Business

One-fifth of CIBC mortgage borrowers seeing loan balances grow because of higher interest rates

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/5HVF42RZLZGIROML3I4L2VNNLI.JPG)

CIBC Square in downtown Toronto on Sept. 29, 2021. New data from CIBC show that 20 per cent of the bank’s mortgage holders are seeing their loan balances increase.Fred Lum/the Globe and Mail

Twenty per cent of Canadian Imperial Bank of Commerce mortgage holders are seeing their loan balances grow, as rising interest rates make it harder for them to pay off their homes.

New data from CIBC show that $52-billion worth of mortgages – the equivalent of 20 per cent of the bank’s $263-billion residential loan portfolio – were in a position where the borrower’s monthly payment was not high enough to cover even the interest portion of the loans. The bank has allowed these borrowers to stretch out the length of time it takes to pay off the loan, which is known as the amortization period. As well, borrowers are adding unpaid interest onto their original loan or principal.

The disclosure, contained in a footnote in CIBC’s recent quarterly financial results, is the first from a major bank outlining the amount of variable-rate loans where payments no longer cover interest costs.

It shows the financial duress homeowners are under because of the jump in interest rates. It also highlights the growing risk borrowers face when it comes time to renew their mortgages and their amortization periods are required to shrink back to the lengths of time specified in the original contracts. Then, the borrower will face much higher monthly payments.

“It’s absolutely a sign of stress to come. It’s just the stress isn’t here yet,” said Mike Rizvanovic, financial services analyst with investment bank KBW.

CIBC and most of the other big Canadian banks offer variable-rate mortgages that have fixed monthly payments. That means when interest rates increase, more of the borrower’s fixed monthly payment is used to cover the interest expense. The borrowers’ payments remain steady because their amortization periods are automatically extended.

Borrowers can reach a trigger rate, which often requires them to make higher monthly payments so that they are always reducing the size of their loan.

But CIBC’s variable-rate product allows borrowers to go past the trigger rate and stick with payments that don’t cover the full amount of the interest owed, up to a certain threshold. The unpaid portion of the interest is deferred and added to the mortgage principal and the borrower’s loan balance grows, or negatively amortizes.

Asked whether borrowers with negative amortizations will be able to handle the higher mortgage payments at renewal time, CIBC pointed to comments its chief risk officer said on its recent conference call.

“At this time, we still only see a small portion, less than $20-million, of mortgage balances with clients we see as being at higher risk from a credit perspective,” Frank Guse said.

“We actively monitor our portfolios and pro-actively reach out to clients who are at higher risk of financial stress,” he said according to a transcript provided by CIBC. “Overall, our mortgage portfolio is well positioned and continues to perform well within our expectations.”

At least two other major lenders, Toronto-Dominion Bank and Bank of Montreal, offer similar products that allow mortgages to negatively amortize. However, TD and BMO did not provide any disclosure on the share of borrowers that have a negative amortization. TD did not respond to a query on the matter. BMO spokesman Jeff Roman said its “reporting methodologies are in accordance with industry guidelines.”

CIBC’s filing, for the first quarter that ended in January, is the only one to provide increased transparency on the impact of higher interest rates on its variable-rate portfolio. The same filing said that in the fourth quarter, $39-billion worth of mortgages were negatively amortizing. That grew to $52-billion in the first quarter, said the footnote in the filing. Last summer, the bank said its borrowers were not yet putting unpaid interest onto the principal.

“Higher mortgage rates have resulted in a greater portion of fixed-payment variable mortgages where the monthly mortgage payment does not cover interest and principal,” said Nigel D’Souza, financial services analyst with Veritas Investment Research. “The full impact of higher mortgage rates will be reflected on renewal,” he said.

Today, the Bank of Canada’s benchmark interest rate is 4.5 per cent compared with 0.25 per cent a year ago.

The most recent quarterly filings from the big banks show that a chunk of their mortgage loans have amortization periods of more than 30 years.

At BMO, the proportion of residential mortgages with amortization periods longer than 30 years reached 32.4 per cent in January. At CIBC, the percentage was 30 per cent. At TD it was 29.3 per cent and at Royal Bank of Canada, it was 25 per cent, according to their regulatory filings.

Mr. D’Souza said the payment increase or shock at the time of renewal will be higher for negatively amortizing mortgages compared with variable-rate products that do not have fixed monthly payments and have faced payment increases with every Bank of Canada interest rate hike.

Business

CANADIAN ACCOUNTANTS TELL ALL ON STATE OF SMB FINANCES IN NEW SURVEY

Accountants “open the books” on inflation, interest rates, technology, and lack of SMB support

TORONTO – Nov. 19, 2024 – A recent survey of 500 Canadian accountants has revealed several surprising conclusions about their frustrations, fears, thoughts on provincial support for SMBs, the investments that make them wary, and how many clients are actually using the financial technology they need.

And for a little fun, the survey even identified which Canadian celebrity they would back as an SMB CEO.

The survey conducted on behalf of Plooto, a leading payment automation solution for small-to-midsize businesses (SMBs), asked accountants, bookkeepers, and finance professionals a series of revealing questions that provide a snapshot of the current state of Canada’s accounting industry.

Key Findings of the Survey:

- IT’S HARD OUT THERE FOR AN SMB

Asked what they think are the biggest financial threats to Canadian SMBs, more than half of Canadian accountants (54.5%) said ‘inflation increasing their own costs.’ This was followed by interest rates making borrowing rates more expensive (46.1%); staff turnover (41.2%); lower prices offered by larger corporations in the same space (39%); interest rates cooling on consumer spending (34.1%) and foreign competition (32%).

- ACCOUNTANTS CALL OUT ONTARIO’S SMB SUPPORT

Asked which province they think is doing the least to help SMBs succeed, a definitive quarter (24.5%) of accountants cited Ontario. Quebec was a distant second at 15%; followed by Alberta (13.3%); BC (11.4%); Manitoba and Newfoundland and Labrador (tied at 7.25%); Saskatchewan (5.9%); and New Brunswick and PEI (tied at 4.9%). Accountants considered Nova Scotia as the province doing the most for SMBs, with the lowest vote of 4%.

- ACCOUNTANTS SHINE THE LIGHT ON COSTLY SMB MISTAKES

Asked what the biggest financial mistake they see Canadian SMBs make on a regular basis, 21% of Canadian accountants said ‘not implementing the proper technology.’ This was followed by ‘not paying enough attention to cash flow’ (19%); investing in elaborate and expensive workplaces (12.2%); hiring too quickly (10.6%); buying rather than leasing equipment (10%); overpaying to attract a top-tier executive (9.8%); hiring too slowly (9.2%); and funding the first year with non-submitted HST payments (8.0%).

- ACCOUNTANTS HESITATE TO ADVISE INVESTMENT IN ENTERTAINMENT AND EDUCATION

Based on the profitability of their current clients, accountants said they would NEVER invest in: arts, entertainment and recreation (32.2%), educational services (24.5%), travel and hospitality (22.9%), agriculture, forestry, fishing and hunting (19.8%) and; finance and insurance (19.6%).

- THE ECONOMY IS CLEARLY KEEPING ACCOUNTANTS UP AT NIGHT

Asked to choose the factors that are keeping them up at night, 48.8% said ‘current interest rates,’ followed by ‘fear of a recession’ (46.7%); ‘worry that their SMB clients will go under’ (29.6%); the current Federal Government (27.3%); ‘another pandemic’ (26.9%); the 2024 U.S. elections (25.3%.) and; ‘a different Federal Government coming into power’ (25.1%).

