Media

How media buyers view the retail media landscape — from Amazon to Walmart to Wawa – Digiday

Today’s retail media network landscape could be compared to the California gold rush of the 1800s. Google’s third-party cookie is finally crumbling, making gold out of the alternative first-party data as retailers chase audience insights.

The promise of wealth, or in this case, ad dollars, has the marketplace heating up with scads of retailers, from first-movers like Amazon to newcomers like Wawa convenience store — even to the unsuspected like Cars.com automotive company.

By the end of this year, retail media ad spend is expected to make up one-fifth of worldwide digital ad spend, scooping up $140 billion, which is up from the forecasted $115 billion in 2023, according to eMarketer.

Retail media is a growing space, no doubt. Especially as advertisers are eager to plug the holes Google’s third-party cookie deprecation is leaving behind. But that growth has led to fragmentation as agencies grapple with where to spend client ad dollars that’ll give the most bang for their buck.

“From where we sit as an agency, it’s certainly making our lives and our day-to-day work more exciting, more challenging,” said Ethan Goodman, evp of digital commerce at The Mars Agency.

In regards to the biggest players in the space, like Amazon Ads, Roundel (Target’s retail media business), Walmart Connect and Albertsons Media Collective, he said, “They have significantly improved and scaled their capabilities — their audience and targeting capabilities, their measurement capabilities. Really practically, they’ve improved their channel offering and the breadth of their channel capabilities.”

Digiday caught up with Goodman and other agency executives to talk about how the retail media competition is looking — and the players most on their radar.

01

Amazon Ads

Amazon Advertising launched in 2012, giving it a first-mover advantage in the space and making it almost synonymous with the concept of retail media. This year, Amazon is expected to hoover up 74% of the nearly $60 billion in U.S. digital retail media ad spend, according to eMarketer’s forecasts. Given its pure scale, Amazon could stand as an unexpected beneficiary of Google Chrome’s third-party cookie fallout once the dust settles.

As its business matures, the mammoth-sized company has made recent ad tech and artificial intelligence upgrades to enhance its offering as well as new inventory, selling ads on Prime Video to advertisers. This layers on top of its self-service ad solution through its owned streaming services like Freevee, Twitch and Thursday Night Football, and in-store advertising through Whole Foods Market and Amazon Fresh, making it a top contender for ad dollars.

“A lot of our brand national dollars are spent across Amazon,” said an agency executive who spoke with Digiday and requested anonymity. The exec did not disclose spend figures. “As CPG becomes more important for Amazon and grocery becomes a bigger deal for them, whether that’s through Whole Foods or Amazon Fresh or other places, we’re going to see our CPG spend continue to increase.”

Beyond its sheer size (it touts an audience of more than 150 million), Amazon’s ad business is an ecosystem with data from Amazon DSP, Amazon Ads APIs and Amazon Marketing Cloud, offering marketers more granular audience insights. Amazon also opened its platform to developers and plug-ins for things like dashboards or other tools.

“They’re able to do closed loop attribution, whereby the performance of an impression served on Amazon Prime can be tracked back to what it ultimately helps drive at the Amazon.com level,” said Harry Inglis, head of activation at Media by Mother, Mother’s three-year-old media agency. “It’s hard to compete with.“

02

Walmart Connect

Another early entrant to the retail media competition, Walmart Connect, has moved recently to close the gap between it and Amazon. In February, Walmart announced plans to acquire smart TV manufacturer Vizio for $2.3 billion, bolstering its retail media offering by adding more streaming capabilities. In January, it set its sights on a TikTok integration, offering advertisers sales measurement data and access to the coveted Gen Z audience. Both of these events build on its partnership with Roku, announced in 2022, to bring shoppable ads to streaming. And it helps that Walmart has a massive physical presence with more than 4,600 locations in the U.S., shadowing Amazon’s 500 Whole Foods Markets.

