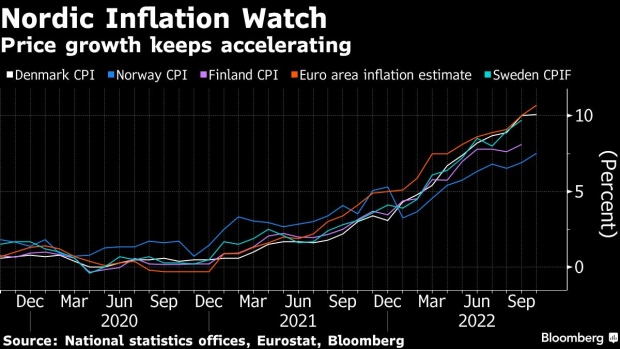

(Bloomberg) — Nordic inflation developments worsened the risk of the region’s looming recession as consumer price growth in Norway and Denmark hit levels not seen in decades.

Norway’s inflation unexpectedly accelerated to 7.5% in October, the fastest pace since 1987, while economists in a Bloomberg survey had expected an increase to 7.1%. Price growth in Denmark rose to 10.1% in September — a 40-year high.

The data suggests a more gloomy outlook for the Nordic countries where soaring prices and borrowing-cost increases have slashed the confidence of both consumers and companies, eroding spending much like in other advanced nations. It also adds to the risk that Sweden’s October inflation, due next Tuesday, may surprise negatively, raising pressure on the Riksbank ahead of its rate-setting meeting later this month.

Clothing prices were the “the only upside surprise” in both countries’ data, Danske Bank A/S analyst Michael Grahn said, adding that may have implications for the upcoming Swedish data.

“Food was on the low side in both while furniture, transportation services, recreation and hotels/restaurants on average roughly as assumed,” he said.

SEB AB earlier this week cut its forecast for the Swedish economy to a contraction of 1.5% next year versus the previous view of little change, saying “rate hikes and cost crisis put extreme pressure on households.” It now sees the Danish economy shrinking 0.5% next year.

The recent decline in energy prices “does not seem to have been fully reflected” in Denmark’s inflation figures, while companies have been passing on the increased costs to consumers, Handelsbanken’s economist Jes Asmussen said.

Norway Rates

In Norway, the latest data will keep alive bets that the central bank may return to a faster pace of hikes next month, even as it cited signs of a cooling economy last week to deliver a quarter-point increase in borrowing costs. The measure monitored by Norges Bank, core inflation, hit an all-time high of 5.9% in October to top estimates by the market and the central bank.

Read More: Norway Inflation Hits New Three-Decade High, Fanning Rate Bets

“High inflation suggests that a 50 basis-point hike in December is not off the table, but more likely it increases the risk that Norges Bank will extend rate hikes into 2023,” SEB’s analysts Erica Dalsto and Marcus Widen said in a note to clients. “That said, we believe inflation dynamics combined with the pace of the looming economic downturn to be decisive for the near-term policy outlook.”

–With assistance from Harumi Ichikura, Mark Evans and Christian Wienberg.

Source link

Related