Real eState

How Real Estate Agents Keep Cities Segregated – Jacobin magazine

How Real Estate Agents Keep Cities Segregated

Under capitalism, housing is a commodity, which means it principally exists to make rich people richer rather than meet human needs. That gap between making money and making profit distorts a whole range of life outcomes for average people — and real estate agents play a critical role in that process.

Real estate agents often convince the wealthy that certain neighborhoods with high housing prices are worth the cost, and tend to steer white homebuyers to white neighborhoods and homebuyers of color to nonwhite neighborhoods, further entrenching neighborhood race and class divides. (Unsplash)

- Interview by

- Karen Narefsky

Although the 2008 recession was triggered by the collapse of a speculative housing bubble, the housing market in New York City was back to business in record time. During the 2010s, luxury construction and condo sales soared and rents reached an all-time high. At the same time, predatory equity companies scooped up rent-stabilized buildings and pushed out working-class tenants, sparking a pushback that led to the historic rent law reforms of 2019. Now, as we enter an even more devastating recession prompted by the coronavirus pandemic, the consequences of neighborhood inequality are on stark display.

From 2012 to 2015, at the start of the real estate market’s resurgence, sociologist Max Besbris shadowed real estate agents in New York State. His recent book Upsold: Real Estate Agents, Prices, and Neighborhood Inequality examines the ways agents use identity and emotion to ensure buyers pay top dollar for their homes — and how this accelerates the segregation of New York’s neighborhoods by class and race.

KN

What motivated you to write Upsold?

MB

When I began my research, I was really influenced by two things. One is the consistent finding in sociology and economics that where you live determines a great deal about your life. It affects your health, the quality of your children’s education, your access to consumer and labor markets, your exposure to violence, your family’s wealth, and your overall chances for economic mobility.

The second issue that really shaped my thinking goes back to Engels and The Housing Question. He argued almost 150 years ago that as long as housing was a commodity, society would never be able to adequately provide it for everyone and that the housing market would remain a key site of exploitation.

With these things in mind, I decided to study real estate agents. Real estate agents are central actors in helping people find a place to live. They handle over 90 percent of residential real estate transactions in the United States. So they seemed like the right lens through which to understand residential mobility and neighborhood inequality, as well as the inherent tensions that are present when something so central to living a good life — housing — is commodified.

I had the added benefit of examining real estate agents at a time when housing prices in New York and many other cities across the United States were spiking. I was curious about what role agents played in driving prices back up so quickly after the Great Recession had exposed the housing market as a site of extreme speculation, financialization, and economic exploitation.

KN

Housing plays a big role in shaping people’s identities. How do real estate agents both use homebuyers’ identities to guide their choices and further shape those identities throughout the process of buying a home?

MB

One obvious way is through race. Real estate agents steer white homebuyers to white neighborhoods and homebuyers of color to nonwhite neighborhoods, and I think it’s imperative to stress that this is a contemporary practice. Just last year, Newsday documented rampant racial discrimination by real estate agents on Long Island.

What’s also important, especially in highly unequal cities like New York, is class. Agents are really adept at convincing the wealthy that certain neighborhoods with high housing prices are worth the cost. They do this in some unsurprising ways, like highlighting the amenities you get when you buy a fancy apartment in a fancy neighborhood. But agents also used cues like buyers’ professions, gender, or relationship status to persuade them that a particular neighborhood was a good match.

For example, I witnessed an agent tell a buyer, who worked in tech and initially said he wanted to buy in Greenpoint, that he should instead look in Williamsburg because that’s where people like him lived. The buyer eventually spent more than he initially said he wanted to on an apartment in Williamsburg. He was upsold on Williamsburg. This reified both his identity as the type of person who lives in Williamsburg and Williamsburg’s identity as an expensive neighborhood that could command higher prices than neighboring Greenpoint.

KN

Upselling happens in many contexts — people often joke about being upsold at Starbucks — but the typical homebuyer has much less information about housing prices than they do about other goods. How does this lead to upselling and general inflation in housing prices?

