Real eState

Massillon area real estate transfers Feb. 12-18 – Massillon Independent

Bethlehem Township

Levengood Myrna & Cochenor Bartt from Low William E & Jennie A, 31 Jacob St NE, $144,000.

Canal Fulton

Buck Ronnie Dean & June A from NVR Inc D/B/A Ryan Homes, 3036 Bonita Cir SE, $253,695.

Donatelli Dante J from Krzynowek Tyler, 632 Poplar St, $153,500.

Krzynowek Tyler from Sowards Nicholas & Steven, 319 Locust St S, $51,500.

Starkey Katrina & Shawn from Yoder Robert D and Jolynne E, 729 Greenwood Dr, $179,500.

Jackson Township

Amos Kelly Ann & Keith Brian from Scotsbury Builders Group LLC, 8800 Scotsbury Glen St NW, $89,000.

Beani Bazar Investments Inc from Cable Shores Realtyllc, 5380 Fulton Dr NW, $1,653,150.

Belknap Jonathan E from Mackey Lawrence A &Terri E, 6590 Dale St NW, $240,900.

Hendershot Ronald D & Mandeville Jamie from Evans Mario & Hubbard Danielle, 8865 Camden Rd NW, $905,000.

Hepler Joseph & Maryelizabeth from Cutlip Ryan Thomas & Meredith Elizabeth, parcel 1603400 Rohrway Ave NW, $34,000.

Kendel Donald J & Kirk Taylor from Stephen Thomas E & Rosemary L Co Ttees, parcel 1600656 Forty Corners St NW, $85,000.

Kinsinger Gregory E Ttee from 2715 Wise Avenue Ltd, 5740 Shadow Ridge Cir NW, $750,000.

Love William P & Rosemary E from Klingshirn Joyce E, 73 Cherry Dr NW, $144,000.

Mccann James & Julie from BG Custom Homes Inc, parcel 1627765 Wooded Point Cir NW, $565,000.

Morrison Seth R & Hollie from Rka Retreats LLC, 7550 Diamondback Ave NW, $309,900.

Palmer Dylan & Denise from Griffiths Craig S, 9924 Cliffview St NW, $852,000.

Pearman Leaha & Shawn from Keyser Douglas R & Julie C, 7546 Montella Ave NW, $550,000.

Perkowski Brent Lee & Rita from Brown David L, 8606 Gentry St NW, $395,000.

Powell Robert D from Smith Daniel P & Andrea J, 7606 Oakdale St NW, $246,000.

Retail Growth Properties LLC from Brendel Farms Inc, parcel 10014671 Arlington Ave NW, $372,900.

Rutan Devan from Marsh Brent A & Jessica M, 8808 Eastlynn Ave NW, $525,000.

Wilkins Tonya R & Thomas L Jr Ttees from Ohio Vedic Homes LLC, parcel 10004332 Springlake Rd NW, $123,025.

Lawrence Township

Cormeg LLC from Tornimparte Terra LLC, parcel 2410955 Beaumont Ave NW, $429,771.

Snyder Geoffrey from Krug Timothy L, 13301 Orrville St NW, $173,900.

Spicer Anthony M from Homebound Management, 4287 Manchester Ave NW # 15, $2,000.

Yoder Zaria from Demastus Samantha L, 4287 Manchester Rd NW #22, $1,000.

Massillon

Brown Matthew from Spuhler Katelyn, 822 Campbell Cir NE, $163,000.

Dotson Corey from Seibert David A Jr & Kelly L Trustees, 4591 West Pointe Cir NW 6-B, $275,000.

Fisher Michael from Apap 1 LLC, 4595 Evangel Ave NW, $222,500.

Gardner Scott W from K S Yoak Enterprises LLC, 430 9th St NE, $139,000.

Garrison Daniel C & Randi L from K Hovnanian at Country View Estates LLC, parcel 10014529 23rd St SW, $77,000.

Habitat for Humanity East Central Ohio from Cecil Karen M, parcel 601698 Arch Ave SE, $3,000.

JD Real Estate Investments Inc from Shew Farms LLC, 256 Erie St S, $215,000.

JD Real Estate Investments Inc from Tone Wolf Music Shoppe LLC, 54 Federal Ave NE, $215,000.

KS Yoak Enterprises LLC from 815 Seneca LLC, 815 Seneca St NE, $15,000.

Lengyel Nicholas C from Halter Ted A, 129 Ertle Ave NE, $90,000.

Marcum Seth A from Flashhouse Cle South LLC, 424 Shaw Ave NE, $151,000.

Max Copper LLC from G L Heck Investments LLC, 1022 North Ave NE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 106 9th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 204 6th St NW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 217 8th St NE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 217 Wales Rd NE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 219 11th St NE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 311 6th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 312 6th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 404 Perry Ave SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 424 7th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 510 5th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 510 Chestnut Ave NE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 523 4th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 527 4th St SW, $840,000.