- ACCOUNTANT IRRITATIONS UP CLOSE

Asked what the most irritating things their clients do on a regular basis are, Canadian accountants said ‘not sending required information’ (64.7%); not reading financial reports (50.2%); not making time to discuss financial reports (48.4%); not paying invoices on time (47.8%); submitting information with ‘bad math’ (44.5%) and; not listening to recommendations (44.3%).

- SMBs DON’T HAVE ALL OF THE TECH RESOURCES THEY NEED

Accountants say less than a third (31.4%) of clients have all of the tech in place that they need, despite its far-reaching benefits.

When their clients use fintech, 65.1% of clients can reconcile their books faster, and 56% can make and receive payments faster.

Bonus Insight:

RYAN REYNOLDS COULD RULE THE C-SUITE

Asked which Canadian celebrity they thought would be the most effective in running a SMB, nearly a quarter of Canadian accountants said Ryan Reynolds (27.1%). Reynolds edged out business celebrity Kevin O’Leary (22%) and left Keanu Reeves (15.3%), Drake (12.6%), Arlene Dickenson (8.6%), and Michele Romano (4.1%) as distant alternatives.

PLEASE REFER TO THIS AS A SURVEY BY PLOOTO IN ANY MEDIA MENTIONS

Business

Which Candidate Would You Hire? A or B?

Speaking from personal experience, a bad hire isn’t a good look. The last thing you want is to hear, “Who the hell hired Bob?” and have your hiring judgment questioned.

The job seeker who’s empathetic to the employer’s side of the hiring desk, which controls the hiring process, is rare.

One of the best things you can do to enhance your job search is to practice perspective-taking, which involves seeing things from a different perspective.

It’s natural for employers to find candidates who have empathy and an understanding of their challenges and pain points more attractive. Candidates like these are seen as potential allies rather than individuals only looking out for themselves. Since most job seekers approach employers with a ‘what’s in it for me’ mindset, practicing perspective-taking sets you apart.

“If there is any one secret of success, it lies in the ability to get the other person’s point of view and see things from that person’s angle as well as from your own.” – Henry Ford.

Perspective-taking makes you realize that from an employer’s POV hiring is fraught with risks employers want to avoid; thus, you consider what most job seekers don’t: How can I present myself as the least risky hiring option?

Here’s an exercise that’ll help you visualize the employer’s side of the hiring process.

Candidate A or B?

Imagine you’re the Director of Customer Service for a regional bank with 85 branches. You’re hiring a call centre manager who’ll work onsite at the bank’s head office, overseeing the bank’s 50-seat call centre. In addition to working with the call centre agents, the successful candidate will also interact with other departments, your boss, and members of the C-suite leadership team; in other words, they’ll be visible throughout the bank.

The job posting resulted in over 400 applications. The bank’s ATS and HR (phone interview vetting, skill assessment testing) selected five candidates, plus an employee referral, for you to interview. You aim to shortlist the six candidates to three, whom you’ll interview a second time, and then make a hiring decision. Before scheduling the interviews, which’ll take place between all your other ongoing responsibilities, you spend 5 – 10 minutes with each candidate’s resume and review their respective digital footprint and LinkedIn activity.

In your opinion, which candidate deserves a second interview?

Candidate A: Their resume provides quantitative numbers—evidence—of the results they’ve achieved. (Through enhanced agent training, reduced average handle time from 4:32 mins. to 2:43 minutes, which decreased the abandon rate from 4.6% to 2.2%.)

Candidate B: Their resume offers only opinions. (“I’m detail-oriented,” “I learn fast.”)

Candidate A: Looks you in the eye, has a firm handshake, smiles, and exudes confidence.

Candidate B: Doesn’t look you in the eye, has a weak handshake.

Candidate A: Referred by Ariya, who’s been with the bank for over 15 years and has a stellar record, having moved up from teller to credit analyst and is tracking to become a Managing Director.

Candidate B: Applied online. Based on your knowledge, they did nothing else to make their application more visible. (e.g., reached out to you or other bank employees)

Candidate A: Well educated, grew up as a digital native, eager and energetic. Currently manages a 35-seat call center for a mid-size credit union. They mention they called the bank’s call centre several times and suggest ways to improve the caller experience.

Candidate B: Has been working in banking for over 25 years, managing the call center at their last bank for 17 years before being laid off eight months ago. They definitely have the experience to run a call centre. However, you have a nagging gut feeling that they’re just looking for a place to park themselves until they can afford to retire.

Candidate A: Has a fully completed LinkedIn profile (picture, eye-catching banner) packed with quantifying numbers. It’s evident how they were of value to their employers. Recently, they engaged constructively with posts and comments and published a LinkedIn article on managing Generations Y and Z call centre agents. Their Facebook, Instagram, and Twitter/X accounts aren’t controversial, sharing between ‘Happy Birthday’ and ‘Congratulations’ messages, their love of fine dining, baseball, and gardening.

Candidate B: Their LinkedIn profile is incomplete. The last time they posted on LinkedIn was seven months ago, ranting about how the government’s latest interest rate hike will plunge the country into a deep recession. Conspiracy theories abound on their Facebook page.

Candidate A: Notices the golf calendar on your desk, the putter and golf balls in the corner, and a photograph of Phil Mickelson putting on the green jacket at the 2010 Masters hanging on your wall. While nodding towards the picture, they say, “Evidently, you golf. Not being a golfer myself, what made you take up golf, which I understand is a frustrating sport?”

Candidate B: Doesn’t proactively engage in small talk. Waits for you to start the interview.

Which of the above candidates presents the least hiring risk? Will likely succeed (read: achieve the results the employer needs)? Will show your boss, upper management, and employees you know how to hire for competence and fit?

_____________________________________________________________________

Nick Kossovan, a well-seasoned veteran of the corporate landscape, offers “unsweetened” job search advice. You can send Nick your questions to artoffindingwork@gmail.com.

Business

Job Seekers’ Trinity Focus, Anger and Evidence

Though I have no empirical evidence to support my claim, I believe job search success can be achieved faster by using what I call “The Job Seekers’ Trinity” as your framework, the trinity being:

- The power of focus

- Managing your anger

- Presenting evidence

Each component plays a critical role in sustaining motivation and strategically positioning yourself for job search success. Harnessing your focus, managing your anger, and presenting compelling evidence (read: quantitative numbers of achieved results) will transform your job search from a daunting endeavour into a structured, persuasive job search campaign that employers will notice.

The Power of Focus

Your job search success is mainly determined by what you’re focused on, namely:

- What you focus on.

Your life is controlled by what you focus on; thus, focusing on the positives shapes your mindset for positive outcomes. Yes, layoffs, which the media loves to report to keep us addicted to the news, are a daily occurrence, but so is hiring. Don’t let all the doom and gloom talk overshadow this fact. Focus on where you want to go, not on what others and the media want you to fear.

Bonus of not focusing on negatives: You’ll be happier.

- Focus on how you can provide measurable value to employers.

If you’re struggling with your job search, the likely reason is that you’re not showing, along with providing evidence, employers how you can add tangible value to an employer’s bottom line. Business is a numbers game, yet few job seekers speak about their numbers. If you don’t focus on and talk about your numbers, how do you expect employers to see the value in hiring you?

Managing Your Anger

Displaying anger in public is never a good look. Professionals are expected to control their emotions, so public displays of anger are viewed as unprofessional.

LinkedIn has become a platform heavily populated with job seekers posting angry rants—fueled mainly by a sense of entitlement—bashing and criticizing employers, recruiters, and the government, proving many job seekers think the public display of their anger won’t negatively affect their job search.

When you’re unemployed, it’s natural to be angry when your family, friends, and neighbours are employed. “Why me?” is a constant question in your head. Additionally, job searching is fraught with frustrations, such as not getting responses to your applications and being ghosted after interviews.

The key is acknowledging your anger and not letting it dictate your actions, such as adding to the angry rants on LinkedIn and other social media platforms, which employers will see.

Undoubtedly, rejection, which is inevitable when job hunting, causes the most anger. What works for me is to reframe rejections, be it through being ghosted, email, a call or text, as “Every ‘No’ brings me one step closer to a ‘Yes.'”

Additionally, I’ve significantly reduced triggering my anger by eliminating any sense of entitlement and keeping my expectations in check. Neither you nor I are owed anything, including a job, respect, empathy, understanding, agreement, or even love. A sense of entitlement and anger are intrinsically linked. The more rights you perceive you have, the more anger you need to defend them. Losing any sense of entitlement you may have will make you less angry, which has no place in a job search.

Presenting Evidence

As I stated earlier, business is a numbers game. Since all business decisions, including hiring, are based on numbers, presenting evidence in the form of quantitative numbers is crucial.

Which candidate would you contact to set up an interview if you were hiring a social media manager:

- “Managed Fabian Publishing’s social media accounts, posting content daily.”

- “Designed and executed Fabian Publishing’s global social media strategy across 8.7 million LinkedIn, X/Twitter, Instagram and Facebook followers. Through consistent engagement with customers, followers, and influencers, increased social media lead generation by 46% year-over-year, generating in 2023 $7.6 million in revenue.”

Numerical evidence, not generic statements or opinions, is how you prove your value to employers. Stating you’re a “team player” or “results-driven,” as opposed to “I’m part of an inside sales team that generated in 2023 $8.5 million in sales,” or “In 2023 I managed three company-wide software implementations, all of which came under budget,” is meaningless to an employer.

Despite all the job search advice offered, I still see resumes and LinkedIn profiles listing generic responsibilities rather than accomplishments backed by numbers. A statement such as “managed a team” doesn’t convey your management responsibilities or your team’s achievements under your leadership. “Led a team of five to increase sales by 20%, from $3.7 million to $4.44 million, within six months” shows the value of your management skills.

Throughout your job search, constantly think of all the numbers you can provide—revenue generated, number of new clients, cost savings, reduced workload, waste reduction—as evidence to employers why you’d be a great value-add to their business.

The Job Seekers’ Trinity—focusing on the positive, managing your anger and providing evidence—is a framework that’ll increase the effectiveness of your job search activities and make you stand out in today’s hyper-competitive job market, thus expediting your job search to a successful conclusion.

_____________________________________________________________________

Nick Kossovan, a well-seasoned veteran of the corporate landscape, offers “unsweetened” job search advice. You can send Nick your questions to artoffindingwork@gmail.com.

-

News20 hours ago

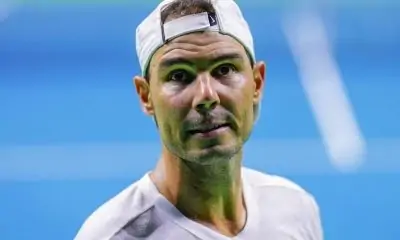

News20 hours agoRafael Nadal calls it an emotional day as he loses in the Davis Cup before retirement

-

News19 hours ago

News19 hours agoMontreal mayor supports Polytechnique survivors’ call for complete assault weapon ban

-

News17 hours ago

News17 hours agoCalgary doctor charged with sexual assaulting patients at clinic

-

News17 hours ago

News17 hours agoSex abuse case: Judge orders seizure of homes belonging to billionaire Robert Miller

-

Business18 hours ago

CANADIAN ACCOUNTANTS TELL ALL ON STATE OF SMB FINANCES IN NEW SURVEY

-

News19 hours ago

Jimmy John’s opens its first Canadian location

-

News20 hours ago

News20 hours agoTampa Bay Rays say new St. Pete stadium is unlikely to be ready for 2028 season, if at all

-

News17 hours ago

News17 hours agoGovernment spending in limbo as Tories, Liberals continue game of chicken in House