AUSTIN — Shooting up from the downtown skyline is a gleaming, 66-story glass behemoth, a place “where Fortune 500 companies, high-rise residents and premier retailers come together to create a community of their own,” as sleek marketing brochures put it. The tech giant Meta scooped up all 19 floors of office space as construction was underway in early 2022.

Real eState

Downtown Austin’s new office space is exploding, but who’s moving in?

But when Austin’s tallest building officially opens later this year, all that office space will be empty. Meta has ditched its move-in plans and is now trying to sublease 589,000 square feet of offices, 1,626 parking spots, 17 private balconies and a half-acre of green space. So far: No takers.

The skyscraper known as “Sixth and Guadalupe” is the most glaring example in the city that made a huge bet on the post-pandemic commercial real estate economy. While other cities worry about a glut of office space as workers resist returning to the familiar 9-to-5 grind, Austin’s challenges are Texas-sized.

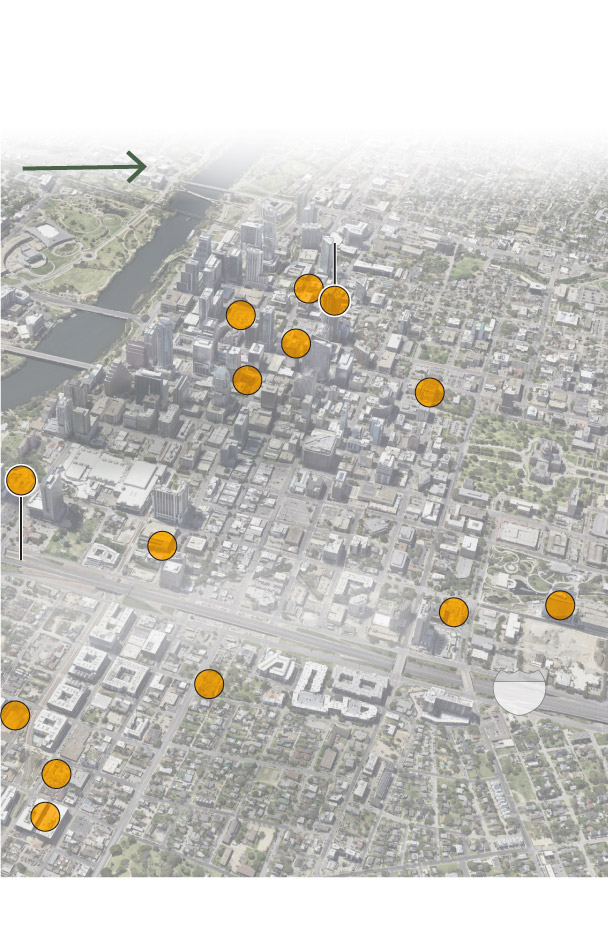

New office construction is changing Austin’s skyline, as buildings get taller.

Office space at Sixth and

Guadalupe, the tallest building in Austin, is expected to open empty this year.

DOWNTOWN

AUSTIN

Texas Capitol

The 74-story Waterline skyscraper will be the tallest building in Texas when it is completed in a few years.

EAST

AUSTIN

Sources: Cushman and Wakefield, Google Earth

JANICE KAI CHEN/THE WASHINGTON POST

New office construction is changing Austin’s skyline, as buildings get taller.

Office space at Sixth and Guadalupe, the tallest building in Austin, is expected to open empty this year.

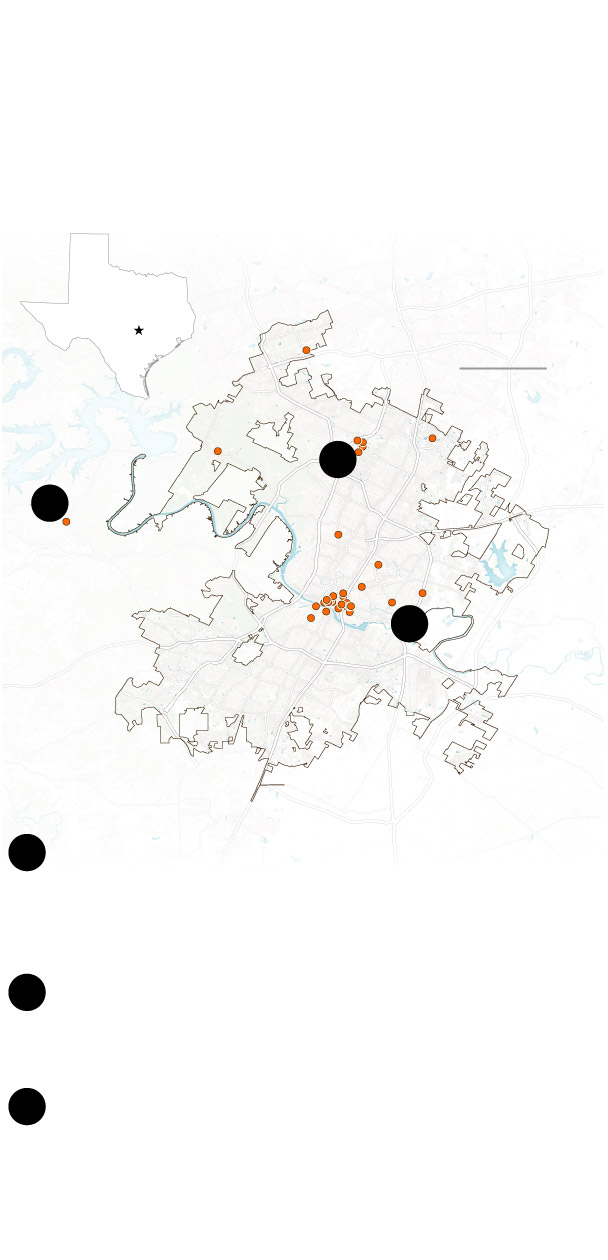

Construction for new offices is booming. But developers are struggling to lease out the space.

87 percent of new office space is expected to open vacant.

NORTH

AUSTIN

WEST AUSTIN

EAST AUSTIN

Highpoint 2222, a 1.1 million square foot

complex of office buildings and apartments, is

currently being redeveloped on the outskirts of

Austin.

Multiple office buildings are being added

at the Domain, a development that includes

luxury shopping, restaurants and hotels.

Eight new office buildings are slated for

completion in East Austin, where pressures of

gentrification are mounting.

