Chinese authorities are tightening limits on capital outflows by restricting access to funds that invest in offshore securities as the country battles a brutal market rout.

About a third of Chinese funds that invest in foreign securities under a scheme that bypasses strict capital controls have announced in stock exchange notices they have suspended or capped sales to retail investors “to maintain stable operations and protect investors’ interests”.

The Beijing-based manager of one fund that focuses on US stocks said they had received informal instructions from the Shanghai Stock Exchange to reduce sales of such products targeting overseas markets after demand went “through the roof”.

Chinese authorities have repeatedly tried to halt a protracted sell-off in domestic equities over the past year, but the efforts have failed to improve battered sentiment, prompting many investors to look for higher yields elsewhere.

The soaring popularity among retail investors of foreign-targeted funds has raised regulator concerns about capital outflows. The Financial Times reported last August that China’s biggest fund houses were nearing government quota limits on offshore investment.

The government’s Qualified Domestic Institutional Investor scheme allows banks, brokerages and asset managers to bypass China’s strict capital controls. Buying into funds offered through the QDII scheme is the only legal way for Chinese retail investors to invest in foreign stocks and bonds.

An increase in investor demand has caused some funds to hit their quota, while other funds have received directions from Chinese regulators to slow or in some cases stop sales of the funds.

Public filings show 79 Chinese QDII funds have suspended sales to retail investors and 53 have capped them. Together, these account for about 30 per cent of all QDII funds that target non-Hong Kong overseas markets. The funds include some operated by JPMorgan Asset Management and Manulife Investment Management.

JPMorgan did not respond to a request for comment, while Manulife declined to comment.

Separately, multiple Chinese brokerages that sell funds to retail investors through the QDII scheme said on Tuesday in public filings that regulators led by the Shanghai Stock Exchange were cracking down on “abnormal trading” in exchange traded funds that invest in foreign equities.

The brokerages said regulators had in particular requested the suspension of transactions involving ETFs that sought to match the performance of the MSCI USA 50, Nasdaq 100 and Japan’s Nikkei 225 indices.

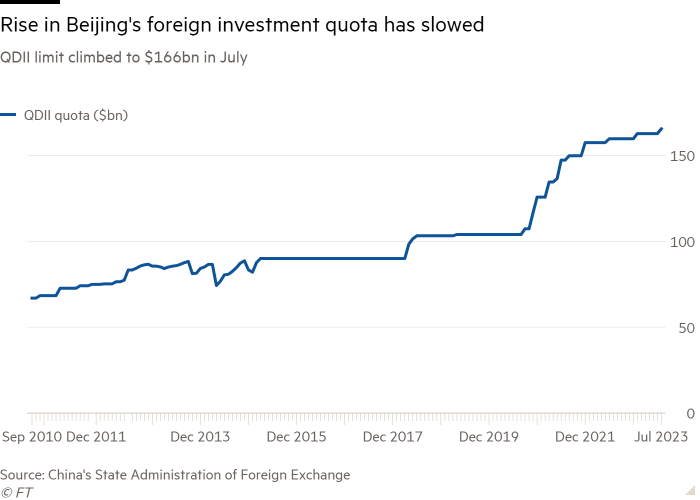

The tightly controlled QDII quotas have intensified competition for outbound investments, with such ETFs trading well above their net asset value. Beijing had a total quota of $166bn across 186 institutions for QDII investments as of the end of 2023, up only slightly since 2021.

“Rocketing demand on one hand and quota restrictions on the other, the two factors both contributed to the particularly hot situation in QDII funds we are seeing right now,” said Ding Wenjie, global capital investment strategist at China Asset Management.

Ding said the appetite for funds linked to Japan’s Nikkei index had become “irrational” this month, with one trading at up to a 20 per cent premium to its asset value. Funds targeting the US and India were also popular, Ding said.

The China Securities Regulatory Commission and Shanghai Stock Exchange did not respond to requests for comment.

In a separate move to support Chinese share prices — which have continued to decline sharply this month — authorities have told some institutional investors not to sell domestic stocks.

Since October, market regulators have been providing private instructions — known as “window guidance” — to some investors, preventing them from being net sellers of equities on certain days.

China’s benchmark CSI 300 index has fallen nearly 5 per cent since the start of 2024, continuing a rout fuelled by disappointment with government policies and lingering concerns about a slow economic rebound.