Calgary housing prices are expected to stabilize in 2020 as the city’s real estate market settles into what is likely a “new normal,” the Calgary Real Estate Board said Tuesday.

Real eState

Easy does it: Calgary real estate market settling into 'the new normal', says CREB – Calgary Herald

Calgary housing prices are expected to stabilize in 2020 as the city’s real estate market settles into what is likely a “new normal,” the Calgary Real Estate Board said Tuesday.

Calgary housing prices are expected to stabilize in 2020 as the city’s real estate market settles into what is likely a “new normal,” the Calgary Real Estate Board said Tuesday.

Six years after the oil price crash, Calgary’s real estate market is slowly moving towards more balanced conditions, said CREB chief economist Ann-Marie Lurie at the organization’s annual forecast event. However, detached home prices remain nearly eight per cent lower than 2014 highs and the days of buying a house and selling it for a tidy profit five years later aren’t coming back anytime soon.

“It’s not going to be like what we had prior to 2014,” Lurie told reporters. “We’re moving into slower, more normal conditions. When you compare it to other markets across the country, we’re looking a lot more like them.”

According to CREB, overall sales activity in 2020 is expected to improve by two per cent over 2019. That combined with easing inventories should help slow the pace of decline in the average benchmark price for a home to just 0.5 per cent in 2020 (versus the larger-than-expected 3.3 per cent decline in the benchmark price that occurred in 2019).

Related

Driving the stabilization is the improvement at the lower end of the Calgary real estate market, Lurie said. In 2019, sales growth in the under $500,000 market grew by seven per cent, while resale sales for the over $500,000 segment declined by nine per cent. The most affordable areas of the city — such as the northeast, southeast and far north — saw the least amount of price decline in 2019 while the more expensive areas, particularly the city centre, saw the steepest drops in price.

While improving conditions in the lower end of a market can eventually spill into the upper end of the market, this is not expected to occur over the next year, Lurie said. Part of the problem is that while the city’s unemployment rate has improved from 2016, it is still high (6.9 per cent in November) compared to historic norms. The employment situation isn’t expected to improve significantly in 2020, and most of the gains that have been made so far have been made in education and health care, not in the higher paid scientific and technical occupations.

In 2019, home sales in the under-$500,000 range remained strong, despite overall weakness in the market.

File /

Postmedia

“We don’t have the same type of job growth in those higher paid sort of salaries that we’ve seen historically, so for that reason alone it will take a lot longer to see those improvements filter through the higher end of the market,” Lurie said.

Lurie said there are risks that could threaten CREB’s 2020 forecast. If recent job losses in the Calgary market continue into 2020, it will impact consumer confidence and housing market activity.

In addition, if new-home construction projects exceed anticipated demand growth, this will slow the downward adjustment in overall housing supply and impact price stabilization. According to the Canada Mortgage and Housing Corporation, there were 3,101 housing starts in Alberta in December 2019 — a 117-per-cent increase from December 2018.

Still, CREB CEO Alan Tennant said evidence of market stabilization is a reason for optimism, and added he believes “the new normal” is nothing to be afraid of.

“Normal may not be sexy and fun, but there’s still a lot of business to be done there,” Tennant said. “That’s the start of maybe the dominoes starting to fall in the right direction.”

On Twitter: @AmandaMsteph

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

Sask. real estate company that lost investors' millions reaches settlement – CTV News Saskatoon

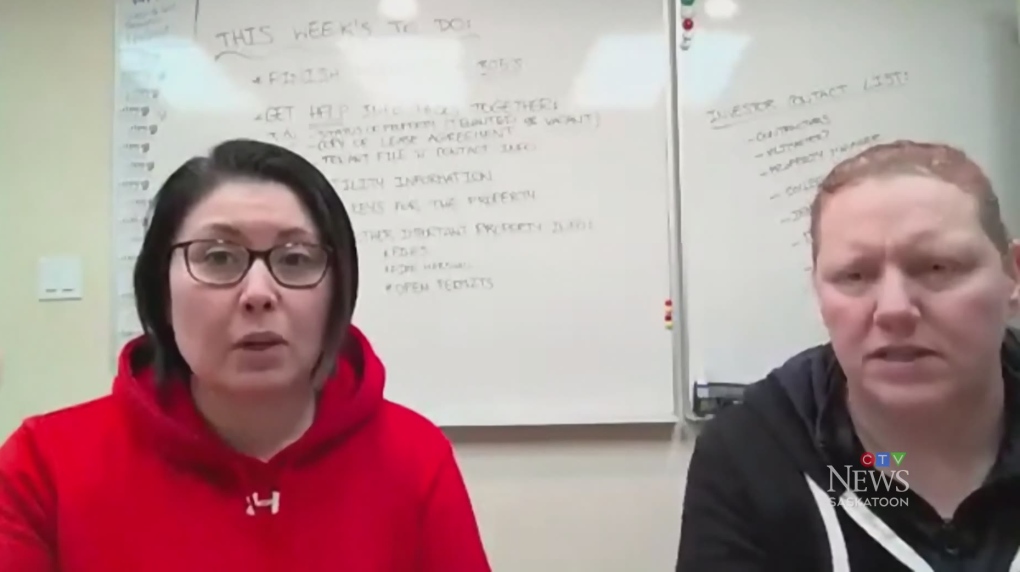

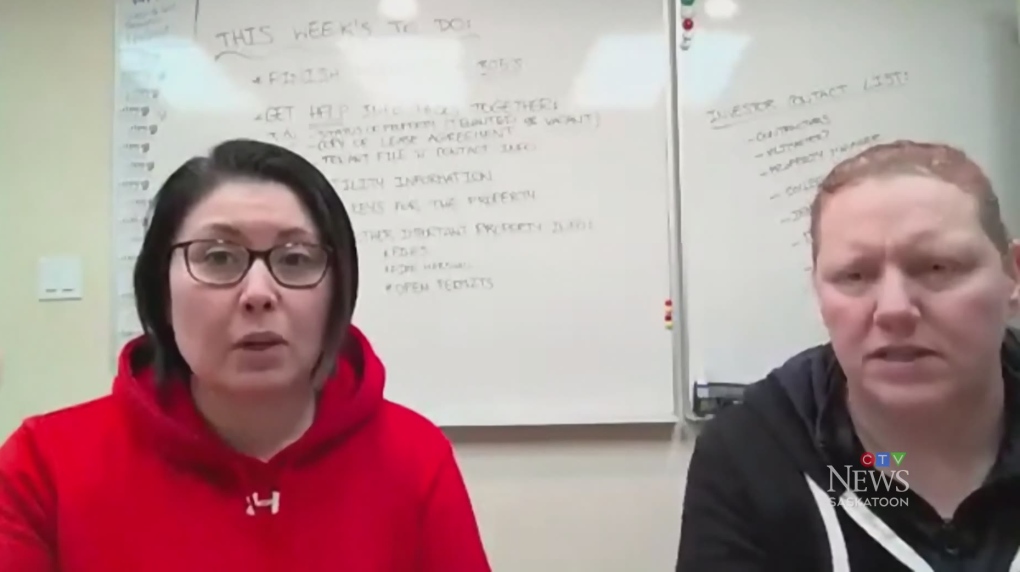

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

Real eState

Hidden Billions in Tokyo Real Estate Lure Activist Hedge Funds

|

|

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

In Japan, there’s a huge gap — 22 trillion yen ($143 billion) by one estimate — between how companies value their real estate assets on their books, versus what those same properties would fetch if sold in the current market. That comes from two factors: First, many of the island nation’s firms have held onto properties for decades, each year writing down the cost of fixed assets due to annual depreciation, a common accounting practice. But at the same time, property prices have soared.

-

Media19 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Real eState23 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Tech24 hours ago

Tech24 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Sports23 hours ago

Sports23 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science23 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment20 hours ago

Investment20 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

Media23 hours ago

Meta's news ban changed how people share political info — for the worse, studies show – CBC.ca

-

Politics22 hours ago

Politics22 hours agoQuebec employers group urges governments to base immigration on labour needs, not politics – CityNews Montreal