WINNIPEG – Manitoba’s recent efforts to curb retail theft are working, by many accounts, and some businesses are hoping for more permanent changes.

Winnipeg police warned last December of a sharp rise in retail theft — sometimes involving violence — and boosted officer presence in retail areas. In May, the provincial government announced it would pay for police officers in Winnipeg to work overtime to target parts of the city where retail theft was most rampant.

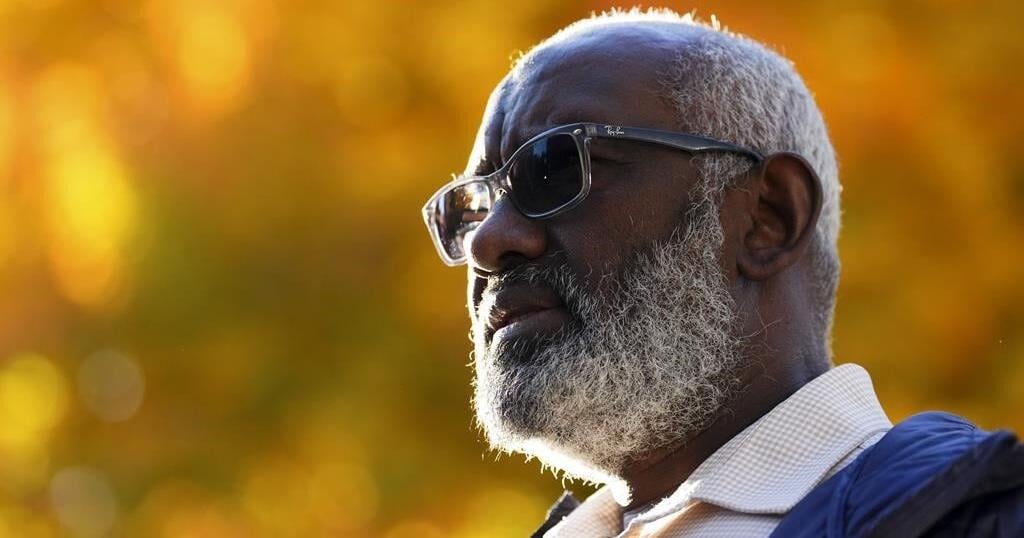

Munther Zeid, whose family owns the local Food Fare chain of grocery stores, says shoplifting incidents have gone down slightly, most notably those committed by organized thieves who steal not to feed themselves but to resell goods for money.

He recalled an incident last year when he was in a parking lot and a man approached him with a vehicle trunk filled with food.

“A guy comes up and he’s trying to sell me my own meat,” Zeid said.

“I just kept delaying it until I got some more of the boys down and we ended up taking the product away from him.”

Police officers, sometimes in uniform and sometimes not, have visited Food Fare stores regularly and word of the increased police presence has served as a deterrent to some thieves, Zeid said.

The head of the Winnipeg Chamber of Commerce also feels recent efforts have worked.

“The increased presence of the police officers is serving as a deterrent to those that would potentially be looking to do theft,” chamber president Loren Remillard said.

Police released statistics last month on the program’s impact over the first several weeks. There were 203 arrests. There were 31 tickets issued for offences such as trespassing.

Last week, police announced charges against a man accused of stealing nine times from one grocery store and a single time from another outlet.

The province’s funding for police overtime is scheduled to expire at the end of the month, and the NDP government has said it is looking at ways to keep up the battle against retail theft.

Relying on police to work overtime isn’t feasible over the long term, said Insp. Jennifer McKinnon with the Winnipeg Police Service’s major crimes division.

“I don’t think any one of us can work all the time. It leads to burnout,” she said.

Anti-poverty groups have said a sharp rise in the cost of housing and food has contributed to the retail theft problem. McKinnon and Remillard both agree that a greater number of people struggling financially is a factor.

They say there are other factors as well — such as the belief that retail theft is a victimless crime and the risk of being apprehended is low.

The increased police presence that began with last December’s ramp-up is one way to address the latter, McKinnon said.

“We’re trying to change the narrative that (shoplifters) can just walk out of the store and nothing’s going to happen,” McKinnon said.

Zeid would like to see stronger penalties for shoplifters.

“Shoplifters will think twice if they know that they’re not just going to be slapped on the hand with a promise to appear (in court).”

This report by The Canadian Press was first published Aug. 12, 2024.