Economy

Mortgage crunch is already hitting Canada’s economy

Canadians now putting more of their income to debt than Americans just before the great financial crisis

The growing burden of mortgage payments as homeowners renew under much higher interest rates has roused concern from policy makers to politicians.

Canada’s household debt, at 187 per cent of disposable income, is among the highest of Organization for Economic Cooperation and Development countries and has long been considered the economy’s biggest vulnerability.

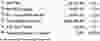

That debt burden now amounts to $2.9 trillion, with mortgage debt making up 74 per cent of that, says a new study from TD Economics. With the increase of 300 basis points in mortgage rates, Canadians are now allocating 15.4 per cent of their income to pay their debts, up from 13.6 per cent in 2020.

That’s higher than the 13.2 per cent Americans were paying to service their debts at the peak of indebtedness just before the Great Financial Crisis.

So how does that affect the economy?

As more homeowners are forced to renew at higher mortgage rates, they have less disposable income to spend on goods and services that drive the economy.

Consumer spending has been dropping in Canada, but up until now the direct effects of higher mortgage debt on that spending were unknown, said James Orlando, senior economist at TD Economics and author of the study.

To find out TD Economics used internal anonymized credit card and mortgage data to track how borrowers were responding to higher interest rates.

“When the Bank of Canada (BoC) first started increasing its policy rate in early 2022, we knew that tough times were coming for Canadian households,” said Orlando.

About 1 per cent less, the study determined, which adds up to a $6 billion hit to the economy.

Expressed in another way, the 1.5 per cent increase in consumer spending so far this year would be 1.9 per cent without the drag of higher interest rates.

But TD didn’t stop there. It also broke down the numbers based on when mortgage renewals occurred and “this is where things really start to get interesting,” said Orlando.

It’s important to note that the majority of households in Canada do not have a mortgage, and for these people, spending over the past year has actually increased. A strong labour market and rising wages have apparently been enough to support consumption, said the study.

Not so for homeowners with a mortgage — and when you renew is important. The TD study found that for those who renewed in 2021 before the Bank of Canada began hiking, spending declined by just 0.9 per cent.

Borrowers who renewed in 2022, when interest rates rose from 0.25 to 4.5 per cent, spent 1.4 per cent less.

But what about the mortgage renewals to come?

The Bank of Canada estimates that 47 per cent of all mortgages will have renewed at higher rates by the end of this year, and 65 per cent by the end of next year.

“Given that the 2024 cohort looks set to renew their mortgage at rates 200 basis points higher than they are paying now, they will be experiencing a similar payment shock to the 2023 cohort,” said Orlando.

And they have already started to trim their spending. The TD study found that over the past year Canadians facing mortgage renewal in 2024 have pulled back on spending by 0.5 per cent, likely bracing for the higher payments ahead.

“This implies that when the 2024 cohort goes through their reset next year, we’d expect to see them trim spending to a greater degree than they already have, putting further downward pressure on overall consumer spending,” he said.

The impact could shave another 0.5 per cent off total spending in the Canadian economy. TD now forecasts that consumption growth will fall a full percentage point to 0.6 per cent in 2024 from 1.6 per cent this year.

“While it does not look like this mortgage reset will be enough to tip the economy into recession, the Canadian consumer is becoming increasingly stressed by high interest rates,” said Orlando.

Just when the U.S. economy appears to be softening it surprises with a show of strength.

Friday’s labour market report came in higher than expected, with a gain of 199,000 jobs in November and the unemployment rate falling to 3.7 per cent.

The numbers were noteworthy enough to draw a rare comment from President Joe Biden, who called the reading, “a sweet spot that’s needed for stable growth and lower inflation, not encouraging the Fed to raise interest rates.”

It’s also a quandary for markets. Solid job growth bodes well for an economic soft landing but also suggests the Federal Reserve could hold interest rates higher for longer. Treasury yields soared and market bets on a March rate cut fell from 50 per cent to 40 on Friday, prompting one analysis to call the data a “heat check for Wall Street.”

Inflation has dropped considerably from the highs in 2022, but even mild inflation can make a big difference to both consumers and investors. Financial risk manager and analyst Rachel Zhang says investors need to understand the difference between nominal and real returns to gauge how well their investments are truly performing. Find the answers at FP Investing

Economy

How will the U.S. election impact the Canadian economy? – BNN Bloomberg

[unable to retrieve full-text content]

How will the U.S. election impact the Canadian economy? BNN Bloomberg

Source link

Economy

Trump and Musk promise economic 'hardship' — and voters are noticing – MSNBC

[unable to retrieve full-text content]

Trump and Musk promise economic ‘hardship’ — and voters are noticing MSNBC

Source link

Economy

Economy stalled in August, Q3 growth looks to fall short of Bank of Canada estimates

OTTAWA – The Canadian economy was flat in August as high interest rates continued to weigh on consumers and businesses, while a preliminary estimate suggests it grew at an annualized rate of one per cent in the third quarter.

Statistics Canada’s gross domestic product report Thursday says growth in services-producing industries in August were offset by declines in goods-producing industries.

The manufacturing sector was the largest drag on the economy, followed by utilities, wholesale and trade and transportation and warehousing.

The report noted shutdowns at Canada’s two largest railways contributed to a decline in transportation and warehousing.

A preliminary estimate for September suggests real gross domestic product grew by 0.3 per cent.

Statistics Canada’s estimate for the third quarter is weaker than the Bank of Canada’s projection of 1.5 per cent annualized growth.

The latest economic figures suggest ongoing weakness in the Canadian economy, giving the central bank room to continue cutting interest rates.

But the size of that cut is still uncertain, with lots more data to come on inflation and the economy before the Bank of Canada’s next rate decision on Dec. 11.

“We don’t think this will ring any alarm bells for the (Bank of Canada) but it puts more emphasis on their fears around a weakening economy,” TD economist Marc Ercolao wrote.

The central bank has acknowledged repeatedly the economy is weak and that growth needs to pick back up.

Last week, the Bank of Canada delivered a half-percentage point interest rate cut in response to inflation returning to its two per cent target.

Governor Tiff Macklem wouldn’t say whether the central bank will follow up with another jumbo cut in December and instead said the central bank will take interest rate decisions one a time based on incoming economic data.

The central bank is expecting economic growth to rebound next year as rate cuts filter through the economy.

This report by The Canadian Press was first published Oct. 31, 2024

The Canadian Press. All rights reserved.

-

News21 hours ago

News21 hours agoJacques Villeneuve calls thieves of late father’s bronze monument soulless idiots

-

News21 hours ago

News21 hours agoB.C. port employers to launch lockout at terminals as labour disruption begins

-

Politics21 hours ago

Politics21 hours agoRFK Jr. says Trump would push to remove fluoride from drinking water. ‘It’s possible,’ Trump says

-

News21 hours ago

News21 hours agoNova Scotia Liberals release four-year $2.3-billion election platform

-

News21 hours ago

News21 hours agoPoilievre asks premiers to axe their sales taxes on new homes worth under $1 million

-

News21 hours ago

News21 hours ago‘Canada is watching’: New northern Alberta police service trying to lead by example

-

News21 hours ago

News21 hours agoAlabama Gov. Kay Ivey treated for dehydration at campaign rally

-

News21 hours ago

News21 hours agoManitoba eyes speedier approval, more Indigenous involvement in mining sector