As bids for the new work kept rising, so did the value of those tokens. By March 11, the day MetaKovan won the Christie’s auction, the value of his shares in the art tokens had risen by about $51 million, according to historical prices on crypto data site CoinMarketCap and a description of his financial stake on his investment fund’s website.

The auctioned artwork, a collection of hundreds of smaller works by the South Carolina artist Beeple, was sold as a non-fungible token, or NFT, which uses the same technology behind cryptocurrencies such as bitcoin to create a certificate of ownership over a specific digital file that can’t be copied or forged. Christie’s called the sale a “milestone for digital art collecting,” and many marked the sale as a key moment for blockchain technology’s move into the mainstream.

Legal experts say it’s not apparent that MetaKoven did anything wrong. It’s not against the law for someone to buy, resell and promote the value of digital assets as long as they do not plan to dump their stake for quick financial gain, said Carol Goforth, a professor of law at the University of Arkansas at Fayetteville who specializes in cryptocurrency regulation.

But the financial interests of the auction’s winning bidder show that the recent frenzy around digital art may be less a sign of an artistic revolution than a gold rush into highly speculative blockchain technology.

“It could be argued that it’s a cash grab,” said Paul Sibenik, an investigator at CipherBlade, a firm that specializes in blockchain and cryptocurrency fraud. He sees no evidence of potential fraud. “If you found value in having the asset itself, maybe you wouldn’t try to sell it in pieces to everyone who wanted a portion of it,” Sibenik said.

A spokeswoman for MetaKovan declined to comment. In blog posts and podcast interviews, the entrepreneur has said he intends to hold his stakes in Beeple artwork for the long term.

MetaKovan says he purchased 20 artworks by Beeple for $2.2 million in December and decided to make shares of the collection available to the public through a digital token, similar to a share in a company. He created 10 million tokens, called B.20, making around 25 percent of them available to the public and keeping about 50 percent for himself, according to a description of how the token would work from MetaKovan’s investment fund.

The remainder he set aside for “friends,” “prospective partners” and Beeple, according to the fund. “It was important for us that the artist was taken care of beyond the sale proceeds, so Beeple gets an allocation of 2%.”

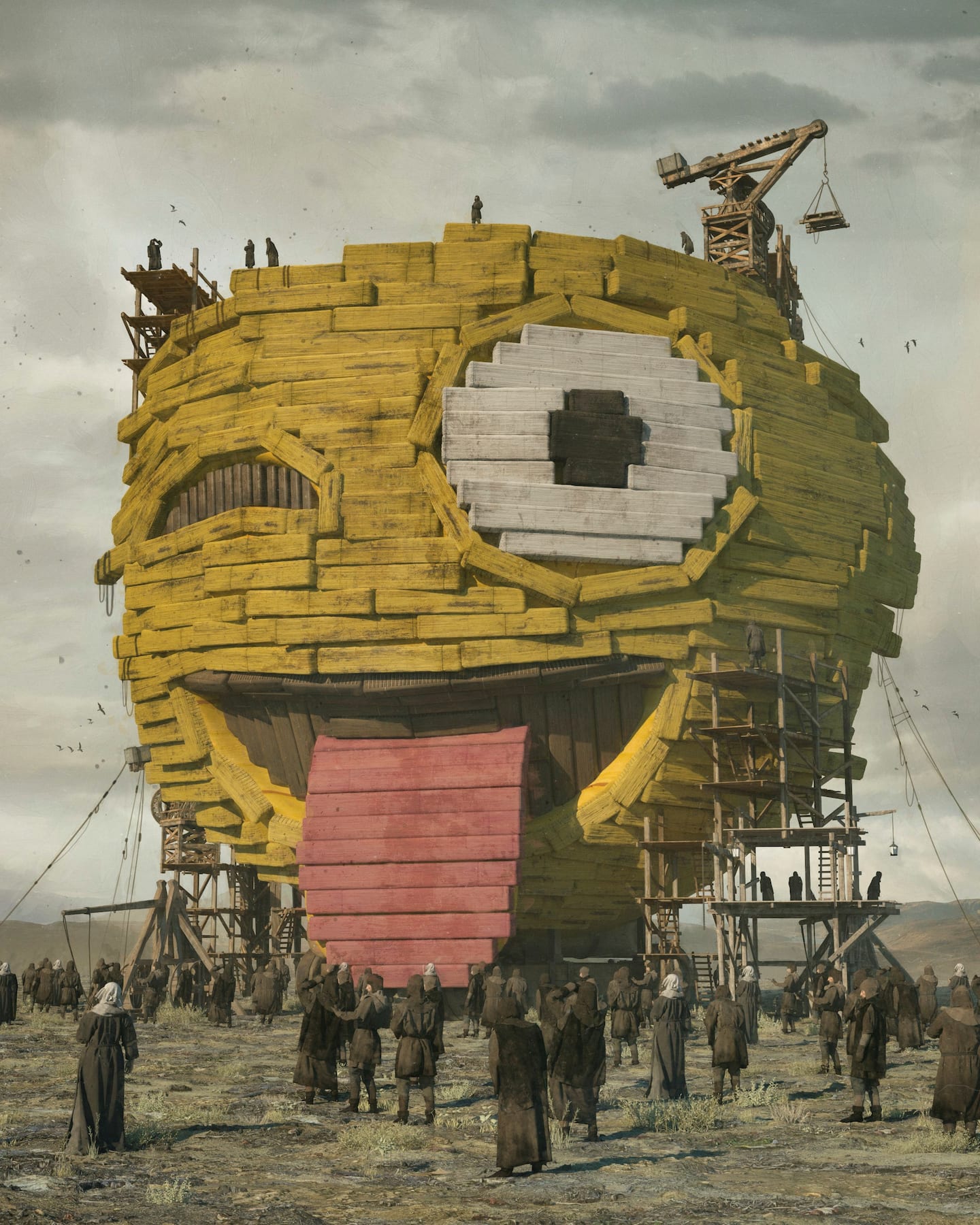

Before becoming the third-most-valuable living artist, Beeple, whose real name is Mike Winkelmann, was best known for his irreverent and grotesque pictures of political and cultural figures like Mickey Mouse or former president Donald Trump. Most of his work appears on Instagram, where he has nearly 2 million followers. He has also helped design concert visuals for musicians including Ariana Grande and Nicki Minaj.

Winkelmann declined to comment.

Winkelmann is savvy when it comes to NFTs. Besides the collection bought by MetaKovan in December, the artist has also sold some of his artwork for $1 a piece on NFT-trading sites, setting off mad scrambles that generate more hype and headlines.

The B.20 tokens based on Beeple’s work are about 41 times more valuable today than they were in January, when MetaKovan first made them available, according to CoinMarketCap. From the day the Christie’s auction began, on Feb. 25, to the close of the auction on March 11, the price of one B.20 token grew from $2.17 to $18.57.

The value of MetaKovan’s stake in B.20 ― about 5 million tokens, according to his blog post — grew by about $51 million over that period. Beeple’s personal stake in B.20 grew by about $2 million.

A spokesperson for Christie’s did not return requests for comment.

Although shared ownership of artworks may reduce the social prestige that comes with a private art collection, it has the benefit of being more tradable, said Will Cong, an associate professor of finance at Cornell University. “Think about how traditional art pieces are hard to trade,” he said. “That is solved after the ownership can be easily divided and traded.”

The investors who jumped into B.20 and helped push up the price include cryptocurrency enthusiasts, traditional art collectors and some novice investors who became interested in digital art only in recent weeks. In interviews with The Washington Post, several people who purchased B.20 tokens said they believed they were getting in on the ground floor of a new type of business built around digital art.

“I invested because I want to make money, but I also want to be a part of the future of modern art,” said Cole Tobias, who purchased $783 worth of B.20 tokens in the past week.

Tobias, a 24-year-old accountant in New York, said he began buying and trading video highlights of basketball stars on the digital auction site NBA Top Shots earlier this year. He became interested in digital art, and he liked the fact that fractional ownership could allow him to purchase a share in art that he could otherwise not afford.

As the auction heated up, more people bought B.20 to get a piece of the action.

A Berlin-based translator who goes by the screen name Nerz said he invested in B.20 partly because he believed the Christie’s auction would confer value on other Beeple artworks.

“B.20 sounded fascinating because of the upcoming Christie’s auction and it sounded like a short term speculation worth a try,” he said to The Post in a private message on Discord. “So I made my decision as a speculation mainly out of financial interest.”

As the end of the auction approached, the bid prices for the Beeple piece increased rapidly. MetaKovan was locked in a bidding war with others who wanted the artwork. One of them, cryptocurrency entrepreneur Justin Sun, said he tried to increase his bid in the final 30 seconds of the auction, but the website froze and wouldn’t let him. He says he doesn’t know MetaKovan personally and doesn’t own any B.20.

“This is basically a new era of art, participating in this auction is kind of making history,” Sun said in an interview.

Nerz, the investor who bought some B.20 because of the excitement around the Christie’s auction, said he thinks the token is still undervalued.

“Right now I think each of the 20 pieces is valued around 7-8 million calculated by the token prize? That seems low,” he said. “It’s a game of optics and narrative and it’s all about what is possible to believe.”