Investment

Kenney urges rural municipalities to do more to attract investment – Edmonton Journal

Article content continued

In October, the province announced three-year property tax exemptions for energy companies drilling new oil wells or building new pipelines in an attempt to boost the energy sector and rescue some companies from bankruptcy. The government estimates its plan will save the industry between $81 and $84 million.

Kenney said the tax exemptions developed by new Municipal Affairs Minister Tracy Allard were a “reasonable solution” that would ensure municipalities can get tax revenue in the future.

“It’s not perfect. These are incredibly complex issues, but we all have to play our part to ensure jobs in rural Alberta — and that is our goal,” he said.

McLaughlin said the tax holiday was a compromise and a short-term solution, and credited Allard with resetting the RMA’s relationship with the province.

“That message saying we’re all going to carry this together, I think that’s been appreciated and recognized,” said McLaughlin.

He added industry lobbyists may have held more sway during consultations, but the province has since recognized local knowledge, and the RMA wants to cultivate a better understanding of that knowledge with the province and federal government.

During his speech, Kenney touted steps his government has taken to help rural communities, saying that a provincewide $10 billion investment in infrastructure projects is “disproportionately” being spent in those municipalities.

NDP Opposition Leader Rachel Notley accused Kenney’s government of going from taking rural Alberta for granted to targeting rural communities by antagonizing doctors, increasing policing costs, and introducing the possibility of toll roads.

Investment

A24 Raises Significant New Investment Round, Valuing Company at $3.5B

A24, the Oscar-winning indie studio that has become an edgy brand name unto itself, is getting a big vote of confidence — and an influx of cash.

The studio said Wednesday it has closed on an investment round led by Joshua Kushner’s Thrive Capital. The Hollywood Reporter has learned that Thrive invested $75 million into the indie studio based on a $3.25 billion pre-money valuation. A source close to A24 with knowledge of the investment notes that the company’s enterprise valuation now sits at $3.5 billion, suggesting this round of funding will net the company a roughly $250 million total investment.

As a part of the investment, Thrive founder Kushner will join the A24 board of directors.

The news of the A24’s new valuation and Thrive’s investment comes as the studio pushed into more commercial projects, with bigger budgets and A-list talent. There was a period, not too long ago, when the Hollywood rumor mill was convinced A24 was on the precipice of being sold. Depending on the week, it was to Apple or to Amazon. Then, in early 2022, the company announced it had done a round of financing instead — $225 million, at a valuation of $2.5 billion. Existing investors are said to have contributed to the most recent round as well.

A24 has long been synonymous with a filmmaker-first approach that has earned it many fans in a contemporary Hollywood that has only grown increasingly risk-averse. Early acquisitions included Alex Garland’s Ex Machina, Harmony Korine’s Spring Breakers and Barry Jenkins’ Moonlight, the latter of which netted A24 its first Oscar-winning title.

As it became known for breaking new directing talent like Ari Aster (Midsommar and Hereditary) and Robert Eggers (The Witch, The Lighthouse), A24 pushed more into production with films like Zola, the X films and the best picture winning Everything Everywhere All at Once. On the television front, A24 found success producing HBO hit Euphoria (albeit A24 only takes a fee on the production) and has expanded its slate to include Netflix Emmy winner Beef and beloved Showtime series The Curse.

All of this led to the studio’s current “cool kid” status, bolstered by its ubiquitous merch that sees the A24 logo emblazoned on sweatshirts and hats worn by moviegoers. A24 has become a household name with intentionality, with the studio having long sold coffee table books, candles and other movie-inspired paraphernalia. (Earlier this year, A24 struck a deal with London-based independent publisher Mack that will see the A24 books sold in stores, a step up from its direct-to-consumer model.)

As for the box office, A24 isn’t known for massive windfalls. The movies that it traditionally releases — passion projects from first-time and auteur filmmakers, festival acquisitions and the occasional genre hit — have tight margins. While some films proved successful, there have been misses (recently, Aster’s Beau Is Afraid) and still other, smaller titles get little to no theatrical play at all.

Still, by 2022, when the studio raised its first massive round of funding since its founding, it became clear that A24 was primed for growth.

As of late, A24 executives have been asking around for the “A24 version” of commercial titles that range from John Wick to Suits, according to several sources. “What’s an A24 version of The Hills or Laguna Beach, which I truly loved just from an audience perspective? We could crush something like that,” A24 TV head Ravi Nandan told Bloomberg earlier this year.

The asks have left some in the industry, including A24’s longtime partners, confused, unsure what to make of the push into more commercial work for a company that built its brand on out-of-the-box filmmaking.

At the box office, A24 has found commercial success with genre films such as Aster’s and the horror feature Talk to Me, which was acquired out of the 2023 Sundance Film Festival and fast-tracked for a sequel by the studio. But a push into an era of making more content has not been without bumps. The A24-produced HBO series The Idol was plagued with production issues, while a third season of Euphoria has remained stubbornly out of reach.

The studio recently released its most ambitious project to date with Alex Garland’s actioner Civil War. The studio placed the budget at $50 million but several sources have pegged the budget closer to $70 million. The film grossed $68 million at the domestic box office to date and over $120 million internationally. (By comparison, Everything Everywhere grossed over $70 million domestically and was produced for roughly $14 million budget.)

The studio’s upcoming slate includes the Benny Safdie and Dwayne Johnson MMA biopic The Smashing Machine, the Adam Wingard action-thriller Onslaught and a project that will pair the studio with Steven Spielberg’s Amblin Entertainment.

Outside of investments like Thrive’s, A24 has bolstered its production efforts with moneyed output deals, including the one signed at the end of 2023 that will see A24 theatrical movies air exclusively on HBO and stream only on Max. Other deals include an exclusive airline distribution deal with Anuvu and Happinet Phantom Studios covering the distribution in Japan.

Thrive was launched by Kushner in 2009 to invest primarily in Internet, software and tech companies. Its investments have included Instagram, Spotify, Slack, Patreon, Stripe and Fanatics, and it currently has about $14 billion in assets under management. In 2022, after he left but before he returned to the company as CEO, Disney’s Bob Iger joined the firm as a partner. A few months later, after he returned to Disney, Iger acquired a stake in Thrive — along with other partners — that was previously owned by Goldman Sachs.

Kushner is the son of real estate developer Charles Kushner and the younger brother of former Trump White House adviser Jared Kushner. He is also married to model and entrepreneur Karlie Kloss.

Said A24 in a statement about today’s news: “We’re thrilled to be working with Thrive Capital whose unique expertise will be invaluable in our growth. With Thrive, alongside our existing partners, we look forward to growing our support of groundbreaking storytellers and helping their voices reach audiences around the world.”

Investment

The secrets of success with Nicolai Tangen, CEO of Norges Bank Investment Management, the leader who saunas

CEO Agenda provides unique insights into how leaders think and lead and what keeps them busy in a world of constant change. We look into the lives, minds and agendas of CEOs at the world’s most iconic companies.

Nicolai Tangen is a man who likes to ask questions. As CEO of Europe’s largest state investment fund, Tangen does so every week on his podcast, In Good Company. Elon Musk, Satya Nadella, Sam Altman, Bill Gates, Jensen Huang,… everyone who is anything in business has answered the Norwegian’s questions.

Most listeners, I reckon, will be most attentive when Tangen asks his peers about their careers or the je ne sais quoi of the iconic brands they shepherd. But having spoken to Tangen several times in places like Davos, I’m always most intrigued when he asks questions about CEO pay or corporate governance best practices, two focal points of the Norwegian investment fund.

This week, however, Tangen isn’t asking, but answering questions. What makes him tick? When does he get up? What makes him productive? What are his rituals? True to his Nordic roots, his answers are succinct and a bit mystical, and some topics are clearly off-limits – ‘leave the politics to the politicians’. As a public servant, Tangen clearly knows his limits in speaking out.

But an attentive reader will find this week’s CEO Agenda very revealing. Tangen is extremely bullish on AI, for example, and makes no effort to hide it—neither here, nor in the investments he stewards. And as a former City hedge fund manager, Tangen isn’t a 9-to-5 man either, nor are those who work for him.

This interview has been edited for brevity.

Down to business

What is the single most important project you are working on with your company?

We work on several important projects, the most important ones involve how we can use AI to reduce trading costs and improve timing.

Technology is priority one! We recently arranged Tech day to learn from each other and to get everybody up to best practice. Great fun and highly recommended! pic.twitter.com/qVcMnPRFWX

— Nicolai Tangen (@NicolaiTang1) June 6, 2024

Which long-term trend are you most bullish about for society and the economy at large? Which one makes you most worried?

AI is a real productivity driver for society and is hugely exciting. I am worried about the fragmentation of the world, and also how Europe is growing less slowly than other areas.

If you were an economic policymaker, what would be your top priority for Europe?

I will leave that to the politicians.

Being productive

What time do you get up, and what part of your morning routine sets you up for the day?

I typically wake up at 6 a.m. and then exercise or take a dip in the ocean, followed by a sauna. Then I scooter to work.

What time do you work until? Do you continue sending emails during the night and/or weekends?

I work until 10 p.m., and I send emails all the time.

I am worried about the fragmentation of the world, and also how Europe is growing less slowly than other areas.

What apps or methods do you use to be more productive?

The one thing that makes me more productive is my executive assistant, Grete. She is with me all the time, and so we can produce stuff even if we are in a taxi or on a plane.

Getting personal

What book have you read, either recently or in the past, that has inspired you?

Brave New Words by Sal Khan, about AI in education. I also recently recorded a podcast with Sal about this.

If you could ask your idol one question, who would it be, and what would you ask?

I am lucky in that through our podcast In Good Company I get to ask many of my idols a lot of questions.

