Economy

Biden’s six favorite lies about inflation and the economy – The Hill

Every modern president has stretched the truth now and then, and the media loved to torch Trump nearly every other day for lying. But Biden’s routine misstatements about money and the economy seem to go unchallenged.

In recent months, as the economy has slipped into a soft recession and with inflation at 9.1 percent the Biden whoppers keep coming fast and furious.

Here are six of the most economically consequential deceptions of the Biden administration.

- Nobody making under four hundred thousand bucks will have their taxes raised. Period.

This one was reminiscent of the infamous George H.W. Bush claim in 1988 “read my lips: no new taxes.” Biden didn’t say he wouldn’t raise taxes on the middle class once or twice, but routinely throughout the campaign — and he even STILL says it.

Except that inflation is a tax that hits the middle class and the poor hardest and over the past year, prices have outpaced wages and salaries by roughly four percentage points. With the average worker wage and salary at roughly $60,000 per year (that’s a lot less than $400,000) this means a $2,400 per worker Biden inflation tax and as much as double that for families with husband and wife both working.

- Inflation is worse everywhere but here.

Biden claimed this most recently in a speech in Philadelphia as an excuse for high inflation here at home. It is hogwash. Inflation is lower in Australia, Canada, China, France, Germany, Italy, Japan, Switzerland, the United Kingdom, and many other countries.

- The economy had stalled when I entered office.

The reality is that Biden was bequeathed an economy with robust growth coming out of the pandemic. In the second half of 2020, the economy grew more than $1.5 trillion at an annualized rate. The growth rate for the second half of 2020 even with COVID was almost 15 percent.

Moreover, when Biden entered office, the economy was prepped for an enormous tail winds gust because of the Trump “operation warp speed” vaccine that was just hitting the market and allowing businesses to reopen and workers to return to the job.

- I am responsible for the strongest job creation economy in modern times.

This is more an exaggeration than a bold-faced lie.

On jobs, we will give the president his due. This has been an impressive hiring spree over the past 14 months and the jobs are out there for those who want them. But this is NOT the strongest period for job creation. That hiring record was set in 2020 under Trump who presided over the initial recovery following the government-imposed lockdowns.

Job growth under Trump from May 2020 to Jan 2021 averaged 1.4 million jobs per month, for a total of 12.5 million people returning to work. But under Biden, average job growth per month has been cut by more than half, down to 542,000 with 8.7 million people returning to work. That means Biden has added 31 percent fewer jobs in 16 months than Trump did in nine.

- Since I took office, families are carrying less debt, their average savings are up.

This is a strange and oft-repeated White House claim.

The amount families are able to save each month has utterly collapsed, falling 74 percent since Biden took office, while the personal savings rate has plummeted from 19.9 percent to just 5.4 percent. Likewise, the claim about declining debt is equally untrue. Household debt has risen by $1.29 trillion in just the first 15 months of Biden’s presidency. Credit card debt, which decreased over $100 billion during the pandemic, is now exploding at the fastest rates on record as families run out of savings and fall into debt.

Put simply, they cannot afford to live in Biden’s America. Biden also ignores a stock market selloff that has evaporated some $10 trillion of Americans’ wealth and savings. This is one of the greatest periods of savings disappearing.

- I’m doing everything I can to lower gas prices.

We wonder if ANYONE actually believes this claim.

The folks at Institute for Energy Research have identified 100 separate Biden executive orders, regulations, and laws that have impeded oil and gas production and raised prices at the pump. These range from killing pipelines, to expanding EPA regulations on oil and gas drilling and refining, to taking hundreds of thousands of acres of prime oil and gas lands on public lands and in areas like the Gulf of Mexico off-limits for drilling. Economist Casey Mulligan of the University of Chicago estimates that these policies have reduced oil and gas drilling by 2 to 3 million barrels a day. That increased production would bring gas prices down at the pump.

Perhaps none of these half-truths and outright fibs should be too surprising. What should we expect from the administration that first denied inflation, then said inflation was transitory, then claimed it was only a high-class problem? Biden has done another about-face, decrying inflation as bad but now it is Russia’s fault or greedy businesses, like meatpackers or oil companies and even mom-and-pop gas station owners.

C’mon Joe. We’re not that dumb. Give us a little more truth.

