Article content

Canada will face growing economic headwinds with considerable momentum.

Latest growth numbers just support the case for larger Bank of Canada hike

Canada will face growing economic headwinds with considerable momentum.

Statistics Canada on April 29 reported that gross domestic product grew 1.1 per cent in February, and the agency estimated the economy likely expanded 0.5 per cent in March, suggesting Canada pushed through the Omicron wave with relative ease.

That wasn’t a given at the end of last year. Many assumed strict health restrictions in Ontario and Quebec over the winter months would kill economic activity, as they had at previous times during the pandemic. The Bank of Canada cited uncertainty over COVID-19 as one of the reasons it opted against raising interest rates in January, even though inflation had surged well above the high end of its comfort zone.

Now, the strength of Canada’s economy is giving the central bank reason to accelerate interest-rate increases. Policymakers earlier this month said GDP likely expanded at an annual rate of three per cent in the first quarter, compared with a January estimate of two per cent. Statistics Canada’s monthly tallies of economic output are calculated differently than its quarterly assessments, but the former generally aligns with the latter. GDP grew about 0.5 per cent from December to January, suggesting the quarterly rate of growth will exceed five per cent, economists said.

“Today’s GDP report reinforces the view that the momentum in Canada’s economy is unrelenting,” James Orlando, a senior economist at Toronto-Dominion Bank, said in a note. “Compared to our neighbour to the south and our global peers, Canada is clearly outperforming.”

Indeed, the first of three estimates of first-quarter growth in the United States by the Commerce Department this week showed the world’s largest economy shrank at an annual rate of 1.4 per cent, surprising most Wall Street forecasters, who were expecting an increase. Canadian bond yields rose after Canada’s numbers were released, suggesting investors anticipate evidence of stronger growth will keep pressure on the Bank of Canada to raise its benchmark rate at a relatively aggressive pace as it tries to catch up to inflation.

“Pressure continues to build for the Bank of Canada to ease off the monetary policy accelerator more rapidly,” Claire Fan, an economist at Royal Bank of Canada, told clients, adding that a second consecutive half-point increase is “looking increasingly likely” at the central bank’s next policy announcement on June 1.

GDP got a boost from some predictable sources. Restaurants and hotels led the way, as the lifting of health restrictions led to a 15 per cent increase in output by the food and accommodation industry, Statistics Canada said. Oil producers and miners posted a 3.4 per cent gain, the biggest since the end of 2020, as companies benefited from increased demand and higher prices. Construction and “computer systems design,” a proxy for the digital technology industry, also posted notable increases.

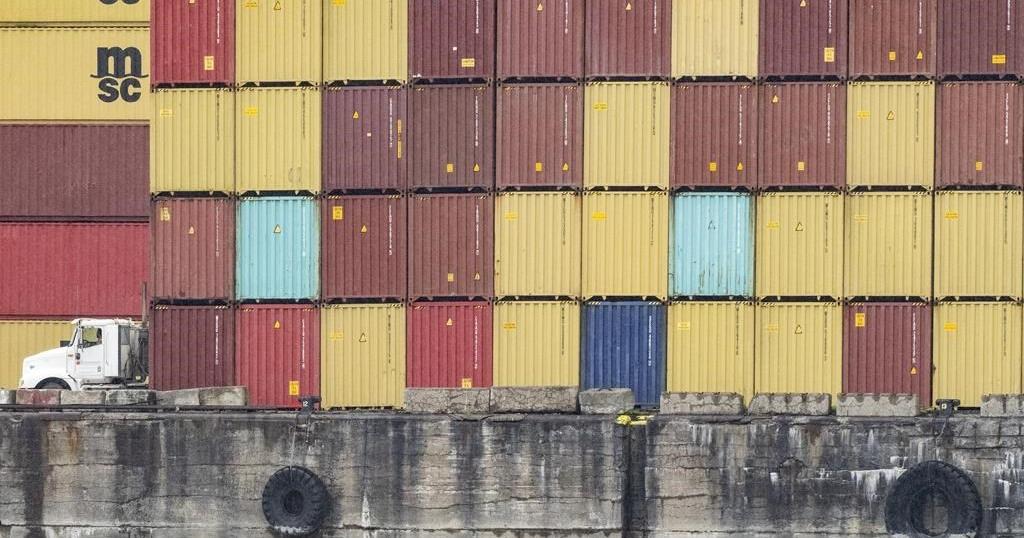

The surprising momentum could be tested in the months ahead, because a growing number of signals suggest global inflation, ongoing supply disruptions and uncertainty over the war in Ukraine could slow the recovery from the COVID-19 recession. Amazon.com Inc. on April 28 said it had downgraded its outlook amid rising costs and weaker demand for the goods it sells online. And Bank of Canada governor Tiff Macklem indicated in parliamentary testimony this week that he’s wary of what recent COVID-19 lockdowns in China portend for global growth and supply-side inflation.

Indeed, it isn’t difficult to find economists who think Canada and other big economies are setting up for another recession. But such speculation won’t stop the Bank of Canada from raising interest rates in the short term, since Macklem told lawmakers that he and his deputies will be considering another half-point increase when they next gather to decide on the benchmark-rate setting.

“The Canadian economy is in good shape,” he told the House finance committee on April 25. “It can handle higher interest rates. It needs higher interest rates.”

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

_____________________________________________________________

We’re introducing FP Answers, a new initiative at the Financial Post where readers ask the questions and we find the answers. Ask your question today

_____________________________________________________________

TORONTO – Strength in the base metal and technology sectors helped Canada’s main stock index gain almost 100 points on Friday, while U.S. stock markets also climbed higher.

The S&P/TSX composite index closed up 93.51 points at 23,568.65.

In New York, the Dow Jones industrial average was up 297.01 points at 41,393.78. The S&P 500 index was up 30.26 points at 5,626.02, while the Nasdaq composite was up 114.30 points at 17,683.98.

The Canadian dollar traded for 73.61 cents US compared with 73.58 cents US on Thursday.

The October crude oil contract was down 32 cents at US$68.65 per barrel and the October natural gas contract was down five cents at US$2.31 per mmBTU.

The December gold contract was up US$30.10 at US$2,610.70 an ounce and the December copper contract was up four cents US$4.24 a pound.

This report by The Canadian Press was first published Sept. 13, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

OTTAWA – Statistics Canada says wholesale sales, excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain, rose 0.4 per cent to $82.7 billion in July.

The increase came as sales in the miscellaneous subsector gained three per cent to reach $10.5 billion in July, helped by strength in the agriculture supplies industry group, which rose 9.2 per cent.

The food, beverage and tobacco subsector added 1.7 per cent to total $15 billion in July.

The personal and household goods subsector fell 2.5 per cent to $12.1 billion.

In volume terms, overall wholesale sales rose 0.5 per cent in July.

Statistics Canada started including oilseed and grain as well as the petroleum and petroleum products subsector as part of wholesale trade last year, but is excluding the data from monthly analysis until there is enough historical data.

This report by The Canadian Press was first published Sept. 13, 2024.

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in the base metal and energy sectors, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 172.18 points at 23,383.35.

In New York, the Dow Jones industrial average was down 34.99 points at 40,826.72. The S&P 500 index was up 10.56 points at 5,564.69, while the Nasdaq composite was up 74.84 points at 17,470.37.

The Canadian dollar traded for 73.55 cents US compared with 73.59 cents US on Wednesday.

The October crude oil contract was up $2.00 at US$69.31 per barrel and the October natural gas contract was up five cents at US$2.32 per mmBTU.

The December gold contract was up US$40.00 at US$2,582.40 an ounce and the December copper contract was up six cents at US$4.20 a pound.

This report by The Canadian Press was first published Sept. 12, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

k.d. lang gets the band back together for Canadian country music awards show

NATO military committee chair, others back Ukraine’s use of long range weapons to hit Russia

Cavaliers and free agent forward Isaac Okoro agree to 3-year, $38 million deal, AP source says

Liverpool ‘not good enough’ says Arne Slot after shock loss against Nottingham Forest

With a parade of athletes on Champs Elysées, France throws one last party for the Paris Olympics

‘Challenges every single muscle’: Champion tree climber turns work into passion

MPs to face new political realities on their return to Ottawa

Air Canada, pilots still far apart as strike notice deadline approaches