy is exiting two years of struggles.

An expectations gauge by the Ifo institute rose to 89.9. in April from a revised 87.7 the previous month. That exceeds the 88.9 median forecast in a Bloomberg survey. A measure of current conditions also advanced.

“Sentiment has improved at companies in Germany,” Ifo President Clemens Fuest said. “Companies were more satisfied with their current business. Their expectations also brightened. The economy is stabilizing, especially thanks to service providers.”

A stronger global economy and the prospect of looser monetary policy in the euro zone are helping drag Germany out of the malaise that set in following Russia’s attack on Ukraine. European Central Bank President Christine Lagarde said last week that the country may have “turned the corner,” while Chancellor Olaf Scholz has also expressed optimism, citing record employment and retreating inflation.

There’s been a particular shift in the data in recent weeks, with the Bundesbank now estimating that output rose in the first quarter, having only a month ago foreseen a contraction that would have ushered in a first recession since the pandemic.

Even so, the start of the year “didn’t go great,” according to Fuest.

“What we’re seeing at the moment confirms the forecasts, which are saying that growth will be weak in Germany, but at least it won’t be negative,” he told Bloomberg Television. “So this is the stabilization we expected. It’s not a complete recovery. But at least it’s a start.”

Monthly purchasing managers’ surveys for April brought more cheer this week as Germany returned to expansion for the first time since June 2023. Weak spots remain, however — notably in industry, which is still mired in a slump that’s being offset by a surge in services activity.

“We see an improving worldwide economy,” Fuest said. “But this doesn’t seem to reach German manufacturing, which is puzzling in a way.”

Germany, which was the only Group of Seven economy to shrink last year and has been weighing on the wider region, helped private-sector output in the 20-nation euro area strengthen this month, S&P Global said.

–With assistance from Joel Rinneby, Kristian Siedenburg and Francine Lacqua.

(Updates with more comments from Fuest starting in sixth paragraph.)

©2024 Bloomberg L.P.

Economy

Parallel economy: How Russia is defying the West’s boycott

|

|

When Moscow resident Zoya, 62, was planning a trip to Italy to visit her daughter last August, she saw the perfect opportunity to buy the Apple Watch she had long dreamed of owning.

Officially, Apple does not sell its products in Russia.

The California-based tech giant was one of the first companies to announce it would exit the country in response to Russian President Vladimir Putin’s full-scale invasion of Ukraine on February 24, 2022.

But the week before her trip, Zoya made a surprise discovery while browsing Yandex.Market, one of several Russian answers to Amazon, where she regularly shops.

Not only was the Apple Watch available for sale on the website, it was cheaper than in Italy.

Zoya bought the watch without a moment’s delay.

The serial code on the watch that was delivered to her home confirmed that it was manufactured by Apple in 2022 and intended for sale in the United States.

“In the store, they explained to me that these are genuine Apple products entering Russia through parallel imports,” Zoya, who asked to be only referred to by her first name, told Al Jazeera.

“I thought it was much easier to buy online than searching for a store in an unfamiliar country.”

Nearly 1,400 companies, including many of the most internationally recognisable brands, have since February 2022 announced that they would cease or dial back their operations in Russia in protest of Moscow’s military aggression against Ukraine.

But two years after the invasion, many of these companies’ products are still widely sold in Russia, in many cases in violation of Western-led sanctions, a months-long investigation by Al Jazeera has found.

Aided by the Russian government’s legalisation of parallel imports, Russian businesses have established a network of alternative supply chains to import restricted goods through third countries.

The companies that make the products have been either unwilling or unable to clamp down on these unofficial distribution networks.

-

Health8 hours ago

Health8 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art13 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Science21 hours ago

Science21 hours ago"Hi, It's Me": NASA's Voyager 1 Phones Home From 15 Billion Miles Away – NDTV

-

News20 hours ago

Some Canadians will be digging out of 25+ cm of snow by Friday – The Weather Network

-

Health12 hours ago

Health12 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Media19 hours ago

Jon Stewart Slams the Media for Coverage of Trump Trial – The New York Times

-

Investment12 hours ago

Investment12 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

Sports23 hours ago

Sports23 hours agoAuston Matthews turns it up with three-point night as Maple Leafs slay Bruins in Game 2 – Toronto Sun