Real eState

In Toronto real estate, a small bounce amid uncertainty

|

|

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/AI5KVYB63VBSHMJFB57JTSPIRI.JPG)

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/AI5KVYB63VBSHMJFB57JTSPIRI.JPG)

By the end of December, the national average house price had dropped 20 per cent from its peak earlier in 2022.Fernando Morales/The Globe and Mail

Canada’s housing market will slowly grind lower in 2023 before finding a bottom later this year, predicts Randall Bartlett, senior director of Canadian Economics at Desjardins Group.

“We think the worst is behind us,” he says of the correction in real estate so far.

Still, buyers are likely to remain cautious as some price discovery takes place, Mr. Bartlett added in an interview.

“Nobody wants to catch a falling knife.”

By the end of December, the national average house price had dropped 20 per cent from its early 2022 peak, and Mr. Bartlett figures it will slip up to five per cent from that level.

Debt-burdened homeowners – particularly those with variable rate mortgages – are likely to find the first quarter the most challenging, says the economist, following the eighth interest rate hike by the Bank of Canada as it strives to bring down inflation.

The central bank also signalled its intention to pause at the latest meeting after moving the policy rate from 0.25 per cent in early 2022 to 4.5 per cent.

Mr. Bartlett is not expecting a wave of distressed homeowners to sell their properties this year, but they will likely rein in spending, he says.

That decrease in consumption will likely contribute to a short and shallow economic recession, according to Mr. Bartlett.

He cautions, though, that the risks to his forecast are tilted to the downside, partly because of the prevalence of people taking out variable rate mortgages during the pandemic.

If the recession turns out to be more severe than he expects, more workers are likely to lose their jobs and another leg down in the housing market is a real possibility, he warns.

His base case is that real estate prices will find a floor in the third or fourth quarter, he says, and Desjardins has pencilled in a rate cut by the Bank of Canada for October or December.

Looking farther ahead, Mr. Bartlett is concerned that slow sales in the current market for pre-construction condo units will lead to a shortage of units in the coming years. While a rush of supply will come on this year and next after a sales boom during the pandemic, that segment is currently in a slump and immigration is expected to increase.

In Toronto, meanwhile, the end of one year and start of the next has brought a sudden flurry of sales, agents say.

Christopher Bibby, broker with Re/Max Hallmark Bibby Group Realty, says some properties that had been lingering on the market all through the fall sold at the end of December or beginning of January.

“I never would have predicted January would be our opportunity,” he says of selling the various properties that were first listed in April, July and August.

Mr. Bibby says the opening salvo of many buyers is an offer well below the asking price, but some back-and-forth usually leads to an agreement.

“Frequently people will call just to gauge the motivation or how desperate we are.”

In one case, a unit at 55 Stewart St. was listed with an asking price of $2.595-million. The buyer chiseled that figure down to a sale price of $2,478,600.

In another case, sellers had actually taken their one-bedroom unit at 301 Markham St. off the market with a plan to relist in the spring. A downsizing couple who had looked at the unit when Mr. Bibby had it listed for $629,900 in the fall contacted him in early January and asked to see it again.

They struck a deal for $600,000.

Typically, condo units sold for between 3 and 6 per cent below the asking price, he says.

“People feel they need some cushioning if prices go down a bit.”

That’s a significant change from the fall when many properties did not even have showings, he says.

Long closings in the 120-day range are increasingly common these days, he adds.

Some agents have reported spirited bidding wars in the Greater Toronto Area – particularly when properties are listed with an asking price far below market value.

In the east end of Toronto, for example, a rundown two-bedroom house was listed with an asking price of $349,000 and drew more than 30 offers. It sold just above $600,000.

In Mr. Bibby’s opinion, most market participants are in no mood for the strategy of attracting eyeballs with an unrealistically low asking price. Listing agents report registered offers, he notes, and often just one offer is enough to discourage others who had viewed the property.

He says an effort to drum up a bidding war can backfire for the seller because they may not get the price they were hoping for and all other potential buyers will know it.

“The minute we say we have an offer, no one wants to compete downtown,” he says. “Once that notice goes out, all eyes are on you.”

With some confidence returning to the market, Mr. Bibby has six properties lined up to list in the coming weeks, but he points out that activity remains very unpredictable. He is not seeing any signs that suggest prices will skyrocket and recommends that potential sellers gauge their own comfort level.

“If the timing doesn’t feel right, don’t do it,” he advises sellers.

Elli Davis, real estate agent with Sotheby’s International Realty Canada, was surprised when two buyers submitted offers for different Bay Street condo units at 9 p.m. on a Saturday night.

Both condos were listed around the $1-million mark and deals firmed up within a few days.

A two-bedroom unit at Granite Place in midtown Toronto received two offers after Ms. Davis launched it during the first week of January.

The 1,312-square-foot unit was listed with an asking price of $1.195-million and sold for $1.3-million.

Ms. Davis says buyers and sellers continue to move for the usual reasons: They are leaving Toronto, expanding their family or downsizing.

“Not everyone is so affected by the economy and interest rates.”

Ms. Davis encourages potential sellers to list when there is so little inventory available, but she stresses that they also need to be realistic about the asking price. Some are dismayed about the tumble from the heights of early 2022.

“‘I don’t want to give my place away,’” is a common refrain, she says, as sellers adjust their mindsets to lower prices.

Her usual response to that is, “let’s look at what you made,” she says, pointing out the gains to sellers who have owned their properties for many years.

Manu Singh, real estate agent with Right at Home Realty Inc., says January was unexpectedly busy for him after a moribund final quarter to the year.

He saw a discernible shift in the segment below $749,000 while he was working with a first-time buyer who purchased a loft in a boutique building near Queen Street W. and Dovercourt Road.

Mr. Singh advised the young professional to take her time looking because units were languishing on the market. Suddenly 25 showings had been booked for the one-bedroom-plus-den unit on Dovercourt Road listed with an asking price of $707,900.

“I hadn’t seen this for months,” he says.

The sellers had already rejected one bid below the asking price when Mr. Singh’s client struck a deal with an offer of $715,500.

Mr. Singh believes pent-up demand from buyers who sat out the fourth quarter is one reason for the spurt. Many have preapproved financing lined up and they wanted to take advantage of the rate they were offered before the Bank of Canada’s January meeting.

In the months ahead, Mr. Singh expects the market to remain fairly flat. Investors are still reluctant to buy, he adds.

“I think rates have actually scared them.”

Real eState

Surreal Estate: $15 million for a turnkey Muskoka resort with 41 guest rooms

|

|

Location: Port Severn, Muskoka

Price: $14,999,000

Size: 17 acres of land with 41 guest rooms and a three-bedroom cottage

Real estate agent: Ali Booth, Sotheby’s International Realty

The place

A fully operational vacation escape sitting on 17 acres of land on Little Lake in Muskoka. The property comes with 41 guest rooms, a three-bedroom cottage, a private island accessible by helicopter and more than 600 metres of shoreline. It’s a short drive from Highway 400 and several neighbouring resorts.

The history

This getaway was originally built in the 1950s. The current owners purchased the place in 2021 and immediately invested $1 million to replace the roof and rebuild the guest cottage. After serving as a filming location for Bachelor in Paradise Canada, it reopened for business in July of 2022. The owners are now taking on a new venture and looking to sell the resort to a wealthy investor.

Related: $11.9 million for a Muskoka compound perched atop its own peninsula

The tour

To begin, here’s an aerial view of the peninsula, with its many docks, green spaces and lodges. That’s Port Severn North Road just beyond the parking lot.

And here’s the main entrance. The original hotel was renovated around Y2K, and the current owners bought it in 2021.

In the lobby: guest check-in, a lounge and doric columns.

The full-service restaurant overlooks the lake and includes a café and lounge.

This reverse angle shows off the bar and dramatic circular ceiling.

There’s also a nail salon down the hall.

The indoor pool and hot tub are open year-round.

The shiplap ceilings and wall of windows add warmth to the massive space.

Here’s the 24-hour gym, with rubber floors.

Now for a peek inside one of the European-style suites, which are larger than traditional hotel rooms. This one is outfitted with hardwood floors, a stone fireplace, a floor-to-ceiling walkout and gold accents throughout.

The hotel also rents out its 90-seat conference centre for weddings and corporate retreats.

Here’s another look at the cavernous conference centre.

Outside, it’s all about the amenities: a tennis court, a patio, a private beach, many docks for water sports and a private island accessible by helicopter.

Speaking of water sports, guests are free to explore Little Lake and its seemingly endless waterways.

Here’s the tropical-themed beach.

Finally, another bird’s eye view of the compound, highlighting the ample space for expansion. While there have been no formal approvals for development, the town has provided zoning guidelines on what could be built here.

Have a home that’s about to hit the market? Send your property to realestate@torontolife.com.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

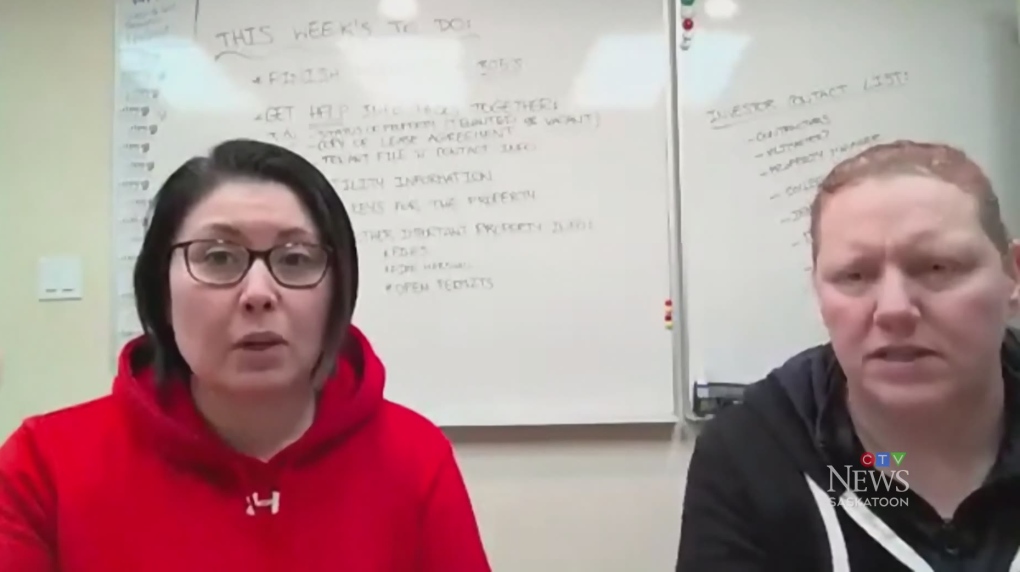

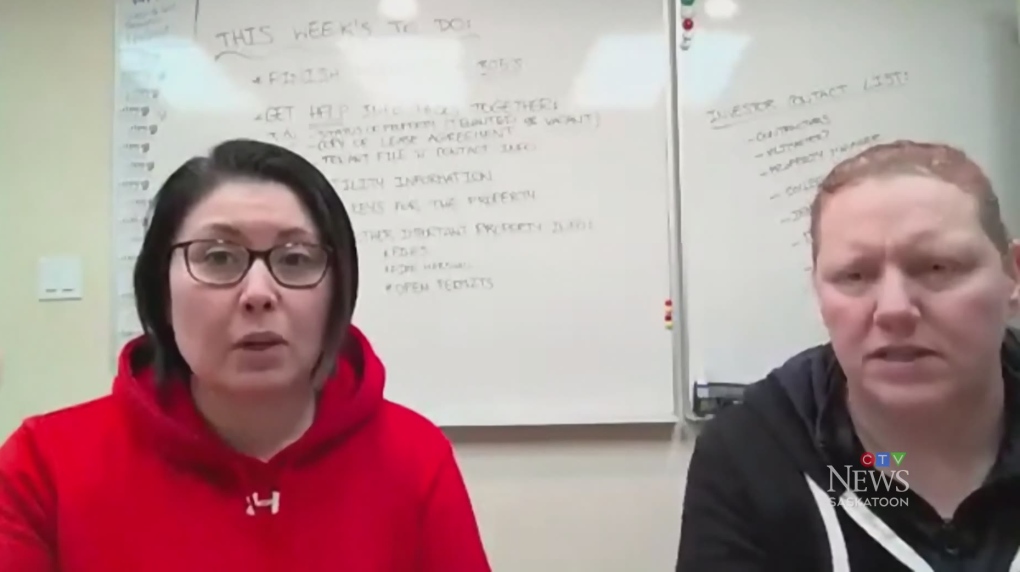

Sask. real estate company that lost investors’ millions reaches settlement

|

|

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

-

Sports5 hours ago

Sports5 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState13 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech12 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Investment21 hours ago

Investment21 hours agoSo You Own Algonquin Stock: Is It Still a Good Investment? – The Motley Fool Canada

-

Science16 hours ago

Science16 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

News23 hours ago

Federal budget will include tax hike for wealthy Canadians, sources say – CBC.ca

-

Health14 hours ago

Health14 hours agoUpgrading the food at VGH for patient and planetary health

-

Investment19 hours ago

Investment19 hours agoGoldman Sachs Backs AI in Hospitals With $47.5 Million Kontakt.io Investment – BNN Bloomberg