Uncategorized

International aid groups fear cuts as budget looms

Canada’s aid sector is nervously awaiting this spring’s federal budget amid fears of funding cuts that could require projects abroad to shut down.

“This lack of predictability is creating anxiety in the sector,” said Louis Belanger, whose group Bigger Than Our Borders advocates on behalf of major Canadian charities.

“The future is uncertain for a lot of organizations that are working in developing countries, because there’s a lack of clarity and a lack of transparency.”

Since taking office in 2015, the Liberals have pledged to keep increasing development spending each year — but emerging crises such as the COVID-19 pandemic and the war in Ukraine have significantly altered the focus of that spending.

Before the pandemic, the Liberals had earmarked an annual $6.6 billion in foreign aid. After the arrival of COVID-19, they boosted the target to more than $8 billion, first for programs related to fighting the virus and then to help Ukraine and its neighbours.

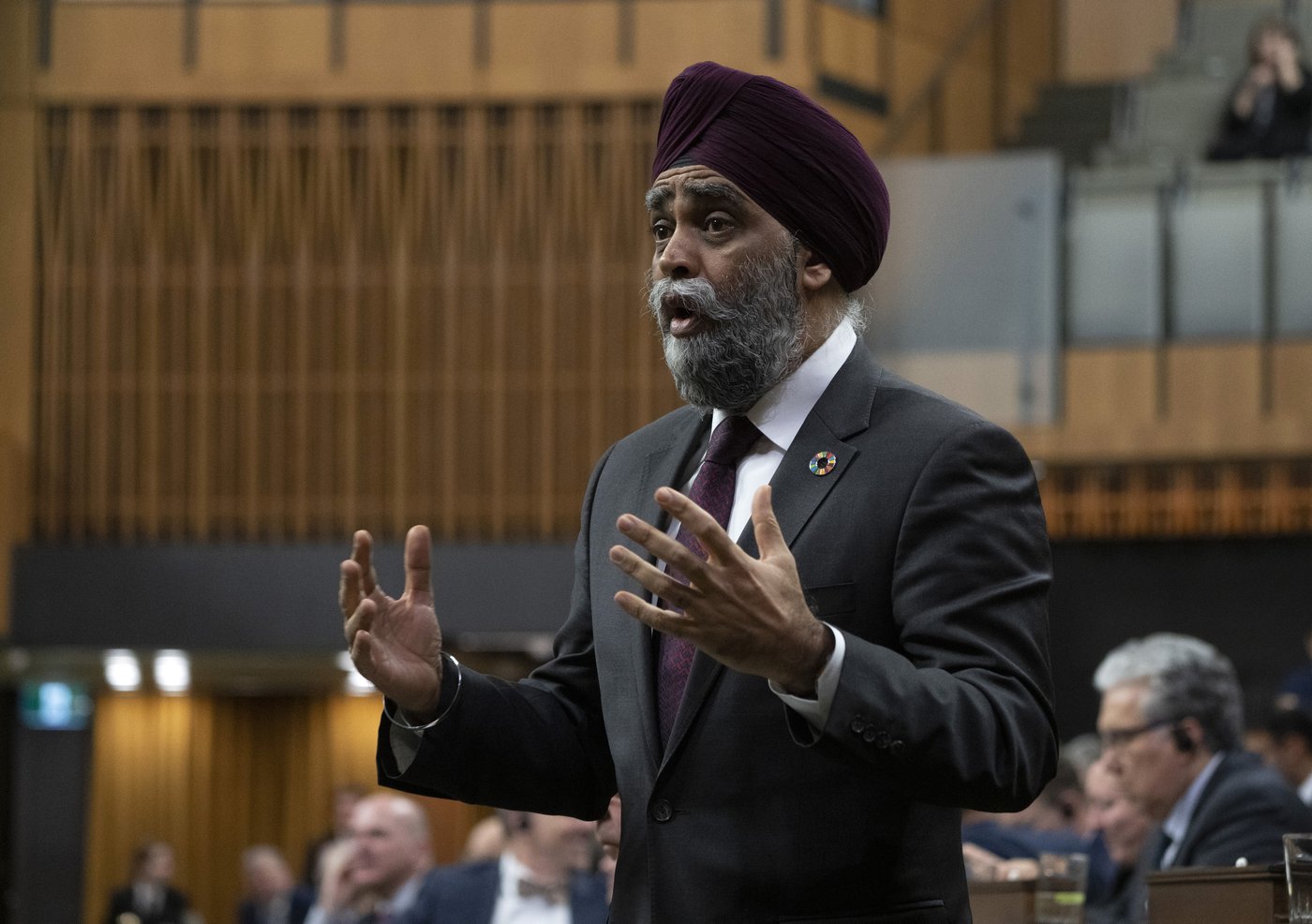

In late 2021, Prime Minister Justin Trudeau was still instructing International Development Minister Harjit Sajjan to “increase Canada’s international development assistance every year.”

And since then, Trudeau has announced large funding allocations related to a UN biodiversity summit, a new Indo-Pacific strategy and the Global Fund, which tackles diseases such as AIDS.

Yet it’s unclear whether the Liberals intend to renew long-standing development programs or let them lapse in order to fund these emerging priorities.

For Belanger, it boils down to whether the Liberals build on the benchmark of funding that preceded the pandemic, or whether they see the current amount of funding as a new baseline.

“(They’re) seeing COVID as the exception, and that we need to go back to 2019 levels. We completely disagree, because there’s a series of crises that we’re seeing in the world right now,” Belanger said.

“You can’t tell me that the needs have decreased since COVID.”

Aid groups fear Canada will follow Britain in announcing cuts. London has long been one of the world’s top development funders, but is facing economic upheaval at home.

Meanwhile, a global focus on suppressing COVID-19 came at the expense of other health programs, leading to a sudden backtracking on two decades of progress in fighting tuberculosis, cholera and extreme poverty.

And the African Development Bank and other continental institutions have lamented rich countries diverting aid to Ukraine.

“COVID left the Global South in critical condition, and so cutting aid now is like pulling the oxygen supply for them,” Belanger said.

“It would be the worst time to cut foreign aid. It would be the worst time to go backwards, when there’s so much need.”

Belanger said officials across federal departments seem most interested in development projects linked to three priorities: climate change; sexual and reproductive health; and paid and unpaid care work.

“Other programs — on governance, nutrition, social justice, even humanitarian programs — have been sort of put on hold until they announce the budget,” said Belanger, who is a former Liberal staffer.

He said years-long projects are sunsetting with no sense of whether Ottawa will renew them. But organizations aren’t speaking openly for fear of losing federal funding.

The aid sector argues that developing countries need strong health, agriculture and education systems in order to withstand political instability and natural disasters — let alone future pandemics.

Save The Children Canada said the government has been right to respond to emerging humanitarian crises, such as this week’s earthquake in Turkey and Syria.

But the charity’s president and CEO, Danny Glenwright, said children also need Canada’s help in places with long-standing conflicts, such as the Central African Republic, Somalia, Yemen and Myanmar.

“Unfortunately, it’s a very long list. We have several cases where needs increase the longer a crisis continues,” he said.

“These are countries that are seldom in the news, because new crises have popped up.”

His organization is asking Ottawa to peg its annual development spending at $10 billion by 2025, through year-over-year increases. He said that would help Canada meet its commitments to the UN’s Sustainable Development Goals, which aim to make the world more resilient to crises by 2030.

In a Wednesday evening speech at a reception held by groups to mark International Development Week, Sajjan gave no hint of what his government’s spring budget will bring.

Instead, he said aid groups need to drum up public support by doing a better job publicizing their progress.

“We need to be louder when things are going well, and saying, ‘This is conflict prevention. This is success.’ And we should be celebrating that even more,” he told the assembled groups.

“Policies are one thing. Money is one thing. But action can only happen through you.”

On Thursday, Sajjan earmarked $23.4 million for public engagement programs to get that message out.

Aid groups are hoping he will announce a boost to Canada’s funding at a speech Friday afternoon in Montreal.

This report by The Canadian Press was first published Feb. 10, 2023.

Uncategorized

The Booming Business of Online Casinos: A Look at Current Trends

Photo: https://unsplash.com/photos/red-playing-cards-kpY9410Ha2s

In the ever-evolving landscape of the gambling industry, online casinos have emerged as a powerhouse, captivating millions of players worldwide. This trend is particularly evident in Canada, where the online casino market has experienced significant growth in recent years. Let’s delve into the latest business news and trends shaping the world of online casinos.

Rise in Demand and Revenue

The online casino business has been on a steady upward trajectory, fueled by the increasing demand for convenient and accessible gambling options. With advancements in technology and the widespread availability of high-speed internet, Canadians are embracing online casinos as a preferred mode of entertainment. This surge in demand has translated into substantial revenue growth for operators, with many reporting record-breaking profits in recent quarters. If you’re interested in checking out what the online casino industry has to offer, check out https://luckycasino.com/en/ to find interesting and innovative ideas in the iGaming industry.

Expansion of the Market

One notable trend in the online casino industry is the expansion of the market to new demographics and regions. Traditionally, online gambling was associated with younger demographics, but there has been a noticeable shift in recent years. Older adults, in particular, are increasingly turning to online casinos for entertainment, contributing to the diversification of the player base. Additionally, with the legalization of online gambling in certain provinces and the growing acceptance of digital currencies like Bitcoin, the market is poised for further expansion.

Technological Advancements

Technology continues to play a pivotal role in shaping the online casino landscape. From state-of-the-art gaming platforms to innovative payment solutions, operators are constantly striving to enhance the user experience. Virtual reality (VR) and augmented reality (AR) technologies are also being integrated into online casinos, offering players a more immersive and interactive gaming experience. These technological advancements not only attract new players but also foster loyalty among existing customers.

Regulatory Challenges and Compliance

Despite its rapid growth, the online casino industry is not without its challenges, particularly in terms of regulation and compliance. As governments around the world grapple with the complexities of online gambling, regulatory frameworks continue to evolve. In Canada, for example, the legality of online gambling varies by province, leading to inconsistencies in regulations and enforcement. Operators must navigate a complex web of laws and regulations to ensure compliance, which can be a daunting task.

The Impact of COVID-19

The COVID-19 pandemic has had a profound impact on the online casino industry, both positively and negatively. On one hand, lockdown measures and social distancing restrictions have driven more people to seek entertainment options online, leading to a surge in demand for online casinos. On the other hand, economic uncertainty and job losses have affected consumer spending, prompting some players to cut back on discretionary expenses like gambling. Overall, the net effect of the pandemic on the online casino business remains to be seen.

Looking Ahead

As we look to the future, the online casino industry shows no signs of slowing down. With continued technological innovations, evolving consumer preferences, and shifting regulatory landscapes, the business of online casinos is poised for further growth and transformation. For players and operators alike, staying abreast of the latest trends and developments will be crucial in navigating this dynamic and ever-changing industry landscape.

In conclusion, the world of online casinos presents a myriad of opportunities and challenges for businesses and players alike. With its growing popularity and profitability, the online casino industry is undoubtedly a force to be reckoned with in the global gambling market.

News

Migrant Justice Organizations and South Asian Diaspora Groups from Across Canada in Support of Permanent Solution for International Students of Indian Origin

Calgary, Edmonton, Montreal, Toronto, Vancouver, Winnipeg, June 20, 2023 – Almost twenty Migrant Justice Organizations and South Asian Diaspora Groups from across Canada urge Immigration, Refugees and Citizenship Minister, Sean Fraser, to put a definite stop to the deportation of scores of international students from India.“These students entered Canada like any other international students and they should not have to bear the burden of proof because of fraud committed by immigration consultants and education recruiters” stated the joint letter. Receiving deportation orders and the precarity of having to live with a constant threat of being separated from their families and uprooted from their communities and the associated struggle and turmoil is a painful process and is punishment in itself.For over two weeks, from May 28, students, their supporters and community members had set up a permanent protest in front of the CBSA headquarters in Mississauga. While this protest now ended with your announcement on June 14 to halt the deportations, students continue to express their concerns over the next steps in this process. Migrant Justice Organizations and South Asian Diaspora Groups stand in solidarity with the students and believe there can be no justice until their demands are met, which are: a permanent solution to the situation, a definitive cancellation of the deportations, and granting them permanent resident status. Nothing short of this is acceptable.These individuals who arrived in Canada as international students call Canada home and have become integral parts of our lives. They are an asset to our communities and should be living here without any hassle or threat of deportation.Deportations are a long standing form of institutional racism, and are manifested in the violent and coercive practices of the state. This situation is yet another example of how the Canadian immigration system and CBSA fail people and produce undocumented migrants. This is why regularization is necessary. Just like Migrant Justice and hundreds of civil society groups across Canada, the signatories of the joint letter call for a comprehensive, inclusive and ongoing regularization program for all people with precarious status. All migrants should be given permanent resident status on arrival. Migrants already here must be granted permanent residency.Close to twenty groups that signed the joint letter urge the minister to take prompt and decisive action to provide a permanent solution, and immediate regularization and permanent resident status for these students and all undocumented people across Canada. Without this, there can be no justice.Status for All, Dignity for All!Signatories of the joint letter:Butterfly (Asian and Migrant Sex Workers Support Network), TorontoCentre sur L’Asie du Sud (CERAS), MontréalImmigrant Workers Centre/Centre Des Travailleurs Et Travailleuses Immigrants (IWC-CTTI), MontréalIndia Civil Watch – International, TorontoMigrante Alberta, EdmontonParkdale Community Legal Services, TorontoProgressive Cultural Association, CalgaryPro-People Arts Project Media Group (Sarokaran Di Awaz), TorontoPunjabi Literary and Cultural Association, WinnipegQuebec Public Interest Research Group – Concordia University (QPIRG), MontréalRang Collective: Arts for Solidarity/Collectif Rang: Les Arts pour la Solidarité, MontréalShaheed Bhagat Singh Book Centre, CalgarySolidarity Across Borders, MontréalSouth Asian Dalit Adivasi Network – Canada, TorontoSouth Asian Diaspora Action Collective (SADAC), MontréalSouth Asian Network for Secularism and Democracy (SANSAD), VancouverSouth Asian Women’s Community Center/Centre Communautaire Des Femmes Sud-Asiatiques (SAWCC-CCFSA), MontréalTeesri Duniya Theatre, MontréalWorkers’ Action Centre, TorontoCC Standing Committee on Citizenship and Immigration:Shafqat Ali, MPAlexis Brunelle-Duceppe, MPSukh Dhaliwal, MPFayçal El-Khoury, MPArielle Kayabaga, MPTom Kmiec, MPJenny Kwan, MPMarie-France Lalonde, MPLarry McGuire, MPHon. Michelle Rempelle Garner, MPBrad Redekopp, MPSalma Zahid, MP

Uncategorized

Federal budget 2022: Highest-earning Canadians face minimum tax rate increase

The federal government is moving to raise the minimum tax rate paid by wealthy Canadians in the budget and narrowing its focus on the highest earners.

In its budget Tuesday, Ottawa is raising the alternative minimum tax rate and imposing new limits on many of the exemptions, deductions and credits that apply under the system starting in 2024.

“We’re making sure the very wealthy and our biggest corporations pay their fair share of taxes, so we can afford to keep taxes low for middle-class families,” Finance Minister Chrystia Freeland said in the prepared text of her remarks.

The alternative minimum tax (AMT) introduced in 1986 is a parallel income tax calculation that allows fewer deductions, exemptions and tax credits than the ordinary tax rules for the country’s highest earners. Wealthy Canadians pay the alternative minimum or regular tax, whichever is higher.

The government announced in the budget that it is increasing the alternative minimum rate to 20.5 per cent from 15 per cent starting in 2024.

To help ensure lower- and middle-income Canadians don’t get caught up in the increase, Ottawa is also proposing to increase the exemption to the start of the fourth federal tax bracket from $40,000. For 2024, it expects the exemption would be about $173,000 and be indexed annually to inflation.

The government estimates that under the new rules about 32,000 Canadians will be covered by alternative minimum tax in 2024, compared with about 70,000 if it did not make the changes.

However, the higher rate and revamping of the allowable deductions and credits mean Ottawa expects to take in an additional $150 million in 2023-24 and an additional $625 million in 2024-25.

Bruce Ball, vice-president for tax at CPA Canada, said there is a broader range of things that will go into the alternative minimum tax calculation, but the good news for most taxpayers is that the threshold will be much higher.

“That should exclude a lot of people even if they have more add-backs than they would have under the old system, so there’s some good news and bad news I guess, depending on your situation,” Ball said.

“If you’re higher income you may end up paying more; if you’re lower income you may not be subject to AMT.”

While the richest Canadians face the possibility of higher taxes, the budget also includes a one-time payment for those who receive the goods and services tax credit to help offset the rising cost of living.

“We all know that our most vulnerable friends and neighbours are still feeling the bite of higher prices. And that is why our budget delivers targeted inflation relieve to those who need it most,” Freeland said.

Under the proposal billed as a grocery rebate, Canadians who are eligible will receive an additional amount equal to twice the GST tax credit amount for January. For couples with two children the amount could be up to $467, while a single Canadian without children could receive up to an extra $234.

Student budgets will also see a boost from the budget as the government increases the Canada Student Grants compared with pre-pandemic levels and raises the interest-free Canada Student Loan limit.

The changes increase the total federal aid available to a full-time student based on financial need to $14,400 for 2023, up from $13,160 for 2022 and $10,140 in 2019 before the pandemic.

The government is also moving to cap the increase on alcohol excise duties to two per cent for one year. Ordinarily, the rates are indexed to the consumer price index and were previously set to rise by 6.3 per cent.

However, Canadians looking to take a flight next year will face an increase in the air travellers security charge paid by those flying in Canada starting on May 1, 2024. The charges, which are paid by passengers when they buy an airline ticket, help pay for the air travel security system and were last increased in 2010.

The charge for a domestic round trip will rise to $19.87, from its current rate of $14.96. The charge for a transborder flight to the U.S. will rise to $16.89 from $12.71, while for departing international flights travellers will pay $34.42, up from $25.91.

This report by The Canadian Press was first published March 28, 2023.

-

News5 hours ago

News5 hours agoAfter grind of MLS regular season, Toronto FC looks forward to Leagues Cup challenge

-

News19 hours ago

News19 hours agoCanadaNewsMedia news July 26, 2024: B.C. crews wary of winds boosting wildfires

-

News10 hours ago

News10 hours agoOntario expanding access to RSV vaccines for young children, pregnant women

-

News6 hours ago

News6 hours agoIn President Milei’s sit-down with Macron, Argentina says the leaders get past soccer chant fallout

-

News13 hours ago

News13 hours agoFederal grand jury charges short seller Andrew Left in $16M stock manipulation scheme

-

News20 hours ago

News20 hours agoFrench train lines hit by ‘malicious acts’ disrupting traffic ahead of Olympics, rail company says

-

News18 hours ago

News18 hours agoPeople should stay inside, filter indoor air amid wildfire smoke, respirologist says

-

News4 hours ago

News4 hours agoUmicore suspends construction of $2.76B battery materials plant in Ontario