Economy

French economy ekes out meagre growth in Q3, inflation hits record high

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WGEMYNUEIFPBJM7PCVW4GNZRP4.jpg)

PARIS, Oct 28 (Reuters) – France’s economy eked out meagre growth in the third quarter as household spending stagnated and a sharp jump in inflation in October signalled headwinds looming in the final quarter of the year.

France’s economy grew 0.2% in the July-September period, in line with market expectations, preliminary data from the INSEE official statistics agency showed.

Stubbornly high inflation, export weakness and risks to energy supply will weigh on the euro zone’s second largest economy in the months ahead, analysts said, just as the European Central Bank jacks up rates to tame price rises.

Bank of France Governor Francois Villeroy de Galhau said he saw no reason to revise downwards his forecast for 2.6% GDP growth in 2022 but that there were clear signs of weakness in the eurozone as a whole.

“That means resilient growth this year and at least a significant slowdown next year,” Villeroy told a webcast hosted by financial site Boursorama.

Villeroy, who is also a European Central Bank member, said “substantial” progress had already been made in the ECB’s bid to fight off a historic surge in inflation.

France has fared better than its neighbours in taming price rises thanks in part to early energy price caps and fuel subsidies, but economists have warned that its heavy spending on blanket protection for households is storing up pain for later.

After two consecutive months of slowing inflation in France that bucked the wider euro zone trend, consumer prices surged in October. Food prices were up 11.8% annually while energy prices soared 19.2%.

On an EU-harmonised basis, inflation rose 1.3% month-on-month, leaving the year-on-year rate at 7.1% — nearly a full point higher than in September and surpassing a record high for France of 6.8% for hit in July.

The data came a day after the European Central Bank raised interest rates again, worried that rapid price growth is becoming entrenched. It lifted its deposit rate by a further 75 basis points to 1.5% – the highest rate since 2009.

The outlook for France, remained difficult with inventories likely to make a negative contribution to growth from the next quarter, ING analysts said.

“With investment at half-mast, risks to energy supply, persistently high inflation and an overall slowdown in demand for exports, it is difficult to expect a strong recovery in growth in the second half of 2023,” ING said.

French President Emmanuel Macron this month in a newspaper interview cautioned policymakers against “demand destruction”.

ECB President Christine Lagarde on Thursday pushed back on political criticism that rapid rate hikes threatened to push the euro zone into recession, arguing that her job was to get inflation under control.

Editing by Silvia Aloisi, Angus MacSwan, William Maclean

Economy

PBO projects deficit exceeded Liberals’ $40B pledge, economy to rebound in 2025

OTTAWA – The parliamentary budget officer says the federal government likely failed to keep its deficit below its promised $40 billion cap in the last fiscal year.

However the PBO also projects in its latest economic and fiscal outlook today that weak economic growth this year will begin to rebound in 2025.

The budget watchdog estimates in its report that the federal government posted a $46.8 billion deficit for the 2023-24 fiscal year.

Finance Minister Chrystia Freeland pledged a year ago to keep the deficit capped at $40 billion and in her spring budget said the deficit for 2023-24 stayed in line with that promise.

The final tally of the last year’s deficit will be confirmed when the government publishes its annual public accounts report this fall.

The PBO says economic growth will remain tepid this year but will rebound in 2025 as the Bank of Canada’s interest rate cuts stimulate spending and business investment.

This report by The Canadian Press was first published Oct. 17, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says levels of food insecurity rose in 2022

OTTAWA – Statistics Canada says the level of food insecurity increased in 2022 as inflation hit peak levels.

In a report using data from the Canadian community health survey, the agency says 15.6 per cent of households experienced some level of food insecurity in 2022 after being relatively stable from 2017 to 2021.

The reading was up from 9.6 per cent in 2017 and 11.6 per cent in 2018.

Statistics Canada says the prevalence of household food insecurity was slightly lower and stable during the pandemic years as it fell to 8.5 per cent in the fall of 2020 and 9.1 per cent in 2021.

In addition to an increase in the prevalence of food insecurity in 2022, the agency says there was an increase in the severity as more households reported moderate or severe food insecurity.

It also noted an increase in the number of Canadians living in moderately or severely food insecure households was also seen in the Canadian income survey data collected in the first half of 2023.

This report by The Canadian Press was first published Oct 16, 2024.

The Canadian Press. All rights reserved.

Economy

Statistics Canada says manufacturing sales fell 1.3% to $69.4B in August

OTTAWA – Statistics Canada says manufacturing sales in August fell to their lowest level since January 2022 as sales in the primary metal and petroleum and coal product subsectors fell.

The agency says manufacturing sales fell 1.3 per cent to $69.4 billion in August, after rising 1.1 per cent in July.

The drop came as sales in the primary metal subsector dropped 6.4 per cent to $5.3 billion in August, on lower prices and lower volumes.

Sales in the petroleum and coal product subsector fell 3.7 per cent to $7.8 billion in August on lower prices.

Meanwhile, sales of aerospace products and parts rose 7.3 per cent to $2.7 billion in August and wood product sales increased 3.8 per cent to $3.1 billion.

Overall manufacturing sales in constant dollars fell 0.8 per cent in August.

This report by The Canadian Press was first published Oct. 16, 2024.

The Canadian Press. All rights reserved.

-

Politics24 hours ago

Politics24 hours agoBad weather forecast for B.C. election day as record numbers vote in advance polls

-

Business24 hours ago

Business24 hours agoNetflix’s subscriber growth slows as gains from password-sharing crackdown subside

-

Politics24 hours ago

Politics24 hours agoPromise tracker: What the Saskatchewan Party and NDP pledge to do if they win Oct. 28

-

News18 hours ago

News18 hours agoTobacco giants would pay out $32.5B to provinces, smokers in ‘historic’ proposed deal

-

News18 hours ago

News18 hours agoHere are the key numbers in the deal proposed by three tobacco giants

-

News18 hours ago

News18 hours agoRCMP say girl’s death in Alberta lake could be criminal

-

News8 hours ago

News8 hours agoCanadanewsmedia news October 18, 2024: Testy B.C. election campaign reaches final day

-

Health17 hours ago

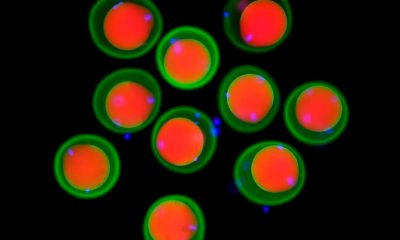

Health17 hours agoScientists show how sperm and egg come together like a key in a lock