The U.S. dollar reached its strongest level in more than a month against the Japanese yen on Tuesday, lifted by a jump in Treasury yields overnight as traders bet on an early Federal Reserve interest rate hike despite surging COVID-19 cases.

The greenback rose as high as 115.395 yen for the first time since Nov. 25, as long-term Treasury yields leapt 12.5 basis points overnight to touch 1.6420% for the first time since Nov. 24.

Money markets have fully priced in a first U.S. rate increase by May, and two more by the end of 2022.

The dollar index, which measures the currency against the yen and five other major peers, held close to the one-week high of 96.328 reached on Monday.

The euro traded at $1.13065, lifting off the one-week low of $1.12795 from overnight.

“The market is pricing in a more aggressive U.S. rate hike scenario – or at least the risk thereof – in 2022, and that definitely remains the key support for the dollar,” said Shinichiro Kadota, senior FX strategist at Barclays in Tokyo.

While the surge in coronavirus cases caused by the Omicron variant continued to impact global travel and public services, and delay the reopening of some U.S. schools after the holidays, investors remained optimistic that lockdowns would be averted.

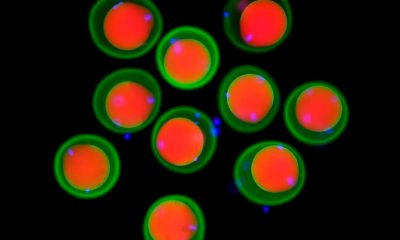

On Monday, the U.S. Food and Drug Administration authorized the use of a third dose of the Pfizer and BioNTech COVID-19 vaccine for children aged between 12 and 15 years, and narrowed the time for all booster shots to five months from six months after primary doses.

The Australian dollar hovered close to a near two-week low of $0.7184 reached in the previous session.

Sterling was about flat at $1.3480 from Monday, when it slipped as low as $1.3431 for the first time since Nov. 29.

========================================================

Currency bid prices at 0039 GMT

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar

$1.1305 $1.1299 +0.05% -0.56% +1.1307 +1.1293

Dollar/Yen

115.3400 115.2600 +0.07% +0.28% +115.3500 +115.3400

Euro/Yen

130.40 130.27 +0.10% +0.06% +130.4200 +130.2500

Dollar/Swiss

0.9178 0.9186 -0.08% +0.63% +0.9189 +0.9177

Sterling/Dollar

1.3476 1.3481 +0.00% -0.33% +1.3485 +1.3480

Dollar/Canadian

1.2751 1.2746 +0.04% +0.85% +1.2755 +1.2742

Aussie/Dollar

0.7194 0.7191 +0.05% -1.02% +0.7198 +0.7185

NZ

Dollar/Dollar 0.6788 0.6788 +0.01% -0.83% +0.6791 +0.6785

All spots

Tokyo spots

Europe spots

Volatilities

Tokyo Forex market info from BOJ

((Reporting by Kevin Buckland; Editing by Simon Cameron-Moore)

Related