Stephen Moore is a distinguished visiting fellow in Economics, and EJ Antoni is a research fellow for Regional Economic in the Center for Data Analysis, at the Heritage Foundation. Moore is a cofounder of Committee to Unleash Prosperity, where Antoni is a senior fellow.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

Economy

IMF Sees OPEC+ Oil Output Lift From July in Saudi Economic Boost – BNN Bloomberg

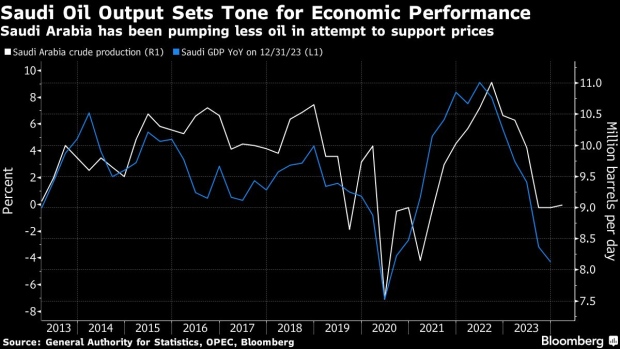

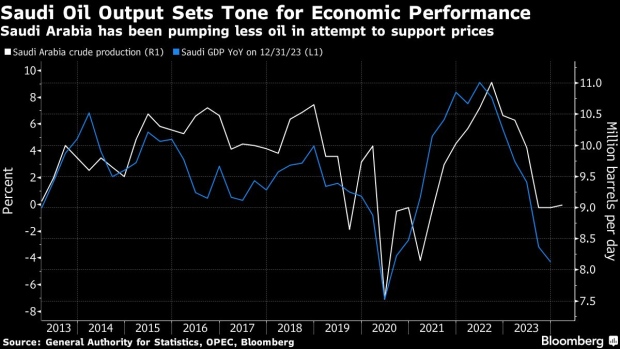

(Bloomberg) — The International Monetary Fund expects OPEC and its partners to start increasing oil output gradually from July, a transition that’s set to catapult Saudi Arabia back into the ranks of the world’s fastest-growing economies next year.

“We are assuming the full reversal of cuts is happening at the beginning of 2025,” Amine Mati, the lender’s mission chief to the kingdom, said in an interview in Washington, where the IMF and the World Bank are holding their spring meetings.

The view explains why the IMF is turning more upbeat on Saudi Arabia, whose economy contracted last year as it led the OPEC+ alliance alongside Russia in production cuts that squeezed supplies and pushed up crude prices. In 2022, record crude output propelled Saudi Arabia to the fastest expansion in the Group of 20.

Under the latest outlook unveiled this week, the IMF improved next year’s growth estimate for the world’s biggest crude exporter from 5.5% to 6% — second only to India among major economies in an upswing that would be among the kingdom’s fastest spurts over the past decade.

The fund projects Saudi oil output will reach 10 million barrels per day in early 2025, from what’s now a near three-year low of 9 million barrels. Saudi Arabia says its production capacity is around 12 million barrels a day and it’s rarely pumped as low as today’s levels in the past decade.

Mati said the IMF slightly lowered its forecast for Saudi economic growth this year to 2.6% from 2.7% based on actual figures for 2023 and the extension of production curbs to June. Bloomberg Economics predicts an expansion of 1.1% in 2024 and assumes the output cuts will stay until the end of this year.

Worsening hostilities in the Middle East provide the backdrop to a possible policy shift after oil prices topped $90 a barrel for the first time in months. The Organization of Petroleum Exporting Countries and its allies will gather on June 1 and some analysts expect the group may start to unwind the curbs.

After sacrificing sales volumes to support the oil market, Saudi Arabia may instead opt to pump more as it faces years of fiscal deficits and with crude prices still below what it needs to balance the budget.

Saudi Arabia is spending hundreds of billions of dollars to diversify an economy that still relies on oil and its close derivatives — petrochemicals and plastics — for more than 90% of its exports.

Restrictive US monetary policy won’t necessarily be a drag on Saudi Arabia, which usually moves in lockstep with the Federal Reserve to protect its currency peg to the dollar.

Mati sees a “negligible” impact from potentially slower interest-rate cuts by the Fed, given the structure of the Saudi banks’ balance sheets and the plentiful liquidity in the kingdom thanks to elevated oil prices.

The IMF also expects the “non-oil sector growth momentum to remain strong” for at least the next couple of years, Mati said, driven by the kingdom’s plans to develop industries from manufacturing to logistics.

The kingdom “has undertaken many transformative reforms and is doing a lot of the right actions in terms of the regulatory environment,” Mati said. “But I think it takes time for some of those reforms to materialize.”

©2024 Bloomberg L.P.

-

Sports24 hours ago

Sports24 hours agoAuston Matthews denied 70th goal as depleted Leafs lose last regular-season game – Toronto Sun

-

Media4 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Business22 hours ago

BC short-term rental rules take effect May 1 – CityNews Vancouver

-

Media6 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Art22 hours ago

Collection of First Nations art stolen from Gordon Head home – Times Colonist

-

Investment22 hours ago

Investment22 hours agoBenjamin Bergen: Why would anyone invest in Canada now? – National Post

-

Tech24 hours ago

Tech24 hours ago'Kingdom Come: Deliverance II' Revealed In Epic New Trailer And It Looks Incredible – Forbes

-

Media18 hours ago

DJT Stock Jumps. The Truth Social Owner Is Showing Stockholders How to Block Short Sellers. – Barron's