Investment

Key Ware Electronics Co., Ltd.’s (GTSM:5498) Investment Returns Are Lagging Its Industry – Simply Wall St

Today we are going to look at Key Ware Electronics Co., Ltd. (GTSM:5498) to see whether it might be an attractive investment prospect. To be precise, we’ll consider its Return On Capital Employed (ROCE), as that will inform our view of the quality of the business.

First of all, we’ll work out how to calculate ROCE. Next, we’ll compare it to others in its industry. Finally, we’ll look at how its current liabilities affect its ROCE.

What is Return On Capital Employed (ROCE)?

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. All else being equal, a better business will have a higher ROCE. Overall, it is a valuable metric that has its flaws. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets – Current Liabilities)

Or for Key Ware Electronics:

0.018 = NT$37m ÷ (NT$3.1b – NT$1.0b) (Based on the trailing twelve months to September 2019.)

Therefore, Key Ware Electronics has an ROCE of 1.8%.

See our latest analysis for Key Ware Electronics

Is Key Ware Electronics’s ROCE Good?

ROCE is commonly used for comparing the performance of similar businesses. Using our data, Key Ware Electronics’s ROCE appears to be significantly below the 10.0% average in the Machinery industry. This could be seen as a negative, as it suggests some competitors may be employing their capital more efficiently. Putting aside Key Ware Electronics’s performance relative to its industry, its ROCE in absolute terms is poor – considering the risk of owning stocks compared to government bonds. It is likely that there are more attractive prospects out there.

In our analysis, Key Ware Electronics’s ROCE appears to be 1.8%, compared to 3 years ago, when its ROCE was 1.2%. This makes us think the business might be improving. You can click on the image below to see (in greater detail) how Key Ware Electronics’s past growth compares to other companies.

It is important to remember that ROCE shows past performance, and is not necessarily predictive. ROCE can be deceptive for cyclical businesses, as returns can look incredible in boom times, and terribly low in downturns. ROCE is, after all, simply a snap shot of a single year. You can check if Key Ware Electronics has cyclical profits by looking at this free graph of past earnings, revenue and cash flow.

What Are Current Liabilities, And How Do They Affect Key Ware Electronics’s ROCE?

Liabilities, such as supplier bills and bank overdrafts, are referred to as current liabilities if they need to be paid within 12 months. The ROCE equation subtracts current liabilities from capital employed, so a company with a lot of current liabilities appears to have less capital employed, and a higher ROCE than otherwise. To counter this, investors can check if a company has high current liabilities relative to total assets.

Key Ware Electronics has total assets of NT$3.1b and current liabilities of NT$1.0b. As a result, its current liabilities are equal to approximately 33% of its total assets. With a medium level of current liabilities boosting the ROCE a little, Key Ware Electronics’s low ROCE is unappealing.

Our Take On Key Ware Electronics’s ROCE

There are likely better investments out there. You might be able to find a better investment than Key Ware Electronics. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Discounted cash flow calculation for every stock

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of any company just search here. It’s FREE.

Investment

Sylvia Jones makes announcement in Muncey | CTV News – CTV News London

An investment has been announced to help connect over 23,000 people to primary care teams in the region.

Speaking in Muncey on Thursday, Ontario Health Minister Sylvia Jones said $6.4-million will help people in London, Lambton and Chathamk-Kent.

The money, part of a bigger $110-million investment will support seven new and expanded interprofessional primary care initiatives that will connect over 23,000 Ontarians to primary care teams and provide services.

Services include

- New mobile services for an Indigenous Primary Health Care Organization that will support First Nations, Inuit and Metis community members in Middlesex County.

- A new mobile bus to connect Indigenous people in rural and urban areas of Lambton-Kent-Middlesex with Indigenous led, culturally relevant primary care services in person and virtually.

- A new Family Health Team for London and the surrounding area, that will expand services through additional Community Hub locations throughout the area. By meeting people where they are, and reducing other barriers, this program will help connect people experiencing homelessness or at risk of homelessness with primary care providers that are trauma and violence informed.

- An expanded Family Health Team in Elgin County that will partner with another Family Health Team and Community Health Centre to increase the number of people who can connect to team-based primary care services.

- A new rural site along with expanded capacity at an urban clinic in Lambton County, focused on connecting isolated seniors, socioeconomically disadvantaged and vulnerable people, newcomers, and refugees to primary care.

- New mobile primary care services in Chatham-Kent, including clinics for respiratory and diabetes management, cancer screening and traditional healers to help provide culturally appropriate care.

