Register now for FREE unlimited access to Reuters.com

Register

Signage is seen on the MetLife Inc building in Manhattan, New York, U.S., December 7, 2021. REUTERS/Andrew Kelly/File Photo

Register

Feb 2 (Reuters) – MetLife Inc’s (MET.N) fourth-quarter profit rose nearly 7% to surpass Wall Street estimates on Wednesday, as strong investment gains cushioned the hit from higher pandemic-related claims in some parts of its business.

The U.S. insurer reported an adjusted profit of $2.17 per share, compared with $2.03 a year earlier. Analysts on average had expected $1.47, according to Refinitiv data.

New York-based MetLife’s net investment income jumped 7% on an adjusted basis to $5.2 billion, bolstered by higher returns from its private equity investments.

Register

Insurance providers worldwide have recorded rising investment returns over the past year as markets continue to rebound from a pandemic-induced slump, helping offset a jump in claim payouts related to the coronavirus crisis.

Vaccine rollouts were expected to ease the burden for insurers, but the highly infectious Delta variant ratcheted up COVID-related claims to $5.5 billion in the first nine months of last year, far higher than the total for all of 2020. read more

Insurers reported higher COVID-related fatalities last year than in 2020, when the deaths were mainly among older people who typically do not take out life insurance.

The company’s group benefits unit saw a 95% slump in earnings in the quarter, hurt by unfavorable group life underwriting as a result of COVID-19.

Adjusted earnings for the insurer’s U.S. business fell 37% to $640 million from unfavorable underwriting, while Asia posted a 19% rise thanks to higher investment income.

For Latin America, adjusted earnings surged to $125 million from $14 million in the same quarter a year earlier due to lower COVID-related claims.

MetLife logged a $196 million loss from net derivatives, driven by forex rate changes and stronger equity markets. Such derivatives are held to hedge against market volatility.

Register

Reporting by Sohini Podder in Bengaluru; Editing by Devika Syamnath

Our Standards: The Thomson Reuters Trust Principles.

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

TORONTO – Canada’s main stock index was little changed in late-morning trading as the financial sector fell, but energy and base metal stocks moved higher.

The S&P/TSX composite index was up 0.05 of a point at 24,224.95.

In New York, the Dow Jones industrial average was down 94.31 points at 42,417.69. The S&P 500 index was down 10.91 points at 5,781.13, while the Nasdaq composite was down 29.59 points at 18,262.03.

The Canadian dollar traded for 72.71 cents US compared with 73.05 cents US on Wednesday.

The November crude oil contract was up US$1.69 at US$74.93 per barrel and the November natural gas contract was up a penny at US$2.67 per mmBTU.

The December gold contract was up US$14.70 at US$2,640.70 an ounce and the December copper contract was up two cents at US$4.42 a pound.

This report by The Canadian Press was first published Oct. 10, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Bad weather forecast for B.C. election day as record numbers vote in advance polls

Netflix’s subscriber growth slows as gains from password-sharing crackdown subside

Promise tracker: What the Saskatchewan Party and NDP pledge to do if they win Oct. 28

Tobacco giants would pay out $32.5B to provinces, smokers in ‘historic’ proposed deal

Here are the key numbers in the deal proposed by three tobacco giants

RCMP say girl’s death in Alberta lake could be criminal

Canadanewsmedia news October 18, 2024: Testy B.C. election campaign reaches final day

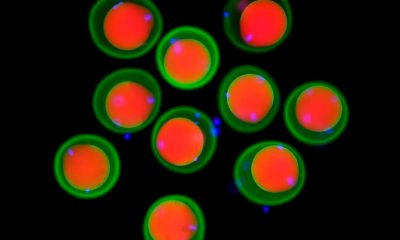

Scientists show how sperm and egg come together like a key in a lock