Real eState

Lack of listings keeps Hamilton-Burlington real estate market red hot – Grand River Sachem

Compared with a year ago, August sales were up nearly 35 per cent while the average home price in Canada hit $586,000, up 18.5 per cent compared with a year ago.

Buyers flocking to Hamilton from the Greater Toronto Area is a factor in the price hikes. But a bigger one is a shortage of listings.

The 955 active residential real estate listings in Hamilton at the end of August was the lowest number since at least April — and it’s 18 per cent lower than the previous August.

For Hamilton and Burlington combined, the number of active listings at the end of August was more than 25 per cent below the 10-year average.

“There are more buyers than there are sellers out there right now,” said Cosentino. “There are a lot of bidding wars happening, especially in the price point under $600,000.

“If there’s a listing for $499,000, there’s probably going to be a bidding war of 10 to 20 buyers on it for sure,” he added.

The COVID pandemic is also having a major impact by altering the nature of the workforce, said Kathy Della-Nebbia, president of the Realtors Association of Hamilton-Burlington (RAHB).

“I believe that working remotely from home has become much more acceptable to many employers, which will have a positive impact on the RAHB marketplace,” said Della-Nebbia. “Those potential buyers who couldn’t afford the GTA and wanted the dream of home ownership but couldn’t face the commute are now able to do so.”

“The opportunity to work from home full- or part-time will allow those buyers to come our way,” she added.

Cosentino doesn’t expect the situation to change much between now and the end of the year.

“It all comes down to supply and demand,” said Cosentino. “If there’s a lot of inventory coming back on the market, then we’re going to have more of a stable market, which we don’t have right now.

“My crystal ball says it’s probably going to be the same as it is now,” he said. “With COVID, people are living with the unknown. We don’t know if there’s going to be a second wave.”

Steve Buist is a Hamilton-based investigative reporter at The Spectator. Reach him via email: sbuist@thespec.com

Real eState

The real estate sector's unique view of 2024 — and what's to come – Yahoo Finance

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Despite a rough few days for the S&P 500, which is still comfortably in the green this year (up 6%), one sector of the stock market is feeling more pain than the rest.

The perception that rates might stay higher for longer is hammering the real estate sector, even as debate rages about how many times — if any — the Federal Reserve will cut rates this year.

The group is far and away the worst performer in the S&P 500 for 2024, down more than 10%. The bulk of those declines have come in the past two weeks, as Treasury yields have climbed to their highest level since November and investors traverse the acceptance phase that the hoped-for cuts are not on their way.

Now investors are faced with the question of whether to buy the dip or, to quote another market cliché, risk trying to catch a falling knife.

One real estate investor said the rent indicators she’s seeing in real time are encouraging on the inflation front. That’s in contrast to the much-criticized rental barometers that the Fed relies on.

“If you take into account real-time shelter costs, it’s much lower than what’s in the prints,” Uma Moriarity, senior investment strategist at CenterSquare, told Yahoo Finance. “We think inflation is trending in the right direction.”

That’s why she’s still confident in three rate cuts this year — a view, of course, that the market has been moving away from. It’s also why she’s still confident in real estate. That, plus the fact that stocks are relatively cheap.

Read more: What the Fed rate decision means for loans and mortgages

The reasons that real estate stocks suffer when rates are on the rise are twofold. First off, the companies tend to carry a lot of debt, and as rates go higher, it becomes more difficult to service or refinance that debt. Secondly, with relatively high dividend yields, the stocks compete with instruments like money market funds for investing dollars.

It’s traditionally been tough for real estate stocks to rally in the face of rising rates. But if Moriarty — and Citigroup — are right, they might not be rising for as long as the broader market anticipates.

Julie Hyman is the co-anchor of Yahoo Finance Live, weekdays 9 a.m.-11 a.m. ET. Follow her on Twitter @juleshyman, and read her other stories.

Click here for in-depth analysis of the latest stock market news and events moving stock prices.

Read the latest financial and business news from Yahoo Finance

Real eState

Celebrity real estate agent Mauricio Umansky explains when housing prices will come down – Fox Business

Real eState

Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: 'Inflation Is Proving Tougher To Bring D – Benzinga

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund XLRE had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. PLD | -6.55% |

| First Industrial Realty Trust, Inc. FR | -3.33% |

| STAG Industrial, Inc. STAG | -2.89% |

| EastGroup Properties, Inc. EGP | -2.89% |

| Rexford Industrial Realty, Inc. REXR | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. SLG | 3.18% |

| Opendoor Technologies Inc. OPEN | 2.55% |

| Medical Properties Trust, Inc. MPW | 2.49% |

| eXp World Holdings, Inc. EXPI | 2.32% |

| Vornado Realty Trust VNO | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Tech18 hours ago

Tech18 hours agoCytiva Showcases Single-Use Mixing System at INTERPHEX 2024 – BioPharm International

-

Science24 hours ago

Science24 hours agoNasa confirms metal chunk that crashed into Florida home was space junk

-

News20 hours ago

Tim Hortons says 'technical errors' falsely told people they won $55K boat in Roll Up To Win promo – CBC.ca

-

Investment24 hours ago

Investment24 hours agoBill Morneau slams Freeland’s budget as a threat to investment, economic growth

-

Politics23 hours ago

Politics23 hours agoFlorida's Bob Graham dead at 87: A leader who looked beyond politics, served ordinary folks – Toronto Star

-

Science23 hours ago

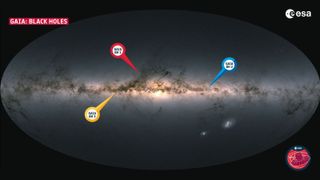

Science23 hours agoRecord breaker! Milky Way's most monstrous stellar-mass black hole is sleeping giant lurking close to Earth (Video) – Space.com

-

Health14 hours ago

Health14 hours agoSupervised consumption sites urgently needed, says study – Sudbury.com

-

Tech20 hours ago

Tech20 hours agoAaron Sluchinski adds Kyle Doering to lineup for next season – Sportsnet.ca