MB

A lot of factors contributed to the astronomical rise in real estate prices we saw in New York City and other cities like San Francisco, Los Angeles, Seattle, Denver, Miami, and Boston in the aftermath of the Great Recession: local factors like rezonings and tax breaks for developers, and national ones like the Fed lowering interest rates dramatically. What I found on the ground, is that real estate agents put these economic conditions to work in their interactions with buyers.

As you mentioned, buyers, even in New York City, don’t have a lot of experience in the housing market. Most people, if they ever buy a house, do it only once or twice in their lifetimes. So agents ended up being incredibly influential in many aspects of buyers’ decisions, including the prices they paid. Agents constantly reminded buyers how hot the market was and how great the current economic conditions were for buying. They would describe the Great Recession as a blip, and they’d talk about New York real estate as the perfect investment commodity that would never depreciate.

Agents would tell buyers that the only way to secure the kind of apartment the buyer wanted was to offer more than what the buyer had said they wanted to spend. With less wealthy buyers, this upselling was sometimes overt. Agents would say to less wealthy buyers, “You need to spend a little more than you thought you would to get your dream apartment — do it now!”

With very wealthy buyers, it tended to be a little subtler. When I say “wealthy buyers,” I mean buyers who said they wanted to spend millions of dollars on housing. Agents would show wealthy buyers apartments listed at or around their stated price ceilings, but the agents would trash talk these apartments. They would disparage architectural or design elements of the building, or say the view wasn’t that great, or that the apartment was too far away from the subway. And these wealthy buyers would say, “Maybe you’re right. What else is there?” Then the agents would take these wealthy buyers to apartments listed at amounts far above the buyers’ initially stated price ceilings.

For example, one buyer had an initially stated price ceiling of $2.9 million, and his agent showed him a handful of apartments at that price. They talked mostly about the things they didn’t like about these units, and so the agent started showing him apartments listed at over $3.5 million. And at open houses for these pricier places, the agent would say, “This place is more your style, isn’t it?” and he would talk about how much better the more expensive listings were than the ones they had previously seen. And this buyer ends up making an offer on one of these more expensive apartments for $3.9 million, spending almost 35 percent more than his initially stated price ceiling.

This upselling is related to what the economist Robert Shiller calls “irrational exuberance” or extreme confidence in markets. Agents fervently believed that prices would continue to rise, and they convinced buyers of this as well. What happens in the aggregate is that real estate becomes more and more valorized and commands higher and higher prices, particularly in already high-priced neighborhoods.

To put it another way, agents are helping to sustain demand for astronomically priced housing in the fanciest parts of New York and other cities. I actually see some good evidence of this when I look at neighborhoods with more real estate agents and find that they have higher price increases over time.

KN

In the book, wealthy buyers are upsold more dramatically than less wealthy buyers — they pay up to 23 percent over their initial stated price ceiling compared to 5 percent for less wealthy buyers. How does this phenomenon compound to increase neighborhood inequality?

MB

I wasn’t interested in whether or not these wealthy buyers could actually afford to spend huge amounts of money on housing. Could the buyer I mentioned before who says he wants to spend $2.9 million and ends up offering $3.9 million afford to do it? Probably. What’s more important for understanding inequality, as you point out, is the broader effects of the upselling trend that I uncovered.

US cities are increasingly segregated by income in addition to being segregated by race, meaning that your neighbors are more likely to have similar incomes to you. This is especially true for higher-income households. Rich people like to live around other rich people.

The unequal impact of upselling that I describe in my book is key. Upselling creates positive feedback loops within local housing markets. The process pushes up prices at the higher end of the market, as those most capable of spending more do. As agents concentrate in already high-priced neighborhoods and then upsell wealthier buyers at higher rates compared to the rates of upselling in lower-priced markets, they contribute to rising prices and concentrate wealthy people who can afford more expensive housing in areas with high pricing.

In the aggregate, interactions between agents and buyers affect demand for houses, which in turn affects housing costs, asset inequality, and residential segregation.

When we think about neighborhood inequality, we should absolutely pay attention to housing prices. Not only do these prices matter for the intergenerational transmission of wealth, housing prices are highly correlated with the quality and robustness of local institutions and amenities. Property taxes — assessed through home value — are an important source of funding for municipal services. Neighborhoods with higher real estate prices tend to have better schools, more community organizations, and get relatively more attention and investment from local and state governments. Housing prices are also clearly linked to racial and ethnic residential segregation, which seems to be increasing in cities with rapidly rising housing prices.

This is all to say that upselling, by sustaining demand in already advantaged neighborhoods, hardens socio-spatial inequality and keeps resources in high-priced neighborhoods.

KN

You sat in on real estate agents’ training on fair housing law. In these trainings, agents treated racism in the housing market as a problem of individual bad actors, rather than a systemic problem. What’s wrong with this understanding?

MB

When we continue to locate racism in the minds of bad actors as opposed to describing it as a feature of the market itself, our solutions will almost certainly be ineffective. This isn’t a new point, but I think the housing market is a place where we can readily see that the policies attempting to eliminate discrimination and encourage integration are woefully inadequate.

What struck me when I sat in on fair housing classes at real estate licensing schools was the abdication of responsibility. Instructors told would-be real estate agents not to discriminate, meaning, don’t let the client’s race dictate where you show them homes. Obviously, this kind of training doesn’t work — racial steering is alive and well — but I think it’s reflective of a broader faith in the market as an equalizer. If you just give people as much choice as possible in the market, then things will work out, segregation will dissipate, and neighborhood inequality will be reduced.

This way of thinking is myopic and dumb. A market where racial inequality is so entrenched offers huge incentives to market actors to further that inequality.

Two things that came through in my interviews with real estate agents really highlight this. First, agents were extremely reticent to show homebuyers of color apartments or houses in white buildings or neighborhoods. This is because they wanted to maintain their reputations in these communities in order to generate referrals, and they feared that showing houses to buyers who didn’t “fit in” with the buildings’ or neighborhoods’ current demographics might upset current residents. The current residents would then not want to do business with the agent who disrupted the “feel” or “vibe” of the building or neighborhood. I’m putting these words in quotes, because agents mostly talked about race in these coded ways (though I would highly recommend the sociologist Elizabeth Korver-Glenn’s research on agents’ overtly racist attitudes).

Second, agents sought to do business in wealthier and whiter neighborhoods because that’s where commissions were higher. And what I think both of these facts demonstrate is that agents have clear economic incentives to discriminate or at least not work to change any of the existing racial dynamics of the market. As Keeanga-Yamahtta Taylor’s book Race for Profit shows so well, segregation is profitable for the real estate industry, including real estate agents.

This was also made very clear by the training agents received. There was never any instruction on how to affirmatively further fair housing, and there was no instruction on what segregation is or why it is harmful. The classes on fair housing that I sat in on were a farce. Fair housing constitutes less than 5 percent of the curriculum of the New York state-mandated courses needed to become a licensed real estate salesperson, and there is little oversight in how these courses are taught. In the classes I attended, time was taken by instructors making flippant jokes about discrimination, debating with students about whether or not different ethnic and religious groups constituted a racial category, and what kinds of people were more or less racist. Instructors told students that all they needed to know for the licensing exam was the date of the passage of the Fair Housing Act and that they should remember what categories of individuals are protected by current law.

KN

What policies or programs do you think could best address the systemic nature of racism in the housing market?

MB

This is a big question, and part of me wants to answer by simply saying we should decommodify housing. But there are some regulatory fixes and some more radical market interventions that I think could have an impact.

On the less transformative side is more regulation of real estate agents and more stringent training requirements. In New York State, it only takes seventy-five hours of required classroom time and passing an exam to get a license. Agents are incredibly important in determining housing outcomes, and it’s more than reasonable to expect them to have more training on existing inequalities in the market, not only in terms of hours but also better content in licensing classes. These classes could be spent more thoroughly educating potential licensees not just about the history of institutional housing discrimination by real estate agents and government entities, but also the consequences of those racist practices that we still live with today. Specifically, the curriculum should include information on segregation — what it is and how it perpetuates inequality.

