Investment

Building construction investment December 2020: Residential strong – Electrical Business – Electrical Business

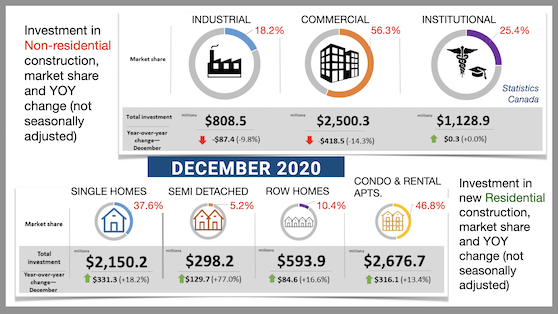

February 8, 2021 – Statscan reports total investment in building construction increased 1.5% in December 2020, following three consecutive months of declines. Investment in the residential sector reached a record high of $11.1 billion.

On a constant dollar basis (2012=100), investment in building construction increased 1.0% to $12.2 billion in December.

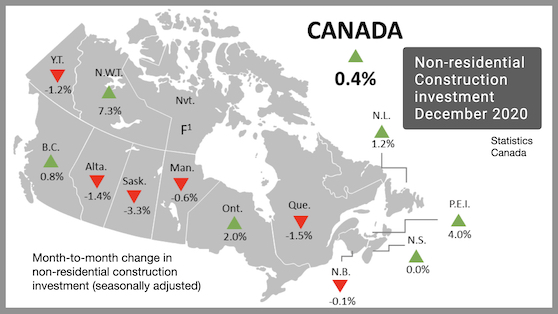

Non-residential investment remains flat

In December 2020, non-residential construction investment remained at $4.4 billion for the third consecutive month. Ontario reported the largest gain—up 2.0% from November—but this growth was offset by declines reported in five provinces.

Investment in commercial building construction edged up 0.3% in December, driven in large part by Ontario’s growth in this sector (+3.6% to $1.1 billion). The construction of large projects, such as Amazon’s Project Python in Ottawa, contributed to the rise.

Institutional investment (+0.9%) also increased in December. British Columbia led the growth with the construction of a new RCMP building in Fort St. John.

Conversely, industrial investment edged down 0.2%, with no significant changes reported in any province.

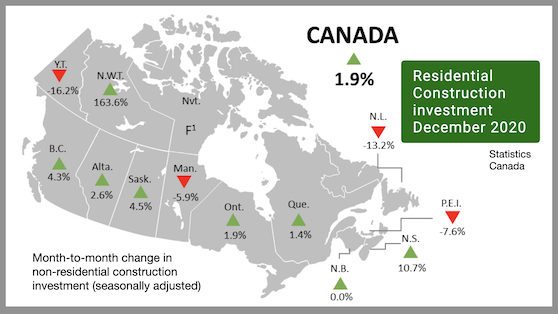

Residential construction star of the show

Investment in residential construction reached a record high in December 2020, up 1.9% to $11.1 billion. Single-unit investment continued to show strength for the third straight month, up 2.6%.

Eight provinces posted gains, with Ontario (+2.8%), Quebec (+3.1%) and Alberta (+4.6%) accounting for the majority of the growth. Newfoundland & Labrador posted a decline in this component for the second straight month, resulting from high-value renovation projects coming to a close.

Nationally, multi-unit investment increased 1.2%. Notable growth was reported in Ontario and British Columbia, attributable primarily to condominium and apartment building construction.

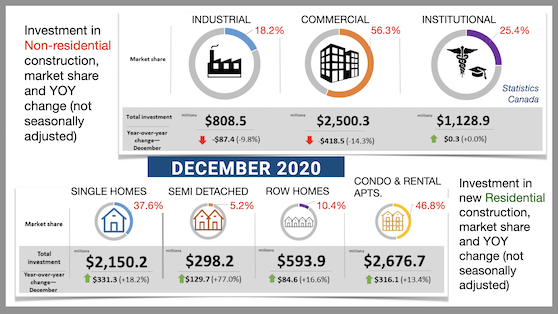

Quarterly growth driven by residential sector

The total value of investment in building construction edged up 0.3% to $46.2 billion in Q4, driven by gains in the residential sector (+5.0%). Investment in residential buildings reported a record quarter, with both single-unit (+7.9%) and multi-unit (+2.2%) investment posting gains.