Max Copper LLC from G L Heck Investments LLC, 61 6th St SE, $840,000.

Max Copper LLC from G L Heck Investments LLC, 905 North Ave NE, $840,000.

Maxheimer Lynn M from Darrow Louis A, 919 Seneca St NE, $60,000.

Mercer Katie M from Wagner William A Jr, 109 5th St SW, $103,000.

Pinchot Diane from Knox John D, 1703 Springhaven Cir NE, $235,000.

PSPR Properties LLC from G L Heck Investments LLC, 2029 Lincoln Way E, $110,000.

Sankovich Joshua from Ruby Land LLC, 1446 Healy St NE, $77,512.

Satterfield Cathy from Baker David L, 433 Ford St NW, $80,000.

Shackelford Jim from Orzeck Phillip J & Kathleen J, 2318 Rhode Island Ave SE, $90,000.

Simma Inc Property Solutions LLC from Yannayon Ann H, 419 Parkview St NE, $45,000.

Smith Leroy Jr & Lisa Garrett from Patterson Joann & Smith Leroy Jr, 1607 Ute Ave SE, $17,900.

Top Notch Real Estate Investments LLC from Brown Diane P, 24 Maple Ave SE, $24,000.

Usher Lloyd from Helline Joseph E & Nancy C, 422 State Ave NE, $60,000.

Perry Township

Bergdorf Christopher A & Amanda L from Farris Thomas B, 4432 17th St NW, $149,500.

Boso John A & Vaughn Jeffrey D from Boso John A & Vaughn Tiffany M & Jeffrey, 3033 Maytime St NW, $54,700.

Bryant Katelyn E from Maslanka Vivian J & Loos Malachi A, 610 Snively Ave NW, $175,000.

Egert John T & Ronda J from Williams Edward P, 4747 Tioga St NW, $130,000.

Fricke Keri A from Belknap Jonathan E & Tammy L, 3343 Meadowwood St NW, $247,500.

Lather Gregory from Ruff Matthew E Jr & Wolf Melanie, 191 Saratoga Ave NW, $125,000.

Overcasher Edward A from Sebald Valerie K Trustee, 124 Woodlawn Ave NW, $89,000.

Santos Stephanie from NVR Inc A Virginia Corporation DBA, 6059 Lavenham Rd SW, $417,720.

Shanklin Jackie E from Poland Matthew E, 6198 Richville Dr SW, $187,140.

Shifflet Marion Mark & Sandra Rinck from Tucke Eileen, 1329 Fairlane Ave SW, $119,900.

Pike Township

Sperlazza Brandon W from Blanton Steven J & Wallace Ashley N, 1853 Paradise St SE, $150,000.

Wiliams Merlin G Jr & Cherrie R from Nolan Robert C, 1745 Battlesburg St SW, $2,486.

Sugarcreek Township

Carr Martin from Strubel David M, 222 Washington Ave SW, $73,000.

Twaddle Jennifer L from Shanklin Jackie E, 140 Huron St NE, $139,000.

Tuscarawas Township

Adams John D from Adams John D, 1505 Manchester Ave NW, $16,896.

Jones Earl J & Debra A Trustees from Jones Earl J &Steven & Scoeppner Terri L, parcel 10014877 Deermont Ave NW, $406,625.

Jordan Joshua E & Brennan Taylor L from Delong Helen L, 962 Kenyon Rd NW, $105,000.

Kemp Faith & Biles Kenneth from Miller Ralph W Jr &Connie H, 12632 Wooster St NW, $265,000.

Pauli Benjamin H & Bethany R from Jenson Amanda S, 1889 Beaumont Ave NW, $193,000.

Talluru Surya Teja from Glick Andrew L & Crystal L, 959 Kenyon Rd NW, $189,000.

Talluru Surya Teja from Glick Andrew L & Crystal L, parcel 7400758 Kenyon Ave NW, $189,000.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