An additional regulatory fix that would go hand in hand with better training is more field testing of discrimination. Fair housing groups, researchers, and occasionally government agencies conduct fair housing audits like the one performed by Newsday. These audits send out testers with the same financial profiles but different race/ethnicities to the same real estate agents over time to see if agents treat people differently depending on their race. More funding for regular audits conducted by fair housing groups or state agencies would better identify areas where discrimination is more or less prevalent. We would then know where more training and other educational initiatives are warranted.

Ultimately, however, we need to remove the profit motive from the act of brokering housing transactions. One step toward that goal could be to eliminate the current commission structure. It’s standard practice for agents to charge 6 percent of the price of a house, which gets split between the listing agent and the buyer’s agent, as their fee. Mandating flat-fee brokerage would change agents’ interests, though they’d still be incentivized to close as many deals as possible. More effective would be for municipalities to fund alternative ways of finding a house. Housing counselors and publicly operated housing service organizations would better foster integration. Past research has shown that movers who use housing counselors during their search find better quality housing in less segregated neighborhoods and tend to stay in their new homes for longer. And other work has shown that communities can remain racially integrated when local housing organizations provide information on available housing for searchers.

What is clear now is that the market, as is, will continue to incentivize agents to produce racially unequal outcomes.

KN

You talk about the need to decouple people’s financial interests from the location of their home as a way to address inequality. What do you think this would look like?

MB

Recent tangible victories around housing justice in New York State are encouraging, as is the trend of local politicians in various cities refusing contributions from the real estate industry. (I live in NY State Assembly District 57, where Phara Souffrant Forrest, a nurse and tenant organizer, was elected on November 3, along with Zohran Mamdani, a housing counselor running in Assembly District 36.) More and more people are organizing around housing as a right and such organizing will spur further policy proposals about how to best remove exploitation from the housing market.

On the Left, I’ve seen a lot of interest in reproducing Red Vienna’s public housing policies as well as council housing policies from the mid-twentieth century in the UK. Additionally, the community land trust movement — which seeks to socialize ownership over land — seems to be growing. I’m all for building more public housing, particularly in the framework of the Green New Deal, as well as establishing more community land trusts as a means to insulate individuals and communities from the ravages of the private housing market. To strengthen moves toward more socialized housing, however, we will also need to link housing more directly to issues of taxation and social insurance.

Most Americans have their wealth (if they have any wealth) tied up in their homes. This is because the overall retrenchment of the state from providing traditional forms of welfare has increased reliance on homeownership for financial stability, particularly after retirement. So to decouple financial interests from housing requires more robust forms of social insurance like universal, high-quality retirement benefits.

It also means eliminating the ways current housing tax law upwardly redistributes wealth. The home mortgage interest deduction, which allows homeowners to deduct the yearly interest on their mortgage from their tax bill, incentivizes homebuyers to take on more mortgage debt and pay more for houses. Though some adjustments were made in the Republican tax bill of 2017, the deduction still largely rewards people who have higher incomes and can therefore take on bigger mortgages. It’s extremely regressive and likely inflates housing prices, making homeownership harder for those with lower incomes. Thankfully, there’s some growing consensus that the mortgage interest deduction needs to be abolished entirely.

Overall, we need to keep defining housing as a right and think strategically about how to better integrate housing with other redistributive policies that enjoy high popularity.

KN

Your research was conducted as the housing market in New York City was climbing out of the recession. Now we’re in a crisis that is further intensifying inequality in the housing market. What effect do you think COVID-19 and the current economic depression will have? Will it be different than that of the 2008 recession?

MB

What is almost assured is that the effects will be spatially unequal and already disadvantaged places will suffer more. In the depths of the Great Recession, foreclosures not only robbed millions of homeowners of a place to live, they also led to the consolidation of rental housing stock formerly owned by mom-and-pop landlords who could not afford their mortgages to more predatory institutional landlords. I think we’ll see similar trends over the next few years.

