Economy

China Looks at Cutting Inequality in Order to Boost the Economy – BNN

(Bloomberg) — The Chinese Communist Party’s new pledge to fix the “demand side” of the economy has prompted expectations the leadership will implement more egalitarian policies to stimulate consumer spending.

The Party’s top leaders used the phrase “demand-side reform” for the first time this month, in a departure from its past focus on “supply-side” changes which involve upgrading industry and cutting capacity in bloated sectors.

Although China is the only major economy set to grow this year due to its effective control of the pandemic, the new slogan signals that the ruling party is worried about the uneven recovery in which household spending has lagged behind investment in real estate and infrastructure. Beijing has not detailed what the phrase means, but officials have dropped hints and economists have been quick to offer suggestions.

Income Redistribution

The term “demand side” is used to refer to investment, consumer spending and any trade surplus. Beijing turned to investment to replace exports as a driver of economic growth during the 2008 financial crisis when overseas orders slowed, and has since struggled to “rebalance” demand toward consumer spending.

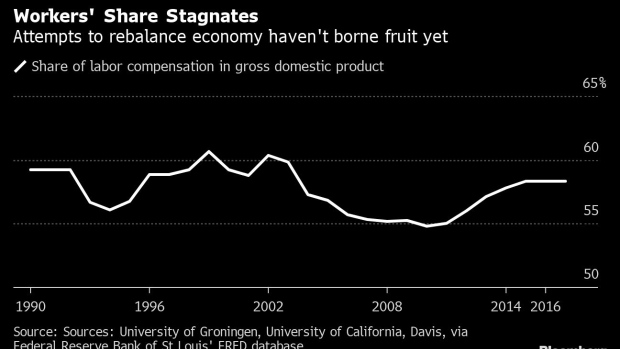

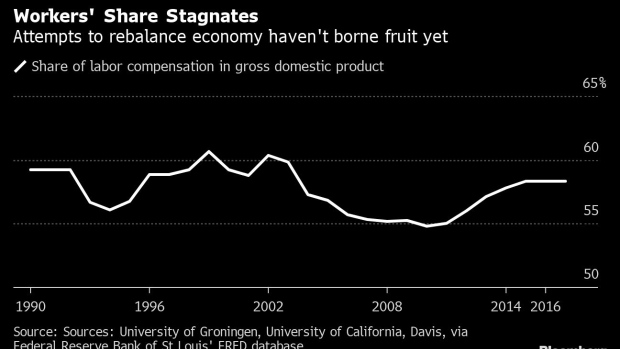

Economists blame that imbalance on several factors, including pay inequality that means income accrues to richer households who are less likely to spend, and the relatively high share of gross domestic product paid as profits to capital owners rather than as wages to workers.

Top officials including President Xi Jinping and Vice Premier Liu He and have drawn attention to those issues this year. In a speech published in August, Xi spoke about the low share of wages in GDP and “outstanding problems in income distribution” and cited French economist Thomas Piketty’s “Capital in the 21st Century,” as showing the harmful effects of inequality. Liu has called for improving mechanisms to increase wages.

What Bloomberg Economics Says…

“In the short term, the aim will likely be to boost domestic demand with public consumption and investment. Longer-term policies will be aimed at spurring a structural shift in household consumption toward higher value-added products and services.”

— David Qu, economist

For the full report, click here

After an annual economic planning meeting this month, the party promised to “optimize the income structure and expand the middle-income group.” Shanghai’s city government included a “fair” income distribution in its next five-year plan, including “regulating excessively high-incomes.”

This will require more government intervention through taxes, some government-affiliated economists say. “When a country has a higher level of income, the government will intensify income redistribution efforts with taxation and transfer payments,” according to a speech in August by Cai Fang, vice president at the Chinese Academy of Social Sciences, an influential government think-tank.

Specific measures could include raising income taxes on the wealthiest, providing income-tax credits to lower earners, imposing taxes on wealth such as property, and levying capital gains charges on financial transactions, most of which are exempt from tax.

“I think the income tax is already pretty progressive. The key is the capital gains tax,” said Gan Li, director of the Survey and Research Center for China Household Finance at China’s Southwestern University of Finance and Economics.

Social Welfare

Beijing has vowed to reduce the large gaps in quality and coverage of public services such as healthcare and education between different regions. Shifting government spending to such services could encourage households to save less of their incomes and spend more on goods and services.

“China’s social security expenditure is about 10% of GDP, which is much lower than 19% in Europe. In the future, it will be the trend to invest more in the social security system, and the structure of fiscal expenditure will be adjusted,” analysts at securities brokerage Guotai Junnan wrote in a report on demand-side reform.

The reform of the resident registration system may also increase access to social welfare. In April, the government said that all cities with populations smaller than 3 million should abolish rules which limited access to government services only to people officially registered to live in the city. Similar changes could cut out-of-pocket social service costs for millions.

Obstacles

With Beijing this year saying it would rely on a “dual circulation” strategy in which economic growth will become increasingly dependent on domestic demand, rather than exports, economists expect the government to maintain high-levels of investment spending, while shifting away from transport infrastructure and housing toward technology and environmental projects.

However, any shift in emphasis is likely to be gradual.

Beijing has struggled to move forward with a property tax it has planned for more than a decade due to resistance from the wealthy and fears about declining asset prices. And the recent Communist Party meeting stated that supply-side reforms would continue to be the “main line” of policy.

“China’s policy makers have been talking about increasing consumption and demand-led growth for decades,” said Terry Sicular, a China-focused economist at Western University in Canada. “But all the talk about it hasn’t made it happen.”

©2020 Bloomberg L.P.

Economy

Biden's Hot Economy Stokes Currency Fears for the Rest of World – Bloomberg

As Joe Biden this week hailed America’s booming economy as the strongest in the world during a reelection campaign tour of battleground-state Pennsylvania, global finance chiefs convening in Washington had a different message: cool it.

The push-back from central bank governors and finance ministers gathering for the International Monetary Fund-World Bank spring meetings highlight how the sting from a surging US economy — manifested through high interest rates and a strong dollar — is ricocheting around the world by forcing other currencies lower and complicating plans to bring down borrowing costs.

Economy

Opinion: Higher capital gains taxes won't work as claimed, but will harm the economy – The Globe and Mail

Canada’s Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland hold the 2024-25 budget, on Parliament Hill in Ottawa, on April 16.Patrick Doyle/Reuters

Alex Whalen and Jake Fuss are analysts at the Fraser Institute.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50-per-cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’s marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivizes investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

Budget’s capital gains tax changes divide the small business community

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7-billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing – that this move only affects the wealthy – lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital gains do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new startups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgment of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Economy

Nigeria's Economy, Once Africa's Biggest, Slips to Fourth Place – Bloomberg

Nigeria’s economy, which ranked as Africa’s largest in 2022, is set to slip to fourth place this year and Egypt, which held the top position in 2023, is projected to fall to second behind South Africa after a series of currency devaluations, International Monetary Fund forecasts show.

The IMF’s World Economic Outlook estimates Nigeria’s gross domestic product at $253 billion based on current prices this year, lagging energy-rich Algeria at $267 billion, Egypt at $348 billion and South Africa at $373 billion.

-

Media10 hours ago

DJT Stock Rises. Trump Media CEO Alleges Potential Market Manipulation. – Barron's

-

Media12 hours ago

Trump Media alerts Nasdaq to potential market manipulation from 'naked' short selling of DJT stock – CNBC

-

Investment11 hours ago

Private equity gears up for potential National Football League investments – Financial Times

-

Business23 hours ago

A sunken boat dream has left a bad taste in this Tim Hortons customer's mouth – CBC.ca

-

News22 hours ago

Best in Canada: Jets Beat Canucks to Finish Season as Top Canadian Club – The Hockey News

-

News21 hours ago

Ontario Legislature keffiyeh ban remains, though Ford and opposition leaders ask for reversal – CBC.ca

-

Health24 hours ago

Health24 hours agoCancer Awareness Month – Métis Nation of Alberta

-

Sports15 hours ago

Sports15 hours ago2024 Stanley Cup Playoffs 1st-round schedule – NHL.com