Investment

Canada's Olympic champion women's soccer team wants to see investment in the game – CBC.ca

Members of Canada’s women’s soccer team believe their gold medal will inspire future generations of young girls to play the game, perhaps even with the prospect of playing professionally at home.

Kadeisha Buchanan, Ashley Lawrence and Adriana Leon were at Toronto’s BMO Field on Tuesday to show off the gold medals they won at the Tokyo Olympics after the team defeated Sweden in the women’s soccer final.

Buchanan echoed teammates Christine Sinclair and Stephanie Labbe when it comes to translating that success into a professional team at home. She said she hopes “something big” will come soon for women’s soccer in Canada, given the growing number of people watching women on the field.

“The momentum for women’s soccer is building and I think it’s at its peak so hopefully with all that goodness that we can push forward and hopefully have a women’s team in Canada,” she said. “That’s the goal.

‘It’s time for that to change’

Canada does not have a professional women’s soccer league, or a team in the U.S.-based National Women’s Soccer League.

“I think we’re the only country ranked in the top 10 to not have some sort of professional environment for their players to play in,” Sinclair said Tuesday in a video conference from Portland, Ore., where she plays with the NWSL’s Thorns. “It’s time for that to change, and we’re hoping this platform will give us the opportunity to start that change.”

Canada Soccer president Nick Bontis said at Tuesday’s availability that the gold-medal win proves investing in women’s soccer is worthwhile.

“The gold medal was perfect because that’s what we needed in inciting action to get past what COVID did to us in the pandemic and to now create a resurgence for investors to realize the return on investment that they can get out of women’s soccer,” he said.

Leon said that after being injured in March and having surgery on her foot, she was pushing through rehab the last few months to be ready for Tokyo. She said winning Olympic gold after all that hard work meant the world to her.

“It’s such an honour to bring this [medal] back home to Canada. It was just such an amazing experience to be in Japan for the last couple months and we created memories that we’ll never forget. This medal’s incredible so it’s going to have to go somewhere very safe.”

Meaning behind gold medal

Reflecting back on how far she has come, Buchanan said she believes the medal means “dream big” and to never give up on goals.

“To be on that podium and to hear that anthem at the end, all the emotion just came to me so it means everything and you just got to find a way to keep pushing,” she said, noting she would be wearing her medal out as much as she can.

Lawrence said watching the women’s team play at the 2012 Olympics in England made her want to play for Canada. Fast forward nine years and she has won gold as a player for the same team.

Lawrence and Buchanan grew up together, and said that being on the field side by side while playing for Canada and winning gold was something they both cherished.

“I just remember there were so many games where towards the end, whether we were down, we would just kind of give each other that look and we knew it’s time to turn it on,” said Lawrence.

“And then the next game, she’s pushing me to set up a goal or score a goal so I just think that from early on, we’ve held each other to such a high standard.”

Buchanan said it felt “unreal” to be on the podium with Lawrence.

“I remember talking to [Lawrence], ‘This is our time to win for each other, and let’s just push each other to be the best that we can be for ourselves and for the team and grind out that win, each and every game.”‘

A celebration tour for the team is expected to be announced in the coming weeks. No dates or locations have been set.

WATCH | Sinclair, Labbe on what winning gold means for soccer in Canada:

Canadian soccer stars Christine Sinclair and Stephanie Labbé talk to Ian Hanomansing about their gold-medal win in Tokyo and what it means for the sport. 6:37

Investment

Wall Street bosses cheer investment banking gains but stay cautious

|

|

Wall Street’s bosses are finally seeing signs of a broader pickup in investment banking, but they are not cheering too loudly just yet.

Investment banking divisions showed robust growth in the first quarter for the largest U.S. banks, which reported surging revenues and fees. Capital markets led the comeback, executives said.

“We have strong backlogs and momentum in every part of the firm,” Morgan Stanley’s MS-N new chief executive Ted Pick told analysts on a conference call after his first quarter at the helm. “While the pipelines are healthy, there remains a backdrop of economic and geopolitical uncertainty.”

Morgan Stanley’s investment banking revenues jumped 16 per cent to US$7-billion in its first quarter, it reported on Tuesday, sending shares up more than 3 per cent.

At Bank of America BAC-N, fees from investment banking surged 35 per cent to US$1.6-billion, but its stock fell more than 4 per cent as it set aside more money to cover souring loans.

“We’re just happy to see the investment banking activity improve,” BofA’s finance chief Alastair Borthwick told journalists. He cited efforts to deepen its presence in middle markets and boost collaboration between corporate and commercial bankers.

“It appears that a rising tide has been lifting all capital market boats here,” said David Wagner, portfolio manager at Aptus Capital Advisors, adding that Morgan Stanley’s performance was “excellent.”

The results echoed strong performances at Goldman Sachs GS-N, JPMorgan Chase JPM-N and Citigroup C-N. While executives cited the return of some activity, they were also quick to point out risks, including interest-rate uncertainty, escalating geopolitical conflicts and the U.S. election.

“I’ve said before that the historically depressed levels of activity wouldn’t last forever,” Goldman’s CEO David Solomon told investors on a conference call Monday. “CEOs need to make strategic decisions for their firms, companies of all sizes need to raise capital and financial sponsors need to transact to generate returns for their investors.”

Goldman shares rallied 3 per cent after profits rose 28 per cent, beating analyst expectations.

Equity capital markets have been a bright spot in recent months as several prominent initial public offerings (IPOs) fuelled optimism that more activity would follow.

“We are cautiously optimistic that we could see a measured reopening of the IPO market in the second quarter,” Citigroup CEO Jane Fraser told analysts on Friday.

Citi’s investment banking fees climbed 35 per cent in the first quarter, lifted by debt and equity capital markets. Yet mergers and acquisitions (M&A) were still slow to emerge, Ms. Fraser said.

“Corporate sentiment is quite positive, especially in the U.S., and our clients around the world have very sound balance sheets,” she said. Still, markets were too “benign” in pricing in risk factors such as geopolitical conflicts, she added.

Citi hired JPMorgan’s former co-head of investment banking, Viswas Raghavan, who is tasked with growing its banking revenues when he joins later this year.

At JPMorgan, chief financial officer Jeremy Barnum also struck a cautious note even as investment banking revenue climbed 27 per cent to US$2-billion.

“While it was encouraging to see some positive momentum in announced M&A in the quarter, it remains to be seen whether that will continue,” Mr. Barnum told analysts on a call on Friday. “And the advisory business still faces structural headwinds from the regulatory environment.”

Morgan Stanley’s Mr. Pick is more optimistic than other CEOs on the effect of geopolitical risks, saying in some cases it can even create incentive for international deals if global conflicts affect supply chains.

“We are in the early innings of a multiyear M&A cycle,” said Mr. Pick at Morgan Stanley, who described investment banking and capital markets as being in the early to middle parts of the business cycle. “We should continue to see all kinds of underwriting … I’m feeling good about this.”

Large M&A announcements in multiple industries presented recent signs of rising confidence from CEOs and boards, that would support capital markets, Ms. Fraser said.

Goldman’s Mr. Solomon expects private equity firms, or financial sponsors, to get more involved in deals in an effort to start returning capital to investors.

Ms. Fraser, meanwhile, noted financial sponsors are sitting on US$3-trillion that they need deploy.

Citigroup shares are up nearly 11 per cent so far this year, outpacing peers including JPMorgan and Bank of America, which have gained 6 per cent and 3 per cent, respectively. Goldman shares have risen 3 per cent, contrasting with a 3-per-cent decline for Morgan Stanley. The S&P 500 banks index has climbed 6 per cent.

Investment

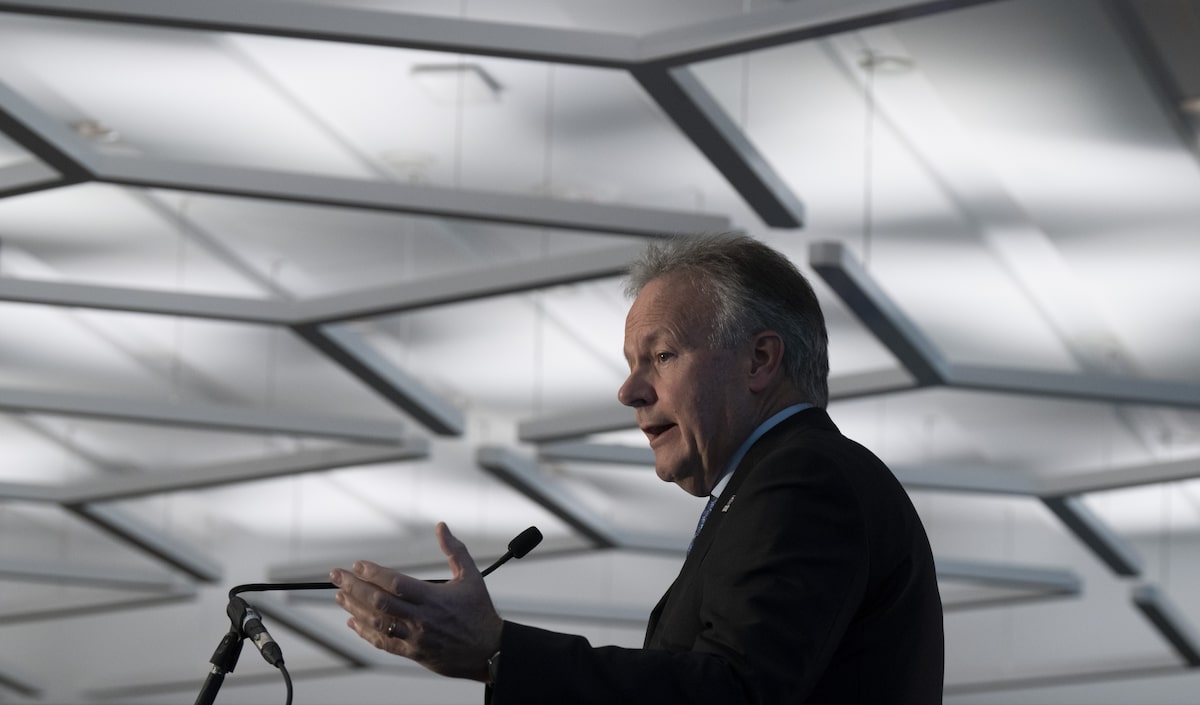

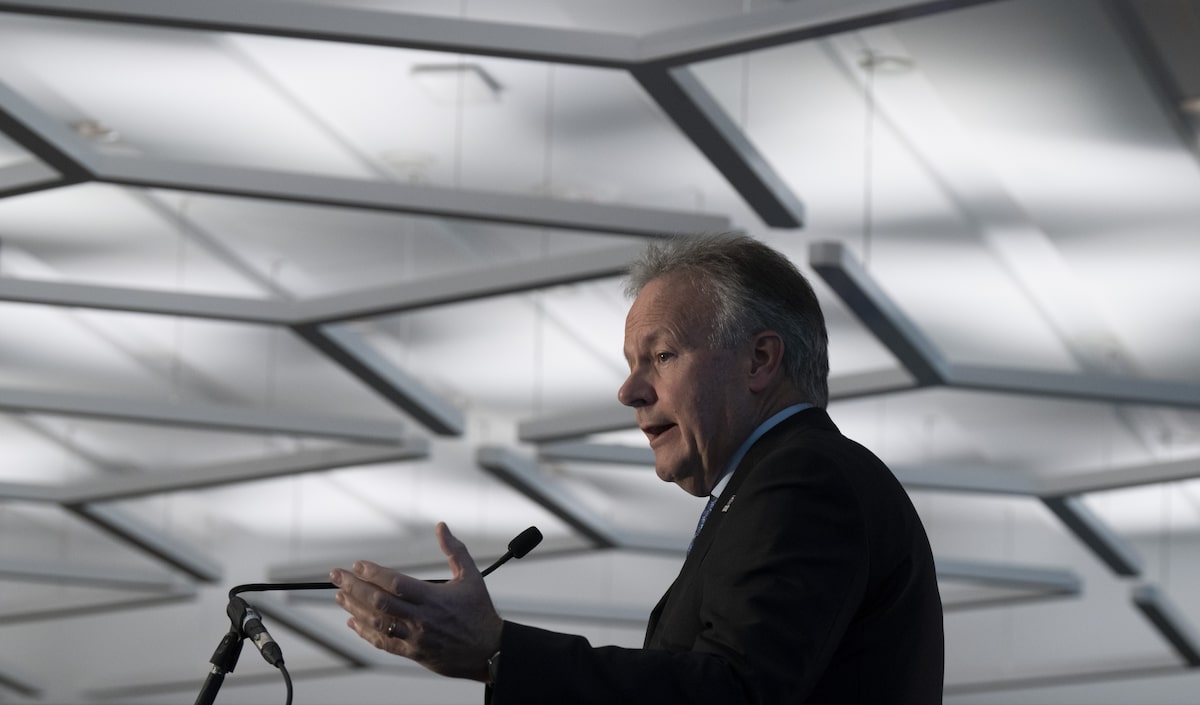

Stephen Poloz will lead push to boost domestic investment by Canadian pension funds

|

|

Ottawa is appointing former Bank of Canada governor Stephen Poloz to lead a new federal working group that will look at ways of encouraging Canadian pension funds to invest more in the country, especially in areas such as digital infrastructure and airports.

The working group is being created to “explore how to catalyze greater domestic investment opportunities for Canadian pension funds,” the government announced in its budget document released Tuesday, and Mr. Poloz will be supported by Finance Minister Chrystia Freeland, with participation from pension leaders.

The review will focus on priority areas that include investment in digital infrastructure, artificial intelligence, physical infrastructure, airport facilities, venture capital to back startup and early-stage companies, as well as building more new homes. There is a particular emphasis on airports – an asset that pension fund leaders have long said would interest them if governments opened them up to private investment.

And the group has been asked to consider whether Canada should lift a rule that restricts pension funds from holding more than 30 per cent of the voting shares in a company, which is considered archaic by some and is already circumvented by some large funds.

The working group is Ottawa’s answer to a debate that flared up in recent months about whether Canada’s largest pension funds, which collectively manage more than $2-trillion of assets, are investing sufficiently in their home country. Senior business leaders, including chief executive officers from some of Canada’s largest companies, have pressed Ms. Freeland and her provincial counterparts to change the rules governing pension funds, as a way of nudging them to put more of their members’ dollars into Canadian investments. But current and former pension fund leaders have strongly pushed back, arguing that the funds must keep their freedom and independence to invest as they see fit, to ensure they can pay sustainable pensions to their members into the future.

Ms. Freeland and Ontario Finance Minister Peter Bethlenfalvy have both signalled a desire to boost pension funds’ domestic investments, and the budget measures announced Tuesday echo previous pledges made in the federal government’s fall economic statement.

But by framing the working group as “working with pension plans,” and focusing on unlocking investment opportunities that align with pension funds’ duties to invest in the best interests of their members, Ottawa appears to be taking a conciliatory approach.

“It appears to us, based on what we’re seeing in the budget, that they have it right,” said Michel Leduc, global head of public affairs and communications at the Canada Pension Plan Investment Board. “If you want to bring all the right people to the table, you’ve got to demonstrate a level of openness, and I think that’s what they’re doing.”

In Mr. Poloz, the government has chosen a respected intermediary to lead the process. The economist and former central banker, who now works as a special adviser for law firm Osler, Hoskin & Harcourt LLP, commands respect from a broad swath of Canada’s business leaders. After a career spent in Ottawa’s senior ranks, he has a deep understanding of the broad forces that shape the country’s economic performance. And his experience leading the Bank of Canada – an institution that fiercely guards its independence – is likely to give some comfort to pension fund executives who are set on preserving their autonomy.

The proposed scope of the working group does not mention more drastic options, which could have included rewriting legislation to add an explicit focus on economic development to public pension funds’ mandates, or changing investment rules to treat investments in Canada differently from ones made abroad. Those types of changes, which are supported by some business leaders, could be hard for Ottawa to make. They would require buy-in from provinces in most cases.

While nearly all of Canada’s largest pension funds have mandates to focus on getting the best investment returns for pensioners while managing risks, Quebec’s Caisse de dépôt et placement du Québec – which manages a $434-billion investment portfolio – has a dual mandate that includes contributing to Quebec’s economic development. In past statements, Ms. Freeland’s office has praised the Caisse’s track record of delivering returns and adding to Quebec’s economy. The latest budget measures appear to steer away from imposing such a dual mandate on other funds.

“A key measure of success will be: Does it create new and better opportunities at scale? Does it lower various forms of risk relative to other markets? Because it’s all about risk-adjusted returns,” CPPIB’s Mr. Leduc said of the budget announcement.

To attract new investment capital to airports, including from pension funds, the budget says the Minister of Transport plans to release a policy statement this summer that highlights “existing flexibilities” in the governance of the national airports system.

The government also plans to make the breakdown of how much Canada’s pension funds invest in Canada and abroad more transparent. The budget says Ottawa will empower the country’s federal financial regulator, the Office of the Superintendent of Financial Institutions, to publicly disclose a standard set of information on large federally regulated pension plans. It would show the proportion of assets invested in each country, broken down by types of assets – for example, stocks, bonds, real estate or infrastructure – in each jurisdiction.

That could help fill gaps where plans don’t already publish that much detail, and Ottawa is pledging to work with provinces and territories to create similar disclosure rules for the large plans they regulate, which would be crucial to creating a consistent standard.

The budget document also sharpens the mandates for the Business Development Bank of Canada and Export Development Canada, two Crown agencies where the government has previously promised to review operations. Ottawa is directing the Business Development Bank of Canada to ramp up financing “for promising new and high-growth businesses,” and to redirect more of its venture capital investments to “emerging and higher-risk sectors to help attract more private capital.”

The government also says in the budget that Export Development Canada should tweak its risk management policies to allow it to take more chances, and create a special envelope of money to enable riskier investments when the agency is supporting exporters in key areas for Canada, because they are expanding into “highly competitive markets.”

Investment

Microsoft’s $1.5B investment in G42 signals growing US-China rift

|

|

As the Gulf region gains strategic importance in the tech war between the U.S. and China, Microsoft is making a big move into one of the Middle East’s oil-rich countries.

On Monday evening, Microsoft announced a $1.5 billion investment in Group 42 Holdings (G42), the Abu Dhabi-based AI company that has become a major force in the United Arab Emirates’ effort to be a global leader in artificial intelligence. The minority stake will give Brad Smith, Microsoft’s vice chair and president, a seat on G42’s board of directors.

The deal signifies more than a commercial collaboration between two AI titans — it serves as evidence of two countries’ strategic positioning amid rising geopolitical tensions.

The funding comes as U.S. politicians’ grow increasingly concerned about G42’s ties with China. In January, the bipartisan House Select Committee on the Chinese Communist Party sent a letter to Commerce Secretary Gina Raimondo, urging the Department of Commerce to investigate G42 for inclusion on the Bureau of Industry and Security’s Entity List, which would bar the Emirati company from accessing sensitive U.S. technologies.

Such a move would put G42 under the same security concerns umbrella as Huawei, which was placed on the Entity List in 2019. Huawei has since been restricted from acquiring critical U.S. technologies, including high-end chips and certain Android services.

Microsoft’s investment this week appears to be an indication of which superpower G42 has aligned itself with.

