Article content

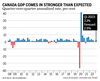

Stronger-than-expected economic growth in the first quarter could force the Bank of Canada to end its pause and hike interest rates again during one of its meetings over the summer, economists are predicting.

Markets now see 40% chance of a hike next week, 100% chance of another hike by September

Stronger-than-expected economic growth in the first quarter could force the Bank of Canada to end its pause and hike interest rates again during one of its meetings over the summer, economists are predicting.

Gross domestic product, the country’s main gauge on the amount of goods and services changing hands, expanded at a 3.1 per cent annualized pace over the first three months of the year. It’s a figure that blew past Bay Street’s expectations of 2.5 per cent growth and the Bank of Canada’s own 2.3 per cent projection.

Economists have been putting more stock into the potential for a rate hike at some point over the next few months, with some predicting a bump as early as next week in its June 7 meeting.

Markets are now pricing in a 40 per cent chance of a hike next week, up from 28 per cent before the data, Reuters reports, and they now expect an increase of 25 basis points by September.

“It seems likely the Bank of Canada will be seriously considering raising rates next week,” said Royce Mendes, Desjardins head of macro strategy, in a May 31 note. “While they might pass on changing course just yet, the belief that the central bank will further tighten policy this summer is justifiably gaining traction.”

The central bank has said it would only maintain a pause on rate hikes if the economy cooled off in line with its expectations, but the latest reading points to continued strength.

The economics team at the Canadian Imperial Bank of Commerce also said the stronger GDP raises the odds of a hike, but say it’s not a done deal. CIBC senior economist Andrew Grantham said he expects policymakers will prefer to wait and see more data and revise forecasts rather than raising rates next week.

Bank of Montreal chief economist Doug Porter said that patience could be key, given the current economic outlook.

“However, given the uncertain backdrop and the possibility that inflation took a big step down in May, the (Bank of Canada) could opt to remain patient for a bit longer and signal that it’s open to hiking in July if the strength persists,” Porter said in a May 31 note.

The latest data on the economy bolsters Monex Canada foreign exchange analyst Jay Zhao-Murray’s argument that the central bank would have to hike in June.

“A few days after we made that call, Governor Macklem tried to downplay the uncomfortably strong inflation data when asked by a journalist, buying himself a bit of time by suggesting that he would wait for today’s GDP report and then take all of the information together before making a decision,” Zhao-Murray wrote.

“With the final piece of the puzzle also suggesting that the economy has more excess demand than the Bank of Canada thought, the stars are aligned for a resumption in the hiking cycle.”

“We are now at a stage where, should the Bank lack the conviction to act in June, the history books likely won’t look kindly upon the decision,” he added.

• Email: shughes@postmedia.com | Twitter:

CALGARY – TC Energy Corp. has lowered the estimated cost of its Southeast Gateway pipeline project in Mexico.

It says it now expects the project to cost between US$3.9 billion and US$4.1 billion compared with its original estimate of US$4.5 billion.

The change came as the company reported a third-quarter profit attributable to common shareholders of C$1.46 billion or $1.40 per share compared with a loss of C$197 million or 19 cents per share in the same quarter last year.

Revenue for the quarter ended Sept. 30 totalled C$4.08 billion, up from C$3.94 billion in the third quarter of 2023.

TC Energy says its comparable earnings for its latest quarter amounted to C$1.03 per share compared with C$1.00 per share a year earlier.

The average analyst estimate had been for a profit of 95 cents per share, according to LSEG Data & Analytics.

This report by The Canadian Press was first published Nov. 7, 2024.

Companies in this story: (TSX:TRP)

The Canadian Press. All rights reserved.

BCE Inc. reported a loss in its latest quarter as it recorded $2.11 billion in asset impairment charges, mainly related to Bell Media’s TV and radio properties.

The company says its net loss attributable to common shareholders amounted to $1.24 billion or $1.36 per share for the quarter ended Sept. 30 compared with a profit of $640 million or 70 cents per share a year earlier.

On an adjusted basis, BCE says it earned 75 cents per share in its latest quarter compared with an adjusted profit of 81 cents per share in the same quarter last year.

“Bell’s results for the third quarter demonstrate that we are disciplined in our pursuit of profitable growth in an intensely competitive environment,” BCE chief executive Mirko Bibic said in a statement.

“Our focus this quarter, and throughout 2024, has been to attract higher-margin subscribers and reduce costs to help offset short-term revenue impacts from sustained competitive pricing pressures, slow economic growth and a media advertising market that is in transition.”

Operating revenue for the quarter totalled $5.97 billion, down from $6.08 billion in its third quarter of 2023.

BCE also said it now expects its revenue for 2024 to fall about 1.5 per cent compared with earlier guidance for an increase of zero to four per cent.

The company says the change comes as it faces lower-than-anticipated wireless product revenue and sustained pressure on wireless prices.

BCE added 33,111 net postpaid mobile phone subscribers, down 76.8 per cent from the same period last year, which was the company’s second-best performance on the metric since 2010.

It says the drop was driven by higher customer churn — a measure of subscribers who cancelled their service — amid greater competitive activity and promotional offer intensity. BCE’s monthly churn rate for the category was 1.28 per cent, up from 1.1 per cent during its previous third quarter.

The company also saw 11.6 per cent fewer gross subscriber activations “due to more targeted promotional offers and mobile device discounting compared to last year.”

Bell’s wireless mobile phone average revenue per user was $58.26, down 3.4 per cent from $60.28 in the third quarter of the prior year.

This report by The Canadian Press was first published Nov. 7, 2024.

Companies in this story: (TSX:BCE)

The Canadian Press. All rights reserved.

TORONTO – Canada Goose Holdings Inc. trimmed its financial guidance as it reported its second-quarter revenue fell compared with a year ago.

The luxury clothing company says revenue for the quarter ended Sept. 29 totalled $267.8 million, down from $281.1 million in the same quarter last year.

Net income attributable to shareholders amounted to $5.4 million or six cents per diluted share, up from $3.9 million or four cents per diluted share a year earlier.

On an adjusted basis, Canada Goose says it earned five cents per diluted share in its latest quarter compared with an adjusted profit of 16 cents per diluted share a year earlier.

In its outlook, Canada Goose says it now expects total revenue for its full financial year to show a low-single-digit percentage decrease to low-single-digit percentage increase compared with earlier guidance for a low-single-digit increase.

It also says it now expects its adjusted net income per diluted share to show a mid-single-digit percentage increase compared with earlier guidance for a percentage increase in the mid-teens.

This report by The Canadian Press was first published Nov. 7, 2024.

Companies in this story: (TSX:GOOS)

The Canadian Press. All rights reserved.

A tiny grain of nuclear fuel is pulled from ruined Japanese nuclear plant, in a step toward cleanup

Health-care spending expected to outpace economy and reach $372 billion in 2024: CIHI

Canadanewsmedia news November 07, 2024: Canada’s health-care spending to reach $372 billion in 2024

DeMar DeRozan scores 27 points to lead the Kings past the Raptors 122-107

PWHL unveils game jerseys with new team names, logos

Who ruined Hobo Hot Springs? Ministry investigates as mystery roils Harrison, B.C.

Saskatchewan’s Jason Ackerman improves to 6-0 at mixed curling nationals

Alberta forestry minister says wolverine, lynx trapping limits lifted to gather data

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation