ARLINGTON, Texas (AP) — Rookie Wyatt Langford homered, doubled twice and became the first Texas player this season to reach base five times, struggling Jonah Heim delivered a two-run single to break a sixth-inning tie and the Rangers beat the Toronto Blue Jays 13-8 on Tuesday night.

Leody Taveras also had a homer among his three hits for the Rangers.

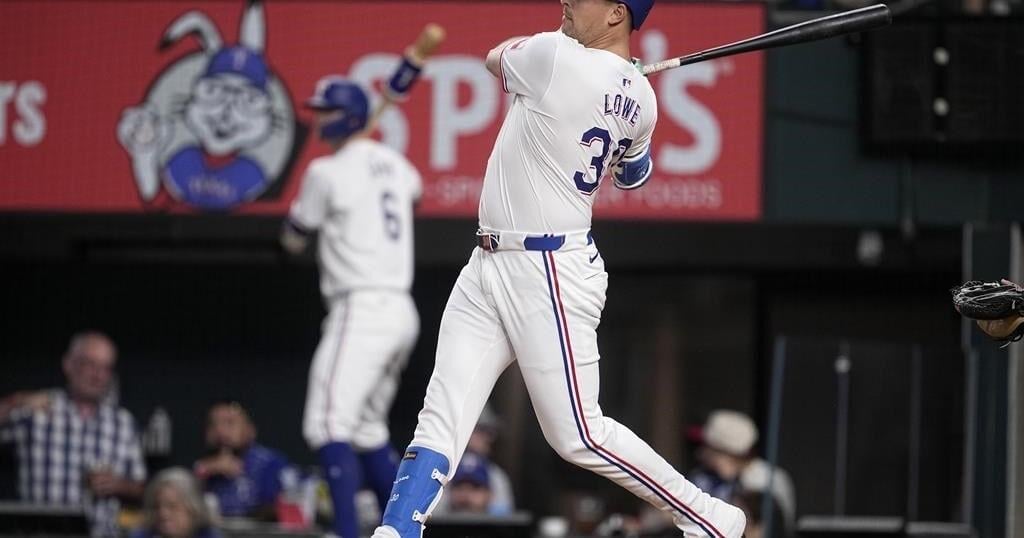

Langford, who also walked twice, has 12 homers and 25 doubles this season. He is hitting .345 in September.

“I think it’s really important to finish on a strong note,” Langford said. “I’m just going to keep trying to do that.”

Heim was 1-for-34 in September before he lined a single to right field off Tommy Nance (0-2) to score Adolis García and Nathaniel Lowe, giving Texas a 9-7 lead. Heim went to the plate hitting .212 with 53 RBIs after being voted an All-Star starter last season with a career-best 95 RBIs. He added a double in the eighth ahead of Taveras’ homer during a three-run inning.

Texas had 13 hits and left 13 men on. It was the Rangers’ highest-scoring game since a 15-8 win at Oakland on May 7.

Matt Festa (5-1) pitched 1 1/3 scoreless innings to earn the win, giving him a 5-0 record in 13 appearances with the Rangers after being granted free agency by the New York Mets on July 7.

Nathan Eovaldi, a star of Texas’ 2023 run to the franchise’s first World Series championship, had his worst start of the year in what could have been his final home start with the Rangers. Eovaldi, who will be a free agent next season, allowed 11 hits (the most of his two seasons with Texas) and seven runs (tied for the most).

“I felt like early in the game they just had a few hits that found the holes, a few first-pitch base hits,” said Eovaldi, who is vested for a $20 million player option with Texas for 2025. “I think at the end of the day I just need to do a better job of executing my pitches.”

Eovaldi took a 7-3 lead into the fifth inning after the Rangers scored five unearned runs in the fourth. The Jays then scored four runs to knock out Eovaldi after 4 2/3 innings.

Six of the seven runs scored against Toronto starter Chris Bassitt in 3 2/3 innings were unearned. Bassitt had a throwing error during Texas’ two-run third inning.

“We didn’t help ourselves defensively, taking care of the ball to secure some outs,” Blue Jays manager John Schneider said.

The Blue Jays’ Vladimir Guerrero Jr. had a double and two singles, his most hits in a game since having four on Sept. 3. Guerrero is hitting .384 since the All-Star break.

TRAINER’S ROOM

Blue Jays: SS Bo Bichette (calf) was activated and played for the first time since July 19, going 2 for 5 with an RBI. … OF Daulton Varsho (shoulder) was placed on the 10-day injured list and will have rotator cuff surgery … INF Will Wagner (knee inflammation) was placed on the 60-day list.

UP NEXT

Rangers: LHP Chad Bradford (5-3, 3.97 ERA) will pitch Wednesday night’s game on extended five days’ rest after allowing career highs in hits (nine), runs (eight) and home runs (three) in 3 2/3 innings losing at Arizona on Sept. 14.

Blue Jays: RHP Bowden Francis (8-4, 3.50) has had two no-hitters get away in the ninth inning this season, including in his previous start against the New York Mets on Sept. 11. Francis is the first major-leaguer to have that happen since Rangers Hall of Famer Nolan Ryan in 1989.

—