- Primary care service expansion in Tillsonburg to connect vulnerable and medically complex community members to comprehensive, convenient and connected primary care closer to home.

Investment

Ottawa's new EV tax credit raises hope of big new Honda investment – The Globe and Mail

People work at Honda’s auto manufacturing plant in Alliston, Ont., on April 5, 2023.CARLOS OSORIO/Reuters

A new tax credit in Tuesday’s federal budget is fuelling industry speculation that Canada is close to landing a massive electric-vehicle investment by Honda.

The proposed measure would provide companies with a 10-per-cent rebate on the costs of constructing new buildings to be used in the electric-vehicle supply chain. It would be atop other such incentives to which Ottawa has previously committed, including a 30-per-cent manufacturing investment tax credit, as well as provincial supports.

But unlike those other credits, this one would only be available to companies making across-the-board investments in battery-making, the manufacturing of battery components known as cathode active materials, and vehicle assembly.

Honda Motor Co. Ltd. HMC-N is the only automaker known to be in advanced talks with the federal and provincial governments for a Canadian EV-sector commitment of that breadth. Earlier this year, the Japanese news group Nikkei reported that the company is considering an investment here of up to $18.5-billion – pointing toward more comprehensive Canadian supply chain plans than those of competitors such as Volkswagen Group and Stellantis NV STLA-N, whose high-profile investments squarely in battery manufacturing would not qualify.

Japanese automaker Honda considering multibillion-dollar EV plant in Canada, report says

Amid a flurry of trips to Japan by Canadian officials – most recently a visit this month by Ontario Economic Development Minister Vic Fedeli – the perception among industry insiders is that the new tax credit may be a final component of an incentive package offered by the federal and provincial governments, to get the negotiations over the finish line.

“There’s a very short list of very big companies who are looking at a very big investment and talking to Canada, Ontario and Quebec, to whom this would apply,” said Automotive Parts Manufacturers’ Association president Flavio Volpe, referring to the two provinces vying for major EV commitments. “The translation here is that there are big new EV investments coming.”

That assessment was echoed by Brendan Sweeney, the managing director of the Trillium Network for Advanced Manufacturing. “All the bread crumbs are leading to something,” he said.

More than just heralding the potential for the largest EV-related Canadian commitment by a global auto giant to date, the new measure is seemingly part of a shift in strategy for how Canada subsidizes supply chain growth – one in which Ottawa and the provinces stop competing for investment by simply matching multibillion-dollar subsidies offered in the United States, and instead offer more nuanced packages that could prove more efficient.

That subsidy-matching approach – in which Canada has guaranteed companies of annual subsidies equivalent to production tax credits offered in the U.S. – has to this point been considered a prerequisite to securing the battery factories meant to serve as EV supply chain anchors.

However, those have come with projected cumulative costs of up to $13-billion for the factory being constructed by Volkswagen in St. Thomas, Ont., and up to $15-billion for the one being constructed by Stellantis and LG Energy Solution in Windsor, Ont., during the early years of plant operations when the subsidies would be available. And Ottawa, which will cover about two-thirds of those costs while Ontario pays the rest, has previously signalled that it does not have the fiscal capacity to provide many more such deals.

But since the Honda negotiations came to light, government officials have expressed optimism about that company being open to a package of support that would revolve more around tax breaks on investment costs – as opposed to operational subsidies once factories have been commissioned – and likely carry a less staggering government cost relative to the total investment. (The Globe and Mail is not identifying the officials, because they were not authorized to speak publicly about the talks.)

One reason for that optimism may be the multifaceted nature of the investment that Honda is considering.

Mr. Volpe noted that for battery factories alone, Canada’s investment tax credits (ITCs) are not enough to compete with the U.S. production tax credits. But he said it’s a different story if the company is also looking at vehicle assembly, production of battery components and other parts of the supply chain, which the U.S. is not subsidizing the same way.

At the same time, those other aspects of the Honda package under consideration also seemingly make its potential investment more attractive to Ottawa than merely chasing another battery plant alone.

Other companies could also take advantage of the new incentive, along with the others being offered by the federal and provincial governments.

The governments have also been in less advanced talks with Toyota Motor Corp., which is the only one of the five global automakers with an established manufacturing presence in Canada not to have made major EV-related commitments here. (The others are General Motors Co. GM-N, Ford Motor Co. F-N, Stellantis and Honda.)

But for now, it’s the prospect of Honda as the first taker for a made-in-Canada approach to EV supports that is causing the most buzz around the sector.

