Nuclear fusion has enjoyed a huge bump-up in global investment over the past 12 months, raising hopes of a breakthrough in clean energy technology.

New industry figures reveal more has been poured into the sector over the past year than the previous ten combined, as first reported in The Telegraph.

Fusion attracted $2.8bn [£2.5bn] over the past year, compared to around $2bn over the previous decade.

The Fusion Industry Association said more than 93p percent of companies that responded to its survey believe that fusion power will be feeding electricity into power grids by the 2030s.

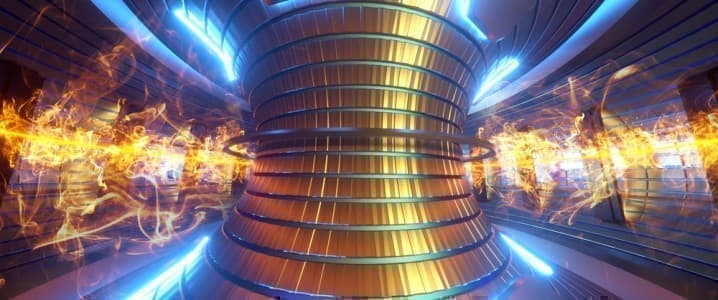

Producing energy through nuclear fusion has been a long-held ambition for scientists and energy experts, and has prominently featured in science fiction novels and movies.

The process involves fusing nuclei together, which throws off energy – which could then provide theoretically abundant energy on earth.

Scientists have for decades tried to use nuclear fusion to produce electricity at a usable scale, however replicating the reaction on Earth is highly challenging, requiring vast amounts of heat and pressure.

So far, they have not yet managed to produce more energy from the reaction than it takes to trigger the reaction.

There are signs of progress, however, with scientists achieving a record 59 megajoules of energy in experiments at a facility in Culham, near Oxford earlier this year.

This enough power to boil about 60 kettles.

The UK is home to some of the world’s leading fusion prospects, such as Tokamak Energy and First Light Fusion, both based in Oxford.

First Light Fusion raised $45m (£33m) in February from investors including Chinese technology giant Tencent – bringing outside backing for the venture to $107m.

The Fusion Industry Association revealed eight new companies have entered the race for fusion over the past twelve months – reflecting renewed optimism in the energy source.

The UK Government backs the technology, with the UK Atomic Energy Authority working on plans for a prototype fusion power plant in the UK.

By City AM

More Top Reads From Oilprice.com: