Real eState

Canadian Real Estate Sentiment Survey: Confidence wanes in Q4 | RENX – Real Estate News EXchange

Q4 2020 REALPAC/FPL Canadian Real Estate Sentiment Survey reports confidence waned in the latter part of 2020. (Courtesy REALPAC)

After plummeting in the second quarter and improving in Q3, confidence in the Canadian real estate market waned slightly heading into year-end, according to the Q4 2020 REALPAC/FPL Canadian Real Estate Sentiment Survey.

The survey captured the thoughts of a variety of industry leaders, including chief executive officers, presidents, board members and executives from a broad set of sectors, including owners and asset managers, financial services providers, and operators and related service providers.

The quarterly survey measures executives’ current and future outlooks on overall real estate conditions, access to capital markets and real estate asset pricing. Survey respondents represent the retail, office, industrial, hotel, multifamily, residential and senior residential asset classes.

Data was collected in October 2020 and the report includes anonymous excerpts from interviews with participants as well as the survey data.

When asked to compare current market conditions to the situation a year earlier, 32 per cent of Canadian respondents believed they were much worse.

Forty-two per cent said they were somewhat worse, 10 per cent thought they were about the same, 14 per cent offered that they were somewhat better and two per cent opined they were much better.

The sentiment in the United States wasn’t far off from that.

The Canadian results to the same question in the third quarter showed: much worse 13 per cent, somewhat worse 60 per cent, about the same 15 per cent, somewhat better 10 per cent and much better two per cent.

General market condition sentiment

Uncertainty remained in the Canadian real estate market moving into 2021, though there was some optimism about vaccines reducing COVID-19 concerns.

Three per cent of Canadian respondents thought general real estate market conditions will be much worse in a year.

Twenty-four per cent said it will be somewhat worse, 18 per cent responded it will be about the same, 47 per cent believed it will be somewhat better and eight per cent opined it will be much better. Those results are relatively close to those from the U.S.

A selection of quotes from respondents:

– “I would describe market conditions at a lower level in Q4 2020 versus 2019, but still stable and reasonable. There’s high liquidity in the marketplace for mortgage debt and refinance opportunities are very solid. We are seeing fewer transactions as there are not as many sales. Refinancing or repositioning financing and development financing are all quite strong.”

– “The next 12 months will see a tremendous number of small businesses fold and the result will be much higher vacancies, lower rents and higher cap rates. Overall, 2021 and 2022 will be very difficult for commercial real estate; however, the downturn will be good for transactions in the later part of 2021 and much of 2022.”

– “(There are) more unknowns today than at any given time in the last 20 years. With the exception of hospitality and retail, private markets are slower to react as players in the market try to digest. (There’s a) slow realization that previously unassailable sectors like office and residential will be impacted, but the extent is a question mark. If unemployment remains where it is for a period of time, and government support ebbs, it will have an impact across the spectrum. The biggest factors in a recovery are treatments/vaccines for COVID-19 as well as continued government support and a subsequent stimulus/recovery plan.”

Asset values sentiment

Transaction volume remains low, resulting in inconclusive asset valuations. Distressed transaction activity has yet to emerge in Canada.

Six per cent of Canadian respondents believed asset values will be much lower in a year, 29 per cent said they will be somewhat lower, 26 per cent thought they will be about the same and 39 per cent stated they’ll be somewhat higher.

No respondents believed they will be much higher. All of those numbers closely mirror those from the U.S.

Here are some quotes from participants:

– “There is a bifurcation in real estate values. Residential and industrial are still doing well while retail and, to a lesser extent, office is struggling. This will not change as there are some systemic changes taking place in the use of real estate.”

– “At a macro level, rent rolls are being suppressed because businesses are uncertain. With that being said, if your rent is questionable, that’s going to have an impact on your asset value and it will spread a lot of cold water on transactions. Within retail, the pandemic is driving the impact. The bricks and mortar contest against online will continue. Tenants are in trouble as the pandemic accelerates asset devaluation in retail. On the commercial side, I think that it is a temporary issue. I see the watermark on operating expenses showing up right now. There’s not a lot of movement in assets so there’s not a lot of transactions to show if this is a true downturn. Depending on a company’s capital structure, organizations might get aggressive on devaluing assets to give themselves a bit of head room for the next couple years, but that’s more aggressive tax planning. There’s devaluation because of rent, and the watermark on operating expenses. This is where technology comes in and delivers. In a building that is not run efficiently, technology will offer operating costs on a fixed basis causing NOI to go up.”

Debt capital sentiment

Lenders remain active, though there’s an increased level of scrutiny during the due diligence process, with many less willing to engage in higher risk investments.

