Canadian companies are joining a growing list of top international brands vowing not to advertise on Facebook Inc. in July because of the company’s refusal to deal with the spread of hateful content on its platform.

Vancouver athleticwear companies Lululemon Athletica Inc., Mountain Equipment Co-op and Arc’teryx are pulling their paid ads from Facebook and joining a boycott that has already been supported by Coca-Cola, Unilever, Honda America, Patagonia and more.

Champions of the #StopHateForProfit boycott – led by civil rights and advocacy groups including the Anti-Defamation League and National Association for the Advancement of Colored People – say Facebook has not done enough to keep racist, false and dangerous content or white supremacists off its platform.

They are also disappointed that the company has allowed users to call for violence against protesters fighting for racial justice in the wake of the deaths of several Black Americans.

MEC’s boycott came into effect on June 25, when it pulled its organic content and paid ads from Facebook and Instagram until the end of July.

The company said it wants to raise “awareness of the harmful, racist content and misinformation that is shared on these social platforms.”

“We ask that Facebook strengthen their content-moderation policies and enforce them consistently,” MEC said in a statement emailed to The Canadian Press.

Lululemon, meanwhile, tweeted its support for #StopHateForProfit on Saturday, saying “We believe we all have a responsibility to create a truly inclusive society and are actively engaging with Facebook to seek meaningful change.”

In its tweets supporting the boycott, Arc’teryx said Facebook profits “will never be worth promoting hate, bigotry, racism, anti-Semitism and violence.”

Facebook, which is based in Menlo Park, Calif. and also owns Instagram and Whatsapp, said in a statement that it invests billions of dollars each year to keep its community safe and continuously works with outside experts to review and update its policies.

The company said it has opened itself up to a civil rights audit and banned 250 white supremacist organizations from Facebook and Instagram.

“The investments we have made in artificial intelligence mean that we find nearly 90 per cent of Hate Speech we action before users report it to us, while a recent European report found Facebook assessed more hate speech reports in 24 hours than Twitter and YouTube,” the company said in an email.

“We know we have more work to do, and we’ll continue to work with civil rights groups, Global Alliance for Responsible Media, and other experts to develop even more tools, technology and policies to continue this fight.”

Their boycott is significant because ad revenues generated almost US$69.66 billion for Facebook last year and is the company’s biggest money maker, according to research firm Statista.

Content moderation concerns have long dogged the company, which has often landed in regulators’ cross hairs as it struggles to balance freedom of speech with its responsibility to keep Facebook users safe.

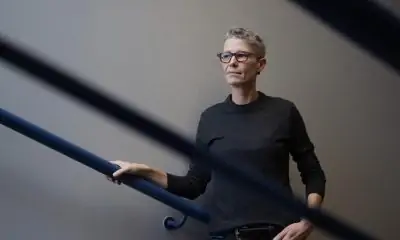

While Facebook is a valuable tool for companies searching for eyeballs and customers willing to dip into their wallets, the boycott hurts the social media company more than the brands edging away from it, said Joanne McNeish, an associate professor of marketing at Ryerson University.

Many brands are not as reliant on Facebook as they once were because they have realized Instagram is more valuable for attracting younger customers and because Facebook has lost some of its more targeted advertising abilities after the data of up to 50 million Facebook users was misused by analytics firm Cambridge Analytica.

“Advertisers have various platforms that they have available, depending on the target group the company is looking for, but at this moment nobody’s talking about boycotting Instagram,” said McNeish. “They’re only boycotting Facebook, and that’s a very traditional way of doing a boycott in that you attack the market leader.”

After brands like Verizon, Eddie Bauer, Levi Strauss and Co. and Mozilla pulled their ads from the platform, Facebook’s stock slid by 8.3 per cent to US$216.08 on Friday, its biggest drop in three months.

The stock rebounded somewhat on Monday afternoon after dropping further in morning trading, gaining US$3.17 to US$219.25.

The fall erased $56 billion from Facebook’s market value and $7.2 billion from founder Mark Zuckerberg’s net worth.

The Bloomberg Billionaires Index now estimates he’s worth $82.3 billion and is the fourth richest person after Amazon.com Inc.’s Jeff Bezos, Microsoft Corp. co-founder Bill Gates and LVMH Moet Hennessy titan Bernard Arnault.

McNeish doesn’t think the losses will weigh on Facebook or Zuckerberg much.

“Mark Zuckerberg has a long tradition of not really caring what people think,” she said.

“He’s a huge organization, he can take quite a big hit on this and still be profitable and still continue to operate.”

This report by The Canadian Press was first published June 29, 2020.

Source:- CP24 Toronto’s Breaking News

Source link

Related