Goldman Sachs (GS) on Monday agreed to sell off its $29 billion Personal Financial Management (PFM) unit to Creative Planning, a Kansas-based Registered Investment Advisor (RIA).

Key Takeaways

- Wall Street investment bank Goldman Sachs has agreed to sell off its $29 billion Personal Financial Management (PFM) unit.

- It’s part of an effort to reorient the firm’s business strategy back toward its core client base: ultra-high net worth investors.

- As one of America’s biggest registered investment advisors (RIAs), Creative Planning could be well-positioned to take over Goldman’s PFM unit.

It’s a move designed to reorient the Wall Street giant’s focus back toward its ultra-high net worth clientele, a market which Goldman has long dominated. The PFM unit is a spinoff from United Capital, an advisory firm that Goldman purchased in May 2019 for $750 million, as part of then-CEO David Solomon’s effort to expand the firm’s client base beyond the ultra-rich and cater to those slightly less affluent.

However, the move proved inconsequential in the firm’s long-term strategy. As of February, Goldman catered to just 1% of the high-net worth market, or those with between $1 million and $10 million to invest. By comparison, ultra-high net worth individuals—Goldman’s main client base—typically have investable funds in excess of $60 million. Goldman’s private wealth arm oversees more than $1 trillion in assets from roughly 16,000 clients.

The sale is expected to close in the fourth quarter and positively impact the wealth division’s finances, boosting its profit margin.

“This transaction is progress toward executing the goals and targets we outlined at our investor day in February,” said Goldman Sachs Global Head of Asset and Wealth Management Marc Nachmann. “It is margin accretive to Asset & Wealth Management and allows us to focus on the execution of our premier ultra-high net worth wealth management and workplace growth strategy.”

As one of the nation’s biggest private investment advisors, with more than 2,000 employees and $245 billion in combined assets under management (AUM), Creative Planning could be well-positioned to take over Goldman’s PFM unit.

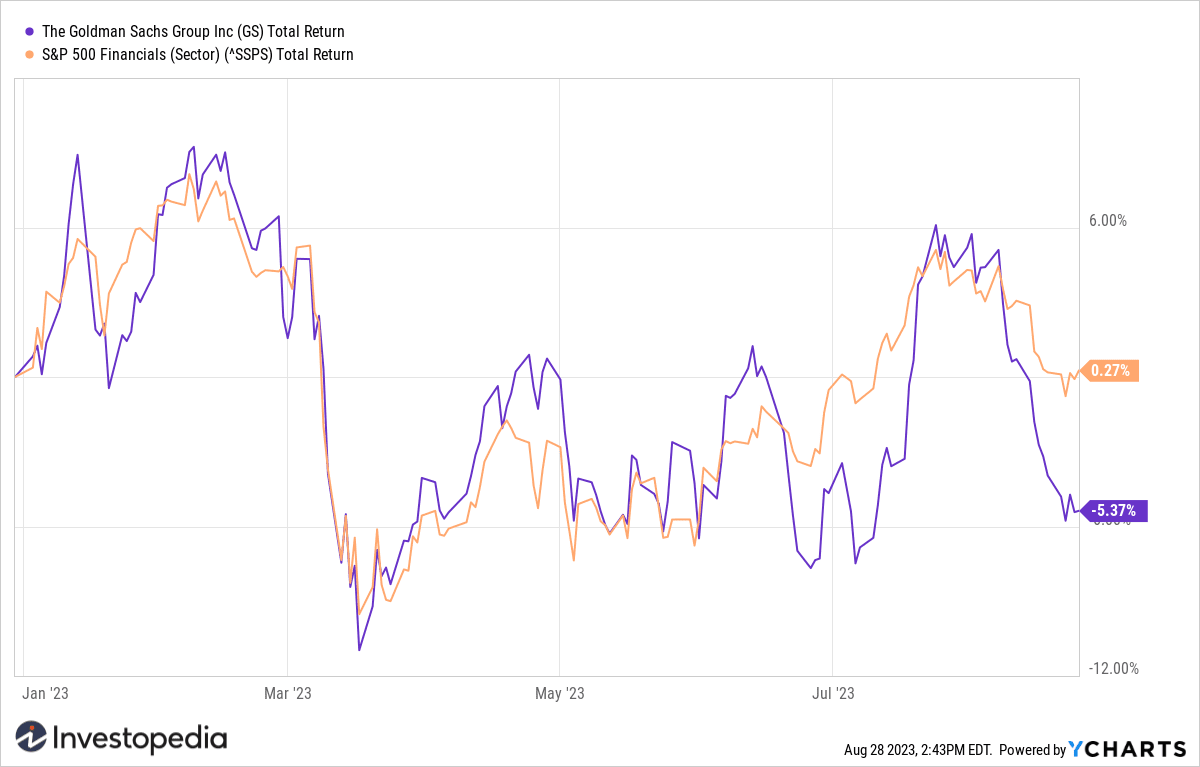

Shares of Goldman Sachs were up over 1% in afternoon trading Monday. They’ve shed more than 5% so far this year, underperforming the broader S&P 500 Financial Sector, which is flat year-to-date.

:max_bytes(150000):strip_icc()/GS_SPXTR_SSPS_chart-a295d39be2094fd7a9fbf5686729aadc.png)