Commercial (-13.4%), industrial (-6.4%) and institutional (-3.2%) investments all declined in Q4 2020, contributing to an overall drop of 9.8% in non-residential investment. The declines in the second and fourth quarters of 2020 reflected the impact of Covid in the non-residential sector. Prior to 2020, the last decrease was posted in the third quarter of 2016.

Investment

Ottawa's new EV tax credit raises hope of big new Honda investment – The Globe and Mail

People work at Honda’s auto manufacturing plant in Alliston, Ont., on April 5, 2023.CARLOS OSORIO/Reuters

A new tax credit in Tuesday’s federal budget is fuelling industry speculation that Canada is close to landing a massive electric-vehicle investment by Honda.

The proposed measure would provide companies with a 10-per-cent rebate on the costs of constructing new buildings to be used in the electric-vehicle supply chain. It would be atop other such incentives to which Ottawa has previously committed, including a 30-per-cent manufacturing investment tax credit, as well as provincial supports.

But unlike those other credits, this one would only be available to companies making across-the-board investments in battery-making, the manufacturing of battery components known as cathode active materials, and vehicle assembly.

Honda Motor Co. Ltd. HMC-N is the only automaker known to be in advanced talks with the federal and provincial governments for a Canadian EV-sector commitment of that breadth. Earlier this year, the Japanese news group Nikkei reported that the company is considering an investment here of up to $18.5-billion – pointing toward more comprehensive Canadian supply chain plans than those of competitors such as Volkswagen Group and Stellantis NV STLA-N, whose high-profile investments squarely in battery manufacturing would not qualify.

Japanese automaker Honda considering multibillion-dollar EV plant in Canada, report says

Amid a flurry of trips to Japan by Canadian officials – most recently a visit this month by Ontario Economic Development Minister Vic Fedeli – the perception among industry insiders is that the new tax credit may be a final component of an incentive package offered by the federal and provincial governments, to get the negotiations over the finish line.

“There’s a very short list of very big companies who are looking at a very big investment and talking to Canada, Ontario and Quebec, to whom this would apply,” said Automotive Parts Manufacturers’ Association president Flavio Volpe, referring to the two provinces vying for major EV commitments. “The translation here is that there are big new EV investments coming.”

That assessment was echoed by Brendan Sweeney, the managing director of the Trillium Network for Advanced Manufacturing. “All the bread crumbs are leading to something,” he said.

More than just heralding the potential for the largest EV-related Canadian commitment by a global auto giant to date, the new measure is seemingly part of a shift in strategy for how Canada subsidizes supply chain growth – one in which Ottawa and the provinces stop competing for investment by simply matching multibillion-dollar subsidies offered in the United States, and instead offer more nuanced packages that could prove more efficient.

That subsidy-matching approach – in which Canada has guaranteed companies of annual subsidies equivalent to production tax credits offered in the U.S. – has to this point been considered a prerequisite to securing the battery factories meant to serve as EV supply chain anchors.

However, those have come with projected cumulative costs of up to $13-billion for the factory being constructed by Volkswagen in St. Thomas, Ont., and up to $15-billion for the one being constructed by Stellantis and LG Energy Solution in Windsor, Ont., during the early years of plant operations when the subsidies would be available. And Ottawa, which will cover about two-thirds of those costs while Ontario pays the rest, has previously signalled that it does not have the fiscal capacity to provide many more such deals.

But since the Honda negotiations came to light, government officials have expressed optimism about that company being open to a package of support that would revolve more around tax breaks on investment costs – as opposed to operational subsidies once factories have been commissioned – and likely carry a less staggering government cost relative to the total investment. (The Globe and Mail is not identifying the officials, because they were not authorized to speak publicly about the talks.)

One reason for that optimism may be the multifaceted nature of the investment that Honda is considering.

Mr. Volpe noted that for battery factories alone, Canada’s investment tax credits (ITCs) are not enough to compete with the U.S. production tax credits. But he said it’s a different story if the company is also looking at vehicle assembly, production of battery components and other parts of the supply chain, which the U.S. is not subsidizing the same way.

At the same time, those other aspects of the Honda package under consideration also seemingly make its potential investment more attractive to Ottawa than merely chasing another battery plant alone.

Other companies could also take advantage of the new incentive, along with the others being offered by the federal and provincial governments.

The governments have also been in less advanced talks with Toyota Motor Corp., which is the only one of the five global automakers with an established manufacturing presence in Canada not to have made major EV-related commitments here. (The others are General Motors Co. GM-N, Ford Motor Co. F-N, Stellantis and Honda.)

