World champion Ilia Malinin won Skate America on Sunday for the third consecutive year, altering his free skate on the fly after an early mistake and punctuating the program with a backflip that had been banned in competition until this season.

The two-time and reigning U.S. champion scored 290.12 points to finish ahead of Kevin Aymoz of France, whose career-best free skate left him with 282.88 points and earned a standing ovation inside Credit Union of Texas Event Center in Allen, Texas.

Kao Miura of Japan, who was second after his short program, finished third with 278.67 points.

“It was a pretty challenging moment for me, just stepping on the ice. I felt way more nervous than usual,” said Malinin, the early favorite for gold at the 2026 Winter Olympics in Italy. “That may have played a part in the whole program.”

Vancouver’s Wesley Chiu placed ninth in the free skate with a score of 140.08 points, he finished ninth overall with a total of 206.94 points.

The ice dance competition was to be decided later Sunday in the final event of the season-opening Grand Prix. Lilah Fear and Lewis Gibson of Britain had the lead over American world champs Madison Chock and Evan Bates after the rhythm dance.

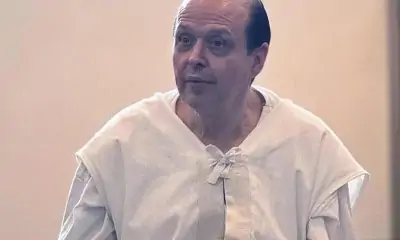

Malinin and Miura were separated by a mere 0.15 points after their short programs, but it was Aymoz who challenged Malinin for the top of the podium. The 27-year-old from France, who struggled mightily at the end of last season, landed a pair of quads in an error-free program to score 190.84 points — the best of all the free skates — and vault into first place.

Nika Egadze of Georgia was next on the ice but fell on his opening quad lutz and stepped out on his quad salchow, and those two mistakes kept him from medal contention. He wound up fourth with 261.71 points.

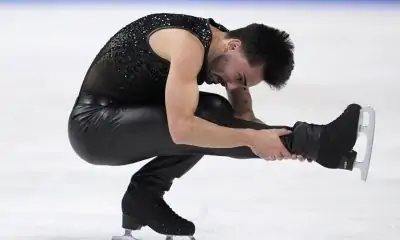

Miura, the 19-year-old former world junior champion, landed three quads during a program set to “The Umbrellas of Cherbourg,” the 1964 musical romantic drama film. But Miura lost points for an under-rotated triple axel and on a step sequence that led into a quad toe loop-triple toe loop combination midway through his free skate.

Malinin was last to take the ice, performing a program set to “I’m Not a Vampire” by the rock band Falling In Reverse.

He opened with a perfect quad flip and then hit a triple axel, even though Malinin remains the only skater to have landed the quad version of the jump in competition. Then came the mistake, when he doubled a planned quad loop, leaving Malinin to make changes on the fly over the second half of the program in an attempt to make up the lost points.

After putting his hand down on his triple lutz, Malinin landed a quad toe loop-triple toe loop combination before a quad salchow-triple axel in sequence — a pair of huge jumping passes that sent his technical score soaring.

Malinin capped the recovery of his program with a backflip during his choreographed sequence, a move that had been banned until this season because of its inherent danger. It was expected all along but nonetheless sent a roar through the crowd, just as Malinin’s program came to an end and a steady stream of stuffed animals were thrown onto the ice.

“It was really hard for me in the middle of the program to think what I have to do — what I need to do,” Malinin said when asked about the early mistake. “I just went full autopilot through there and I’m glad I made it out.”

___