Sources: Cushman and Wakefield, OpenStreetMap

JANICE KAI CHEN/THE WASHINGTON POST

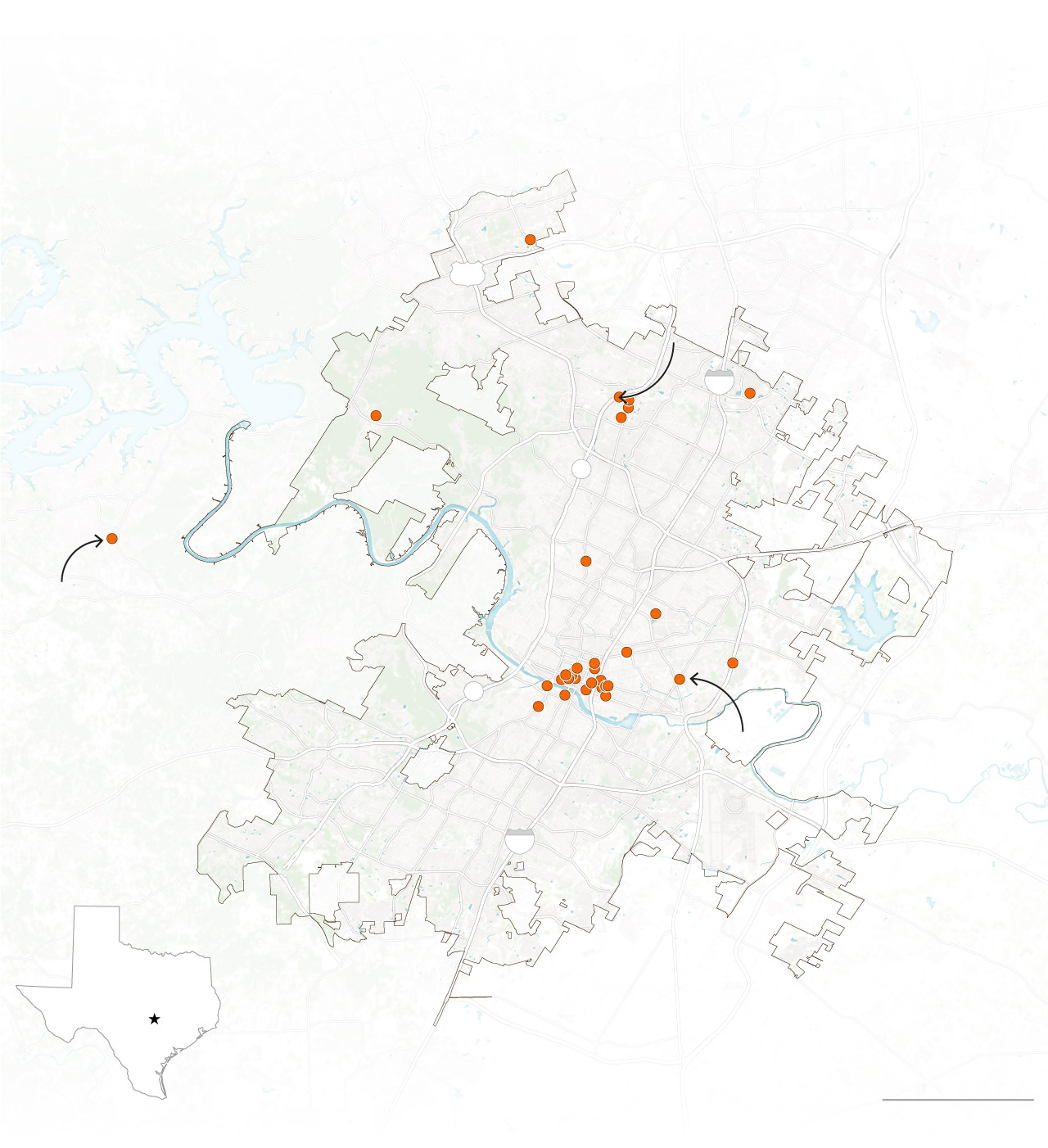

Construction for new offices is booming. But developers

are struggling to lease out the space.

87 percent of new office space is expected to open vacant.

Multiple office buildings are being added at the Domain,

a development that includes luxury shopping, restaurants and hotels.

NORTHWEST

AUSTIN

NORTH

AUSTIN

WEST AUSTIN

CENTRAL

AUSTIN

Highpoint 2222, a 1.1 million square foot complex of office buildings and apartments, is currently being redeveloped

on the outskirts of Austin.

EAST AUSTIN

Eight new office buildings are slated for completion in East Austin, where pressures of gentrification are mounting.

SOUTH

AUSTIN

SOUTHWEST

AUSTIN

Sources: Cushman and Wakefield, OpenStreetMap

JANICE KAI CHEN/THE WASHINGTON POST

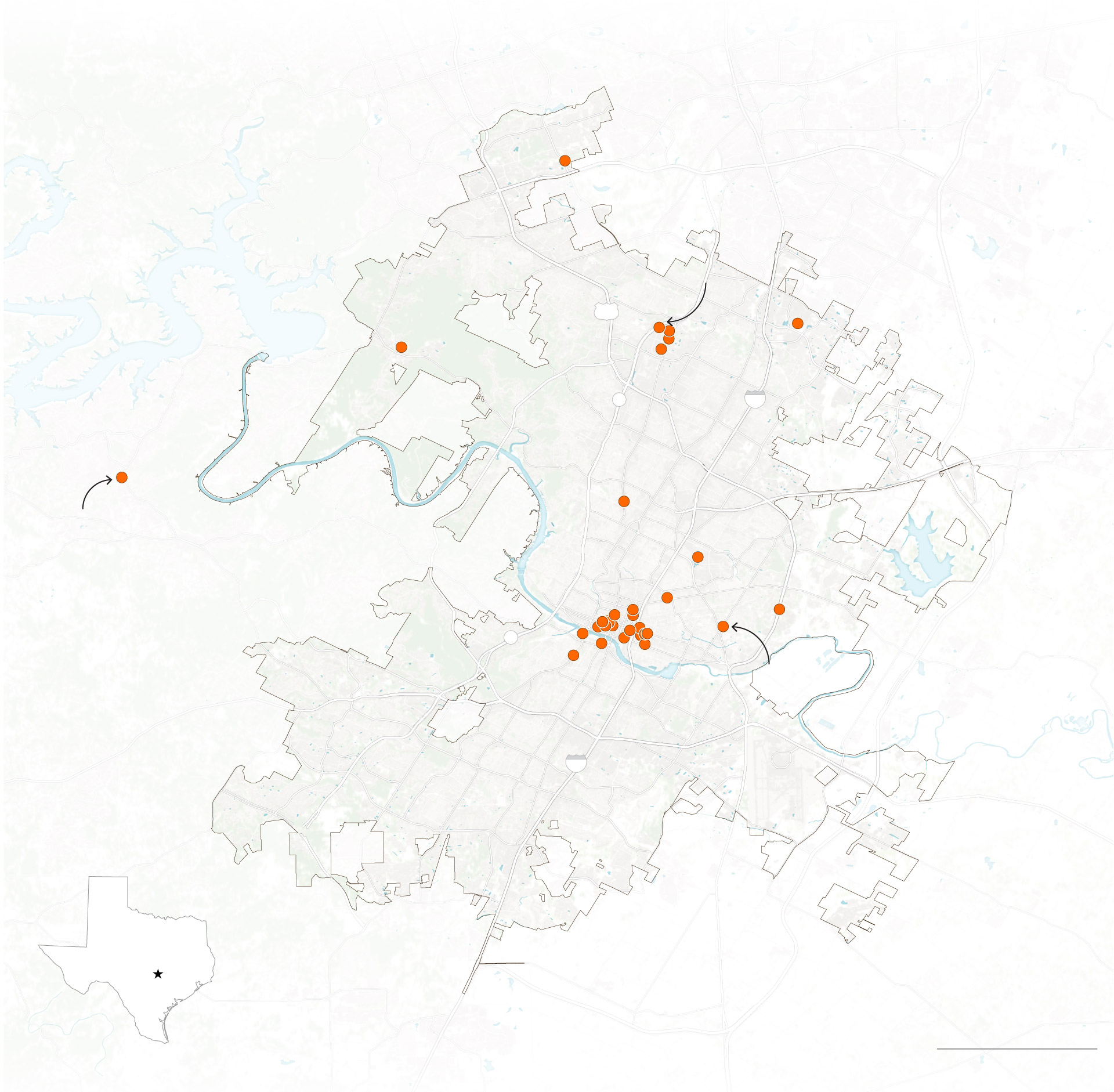

Construction for new offices is booming. But developers are struggling to lease out the space.

87 percent of new office space is expected to open vacant.

Multiple office buildings are being added at the Domain, a development that includes luxury shopping, restaurants and hotels.

NORTHWEST

AUSTIN

NORTH

AUSTIN

WEST AUSTIN

CENTRAL

AUSTIN

Highpoint 2222, a 1.1 million square foot complex of office buildings and apartments, is currently being redeveloped

on the outskirts of Austin.

EAST AUSTIN

Eight new office buildings are slated for completion in East Austin, where pressures of gentrification are mounting.

SOUTH

AUSTIN

SOUTHWEST

AUSTIN

Sources: Cushman and Wakefield, OpenStreetMap

JANICE KAI CHEN/THE WASHINGTON POST

#g-austinoffices-overviewmap-xxsmall display: none

@media (max-width: 639px) and (min-width: 260px)

#g-austinoffices-overviewmap-xxsmall

display: block

#g-austinoffices-overviewmap-medium display: none

@media (max-width: 959px) and (min-width: 640px)

#g-austinoffices-overviewmap-medium

display: block

#g-austinoffices-overviewmap-xlarge display: none

@media (min-width: 960px)

#g-austinoffices-overviewmap-xlarge

display: block

Austin wasn’t always like this. Decades before Tesla’s headquarters and a burgeoning crypto scene arrived, the University of Texas was a major player in the local economy. The state Capitol was among the tallest landmarks, and housing was cheap. Tech had a presence starting in the 1970s and 1980s, thanks to Motorola, IBM and Dell. But a popular mantra then summed up the desire to preserve the city’s small-town feel: “If we don’t build it, they won’t come.”

But that changed as Big Tech expanded beyond San Francisco. Indeed, the job search site, was co-founded in Austin in 2004. Apple, Google, Facebook and Palantir expanded their local offices. In 2020, Oracle announced it would relocate its corporate headquarters from Silicon Valley.

The pandemic supercharged Austin’s growth even more. The tech industry exploded as the world shifted online. Home buyers raced to scoop up cheap properties, and young workers seized the chance to work remotely under the Texas sun. And with so many people flocking here — Austin is now the country’s 10th largest city — developers and local officials bet on a real estate boom.

Interest rates were rock-bottom until early 2022, making it easy for developers to get financing for dozens of new projects. And since it’s common in Texas for commercial real estate to be built entirely on spec, developers could get loans without any guarantee that they’d be able to lease the space.

To cater to young workers with high-paying salaries, many buildings were designed as all-in-one complexes, with office space, apartments, shops and dining all stacked together. A new luxury building called Paseo promises the chance to “Live, work, play and rest in one place” when it opens in 2025. A mile away at Sixth and Guadalupe, 33 floors of apartments are stacked on top of 19 floors of offices. Elon Musk’s brother is opening up a restaurant on the ground floor.

Seth Johnston, senior vice president and market leader of Lincoln Property Company, said timing is on the industry’s side. The global developer is behind multiple Austin projects including Sixth and Guadalupe, which got rolling when financing was cheap. Now LPC and its peers will have the newest offerings with the sleekest amenities, Johnston said. And there won’t be fresh competition coming up behind them, since financing for new projects has almost entirely dried up.

“These companies, they want newer amenities in their space,” Johnston said. “They want fresher air filtration systems. They want touchless technology, and that’s harder to do in the older, ’80s vintage buildings downtown … By and large, there’s always going to be that flight to quality. And I think we’re in a position to hopefully take advantage of that.”

In a statement, Meta spokesman Tracy Clayton said Meta’s goal is to “build a best-in-class hybrid work experience.” The company’s commitment to Austin is also clear by the roughly 1,000 employees who live there, Clayton said.

Industry officials also argue that, technically, many of the buildings aren’t vacant. Meta’s name is still on the lease at Sixth and Guadalupe, after all, even while the company looks for new tenants. Another LPC building, called The Republic, has leases lined up for a law firm and a private equity firm. Another building downtown had 35 floors scooped up by Google, which continues to pay rent even though its move-in plans are still in flux. That means developers and their lenders stay financially sound, at least for now.

Still, only the biggest, richest firms can afford to lease huge offices they don’t use. And empty towers don’t do much to liven up an area or attract new customers.

Down the block from Meta’s skyscraper, Nikki Nichol was getting ready to open Ranch 616 one morning last month. The restaurant where she works as an assistant manager and bartender is typically hopping on weekends. Except lately, Nichol said more customers complain about the towering buildings blocking all the breeze.

When Nichol moved to Austin in 2010, she paid $695 for a one-bedroom apartment. Now she’s paying almost double for a studio. She said parking is “atrocious,” and that getting around the city is impossible because of all the construction. She said she can’t grasp the vision for a city that’s getting harder and harder to recognize.

“It’s like they’re going to ‘field of dreams’ it,” she said.

Remarkably, there’s a craving for even more space. Data from the Downtown Austin Alliance shows developers have proposed an additional 3.9 million square feet of office space — and would be moving forward if banks weren’t shying away from new loans.

“If rates were low and money was available, there’s every indication that these buildings would get built,” said Dewitt Peart, the organization’s president and chief executive. “Now the pandemic has thrown a wrench into everything. But I think the sense is that money still wants to flow to Austin.”

At the same time, though, all of the new space is driving down the value of decades-old buildings that are gradually hollowing out. On one downtown street corner, a drab 40-year-old building bears a large “For Lease” banner. Right next door, construction crews were working on a luxury, 58-story skyscraper.

Jeff Graves, research director at Cushman & Wakefield, can look out the window at the changing skyline. From his office, he pointed to a luxe new building right across the street from an abandoned, rat-infested government building that is slated for demolition. Turning a little, he gestured to an old Austin landmark that has managed to hold on to its tenants, which he called an outlier.

Just on the other side of Graves’s window, a construction crew was practically dangling out the side of a brand new office tower.

Graves lived in Las Vegas during the 2007-08 housing market crash, and wonders if a similar bubble could come for Austin commercial real estate. The answer may lie in what happens with prices, which so far aren’t budging. Leases at brand new skyscrapers — roughly $50 per square foot at the newest buildings — are so high that smaller businesses are getting priced out. But so far, landlords would prefer to throw in perks, like six months of free rent on a decade-long lease, before caving to a discount.

That approach may only work for so long. And things could come to a head if lenders get antsy that they’re taking too much of a loss.

“No one wants to be the first to drop rates,” Graves said. “They’re in for a lot of money.”

Other problems could hit Austin hard, too. Tech firms that bulged in the pandemic are laying off thousands of employees. Return to office policies are still fraught and in some cases, backfiring.

***

Zoom out a bit more, and cities nationwide are trying to figure out what comes next. New York and San Francisco are overwhelmed with untapped office space. Some economists fear that midsize cities, from Minneapolis to Memphis, could be even more vulnerable to a kind of “doom loop” that starts with empty offices and canceled leases, and spirals into something scarier for downtowns and city coffers.

And policymakers are still pushing hard to cool the economy down. Officials at the Federal Reserve have made clear that they will keep interest rates high for as long as necessary. No one knows how long their aggressive moves will slow growth, especially because the totality of the Fed’s moves may not have hit yet.

Some economists argue those delays are shorter nowadays. The Fed telegraphs its moves far in advance so the markets have time to price higher rates in. But when Coronado, the MacroPolicy Perspectives economist, looks around Austin, she sees consequences still ahead.

It takes years, she said, for massive commercial real estate projects to get financing and permitting, and finish construction and price out leases. By the time each new building goes through the cycle, supply will far outstrip demand. Prices could drop, even plummet, in a way the city may not be ready for.

“I don’t know whether this just means losses for contractors, but it’s fine. Or losses for some banks, but they absorb the blow,” Coronado said. “But I do know that even if it is the intended effect of Fed policy, the full effect isn’t yet in the employment data, in the construction data, that still lies ahead.”

Only time will tell. But already, the mismatch stands out. On a recent afternoon, shoppers milled about the Domain, a sprawling outpost of office suites, restaurants, high-end retail stores and hotels 12 miles north of downtown. Scattered between Gucci and Tesla storefronts are a few reminders that shoppers are still in Texas: a burnt orange window display at a jewelry store, a leather boots shop. An overhead speaker played Taylor Swift’s “Wildest Dreams.”

The office park nearby towered over the few workers around. Companies like Indeed, Vrbo, Amazon, IBM, Charles Schwab and Facebook have taken up space. But the overall vacancy rate across the complex is still 15 percent, according to Cushman & Wakefield. (Amazon founder Jeff Bezos owns The Washington Post, and the newspaper’s interim chief executive, Patty Stonesifer, sits on Amazon’s board.)

Ryan Crawford was walking back from lunch with co-workers from AWS last month. Crawford said the area had been a bit more crowded since Labor Day, when a wave of return-to-office orders went into effect. But not by much.

“The bars, the restaurants are one-third full,” he said. “Few people are sticking around to socialize. Most people do live far away.”

Sitting at a table nearby, a man read a book on his lunch break. He’d recently learned he was laid off from the consulting and tech firm Accenture, which was shedding more than 500 workers at its Domain office. He declined to share his name, fearing retribution from the company.

He said he lived nearby and had mixed feelings as the site went up. The high-end offices with the high-paying jobs fit uneasily in what was otherwise a lower-income area, he said. On the other hand, he had an easy commute, until his job went away altogether.

What would happen to his old office, he didn’t know.

Real eState

Greater Toronto home sales jump in October after Bank of Canada rate cuts: board

TORONTO – The Toronto Regional Real Estate Board says home sales in October surged as buyers continued moving off the sidelines amid lower interest rates.

The board said 6,658 homes changed hands last month in the Greater Toronto Area, up 44.4 per cent compared with 4,611 in the same month last year. Sales were up 14 per cent from September on a seasonally adjusted basis.

The average selling price was up 1.1 per cent compared with a year earlier at $1,135,215. The composite benchmark price, meant to represent the typical home, was down 3.3 per cent year-over-year.

“While we are still early in the Bank of Canada’s rate cutting cycle, it definitely does appear that an increasing number of buyers moved off the sidelines and back into the marketplace in October,” said TRREB president Jennifer Pearce in a news release.

“The positive affordability picture brought about by lower borrowing costs and relatively flat home prices prompted this improvement in market activity.”

The Bank of Canada has slashed its key interest rate four times since June, including a half-percentage point cut on Oct. 23. The rate now stands at 3.75 per cent, down from the high of five per cent that deterred many would-be buyers from the housing market.

New listings last month totalled 15,328, up 4.3 per cent from a year earlier.

In the City of Toronto, there were 2,509 sales last month, a 37.6 per cent jump from October 2023. Throughout the rest of the GTA, home sales rose 48.9 per cent to 4,149.

The sales uptick is encouraging, said Cameron Forbes, general manager and broker for Re/Max Realtron Realty Inc., who added the figures for October were stronger than he anticipated.

“I thought they’d be up for sure, but not necessarily that much,” said Forbes.

“Obviously, the 50 basis points was certainly a great move in the right direction. I just thought it would take more to get things going.”

He said it shows confidence in the market is returning faster than expected, especially among existing homeowners looking for a new property.

“The average consumer who’s employed and may have been able to get some increases in their wages over the last little bit to make up some ground with inflation, I think they’re confident, so they’re looking in the market.

“The conditions are nice because you’ve got a little more time, you’ve got more choice, you’ve got fewer other buyers to compete against.”

All property types saw more sales in October compared with a year ago throughout the GTA.

Townhouses led the surge with 56.8 per cent more sales, followed by detached homes at 46.6 per cent and semi-detached homes at 44 per cent. There were 33.4 per cent more condos that changed hands year-over-year.

“Market conditions did tighten in October, but there is still a lot of inventory and therefore choice for homebuyers,” said TRREB chief market analyst Jason Mercer.

“This choice will keep home price growth moderate over the next few months. However, as inventory is absorbed and home construction continues to lag population growth, selling price growth will accelerate, likely as we move through the spring of 2025.”

This report by The Canadian Press was first published Nov. 6, 2024.

The Canadian Press. All rights reserved.

Real eState

Homelessness: Tiny home village to open next week in Halifax suburb

HALIFAX – A village of tiny homes is set to open next month in a Halifax suburb, the latest project by the provincial government to address homelessness.

Located in Lower Sackville, N.S., the tiny home community will house up to 34 people when the first 26 units open Nov. 4.

Another 35 people are scheduled to move in when construction on another 29 units should be complete in December, under a partnership between the province, the Halifax Regional Municipality, United Way Halifax, The Shaw Group and Dexter Construction.

The province invested $9.4 million to build the village and will contribute $935,000 annually for operating costs.

Residents have been chosen from a list of people experiencing homelessness maintained by the Affordable Housing Association of Nova Scotia.

They will pay rent that is tied to their income for a unit that is fully furnished with a private bathroom, shower and a kitchen equipped with a cooktop, small fridge and microwave.

The Atlantic Community Shelters Society will also provide support to residents, ranging from counselling and mental health supports to employment and educational services.

This report by The Canadian Press was first published Oct. 24, 2024.

The Canadian Press. All rights reserved.

Real eState

Here are some facts about British Columbia’s housing market

Housing affordability is a key issue in the provincial election campaign in British Columbia, particularly in major centres.

Here are some statistics about housing in B.C. from the Canada Mortgage and Housing Corporation’s 2024 Rental Market Report, issued in January, and the B.C. Real Estate Association’s August 2024 report.

Average residential home price in B.C.: $938,500

Average price in greater Vancouver (2024 year to date): $1,304,438

Average price in greater Victoria (2024 year to date): $979,103

Average price in the Okanagan (2024 year to date): $748,015

Average two-bedroom purpose-built rental in Vancouver: $2,181

Average two-bedroom purpose-built rental in Victoria: $1,839

Average two-bedroom purpose-built rental in Canada: $1,359

Rental vacancy rate in Vancouver: 0.9 per cent

How much more do new renters in Vancouver pay compared with renters who have occupied their home for at least a year: 27 per cent

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

-

News23 hours ago

News23 hours agoFreeland says she’s ready to deal with Trump |

-

News23 hours ago

News23 hours agoNASA astronauts won’t say which one of them got sick after almost eight months in space

-

News23 hours ago

News23 hours ago43 monkeys remain on the run from South Carolina lab. CEO thinks they’re having an adventure

-

News23 hours ago

News23 hours agoFreeland rallies a united front ahead of Trump’s return to White House

-

News23 hours ago

News23 hours agoDeputy minister appointed interim CEO of AIMCo after Alberta government fires board

-

News23 hours ago

News23 hours agoMontreal says Quebec-Canada dispute stalling much-needed funding to help homeless

-

News23 hours ago

News23 hours agoS&P/TSX composite index down Friday, Wall St. extends post-election gains

-

News23 hours ago

News23 hours agoMitch Marner powers Matthews-less Maple Leafs over Red Wings