But for now, it’s the prospect of Honda as the first taker for a made-in-Canada approach to EV supports that is causing the most buzz around the sector.

“I think this could be a really useful departure,” Mr. Sweeney said. “We have to be competitive with the United States, but we’re a sovereign country. Can we do this in a way that works better for Canada?”

Investment

'I was always so proud of it': Charlie Munger had a ready reply when asked to name the investment he liked most – Yahoo Finance

To say Charlie Munger lived a long, full and rich life is putting it both mildly and literally.

The Berkshire Hathaway sidekick of billionaire Warren Buffett died in November just weeks short of his 100th birthday. His estimated net worth? A mere $2.2 billion, according to Forbes.

Don’t miss

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

-

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here’s how

-

‘It’s not taxed at all’: Warren Buffett shares the ‘best investment’ you can make when battling rising costs — take advantage today

Indeed, Munger was an investing legend — and just as much a font of no-nonsense wisdom and wit. Regarding the extravagant purchases consumers love, he once quipped, “Who in the hell needs a Rolex watch?”

As investors, we arguably need to measure time in a different kind of way: that is, ticking off the moments until we trade big-ticket spending for even an ounce of Munger’s golden investment guidance.

In one video capturing Munger’s remarks from the 2022 Daily Journal ($DJCO) Annual Meeting, he shares the story of a big win … and the following year, a bad flop.

Munger’s best investment ever

Munger’s musings on the extremes of his financial life were sparked by a certain Wes in Miami, who asked him, “In your storied investment career, which investment did you like the most?”

“Well, that’s rather interesting,” Munger replied, his trusty Diet Coke can sitting in front of him. He mentioned the World Book Encyclopedia, which he remembered from his youth as a product sold door to door. “It was easy for a child who wasn’t necessarily a brilliant student.”

And as an investment, the World Book provided volume after volume of wealth. ”Berkshire made $50 million pre-tax per year out of that business for years and years and years. I was always so proud of it because I grew up with it and it helped me.”

The World Book triumph follows a pattern of Buffett and Munger buying into successful businesses whose products they loved, including Dairy Queen, See’s Candies, and yes, Coca-Cola.

Berkshire Hathaway also followed a model that almost seems old fashioned today: it invested in companies whose stocks were undervalued; that is, when the intrinsic value per share dips below the current market share price.

Read more: Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

World Book only ceased to return monstrous profits when, as Munger noted, “a man named Bill Gates came along and decided he was going to give away a free encyclopedia with every damn bit of software.”

The World Book success story boils down to the kind of simple principle Munger loved so much: buy in companies whose products and profit potential you believe in, especially after you study the numbers and marketplace dominance.

“It’s still a marvelous product,” Munger said, “and it wasn’t good that we lost what World Book was doing for this civilization. World Book helped me get ahead in life.”

Charlie’s folly

But even the most successful market gurus have their crash-and-burn moments. Munger had no trouble recalling the dud that haunted him at the Daily Journal’s 2023 meeting: Alibaba “was one of the worst mistakes I’ve ever made.”

Munger said he was “over-charmed” by online retailing and “got a little out of focus” when it came time to invest his money in Alibaba. In fact, Munger acknowledged that he used leverage to buy the stock— a tactic he has frowned on in the past — because “the opportunities were so ridiculously good I thought it was desirable to do that.”

Munger initially bought about 165,000 Alibaba shares in the first quarter of 2021 and increased that to 602,060 shares in the fourth quarter. But he then cut that back to 300,000 shares in the first quarter of 2022.

The lesson Munger learned and that we can especially benefit from today is that the market’s bright shiny objects may distract us from doing our homework. E-commerce, he said, wasn’t a slam dunk but just another form of retail where a business has to prove its viability, just like a brick-and-mortar store.

This story should be familiar to anyone who has jumped on an IPO from a much-hyped company, only to see its stock falter days afterward. Trump Media, for example, recently dropped below $30 a share, compared to an IPO price that soared above $70.

As for his particular market tumble, Munger’s response was pure Munger: “I keep rubbing my own nose in my own mistakes like I’m doing now because I think it’s good for [me].”

