OTTAWA – The Liberal government plans to temporarily lift the federal sales tax off a slew of items just in time for Christmas and send cheques to millions of Canadians this spring, Prime Minister Justin Trudeau announced on Thursday.

“Our government can’t set prices at the checkout, but we can put more money in people’s pockets,” Trudeau said at a press conference in Toronto alongside Finance Minister Chrystia Freeland.

“The working Canadians rebate of $250 which will be sent to people in April, is going to give people that relief they need, and the tax break over the next two months is going to help on the costs of everything as we approach the holidays, as we get into the new year.”

The GST break would begin Dec. 14 and end Feb. 15. The Liberals say it will apply to a number of items including children’s clothing and shoes, toys, diapers, restaurant meals and beer and wine.

It also applies to Christmas trees — both natural and artificial — along with a variety of snack foods and beverages, and video game consoles.

Canadians who worked in 2023 and earned less than $150,000 would also receive a $250 cheque in the spring.

About 18.7 million people will receive the cheques, costing the government about $4.7 billion, while the GST break is expected to cost another $1.6 billion.

The measures come as an inflation-driven affordability crunch has left voters unhappy with the Trudeau government.

High inflation has also put pressure on the Liberals to avoid introducing measures that would stimulate spending and fuel price growth.

However, the prime minister dismissed the idea that this move could raise inflation again, noting that price growth and interest rates are down.

“It allows us to make sure that we are putting money in people’s pockets in a way that is not going to stimulate inflation, but is going to help them make ends meet and continue our economic growth,” Trudeau said.

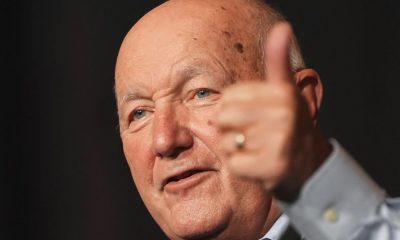

Conservative Leader Pierre Poilievre blasted the NDP and Liberals and called the tax break a “trick.”

“Today, what we have is a two-month temporary tax trick that will not make up for the permanent quadrupling of the carbon tax on heat, housing, food and fuel,” Poilievre said.

Poilievre was referring to the Liberal plan to continue increasing the carbon price annually until 2030.

The Conservatives have pledged to scrap the federal fuel charge, which is applied on the purchases of 21 different fuels. Proceeds from the federal consumer carbon price are returned to Canadians and small businesses through rebates.

Ontario Finance Minister Peter Bethlenfalvy said the federal government took the rebate idea from his playbook. Last month, the province announced it was sending out $200 cheques to all Ontario taxpayers and their children as part of its own suite of measures designed to ease the effects of the affordability crisis.

“We came up with the $200 rebate, but you know what the federal government can do is scrap the carbon tax,” he said. “I mean, that is taking money out of people’s pockets.”

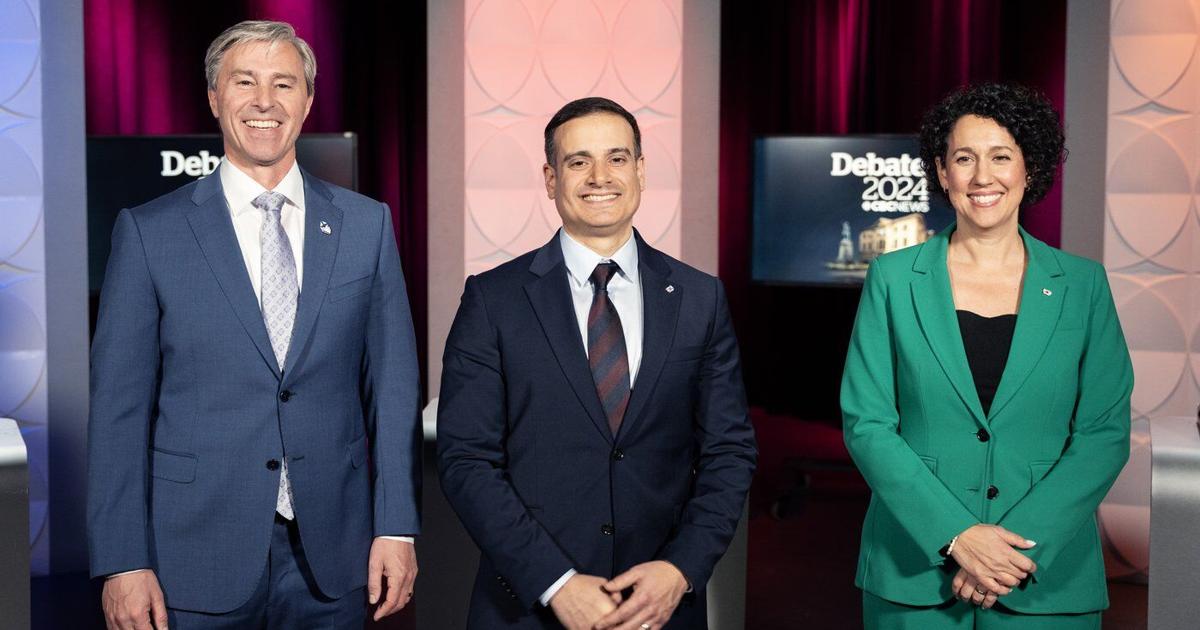

In order to get the measures passed through Parliament, the Liberals will need the support of an opposition party. The NDP appears poised to be a willing partner, taking credit for forcing the minority government to adopt its idea — although NDP Leader Jagmeet Singh insisted Thursday there was no negotiation between the parties.

Last week, the NDP promised it would issue a permanent GST break for essential items if it wins the next election, and late Wednesday Singh said in a statement that his party won a “tax holiday” for Canadians.

“The Prime Minister’s Office just informed us that he’s caving to our Tax-Free-Essentials campaign — partly,” Singh said in the statement.

Singh wanted to permanently remove the GST from essentials including diapers, prepared meals, cellphone and internet bills. That was expected to cost $5 billion, but he was also urging provincial governments to match the plan with cuts to provincial sales taxes.

The changes proposed by the Liberals will be part of the annual fall economic statement, which will need to pass through Parliament in order to take effect.

The House of Commons has been embroiled in a stalemate for nearly two months as the Conservatives filibuster a motion demanding the government release unredacted documents related to misspending at a green tech fund.

That means no legislation has been debated or voted on for more than eight weeks, because matters of privilege take precedence over all other House business.

The NDP says it will not end the privilege debate. Instead, a spokesperson for the party says it will use a procedural measure to adjourn that debate for one day at a time to allow the tax measures to pass.

This report by The Canadian Press was first published Nov. 21, 2024.