And while the substantial drop in the number of housing sales and prices in some of the wealthiest parts of Manhattan have received a lot of media attention, it seems as if demand has sustained in other wealthy parts of Brooklyn. This is to say, I don’t think the COVID-19 pandemic will make housing more affordable — the cooling-off of the extremely high-end of the market was happening before the pandemic. If anything, like past crises, it is likely to make things worse.

I’m unsure what the pandemic does to the real estate industry, which employs hundreds of thousands of people in NYC. During the Great Recession, there were huge drops in the number of active real estate salespeople and brokers. While I think there may be some reductions as unemployment remains high overall, the industry might be somewhat sustained as buyers seek out deals, and we keep seeing plenty of glamorous portrayals of real estate brokerage on TV. (I, admittedly, watched a ton of Selling Sunset during quarantine.)

Real eState

The real estate sector's unique view of 2024 — and what's to come – Yahoo Finance

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Despite a rough few days for the S&P 500, which is still comfortably in the green this year (up 6%), one sector of the stock market is feeling more pain than the rest.

The perception that rates might stay higher for longer is hammering the real estate sector, even as debate rages about how many times — if any — the Federal Reserve will cut rates this year.

The group is far and away the worst performer in the S&P 500 for 2024, down more than 10%. The bulk of those declines have come in the past two weeks, as Treasury yields have climbed to their highest level since November and investors traverse the acceptance phase that the hoped-for cuts are not on their way.

Now investors are faced with the question of whether to buy the dip or, to quote another market cliché, risk trying to catch a falling knife.

One real estate investor said the rent indicators she’s seeing in real time are encouraging on the inflation front. That’s in contrast to the much-criticized rental barometers that the Fed relies on.

“If you take into account real-time shelter costs, it’s much lower than what’s in the prints,” Uma Moriarity, senior investment strategist at CenterSquare, told Yahoo Finance. “We think inflation is trending in the right direction.”

That’s why she’s still confident in three rate cuts this year — a view, of course, that the market has been moving away from. It’s also why she’s still confident in real estate. That, plus the fact that stocks are relatively cheap.

Read more: What the Fed rate decision means for loans and mortgages

The reasons that real estate stocks suffer when rates are on the rise are twofold. First off, the companies tend to carry a lot of debt, and as rates go higher, it becomes more difficult to service or refinance that debt. Secondly, with relatively high dividend yields, the stocks compete with instruments like money market funds for investing dollars.

It’s traditionally been tough for real estate stocks to rally in the face of rising rates. But if Moriarty — and Citigroup — are right, they might not be rising for as long as the broader market anticipates.

Julie Hyman is the co-anchor of Yahoo Finance Live, weekdays 9 a.m.-11 a.m. ET. Follow her on Twitter @juleshyman, and read her other stories.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

Real eState

Celebrity real estate agent Mauricio Umansky explains when housing prices will come down – Fox Business

Real eState

Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: 'Inflation Is Proving Tougher To Bring D – Benzinga

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund XLRE had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. PLD | -6.55% |

| First Industrial Realty Trust, Inc. FR | -3.33% |

| STAG Industrial, Inc. STAG | -2.89% |

| EastGroup Properties, Inc. EGP | -2.89% |

| Rexford Industrial Realty, Inc. REXR | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. SLG | 3.18% |

| Opendoor Technologies Inc. OPEN | 2.55% |

| Medical Properties Trust, Inc. MPW | 2.49% |

| eXp World Holdings, Inc. EXPI | 2.32% |

| Vornado Realty Trust VNO | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Tech17 hours ago

Tech17 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science23 hours ago

Science23 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

News19 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Investment23 hours ago

Investment23 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

Science22 hours ago

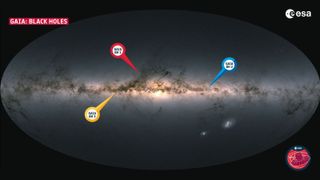

Science22 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Politics22 hours ago

Politics22 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health13 hours ago

Health13 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech19 hours ago

Tech19 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca