Real eState

Distrikt Capital moving up to high-rise development | RENX – Real Estate News EXchange

Distrikt Trafalgar will be the first venture into high-rise development for Distrikt Capital. (Courtesy Distrikt)

“Distrikt is only five years old, but it’s a business that was 25 years in the making,” co-founder and chief executive officer Paul Simcox says of Distrikt Capital, which acquires and develops Greater Toronto Area (GTA) real estate.

“We’ve brought together a lot of experience and work that people have done at other locations, and they want to do it at Distrikt.”

Simcox is also the founder of NorthHaven Capital Group. The private equity and real estate investment and advisory firm is focused on multi-year corporate and portfolio mandates, as well as new platform creation, investment and growth.

Simcox started his career in investment banking and private equity in New York City before returning to Canada in 2007 to co-found Whiterock REIT, a Toronto Stock Exchange-listed firm that was acquired in 2012 by Dundee REIT (now known as Dream Office REIT). He’s also been involved with retail and residential development in Canada and income property acquisitions in the United States.

Toronto-based Distrikt Capital’s other co-founder is president Emil Toma, who also founded Distrikt Developments and Toma Construction Management.

Toma previously co-led an international supply and construction services company called Caribbean International Supply that was based out of Toronto but with multiple offices in Central America. It was heavily involved in the Caribbean resort development industry.

“We were doing everything from design, tendering, supply, installation, turnkey service and after-sale service,” Toma told RENX.

The firm was sold in 2008 to enable him to return to Toronto to build custom homes and development properties.

Distrikt Capital’s launch and growth

The two men became friends when Toma was building a home for Simcox. They thought there was a good business fit between their skills and experience and they launched Distrikt Capital in 2015.

“We have the ability to oversee projects, not just on the development side, but also from construction to occupancy,” said Toma. “We’ve attracted a lot of attention from financial institutions and have a mix of private investment and institutional investment working with us.”

Distrikt, which will be up to 15 employees by the fall after making a couple of new hires, invests alongside its partners in every deal.

Distrikt isn’t involved in property management at this point.

“Once our portfolio is larger, we might look at it, but right now we get the best service and value from larger providers,” Simcox told RENX.

Focus on GTA residential development

While Distrikt’s early focus was on low-rise housing, it’s moving more into mid-rise and high-rise residential development, with some projects also including small commercial components.

The company’s current focus is on projects in Oakville and Toronto.

“We look at ourselves as investors first and developers second,” said Simcox. “From an investor viewpoint, we think the GTA is an excellent place to be.”

Simcox said Distrikt has land banked which can support up to 1.8 million square feet of development.

“We have a robust pipeline and are always looking for new opportunities where we can see value in the land, number one, and second in the eventual build-out.”

Distrikt’s Oakville projects

Distrikt The 6ixth is a sold-out 100-townhome development that’s delivering properties and will be finished construction this year.

Distrikt Trailside 2.0 sold more than 200 units, both virtually and through a sales centre, in 72 hours. After selling most of its first release, it’s pushing the second release up to this month.

The two Trailside projects will combine to have about 600 mid-rise and townhome units.

“People are excited about it because it’s a combination of good value, good design, good location and on- and off-site amenities,” said Simcox. “We look for what we call walkable suburban locations where you can walk to major transportation, grocery stores, schools and sports infrastructure.

“That’s what attracted us to these Oakville locations.”

At Distrikt Station, land is still being assembled for a condo project planned for the foot of the Queen Elizabeth Way and Trafalgar Road, near the heavily used Oakville GO Transit station.

Distrikt is working on a site plan application for that site as well.

“Oakville is growing dramatically, not only with residential population but also jobs,” said Simcox. “Five thousand people take that specific train, reverse commuting, for jobs in Oakville.”

Distrikt Trafalgar will mark the company’s move into high-rise development, with two 30-storey towers that will combine for about 650 units.

It’s on a main artery in north Oakville, close to the Trafalgar GO station and within walking distance of grocery stores, restaurants, banks and schools.

Simcox said it’s too early to talk about suite mixes or pricing since sales aren’t expected to launch until mid-2021. He added Distrikt Trafalgar may include a couple of convenience amenities, such as a coffee shop or dentist office.

Distrikt’s Toronto projects

Distrikt Islington Village is a townhome development on Burnhamthorpe Road that’s located about 500 metres from the Islington subway station and close to schools and amenities on Dundas Street.

It’s still in the planning process.

Simcox called it “a great example of missing-middle development” that will be comprised of townhomes slightly larger than average in size. He expects it to appeal to both move-up and movie-down buyers.

“This will be a higher-end, high-quality project that fits in with the historic Etobicoke area. We’re taking a lot of design cues from local buildings and integrating that into our design.”

Distrikt Forest Hill will feature 45 townhomes near Bathurst Street and Elderwood Drive in the upscale Forest Hill neighbourhood, where many homes sell for $5 million and up. Simcox expects the project to launch soon.

“This is a great form of gentle density, bringing in higher-end townhomes primarily for move-down buyers looking to stay in the area, but looking for a new product,” he said.

Real eState

Surreal Estate: $15 million for a turnkey Muskoka resort with 41 guest rooms

|

|

Location: Port Severn, Muskoka

Price: $14,999,000

Size: 17 acres of land with 41 guest rooms and a three-bedroom cottage

Real estate agent: Ali Booth, Sotheby’s International Realty

The place

A fully operational vacation escape sitting on 17 acres of land on Little Lake in Muskoka. The property comes with 41 guest rooms, a three-bedroom cottage, a private island accessible by helicopter and more than 600 metres of shoreline. It’s a short drive from Highway 400 and several neighbouring resorts.

The history

This getaway was originally built in the 1950s. The current owners purchased the place in 2021 and immediately invested $1 million to replace the roof and rebuild the guest cottage. After serving as a filming location for Bachelor in Paradise Canada, it reopened for business in July of 2022. The owners are now taking on a new venture and looking to sell the resort to a wealthy investor.

Related: $11.9 million for a Muskoka compound perched atop its own peninsula

The tour

To begin, here’s an aerial view of the peninsula, with its many docks, green spaces and lodges. That’s Port Severn North Road just beyond the parking lot.

And here’s the main entrance. The original hotel was renovated around Y2K, and the current owners bought it in 2021.

In the lobby: guest check-in, a lounge and doric columns.

The full-service restaurant overlooks the lake and includes a café and lounge.

This reverse angle shows off the bar and dramatic circular ceiling.

There’s also a nail salon down the hall.

The indoor pool and hot tub are open year-round.

The shiplap ceilings and wall of windows add warmth to the massive space.

Here’s the 24-hour gym, with rubber floors.

Now for a peek inside one of the European-style suites, which are larger than traditional hotel rooms. This one is outfitted with hardwood floors, a stone fireplace, a floor-to-ceiling walkout and gold accents throughout.

The hotel also rents out its 90-seat conference centre for weddings and corporate retreats.

Here’s another look at the cavernous conference centre.

Outside, it’s all about the amenities: a tennis court, a patio, a private beach, many docks for water sports and a private island accessible by helicopter.

Speaking of water sports, guests are free to explore Little Lake and its seemingly endless waterways.

Here’s the tropical-themed beach.

Finally, another bird’s eye view of the compound, highlighting the ample space for expansion. While there have been no formal approvals for development, the town has provided zoning guidelines on what could be built here.

Have a home that’s about to hit the market? Send your property to realestate@torontolife.com.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

Sask. real estate company that lost investors' millions reaches settlement – CTV News Saskatoon

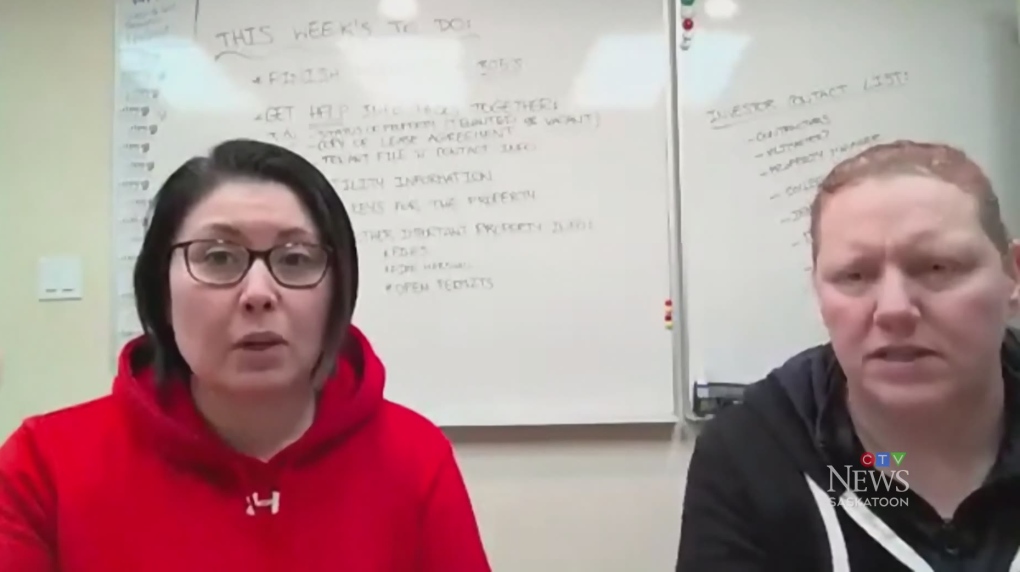

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

-

Tech5 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Real eState6 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Media18 hours ago

Psychology group says infinite scrolling and other social media features are ‘particularly risky’ to youth mental health – NBC News

-

News18 hours ago

Budget 2024 sets up a ‘hard year’ for the Liberals. Here’s what to expect – Global News

-

Investment14 hours ago

Investment14 hours agoSo You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada

-

Politics23 hours ago

Politics23 hours agoLiz Truss: The world was safer under Trump – BBC.com

-

News20 hours ago

Freeland 2024 budget 'likely to be the worst' in years: Dodge – CTV News

-

News19 hours ago

Federal budget will include tax hike for wealthy Canadians, sources say – CBC News