Delicate dance

Though a long-time economic and military ally of the U.S., the UAE has in recent times diverged from Washington’s foreign policy, and expanded its partnerships with China, a development that worries Washington.

Last year, the UAE’s president, Mohamed bin Zayed Al Nahyan, attended Russia’s flagship economic forum, which was largely shunned by Western countries in protest of the Ukraine war. The UAE has also increased military cooperation with China, and has even planned their first joint air force training last year.

On the business side, the UAE is attracting a wave of Chinese venture capitalists and entrepreneurs who are increasingly excluded from the U.S. market. Managers of Chinese funds have also turned to the UAE and its affluent Middle Eastern neighbors for capital as limited partners in the U.S. retreat from China. Capitalizing on the UAE’s commitment to electrify its economy, China’s electric vehicle manufacturers have been aggressively touting plug-in models in the market. Last year, premium EV maker Nio secured $738.5 million investment from an Abu Dhabi-backed fund.

Given the two countries’ burgeoning economic alliance, it’s no surprise that G42, which is spearheading the UAE’s AI development, has also forged ties with Chinese firms. These commercial relationships, however, have greatly concerned the U.S.

In its letter to Raimondo, the House Select Committee on the CCP noted that G42 maintains relationships with entities like Huawei, the Beijing Genomics Institute (BGI) and Tencent.

The Committee also highlighted the background of G42’s CEO Peng Xiao, who previously held a senior position at a subsidiary of DarkMatter, a company that develops “spyware and surveillance tools that can be used to spy on dissidents, journalists, politicians, and U.S. companies,” the committee wrote.

Given these alleged Chinese ties, the committee is concerned that G42 can be a way for Chinese firms to access U.S. technologies that are otherwise under export controls. The Committee is in particular wary of its “extensive commercial relationships” with U.S. tech companies including Microsoft, Dell, and OpenAI.

Picking sides

Microsoft investment in G42 is an uncommon example of a deal that’s received overt backing from their respective governments. According to the companies’ statement, this “commercial partnership is backed by assurances to the U.S. and UAE governments through a first-of-its-kind binding agreement to apply world-class best practices to ensure the secure, trusted, and responsible development and deployment of AI.”

If the deal goes through, it will designate Microsoft as G42’s official cloud partner. Under the agreement, the Emirati company’s data platform and other key infrastructure will migrate to Microsoft Azure, which will power G42’s product development. G42 already has a partnership with OpenAI that commenced in 2023.

The partnership with Microsoft appears to be part of an ongoing effort at G42 to tone down its Chinese influence. The firm divested its China-related investments, including its shares in TikTok parent ByteDance, this February. Xiao also said late last year that the firm planned to phase out Chinese hardware, saying, “We cannot work with both sides.”

What Microsoft gains in return is extensive access to the region’s market. Its AI business and Azure will get access to a range of industries like financial services, healthcare, energy, government and education. The partnership will also see the pair launching a $1 billion fund “for developers to boost AI skills” in the UAE and the broader region.

As tech companies have learned in the past few years, it has become increasingly difficult to avoid choosing sides between the U.S and China — whether in terms of technology vendors, users or investors. The developments around G42 demonstrate that even a country like the UAE, which has sought to maintain a neutral stance, may ultimately be forced to take a side.

-

Sports2 hours ago

Sports2 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState10 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech9 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

News23 hours ago

Budget 2024 sets up a ‘hard year’ for the Liberals. Here’s what to expect – Global News

-

Economy21 hours ago

China’s economy grew 5.3% in first quarter, beating expectations – CityNews Halifax

-

Investment18 hours ago

Investment18 hours agoSo You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada

-

Media23 hours ago

Psychology group says infinite scrolling and other social media features are ‘particularly risky’ to youth mental health – NBC News

-

Sports22 hours ago

Sports22 hours agoTiger Woods finishes Masters with his highest score as a pro, sets sights on coming majors – The Globe and Mail