Having launched back in 2017, Walmart Connect has spent the last year-and-a-half beefing up its advertising capabilities, including the Walmart Connect Academy Ad Certification program to educate agencies and brands on what it can do. Its latest move with Vizio, and now integration with TikTok, is intended to reach advertisers’ latest fascination: streaming and digital video.

“The more that they’re moving those digital solutions in-store, I think will be some of the growth,” the anonymous agency exec told Digiday. “[RMNs] already made partnerships and social, which was smart because that’s where people are spending a lot of their time. And then, now where? Now, it’s streaming?”

Spending on platforms outside of Amazon, like Walmart, Target and the like, is seeing double-digit growth this year. Notably, Walmart appears to be at the helm of said growth spurt, according to previous Digiday reporting.

03

Albertsons Media Collective

The U.S. Federal Trade Commission’s decision to block the Kroger-Albertsons merger last month may have put a wrench in growth plans, but Albertsons Media Collective is still one of the top contenders for retail media network spend — a tertiary challenger, behind the likes of Amazon, Walmart, Target and of course, Kroger, agency execs say.

It only launched back in 2022, but has sparked advertisers’ interest, noted as a more ambitious player in the space, listening to both needs and wants in the marketplace, per agency execs. Last January, Albertsons became the first advertiser to use LiveRamp and Pinterest’s clean room offering to tie offline sales to online behavior.

But perhaps most notably, the grocery chain has started aiming to tackle standardization and measurement issues, a pain point in an increasingly crowded and fragmented marketplace. And that’s what sets it apart, per agency execs.

“Albertsons actually came out publicly and are talking all about measurement and standardization,” said a second agency exec who wished to remain anonymous. “They’re really trying to set the standards, be the retailer that’s leaning into these standards.”

04

The Home Depot’s Retail Media+

In a sea of retail media networks, agency executives highlighted The Home Depot’s unique data as a keen proposition to advertisers. The retailer offers on-site and off-site ad placements and is able to create audiences around specific groups, including people who have recently moved, those who are redecorating, or setting up a business or any other life event. Each of these data points can win over a range of advertisers, whether it be internet providers or insurance companies.

The niche nature of The Home Depot, which launched its offering in 2019, gives it a competitive edge for some executives. Instead of identifiers like demographics or psychographic data, The Home Depot builds audiences based on home projects shoppers are doing — a data point not easily found within the retail media space, especially at that scale. Notably, the company has more than 2,300 stores across North America.

“Home Depot, they actually have something unique in the sense of they created the retail media plus network,” said the second agency exec. “From that capacity, they are trying to not only sell media to their suppliers, but ask their suppliers what they want.”

In a recent interview with Digiday, Melanie Babcock, vp of Retail Media+ and monetization at The Home Depot, said the company is looking to expand beyond endemic advertisers.

05

Instacart

Instacart exploded during the pandemic lockdown, when shoppers turned to the delivery service to shop at grocery stores and convenience stores without leaving the comfort of their home.

In a post-Covid world, agency execs wondered if Instacart would continue to thrive and if it would gobble up ad dollars via its retail media network, which launched in 2022.

“We were questioning whether it was true incrementality because a lot of what they were delivering was retailers that we already had agreements with. They were just the delivery platform at the time,” said the first agency executive. Thus far, they said, it’s held up.

This year, the company started looking at off-site retail media, pitching advertisers on Google Shopping ads, which are enhanced by its own retail media data. As Retail Dive recently reported in January, early advertisers for the move include Danone’s Oikos and Kraft Heinz’s Kraft.

That partnership has sparked advertisers’ interest as the company’s retail partners are making placements available on their shopping cart, an interesting proposition for consumer packaged goods brands, the exec said.

Other off-site efforts include a partnership with Roku last April, and ad targeting on Sprouts Farmers Market last May.

06

Kroger Precision Marketing

With seven years in the retail media network game, Kroger Precision Marketing (KPM) has made a name for itself, partnering with the likes of Cooler Screens, Meta, Pinterest, Roku, Snap, The Trade Desk and others.

Like Albertsons, the U.S. Federal Trade Commission’s decision to block the Kroger-Albertsons merger may have put a damper on growth. But with recent innovations, growth is expected to continue. The retailer has been steadily growing its ad offering, with efforts to marry online and offline sales data dating back to 2020.

Last November, KPM announced new programmatic capabilities with The Trade Desk. Last June, Kroger took its self-service ad platform in-house, giving advertisers access to the grocer’s product listing ads as well as display advertising.

“Kroger is one of the top offerings in the U.S.,” said the second agency executive. “We think the best data offerings to date. However, they are extremely conservative when it comes to making any type of decisions (innovations, legal, negotiations etc.).” Again, this is in comparison to retailers like Albertsons, which the agency exec says is more ambitious when it comes to responding to an ever-changing marketplace.

Kroger may have more red tape, but it has spent the last year-and-a-half shifting to a “mindset of collaboration,” according to the first agency executive. The retailer has also started to focus on things like standardization and measurement. All in all, Kroger is considered a top partner for the agency, who said Kroger’s offering is on par with Walmart.

07

Target’s Roundel

Target has been aiming to build a media business to rival Amazon since rebranding as Roundel in 2019. Seemingly, it’s making good on its promise, coming in at marketers’ third most-used retail media network, according to Digiday research, behind Amazon and Walmart.

Last October, Target announced that it was enhancing its Roundel retail media business with Roundel Media Studio, a self-service buying tool, premium programmatic publisher partners and experimenting with shoppable connected TV. Roundel has recently been focused on expanding both its onsite and offsite inventory, including new ad formats like shoppable CTV, according to The Mars Agency’s Retail Media Report Card, a quarterly assessment and comparison retail media platform comparison tool.

It all makes a compelling argument as far as advertisers are concerned. Meaning Roundel is considered one of the leaders in the retail media landscape, given the retailer’s capabilities around audiences, channels and measurement. “They are also notably ahead of the game when it comes to taking an integrated approach to media and merchandising, and creating both seamless omnichannel experiences for Target guests and holistic, added-value opportunities for brands/advertisers,” said a third agency exec, who spoke anonymously.

08

Wawa’s Goose Media Network

Wawa convenience store is the latest to throw its hat in the ring as a retail media network competitor. While having only launched weeks ago, agency executives say clients are already interested in its offerings, especially in its fuel pump screen inventory.

The convenience store partnered with Publicis Groupe’s Publicis Sapient, Epsilon, and CitrusAd for its offering, with custom ads and campaigns on digital channels like Wawa’s websites, mobile app or video ads at a Wawa pump — a selling point for advertisers looking for more ways to get in front of shoppers.

“In addition to allowing brands to reach their shoppers on their website and inside their mobile app, they’re also making some of their gas station screen inventory available,” said Goodman. “Some of those unique inventory opportunities are again, a potential point of differentiation for players like that.”

Other selling points are Wawa’s audience, which could be unique given it has a cult-like following, and its ability to close the loop from customers seeing an ad at the pump before going into the convenience store to make a purchase. Given, the convenience store chain is smaller with about 1,000 locations in Pennsylvania, New Jersey and Florida. This year, the convenience store opened its first Georgia location.

“For a challenger like Wawa to go out to the brand marketplace and say, ‘I can uniquely reach this audience segment that you can’t reach through another retail media network,’ is a potential way in and is an advantage for them for sure,” per Goodman.

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

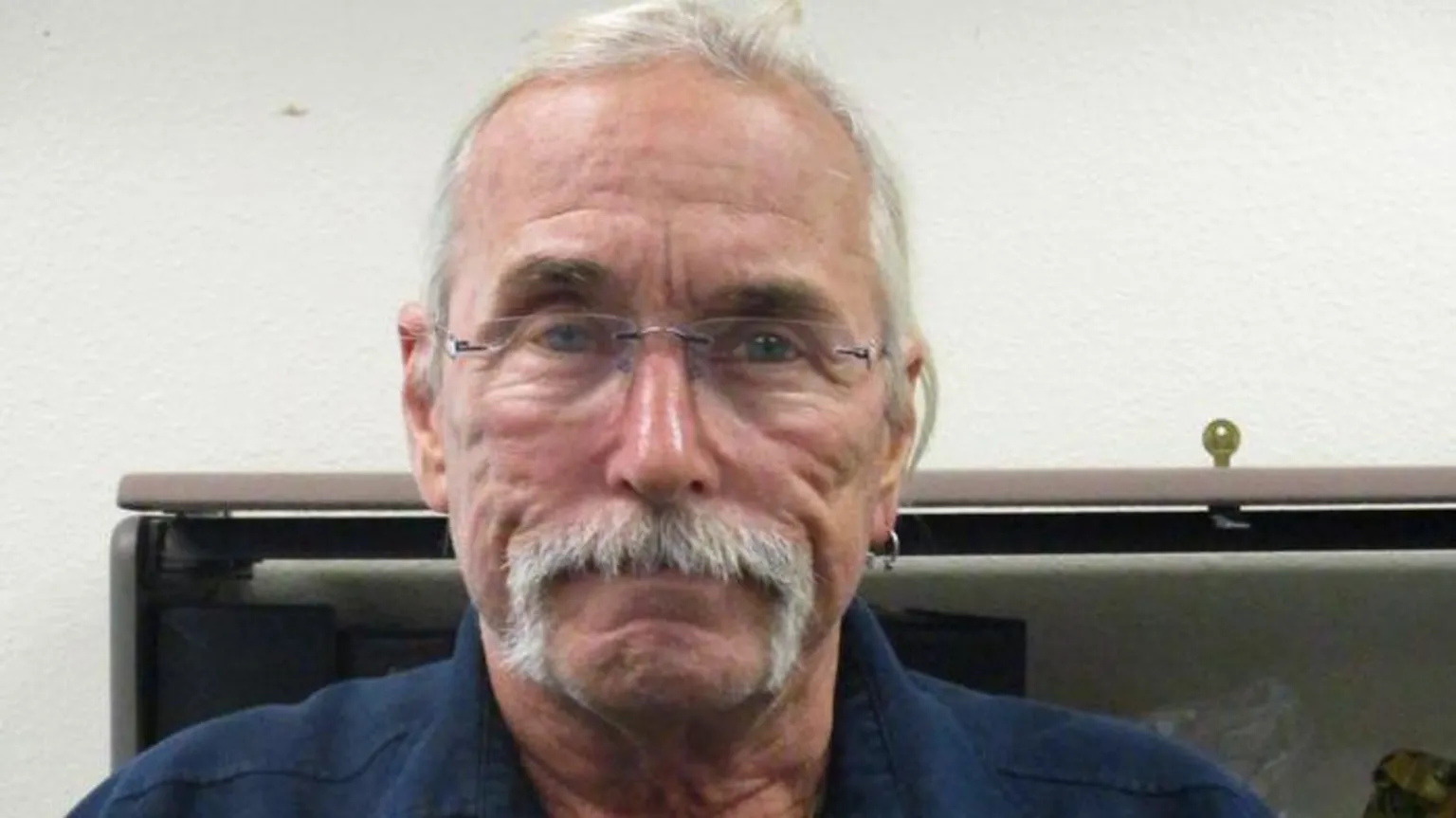

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

News13 hours ago

News13 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News13 hours ago

News13 hours agoA linebacker at West Virginia State is fatally shot on the eve of a game against his old school

-

Sports14 hours ago

Sports14 hours agoLawyer says Chinese doping case handled ‘reasonably’ but calls WADA’s lack of action “curious”

-

Sports8 hours ago

Sports8 hours agoCanada’s Marina Stakusic advances to quarterfinals at Guadalajara Open

-

News13 hours ago

News13 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News15 hours ago

News15 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News23 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News15 hours ago

News15 hours agoProvinces decry Ottawa’s plan to resettle asylum seekers across the country