“I think this could be a really useful departure,” Mr. Sweeney said. “We have to be competitive with the United States, but we’re a sovereign country. Can we do this in a way that works better for Canada?”

Investment

'I was always so proud of it': Charlie Munger had a ready reply when asked to name the investment he liked most – Yahoo Finance

To say Charlie Munger lived a long, full and rich life is putting it both mildly and literally.

The Berkshire Hathaway sidekick of billionaire Warren Buffett died in November just weeks short of his 100th birthday. His estimated net worth? A mere $2.2 billion, according to Forbes.

Don’t miss

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

-

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here’s how

-

‘It’s not taxed at all’: Warren Buffett shares the ‘best investment’ you can make when battling rising costs — take advantage today

Indeed, Munger was an investing legend — and just as much a font of no-nonsense wisdom and wit. Regarding the extravagant purchases consumers love, he once quipped, “Who in the hell needs a Rolex watch?”

As investors, we arguably need to measure time in a different kind of way: that is, ticking off the moments until we trade big-ticket spending for even an ounce of Munger’s golden investment guidance.

In one video capturing Munger’s remarks from the 2022 Daily Journal ($DJCO) Annual Meeting, he shares the story of a big win … and the following year, a bad flop.

Munger’s best investment ever

Munger’s musings on the extremes of his financial life were sparked by a certain Wes in Miami, who asked him, “In your storied investment career, which investment did you like the most?”

“Well, that’s rather interesting,” Munger replied, his trusty Diet Coke can sitting in front of him. He mentioned the World Book Encyclopedia, which he remembered from his youth as a product sold door to door. “It was easy for a child who wasn’t necessarily a brilliant student.”

And as an investment, the World Book provided volume after volume of wealth. ”Berkshire made $50 million pre-tax per year out of that business for years and years and years. I was always so proud of it because I grew up with it and it helped me.”

The World Book triumph follows a pattern of Buffett and Munger buying into successful businesses whose products they loved, including Dairy Queen, See’s Candies, and yes, Coca-Cola.

Berkshire Hathaway also followed a model that almost seems old fashioned today: it invested in companies whose stocks were undervalued; that is, when the intrinsic value per share dips below the current market share price.

Read more: Suze Orman says Americans are poorer than they think — but having a dream retirement is so much easier when you know these 3 simple money moves

World Book only ceased to return monstrous profits when, as Munger noted, “a man named Bill Gates came along and decided he was going to give away a free encyclopedia with every damn bit of software.”

The World Book success story boils down to the kind of simple principle Munger loved so much: buy in companies whose products and profit potential you believe in, especially after you study the numbers and marketplace dominance.

“It’s still a marvelous product,” Munger said, “and it wasn’t good that we lost what World Book was doing for this civilization. World Book helped me get ahead in life.”

Charlie’s folly

But even the most successful market gurus have their crash-and-burn moments. Munger had no trouble recalling the dud that haunted him at the Daily Journal’s 2023 meeting: Alibaba “was one of the worst mistakes I’ve ever made.”

Munger said he was “over-charmed” by online retailing and “got a little out of focus” when it came time to invest his money in Alibaba. In fact, Munger acknowledged that he used leverage to buy the stock— a tactic he has frowned on in the past — because “the opportunities were so ridiculously good I thought it was desirable to do that.”

Munger initially bought about 165,000 Alibaba shares in the first quarter of 2021 and increased that to 602,060 shares in the fourth quarter. But he then cut that back to 300,000 shares in the first quarter of 2022.

The lesson Munger learned and that we can especially benefit from today is that the market’s bright shiny objects may distract us from doing our homework. E-commerce, he said, wasn’t a slam dunk but just another form of retail where a business has to prove its viability, just like a brick-and-mortar store.

This story should be familiar to anyone who has jumped on an IPO from a much-hyped company, only to see its stock falter days afterward. Trump Media, for example, recently dropped below $30 a share, compared to an IPO price that soared above $70.

As for his particular market tumble, Munger’s response was pure Munger: “I keep rubbing my own nose in my own mistakes like I’m doing now because I think it’s good for [me].”

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

-

Tech18 hours ago

Tech18 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science23 hours ago

Science23 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

Investment23 hours ago

Investment23 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

News19 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Science22 hours ago

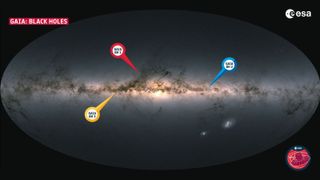

Science22 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Politics22 hours ago

Politics22 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Health13 hours ago

Health13 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech20 hours ago

Tech20 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca