New MaxiMetal fire truck will keep residents safe, home insurance costs low, chief says

Investment

‘It’s a good investment’ — Hemsworth

PRINCE TOWNSHIP — For many small communities, a brand-new fire truck with a $400,000 price tag might seem like a budget-busting extravagance.

But Steve Hemsworth, fire chief at the Prince Township Volunteer Fire Department, believes the township’s new pumper/tanker truck will prove a solid long-term investment.

“We should get 30 years of life out of this truck, Hemsworth said during a recent interview at the fire hall. “We’re going to run it the first 15 as a pumper … (and) 15 years as a tanker.

“The nice part about us having a new truck now is that we get the best years out of a truck for once, to enjoy the minimal repairs and having a dependable unit.”

The 2019 truck was manufactured by the Quebec-based MaxiMetal Inc., which supplies emergency vehicles to the Montreal Fire Department. Before it’s arrival in Prince, it was used only as a demonstrator.

At 27-foot long, the vehicle is compact, but its tank holds 1,800 Imperial gallon of water, and its on-board pump can deliver 1,000 gal. of water a minute through 4” diameter hoses. It also carries an on-board system to deliver fire retardant foam at the flip of a couple of switches.

The truck is also equipped with a large porta tank, which firefighters can quickly set up at a fire scene as an emergency water supply. The porta tank can hold the contents of the truck’s tank with room to spare.

“If we have a call where we don’t have a hydrant, (the porta tank) is our hydrant,” Hemsworth explained. “The tanker crew would take the porta tank off the truck, set it up, and dump the truck’s water into it. Then the truck can go to a hydrant or a lake to be refilled with water.”

With its multiple storage compartments, the truck can carry all the equipment firefighters are likely to need in any rural firefighting scenario: a medical kit, cutting tools, four self-contained breathing apparatus units, hoses, and several portable pumps, including those needed to battle a wildland blaze.

The pumps and hoses designed for wildland firefighting are compatible with those used by the Ministry of Natural Resources, Hemsworth noted.

The compatibility means that township firefighters can battle a wildland fire unassisted until MNR firefighters reach the scene then work seamlessly with them once they arrive.

The cab includes new safety features the department’s second-hand vehicles lacked, including a warning system that alerts the driver when a door or compartment is open and a backup camera.

“Everything on this vehicle meets the safety standards that are current now,” Hemsworth said.

The MaxiMetal truck has now replaced the township’s 24-year-old pumper truck as the department’s front-run, or primary, firefighting vehicle. Over the next five years, the old pumper truck will serve as a backup vehicle, but its main use will be for medical first response calls.

Once it reaches age 30, Hemsworth wants to see it decommissioned and replaced, but he added that the decision will be up to “the council of the day.”

Two other fire department vehicles have already been decommissioned and will shortly be sold: the 24-year-old medical rescue van, and the 34-year-old tanker truck.

What’s most important to Hemsworth is that the purchase of the new truck k brings the fire department into compliance with the standards required by Underwriters’ Laboratories of Canada (ULC), which sets the fire insurance rates for residential and commercial properties in all Canadian municipalities that have fire departments.

ULC standards require a municipality with more than 1,000 residents to have at least one front-run firefighting vehicle that is no more than 15 years old.

The standards permit fire trucks more than 15 years old may to be used as backup, or support, vehicles and kept up to the age of 30.

In his report to council last November, Hemsworth cautioned that the township would risk liability for any damages that might result if the fire department sent its 24-year old pumper truck as the front-run vehicle on a fire call and the truck or its pump broke down.

The arrival of the new truck eliminates that risk.

“It’s a good investment, because we now have a dependable truck that’s in good repair. We have a truck that meets all the insurance standards and will keep taxpayers’ insurance rates low,” Hemsworth said.

“We’ll get the first 15 years of good service and keep repair costs low, because (the truck) is under warrantee.”

Economy

S&P/TSX composite down more than 200 points, U.S. stock markets also fall

TORONTO – Canada’s main stock index was down more than 200 points in late-morning trading, weighed down by losses in the technology, base metal and energy sectors, while U.S. stock markets also fell.

The S&P/TSX composite index was down 239.24 points at 22,749.04.

In New York, the Dow Jones industrial average was down 312.36 points at 40,443.39. The S&P 500 index was down 80.94 points at 5,422.47, while the Nasdaq composite was down 380.17 points at 16,747.49.

The Canadian dollar traded for 73.80 cents US compared with 74.00 cents US on Thursday.

The October crude oil contract was down US$1.07 at US$68.08 per barrel and the October natural gas contract was up less than a penny at US$2.26 per mmBTU.

The December gold contract was down US$2.10 at US$2,541.00 an ounce and the December copper contract was down four cents at US$4.10 a pound.

This report by The Canadian Press was first published Sept. 6, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Economy

S&P/TSX composite up more than 150 points, U.S. stock markets also higher

TORONTO – Canada’s main stock index was up more than 150 points in late-morning trading, helped by strength in technology, financial and energy stocks, while U.S. stock markets also pushed higher.

The S&P/TSX composite index was up 171.41 points at 23,298.39.

In New York, the Dow Jones industrial average was up 278.37 points at 41,369.79. The S&P 500 index was up 38.17 points at 5,630.35, while the Nasdaq composite was up 177.15 points at 17,733.18.

The Canadian dollar traded for 74.19 cents US compared with 74.23 cents US on Wednesday.

The October crude oil contract was up US$1.75 at US$76.27 per barrel and the October natural gas contract was up less than a penny at US$2.10 per mmBTU.

The December gold contract was up US$18.70 at US$2,556.50 an ounce and the December copper contract was down less than a penny at US$4.22 a pound.

This report by The Canadian Press was first published Aug. 29, 2024.

Companies in this story: (TSX:GSPTSE, TSX:CADUSD)

The Canadian Press. All rights reserved.

Investment

Crypto Market Bloodbath Amid Broader Economic Concerns

-

Sports24 hours ago

Sports24 hours agoCanada’s Stakusic, partner Savinykh lose in doubles quarterfinals at Guadalajara Open

-

News4 hours ago

News4 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News24 hours ago

News24 hours agoSouthern Baptist trustees back agency president but warn against needless controversy

-

News4 hours ago

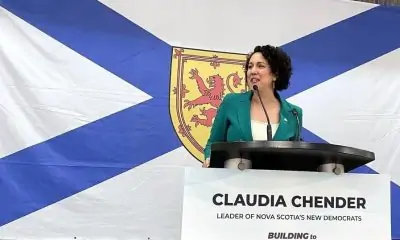

News4 hours agoNova Scotia adopts bill declaring domestic violence in the province an epidemic

-

News14 hours ago

News14 hours agoCanadanewsmedia news September 12, 2024: Air Canada pilot strike looms, BC transit strike talks resume

-

News3 hours ago

News3 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News13 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News3 hours ago

News3 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby