Investment

FP Answers: Is whole life insurance a good investment? If so, in what circumstances?

If you have a large or complicated estate, it pays to take a look at insurance, experts say

Q: “My wife and I are both 50 and have two kids. Our household income is about $200,000 a year, evenly split between my wife and I. I’d like to leave a large inheritance to my two kids. Is it ever a good idea to buy a whole life insurance policy as an investment vehicle? Why or why not? And if not, what would be a better option? — Alejandro

FP Answers: Whole life insurance can be a controversial product, but its two main features, tax-sheltered growth, and a tax-free death benefit, make it worth considering when you’re doing estate planning, or when looking for another tax shelter after maximizing your registered retirement savings plans (RRSPs) and tax-free savings accounts (TFSAs).

Integrating whole life insurance into a plan is unique to everyone and there are many different ways to leverage the value of a policy, but that’s a topic for a different article. Your questions here are whether whole life insurance is a good investment and what are the alternatives if you want to leave a large inheritance to your children?

At year 40, or when both you and your wife turn age 90, the whole life policy is projected to give you an average annual after-tax return of 4.8 percent. Keep in mind this is not guaranteed. The projected values and returns will be different, but the results shown are based on current rates.

By comparison, current five-year guaranteed investment certificates (GIC) rates are sitting at five per cent. Forgetting tax for a minute, investing the $1,850 monthly premium into a GIC over 40 years will grow to $2,755,651. If you factor in a marginal tax rate of 40 per cent, the GIC investment would only grow to $1,701,891, about $1 million less than insurance. Does that make whole life insurance a good investment?

Sometimes, there isn’t an alternative to whole life for inheritance purposes, or it takes time to create an alternative. What insurance, term or whole life, excels at is providing an immediate estate value — or inheritance value — for your children. I don’t know of any alternatives that can do that.

You can create alternatives to whole life insurance if you have the time and the ability to save and invest money. These alternatives combine term insurance with investment and/or debt-reducing strategies. Term insurance is put in place to provide the immediate estate value and buy you time to grow your investments to the point where the insurance is no longer required.

There is always a risk when creating alternatives that by combining term and investing strategy you won’t save enough, you’ll spend your money yourselves, the markets may crash the day you die, you have a new spouse later in life and so forth. Insurance is called insurance for a reason.

Decide what’s important to you about leaving money to your children when you die. What benefits would come to you and your children if you gifted them money earlier in their lives?

Whole life insurance can also be used as an investment vehicle to create and maintain an estate’s value. But I find that its tax advantages more often make it more useful once a large estate has been created through investing, multiple real estate holdings, corporate success, farming and other investments. If you have a large or complicated estate, it pays to take a look at insurance.

Allan Norman provides fee only certified financial planning services through Atlantis Financial Inc. Allan is also registered as an investment advisor with Aligned Capital Partners Inc. He can be reached at www.atlantisfinancial.ca or alnorman@atlantisfinancial.ca. This commentary is provided as a general source of information and is not intended to be personalized investment advice.

_Share this article in your social network

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite little changed in late-morning trading, U.S. stock markets down

TORONTO – Canada’s main stock index was little changed in late-morning trading as the financial sector fell, but energy and base metal stocks moved higher.

The S&P/TSX composite index was up 0.05 of a point at 24,224.95.

In New York, the Dow Jones industrial average was down 94.31 points at 42,417.69. The S&P 500 index was down 10.91 points at 5,781.13, while the Nasdaq composite was down 29.59 points at 18,262.03.

The Canadian dollar traded for 72.71 cents US compared with 73.05 cents US on Wednesday.

The November crude oil contract was up US$1.69 at US$74.93 per barrel and the November natural gas contract was up a penny at US$2.67 per mmBTU.

The December gold contract was up US$14.70 at US$2,640.70 an ounce and the December copper contract was up two cents at US$4.42 a pound.

This report by The Canadian Press was first published Oct. 10, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

Sports9 hours ago

Sports9 hours agoForward Jade Kovacevic is the first player signing announced by Northern Super League

-

Business6 hours ago

Business6 hours agoWhat Difference Will You Make to an Employer?

-

News7 hours ago

News7 hours agoSupply shortage for Ontario home care, palliative patients unacceptable: minister

-

News9 hours ago

News9 hours agoHarris raises $633 million in the third quarter but spends heavily in final push

-

News7 hours ago

News7 hours agoCarbon monoxide poisoning suspected in deaths of three found in car in Quebec’s Gaspé

-

News24 hours ago

News24 hours agoHurricane Oscar makes landfall in eastern Cuba after striking the Bahamas

-

Health9 hours ago

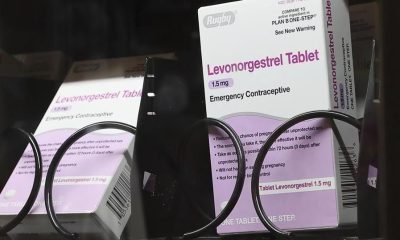

Health9 hours agoWhite House says health insurance needs to fully cover condoms, other over-the-counter birth control

-

Health9 hours ago

Health9 hours agoPolio is rising in Pakistan ahead of a new vaccination campaign