The government on Thursday announced a sweeping promise to make groceries, children’s clothing, Christmas trees, restaurant meals and more free from GST/HST between Dec. 14 and Feb. 15.

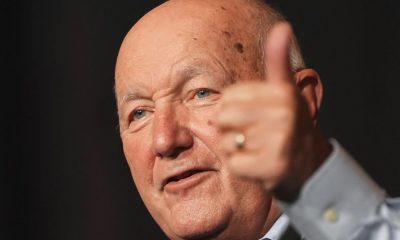

“Our government can’t set prices at checkout, but we can put more money in people’s pockets,” Trudeau said at a press conference announcing the measures.

The government says removing GST from these goods for a two-month period would save $100 for a family that spends $2,000 on those goods during that time. For those in provinces with HST, a family spending $2,000 would save $260.

Thursday’s announcement also included a rebate for Canadians who worked in 2023 and made less than $150,000, totalling $250 per person.

Here are the items that will be GST/HST-free if the Liberals’ legislation passes.

Groceries

Many grocery items are already tax-free. The Canada Revenue Agency considers most food and beverages to be “basic” grocery items, such as produce, bread, cereal, canned and frozen food, eggs, coffee, milk, and meat.

However, certain categories, like carbonated drinks, candies and snack foods, are taxed.

The government’s tax break will apply to certain items that normally are subject to tax.

These include prepared foods such as vegetable trays and pre-made meals, as well as snacks such as chips, candy and granola bars.

Carbonated beverages, water bottles fruit juices and juice crystals are included, as are ice cream products and baked desserts like cakes and pies.

The government says its tax break will mean “essentially all food” will be GST/HST-free.

Alcohol

The tax break will also apply to alcoholic beverages below seven per cent alcohol by volume, including beer, wine, cider, and pre-mixed drinks.

Normally, all alcoholic drinks are taxed.

Restaurants

Restaurant meals will also be subject to the tax break. It will apply whether you’re dining in, taking food to go, or ordering delivery.

Children’s items

Children’s clothing, including baby bibs, socks, hats and footwear, will qualify for the tax break. So will children’s diapers and car seats.

Children’s footwear and clothing used exclusively for sports or recreational activities will not be included in the tax break. This includes costumes.

Children’s toys will be included in the tax break as long as they’re designed for use by children under 14 years old. These could include board games, dolls, card games, Lego, Plasticine and teddy bears.

Printed goods

Print newspapers will be included in the tax break, but electronic or digital publications will not.

Most flyers, magazines, inserts and periodicals will be excluded.

Printed books will be included in the tax break, including religious scripture. Audio books where 90 per cent or more of the recording is a reading of a printed book are included.

Printed items that aren’t subject to the tax break include magazines where advertisements take up more than five per cent of total printed space, sales catalogues and brochures, books designed for writing on, event programs, agendas and directories.

Other

Christmas trees, natural or artificial, will be included in the tax break.

Puzzles and video game consoles are also included.

This report by The Canadian Press was first published Nov. 21, 2024.