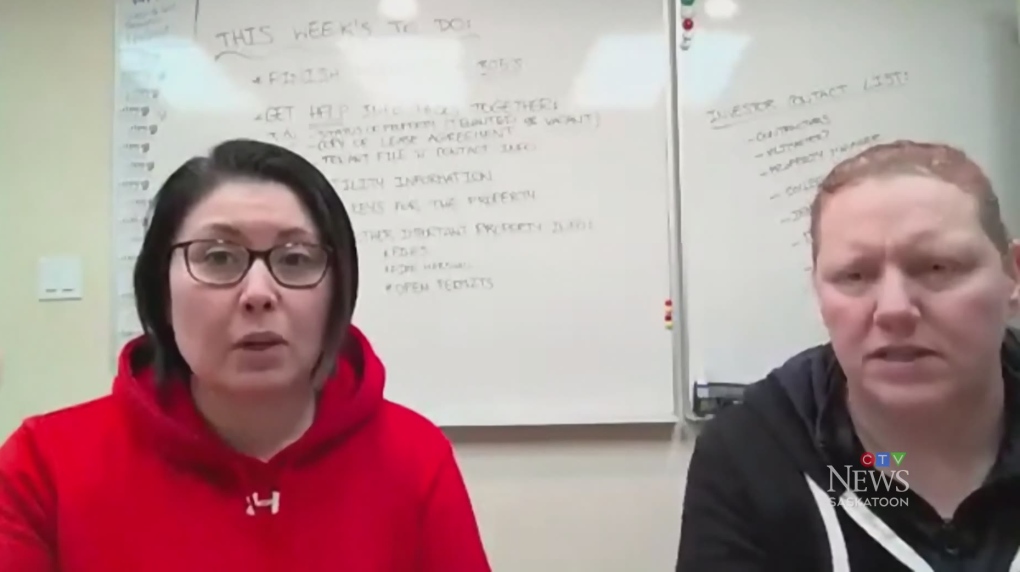

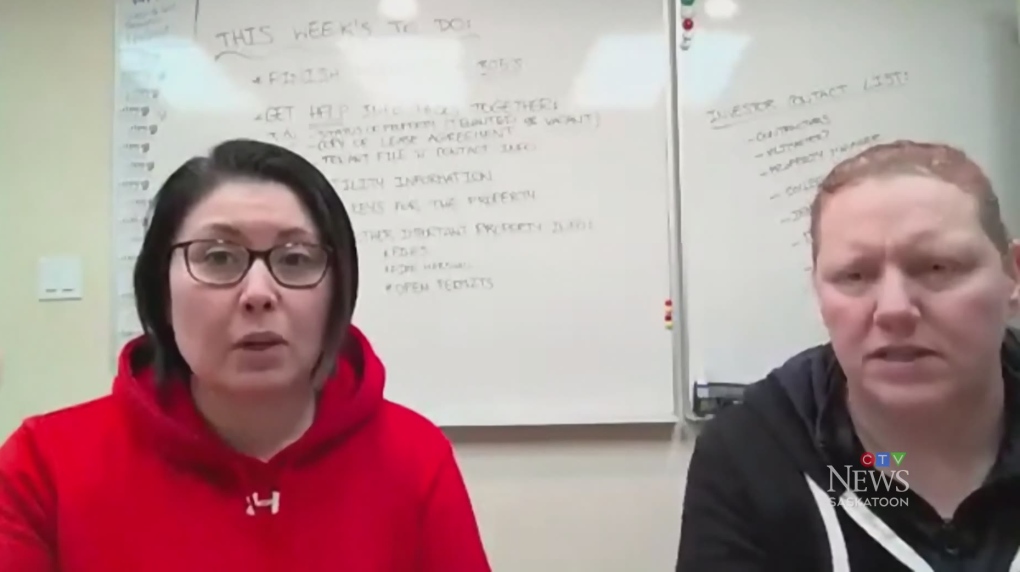

Sask. real estate company that lost investors' millions reaches settlement – CTV News Saskatoon

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

Real eState

Hidden Billions in Tokyo Real Estate Lure Activist Hedge Funds

|

|

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

In Japan, there’s a huge gap — 22 trillion yen ($143 billion) by one estimate — between how companies value their real estate assets on their books, versus what those same properties would fetch if sold in the current market. That comes from two factors: First, many of the island nation’s firms have held onto properties for decades, each year writing down the cost of fixed assets due to annual depreciation, a common accounting practice. But at the same time, property prices have soared.

-

Media20 hours ago

Trump Media plunges amid plan to issue more shares. It's lost $7 billion in value since its peak. – CBS News

-

Real eState23 hours ago

Real estate mogul concerned how Americans will deal with squatters: ‘Something really bad is going to happen’ – Fox Business

-

Tech24 hours ago

Tech24 hours agoJava News Roundup: JobRunr 7.0, Introducing the Commonhaus Foundation, Payara Platform, Devnexus – InfoQ.com

-

Sports23 hours ago

Sports23 hours agoRafael Nadal confirms he’s ready for Barcelona: ‘I’m going to give my all’ – ATP Tour

-

Science23 hours ago

Total solar eclipse: Continent watches in wonder – Yahoo News Canada

-

Investment20 hours ago

Investment20 hours agoLatest investment in private health care in P.E.I. raising concerns – CBC.ca

-

Media23 hours ago

Meta's news ban changed how people share political info — for the worse, studies show – CBC.ca

-

Politics22 hours ago

Politics22 hours agoQuebec employers group urges governments to base immigration on labour needs, not politics – CityNews Montreal