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Investment

TFSAs, RRSPs and more could see changes in allowed investments – Investment Executive

“It’s a useful and probably much needed exercise,” said Carl Hinzmann, partner with Gowling WLG in Toronto. “If they can get the [qualified investments definitions] down to a singular definition, I think it would be significantly easier for the investment community that’s trying to provide advice and develop products.”

Holding a non-qualified or prohibited investment can lead to severe tax consequences: the plan would incur a 50% tax on the fair market value of the non-qualified or prohibited investment at the time it was acquired or changed status, and the investment’s income also would be taxable.

The consultation asked stakeholders to consider whether updated rules should favour Canada-based investments. Hinzmann likened this to the debate about whether pension funds should invest more domestically.

“I don’t think tax legislation is the appropriate way to tell pension funds to invest their money, so why [do that to] ordinary Canadians?” he said.

To achieve the goal of favouring Canadian investments, Hinzmann said the government could either require a certain percentage of domestic investments or treat domestic investments more favourably within a plan. Canada had a foreign content limit for RRSPs and RRIFs from 1971 to 2005, which ranged from 10% to 30%.

The budget acknowledged that the qualified investment rules “can be inconsistent or difficult to understand” due to their many updates since their introduction in 1966.

For example, different plans have slightly different rules for making investments in small businesses; certain types of annuities are qualified investments only for RRSPs, RRIFs and RDSPs; and certain pooled investment products are qualified investments only if they are registered with the Canada Revenue Agency.

“There’s no good policy reason” for the inconsistencies, Hinzmann said, adding that the purpose of the rules is to ensure registered plans hold stable, liquid products and that the planholder does not gain a personal tax advantage.

By having unwieldy, inconsistent rules, “all you’re really doing is increasing costs for the people offering these investment services to Canadians,” he said.

The budget asked for suggestions on how to improve the regime. In addition to questioning whether the rules should favour Canadian investments, the budget asked stakeholders to consider the pros and cons of harmonizing the small-business and annuities rules; whether crypto-backed assets should be considered qualified investments; and whether a registration process is indeed required for certain pooled investment products.

Hinzmann said the consultation’s highlighting of crypto-backed assets suggests the government may be questioning whether investment funds that hold cryptocurrency should be included in registered plans, though he acknowledged the government also could wish to expand the types of crypto products allowed.

Cryptocurrency itself is a non-qualifying investment in registered plans.

The qualified investments consultation ends July 15.

Qualified, non-qualifying and prohibited investments

Registered plans are allowed to hold a wide range of investments, including cash, GICs, bonds, mutual funds, ETFs, shares of a company listed on a designated exchange, and private shares under certain conditions. These are called qualified investments.

However, investments such as land, general partnership units and cryptocurrency are generally non-qualifying investments. (A cryptocurrency ETF is qualified if it’s listed on a designated exchange.)

A prohibited investment is property to which the planholder is “closely connected.” This includes a debt of the planholder or a debt or share of, or an interest in, a corporation, trust or partnership in which the planholder has an interest of 10% or more. A debt or a share of, or an interest in, a corporation, trust or partnership in which the planholder does not deal at arm’s length also is prohibited.

A registered plan that acquires or holds a non-qualified or prohibited investment is subject to a 50% tax on the fair market value of the investment at the time it was acquired or became non-qualified or prohibited. However, a refund of the tax is available if the property is disposed of, unless the planholder acquired the investment knowing it could become non-qualified or prohibited.

Income from a non-qualified investment is considered taxable to the plan at the highest marginal rate. Income earned by a prohibited investment is subject to an advantage tax of 100%, payable by the planholder.

A non-qualified investment that is also a prohibited investment is treated as prohibited.

-

News23 hours ago

Loblaws Canada groceries: Shoppers slam store for green onions with roots chopped off — 'I wouldn't buy those' – Yahoo News Canada

-

Business22 hours ago

Rupture on TC Energy's NGTL gas pipeline sparks wildfire in Alberta – The Globe and Mail

-

Investment22 hours ago

Saudi Arabia Highlights Investment Initiatives in Tourism at International Hospitality Investment Forum

-

Tech15 hours ago

Tech15 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Art22 hours ago

Squatters at Gordon Ramsay's Pub Have 'Left the Building' After Turning It Into an Art Café – PEOPLE

-

Politics22 hours ago

Politics22 hours agoThe Earthquake Shaking BC Politics

-

Science21 hours ago

Science21 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

Science23 hours ago

Science23 hours agoFederal government announces creation of National Space Council – CBC News