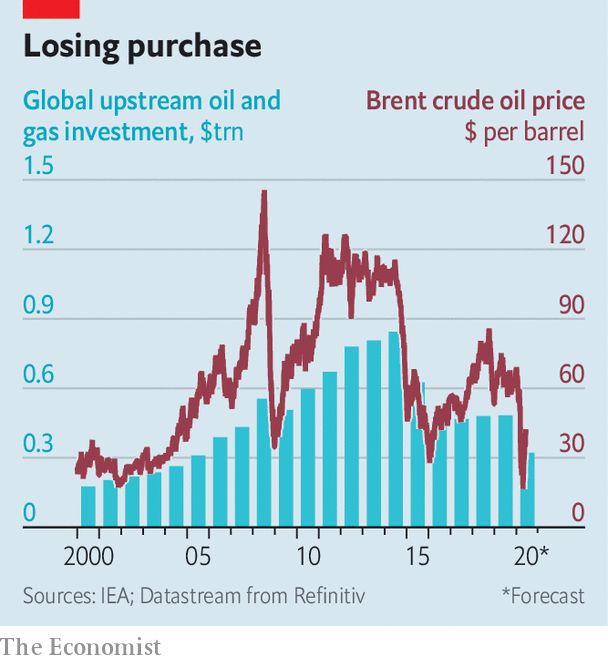

Global investment in future supply has collapsed. The International Energy Agency (IEA), an intergovernmental forecaster, estimates that upstream investment this year will fall to its lowest since 2005 (see chart). Goldman Sachs, a bank, expects production outside OPEC to stagnate in the 2020s, due not to geology or even demand, but lack of investment. Bernstein, a research firm, thinks that non-OPEC supply, which accounts for about 60% of global output, may peak in 2025, and then only at around last year’s level.

Investment

Investment in oil supply has collapsed. It may not roar back – The Economist

IN APRIL, WITH the world in lockdown from covid-19 and oil demand sinking faster than at any time in history, oil producers from Dhahran to the Delaware basin made the only possible choice: cut supply, fast. American output fell by about 2m barrels a day between March and May. The Organisation of the Petroleum Exporting Countries (OPEC) and its allies agreed to reduce supply by a record 9.7m barrels a day in May and June. The cuts helped propel the price of a barrel of Brent crude from less than $17 in mid-April to $42 on June 5th.

On June 6th, with demand still fragile, the OPEC alliance extended the cuts by a month. It is one thing to see supply drop when the oil market is engulfed by crisis. The more interesting question is how quickly supply will climb as normality returns. Production will respond, of course, as demand rises for jet fuel, petrol and diesel. If prices remain over $40, some shale firms and petrostates may boost output this summer. In the longer term, though, supply faces other constraints.

That would mark a dramatic shift. Because oil reserves are depleted continuously, producers have usually operated under the tenet of drill or die. An analyst once asked Lee Raymond, then the chief executive of Exxon, what kept him up at night. “Reserve replacement,” he responded.

The obsession with booking reserves, not surprisingly, supported the growth of supply. In the mid-2000s, as some fretted that the world might run out of oil, both listed and state-backed firms scoured the world for projects. Over the past decade, fracking has unleashed supply across America’s heartland, transforming the country into the world’s largest oil producer (see chart). Big projects in Norway and off the coast of Brazil, where oil lies beneath a thick layer of salt below the sea floor, helped boost supply, too.

Investment began falling, though, even before the pandemic. A crash in prices from 2014 to 2016 had sapped appetite for big, risky projects. Even after prices climbed in 2017 poor returns made investors less interested in reserve replacement than cash flow. Companies have squeezed suppliers and found ways to pump more oil from existing fields. ExxonMobil and Chevron are among the giants to invest in America’s shale basins, where output is relatively easy to ramp up and down.

Oil producers can now credibly say they are able to wring more value from their capital budgets. Still, the decline in investment was steep enough to stir debate over future supply. Upstream spending on oil and gas last year was 43% below that in 2014, according to the IEA. Bernstein examined the 50 biggest listed energy companies outside OPEC and the former Soviet Union. In 2019 they reinvested an average of 64% of their operating cash flow. The long-term average was 87%.

The pandemic has exacerbated matters. Producers have shut in wells, delayed projects and slashed investment further. Rystad Energy, a data firm, estimates that of the 3m barrels a day that were shut in last month, mainly in America and Canada, 10-15% will never restart. The IEA predicts that investment in supply will be 33% lower this year than in 2019 and 62% lower than the high in 2014. There is less fat to trim than there was five years ago, the IEA reckons. That means declining investment may have a greater impact on supply.

Some companies, such as ExxonMobil, remain focused on growth. But it is not clear when a broader surge in capital spending will come. Returns for many firms have fallen below the cost of capital, points out Neil Beveridge of Bernstein. Investors are unlikely to favour a return to rapid expansion; the energy sector’s performance has been poor, the rebound in demand is uncertain and greener regulation may be in the offing. In a sign of the times, JPMorgan Chase, America’s biggest bank, demoted Mr Raymond from his role as its board’s lead independent director in May, under pressure from climate activists. Michele Della Vigna of Goldman Sachs argues that the historic cycle of high prices, investment and supply may be breaking.

As for American shale, analysts are feverishly watching rig counts, pipeline data and shut-ins for signs of a surge in supply. Shin Kim of S&P Global Platts, a data firm, expects it to tick up briefly this summer, as prices recover. But there is consensus that growth in the 2020s will be muted compared with the boom. Shale output is vast and wells’ production declines are steep. Improvements to productivity have slowed. Investors can find better returns elsewhere.

This bodes well for OPEC and its allies, which have been battered in the past decade. In 2014-16 it waged a failed price war to wipe out American frackers. Since then the cartel and its partners, led by Russia, have propped up oil prices enough to sustain shale, but not enough to support many members’ domestic budgets. In March Saudi Arabia urged Russia to slash output; Russia refused, loth to let Americans free-ride on OPEC-supported prices. The ensuing price war was spectacularly ill-timed, as it coincided with the biggest drop in oil demand on record.

The desire to chasten American frackers remains, though. OPEC controls about 70% of the world’s oil reserves, more than its 40% market share would suggest, points out Martijn Rats of Morgan Stanley, a bank. If the world’s appetite for oil shrinks due to changing habits, cleaner technology or greener regulations, countries with vast reserves risk having to leave oil below ground. “OPEC will defend its market share more firmly in the future,” predicts Mr Rats. Even better, then, if state-owned firms can depend on their rivals’ paltry investment to limit supply for them. ■

This article appeared in the Finance & economics section of the print edition under the headline “After the fall”

Investment

Tesla shares soar more than 14% as Trump win is seen boosting Elon Musk’s electric vehicle company

NEW YORK (AP) — Shares of Tesla soared Wednesday as investors bet that the electric vehicle maker and its CEO Elon Musk will benefit from Donald Trump’s return to the White House.

Tesla stands to make significant gains under a Trump administration with the threat of diminished subsidies for alternative energy and electric vehicles doing the most harm to smaller competitors. Trump’s plans for extensive tariffs on Chinese imports make it less likely that Chinese EVs will be sold in bulk in the U.S. anytime soon.

“Tesla has the scale and scope that is unmatched,” said Wedbush analyst Dan Ives, in a note to investors. “This dynamic could give Musk and Tesla a clear competitive advantage in a non-EV subsidy environment, coupled by likely higher China tariffs that would continue to push away cheaper Chinese EV players.”

Tesla shares jumped 14.8% Wednesday while shares of rival electric vehicle makers tumbled. Nio, based in Shanghai, fell 5.3%. Shares of electric truck maker Rivian dropped 8.3% and Lucid Group fell 5.3%.

Tesla dominates sales of electric vehicles in the U.S, with 48.9% in market share through the middle of 2024, according to the U.S. Energy Information Administration.

Subsidies for clean energy are part of the Inflation Reduction Act, signed into law by President Joe Biden in 2022. It included tax credits for manufacturing, along with tax credits for consumers of electric vehicles.

Musk was one of Trump’s biggest donors, spending at least $119 million mobilizing Trump’s supporters to back the Republican nominee. He also pledged to give away $1 million a day to voters signing a petition for his political action committee.

In some ways, it has been a rocky year for Tesla, with sales and profit declining through the first half of the year. Profit did rise 17.3% in the third quarter.

The U.S. opened an investigation into the company’s “Full Self-Driving” system after reports of crashes in low-visibility conditions, including one that killed a pedestrian. The investigation covers roughly 2.4 million Teslas from the 2016 through 2024 model years.

And investors sent company shares tumbling last month after Tesla unveiled its long-awaited robotaxi at a Hollywood studio Thursday night, seeing not much progress at Tesla on autonomous vehicles while other companies have been making notable progress.

Tesla began selling the software, which is called “Full Self-Driving,” nine years ago. But there are doubts about its reliability.

The stock is now showing a 16.1% gain for the year after rising the past two days.

The Canadian Press. All rights reserved.

Investment

S&P/TSX composite up more than 100 points, U.S. stock markets mixed

TORONTO – Canada’s main stock index was up more than 100 points in late-morning trading, helped by strength in base metal and utility stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 103.40 points at 24,542.48.

In New York, the Dow Jones industrial average was up 192.31 points at 42,932.73. The S&P 500 index was up 7.14 points at 5,822.40, while the Nasdaq composite was down 9.03 points at 18,306.56.

The Canadian dollar traded for 72.61 cents US compared with 72.44 cents US on Tuesday.

The November crude oil contract was down 71 cents at US$69.87 per barrel and the November natural gas contract was down eight cents at US$2.42 per mmBTU.

The December gold contract was up US$7.20 at US$2,686.10 an ounce and the December copper contract was up a penny at US$4.35 a pound.

This report by The Canadian Press was first published Oct. 16, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX up more than 200 points, U.S. markets also higher

TORONTO – Canada’s main stock index was up more than 200 points in late-morning trading, while U.S. stock markets were also headed higher.

The S&P/TSX composite index was up 205.86 points at 24,508.12.

In New York, the Dow Jones industrial average was up 336.62 points at 42,790.74. The S&P 500 index was up 34.19 points at 5,814.24, while the Nasdaq composite was up 60.27 points at 18.342.32.

The Canadian dollar traded for 72.61 cents US compared with 72.71 cents US on Thursday.

The November crude oil contract was down 15 cents at US$75.70 per barrel and the November natural gas contract was down two cents at US$2.65 per mmBTU.

The December gold contract was down US$29.60 at US$2,668.90 an ounce and the December copper contract was up four cents at US$4.47 a pound.

This report by The Canadian Press was first published Oct. 11, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

-

News15 hours ago

News15 hours agoChrystia Freeland says carbon rebate for small businesses will be tax-free

-

News14 hours ago

News14 hours agoFACT FOCUS: Election officials knock down Starlink vote rigging conspiracy theories

-

News14 hours ago

News14 hours agoFormer B.C. premier John Horgan, who connected with people, dies at 65

-

News14 hours ago

News14 hours agoNova Scotia election promise tracker: What has been promised by three main parties?

-

News14 hours ago

News14 hours agoB.C. teen with bird flu is in critical care, infection source unknown: health officer

-

News14 hours ago

News14 hours agoSuncor Energy earnings rise to $2.02 billion in third quarter

-

News15 hours ago

News15 hours agoSwearing-in ceremonies at B.C. legislature mark start of new political season

-

News14 hours ago

News14 hours agoFederal government launching research institute for AI safety