As a consumer, what is your favorite company and why?

Investment

The high cost of overcomplicating your investments

Sam Sivarajan is a speaker, independent wealth management consultant and author of three books on investing and decision-making.

In the world of personal fitness, new products and shiny gadgets are constantly flooding the market. Yet, they are just variations of a few basic movements: push, pull and cardio exercises. While workouts can get complicated, the core principles of human physiology remain the same.

The world of investing is no different. Despite the myriad of mutual funds and ETFs, and the emergence of new asset classes, the fundamental principles of investing haven’t changed: buy low, sell high; diversify across asset classes and geographies; prioritize consistency over timing, etc. Here, complexity doesn’t equate to better returns.

Howard Marks, a renowned portfolio manager, regularly publishes investment memos. In one, he emphasized the power of simplicity and consistency, telling the story of David VanBenschoten, who managed the General Mills pension fund. Over 14 years, David’s fund never ranked above the 27th percentile or below the 47th percentile in annual returns. Yet, his fund ended up in the fourth percentile overall for that period, outperforming 96 per cent of other funds. This success came not from aiming for top performance each year, but from avoiding large losses and maintaining steady, above-average returns.

Karl Weick’s analysis of the Pittsburgh Steelers in the 1970s underscores a similar point. The Steelers won 98 per cent of their games against weaker teams using a simple game plan, but their success rate dropped to 50 per cent against stronger teams, where more complex strategies were needed.

This shows that consistently executing a straightforward plan can lead to extraordinary success in most situations – the Steelers won four Super Bowls in this period.

The recent experience of the Canada Pension Plan Investment Board illustrates the potential dangers of taking a more complex approach. Since 2006, the CPPIB shifted from a simple, low-cost index-based strategy to a complex, actively managed approach. This change increased staffing to more than 2,100 today from roughly 150 employees in 2006, and costs soared to $3.5-billion from $36-million. Despite these efforts, the CPPIB’s performance lagged those of a simple, passive investment strategy.

Over an 18-year period, the CPPIB’s active management strategy resulted in a negative annualized return of 0.1 per cent relative to its benchmark, amounting to a $42.7-billion loss. While the fund achieved an annualized 7.7-per-cent return, the reference portfolio – a composite of global equity and bond indexes – earned 7.8 per cent annually. This underperformance highlights how complexity can introduce unnecessary costs and risks that outweigh potential benefits.

Andrew Coyne points out that the CPPIB’s experience is not unique. Many actively managed funds underperform their benchmarks, especially after fees. The CPPIB’s transformation into a “giant hedge fund” involved stock picking, board seats and investing in alternative assets such as real estate and private equity. These efforts increased the fund’s complexity and costs without delivering better returns.

The Pareto principle, or the 80/20 rule, asserts that 80 per cent of results come from 20 per cent of the effort. In investing, focusing on core factors, such as making consistent contributions, minimizing costs and diversifying, can help achieve most goals.

Research by Victor De Miguel and colleagues showed that a simple equal-weighted portfolio often outperforms more complex strategies that are based on mean-variance optimization. (The optimization approach suggests that one can, through analysis and calculation, identify a portfolio that maximizes returns for any given level of risk.)

Even Harry Markowitz, the Nobel-prizing winning father of mean-variance optimization, admitted to not following his own advice. He said that he split his investments equally between stocks and bonds rather than following the complex approach for which he won his Nobel Prize.

When it comes to investing, it’s crucial to establish goals, time horizons and risk appetite at the outset. While these factors differ for institutional investors – like the CPPIB – compared with individual investors, Leonardo da Vinci’s motto is worth keeping in mind: “Simplicity is the ultimate sophistication.”

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.

-

Science19 hours ago

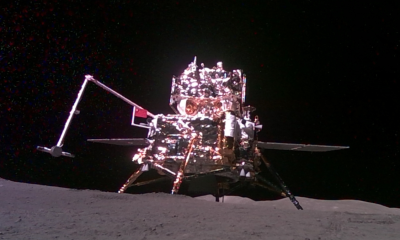

Science19 hours agoWhat happened to China’s Chang’e 6 lander on the moon’s far side?

-

Business19 hours ago

WestJet mechanics issue strike notice for possible job action Friday

-

Sports18 hours ago

Edmonton Oilers stars McDavid, Draisaitl played through injuries in playoffs: coach

-

News17 hours ago

News17 hours agoFederal government ends northern cod moratorium in Newfoundland after 32 years

-

Health16 hours ago

Health16 hours agoLittle sign of new tick-borne disease on Prince Edward Island — so far

-

Art20 hours ago

Calgary’s Arts Commons advances its revitalization into downtown hub with $75-million donation

-

News19 hours ago

News19 hours agoPower back on in western Labrador after wildfires knocked out transmission lines

-

Real eState19 hours ago

Big US banks withstand Fed’s commercial real estate shock scenario