Four per cent of Canadian respondents said the availability of debt capital will be much worse in a year.

Twenty-two per cent thought it will be somewhat worse, 29 per cent believed it will be about the same, 39 per cent opined it will be somewhat better and six per cent responded it will be much better.

There was a wider discrepancy with the U.S. results in this category. There was less optimism south of the border, where the respective sentiment numbers were two, 15, 38, 40 and five per cent.

Here are some quotes from respondents:

– “The dichotomy among the lending community is staggering. Rates change so quickly.”

– “We prefer Tier 1 and Tier 2 banks. Tier 1 banks are most cautious while Tier 2 banks are more willing to have a conversation. Alternative lenders see this as an opportunity.”

Equity capital sentiment

While equity capital is available, investors are increasingly discerning when evaluating investment track records and leverage ratios.

Two per cent of Canadian respondents thought the availability of equity capital will be much worse in a year.

Six per cent said it will be somewhat worse, 36 per cent responded it will be about the same, 52 per cent believed it’ll be somewhat better and four per cent said it will be much better. Those numbers are pretty close to those from the U.S.

Some quotes from participants:

– “(Equity capital is) not as bad as we thought it would be. Alignment between objectives with investors is very important. We would not go on a road show right now.”

– “We have had groups express interest. Investors are looking for a history of being conservative with debt. There are more conversations around risk mitigation versus track records.”

– “People are looking for anywhere where they can find a decent level of risk-adjusted return. There is a lot of capital moving into the space in private markets in general, whether it’s equity or debt.”

REALPAC and Ferguson Partners

REALPAC is the national industry association dedicated to advancing the long-term vitality of Canada’s real property sector.

Its more than 120 members include publicly traded real estate companies, real estate investment trusts, private companies, pension funds, banks and life insurance companies with investment real estate in all asset classes.

Ferguson Partners compiled the sentiment survey in conjunction with REALPAC.

The boutique talent management firm is involved with executive and board recruitment as well as compensation, leadership and management consulting.

Real eState

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions – The New York Times

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary approval from a federal judge.

On Tuesday morning, Judge Stephen R. Bough, a United States district judge, signed off on an agreement between the National Association of Realtors and home sellers who sued the real estate trade group over its longstanding rules on commissions to agents that they say forced them to pay excessive fees.

The agreement is still subject to a hearing for final court approval, which is expected to be held on Nov. 22. But that hearing is largely a formality, and Judge Bough’s action in U.S. District Court for the Western District of Missouri now paves the way for N.A.R. to begin implementing the sweeping rule changes required by the deal. The changes will likely go into full effect among brokerages across the country by Sept. 16.

N.A.R., in a statement from spokesman Mantill Williams, welcomed the settlement’s preliminary approval.

“It has always been N.A.R.’s goal to resolve this litigation in a way that preserves consumer choice and protects our members to the greatest extent possible,” he said in an email. “There are strong grounds for the court to approve this settlement because it is in the best interests of all parties and class members.”

N.A.R. reached the agreement in March to settle the lawsuit, and a series of similar claims, by making the changes and paying $418 million in damages. Months earlier, in October, a jury had reached a verdict that would have required the organization to pay at least $1.8 billion in damages, agreeing with homeowners who argued that N.A.R.’s rules on agent commissions forced them to pay excessive fees when they sold their property.

The group, which is based in Chicago and has 1.5 million members, has wielded immense influence over the real estate industry for more than a century. But home sellers in Missouri, whose lawsuit against N.A.R. and several brokerages was followed by multiple copycat claims, successfully argued that the group’s rule that a seller’s agent must make an offer of commission to a buyer’s agent led to inflated fees, and that another rule requiring agents to list homes on databases controlled by N.A.R. affiliates stifled competition.

By mandating that commission be split between agents for the seller and buyer, N.A.R., and brokerages who required their agents to be members of N.A.R., violated antitrust laws, according to the lawsuits. Such rules led to an industrywide standard commission that hovers near 6 percent, the lawsuits said. Now, agents will be essentially blocked from making those commission offers, a shift that will, some industry analysts say, lower commissions across the board and eventually force down home prices as a result.

Real estate agents are bracing for pain.

“We are concerned for buyers and potentially how we will get paid for working with buyers moving forward,” said Karen Pagel Guerndt, a Realtor in Duluth, Minn. “There’s a lot of ambiguity.”

The preliminary approval of the settlement comes as the Justice Department reopens its own investigation into the trade group. Earlier this month, the U.S. Court of Appeals for the District of Columbia overturned a lower-court ruling from 2023 that had quashed the Justice Department’s request for information from N.A.R. about broker commissions and how real estate listings are marketed. They now have the green light to scrutinize those fees and other N.A.R. rules that have long confounded consumers.

“This is the first step in bringing about the long awaited change,” said Michael Ketchmark, the lawyer who represented the home sellers in the main lawsuit. “Later this summer, N.A.R. will begin changing the way that homes are bought and sold in our country and this will eventually lead to billions of dollars and savings for homeowners.”

Under the settlement, homeowners who sold homes in the last seven years could be eligible for a small piece of a consolidated class-action payout. Depending on how many homeowners file claims by the deadline of May 9, 2025, that could mean tens of millions of Americans.

Real eState

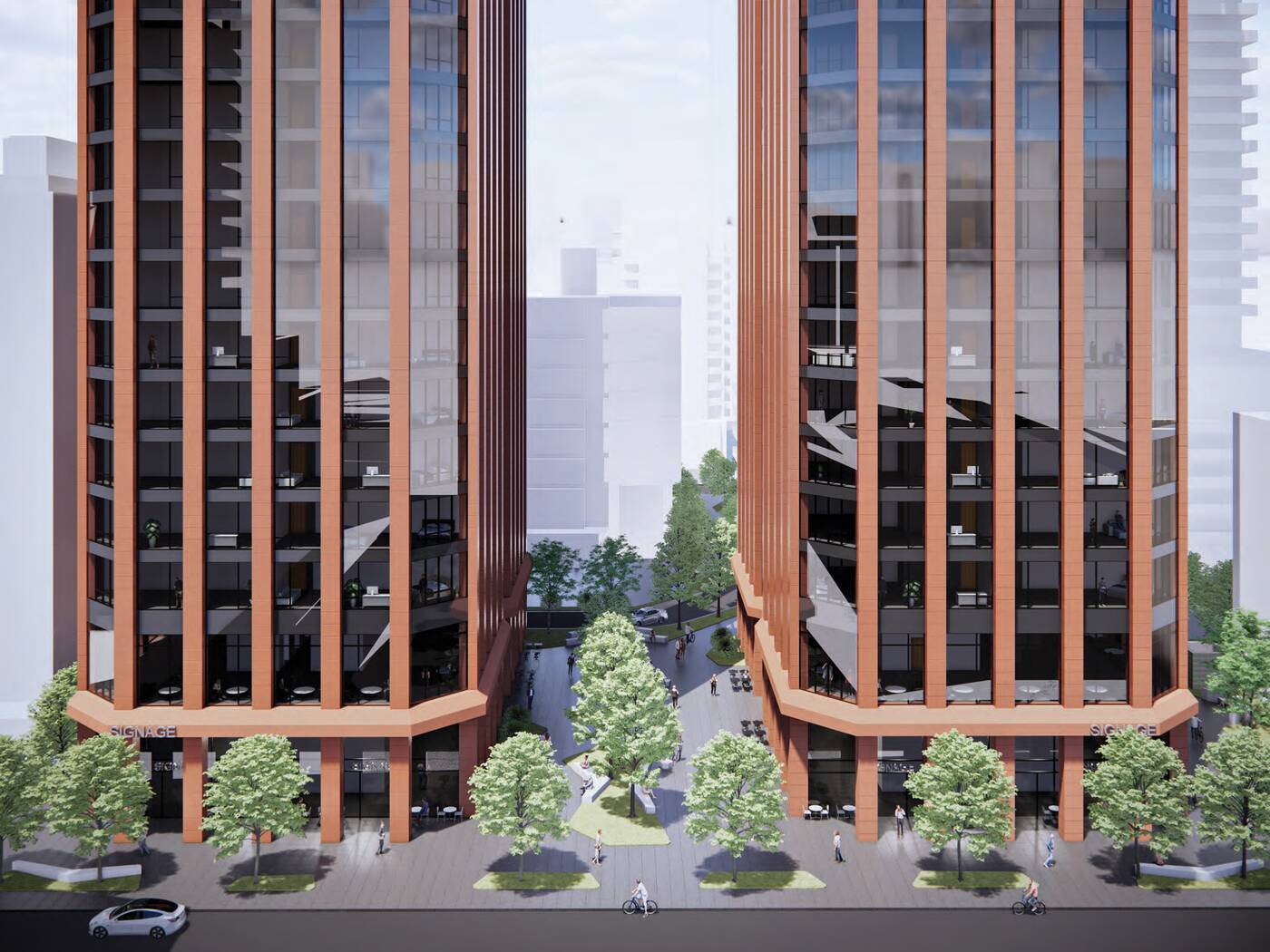

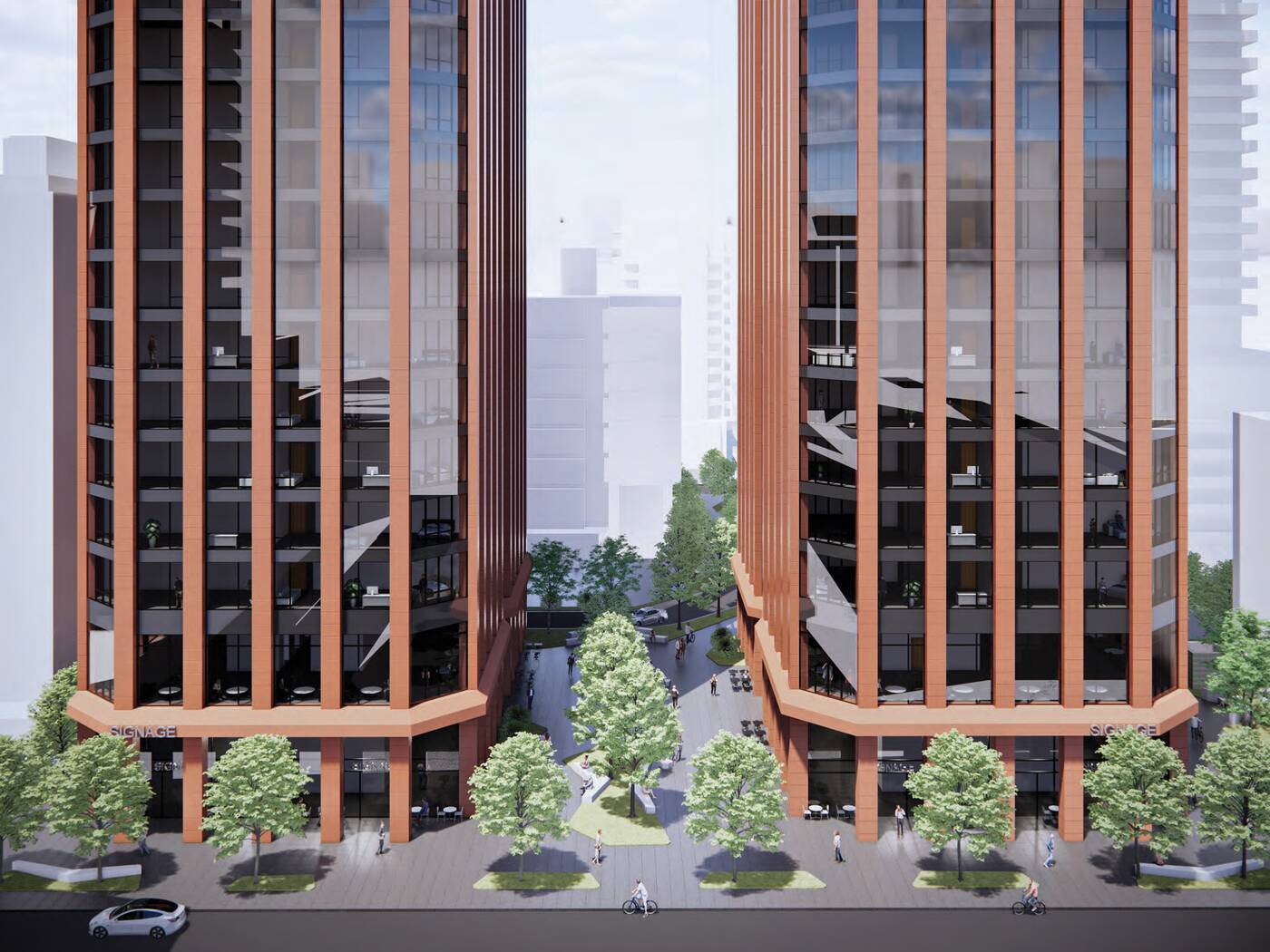

Two matching megacomplexes to totally transform Toronto neighbourhood – blogTO

A pair of twinned proposals aim to completely redefine the skyline of Toronto’s midtown area with an architectural statement that would set the neighbourhood apart from other high-rise clusters in the city.

Two separate proposals from developer Madison Group at 110 and 150 Eglinton Avenue East have been resubmitted to city planners, calling for two pairs of mixed-use condominium towers with standout designs unlike anything that exists in the city today.

In a surprising twist from a developer not exactly known for breaking the bank on architecture, the proposals now boast brand-new complementary designs from acclaimed firm Rafael Viñoly Architects.

The 110 Eglinton site, currently home to a pair of mid-rise office buildings, would be demolished and built out with two 58-storey towers.

A few doors to the east, the 150 Eglinton site includes a handful of mid-rise and low-rise commercial buildings along Eglinton, wrapping around Redpath Avenue. These buildings would also be demolished and replaced with a pair of 61-storey towers.

All four towers will feature matching designs boasting red aluminum cladding forming vertical piers that accentuate the towers’ heights, though there will be some key differences between the pairs at 110 and 150 Eglinton.

150 Eglinton East

The 58-storey towers at 110 Eglinton East will be linked via an enormous floating bridge spanning levels five through 10, framing a large open public space below and supporting an elevated residential amenity floor above.

The 61-storey towers lack a skybridge, but will also feature amenity levels with panoramic views, including spaces on the 28th and 40th floors.

At heights of just over 236 metres, these four towers all stand taller than anything that exists in the neighbourhood as of 2024.

The combined proposals would add a staggering 3,364 condominium units to the neighbourhood, along with new retail and office space to maintain employment uses along this evolving corridor.

One standout of the proposals is a series of privately-owned publicly accessible spaces measuring over 5,000 square metres across the combined sites.

Among the publicly-accessible spaces proposed are the aforementioned area below the bridge at 110 Eglinton, along with pedestrian walkways that will allow foot traffic to filter through the block between Eglinton and Roehampton Avenue to the north.

It’s the type of proposal one would expect to be met with significant local backlash. However, early feedback from the neighbourhood is surprisingly positive.

Local city councillor Josh Matlow took to X to voice his support for the project, calling it “genuinely exciting.”

“The architecture is beautifully designed,” said Matlow, hyping up locals with a promise that renderings of the new public space would wow the community. It’s remarkable for our community and city — like bringing Rockefeller Center to midtown Toronto,” said Matlow.

Rafael Viñoly Architects

Real eState

This Toronto home is a ’90s decor trip but a steal at only $600K

|

|

If you’re a millennial and grew up in the ’90s, you’ll probably remember a fair amount of ’90s home decor trends that might still haunt you to this day.

There were sponge-painted walls, all-beige everything, wallpaper borders, oak cabinets, carpets in places where there shouldn’t be carpets, bedroom sets from big-box stores, Southwestern or Tuscan decor in homes that weren’t in Arizona or Italy, and the list goes on.

We thought we’d left those troubling times in the past, but 39 Hatherley Rd. really brings back all those memories.

The front porch.

Somehow this two-bedroom, one-bathroom house hit almost every ’90s trend, except for carpets in the bathroom (phew!).

The entryway.

What’s weird is this house has changed ownership a few times since the 90s. In fact, it was most recently purchased in 2010 for $250,000.

The living room.

So it’s somewhat surprising that when you look at past listing photos, almost nothing has changed. In fact, it seems they added the sponge-painted walls in 2010.

The kitchen.

But despite 39 Hartherley Rd. being a total throwback, this house is, as the listing says, “a diamond in the rough.”

The backyard.

First off, it’s a detached house with a 125-foot deep lot in a good location.

The kitchen has plenty of storage but, sadly, no dishwasher.

The main floor has a living room and kitchen with enough space for a dining table.

The main floor.

The layout is a bit awkward but the Dutch door off the kitchen is too cute.

The back patio.

Off the kitchen is a laundry room/mud room that leads to the spacious backyard.

The primary bedroom.

Upstairs, there are two decently sized rooms and a small bathroom.

The second bedroom.

The house definitely needs some updating but the roof was done in 2015, the furnace is only a few years old, the electrical has been updated, and there’s room for expansion.

A fireplace in the living room.

Also, a coat of paint will do wonders to brighten up the all-beige ’90s aesthetic.

The small bathroom.

However, the biggest selling point of this home is the price point.

The back of the house.

39 Hatherley Rd. is listed for only $599,999, which is almost unheard of in Toronto, even if this place will probably go for closer to $700K.

-

Health13 hours ago

Health13 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art19 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Health17 hours ago

Health17 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Media24 hours ago

Jon Stewart Slams the Media for Coverage of Trump Trial – The New York Times

-

Investment17 hours ago

Investment17 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

News17 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Science21 hours ago

Science21 hours agoiN PHOTOS: Nature lovers celebrate flora, fauna for Earth Day in Kamloops, Okanagan | iNFOnews | Thompson-Okanagan's News Source – iNFOnews

-

Art18 hours ago

An exhibition with a cause: Montreal's 'Art by the Water' celebrates 15 years – CityNews Montreal