Real eState

Opportunistic real estate buyers step to the stage as prices decline

|

|

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/S7EN63YQAFCQRH3N5PUH4XFJBM.JPG)

A home for sale on Woodfield Rd. in Toronto’ east end near Toronto’s Little India neighbourhood.Fred Lum/the Globe and Mail

The real estate market in Toronto and surrounding areas is heading into October in a state of calm, but buyers and sellers appear to have some angst about the weeks to come.

October often marks the peak of the fall market: September’s whirl of events has settled down and the traditional winter retreat in real estate is several weeks away.

Ira Jelinek, real estate agent with Harvey Kalles Real Estate Ltd., is seeing an increasing number of “opportunistic” buyers emerge after prices fell from their February peak.

Some have been looking at properties for years and years and years, he says.

“They see the market has shifted and they’re finally ready to step in,” he says.

Mr. Jelinek describes the opportunistic buyers as those who are firm with their offer but less aggressive than the extreme low ballers.

On a property with an asking price of $1.5-million, for example, an opportunistic buyer might offer $1.275-million. When Mr. Jelinek says he’ll take the offer to the seller, the buyer emphasizes that he or she is not willing to negotiate and that the offer is firm.

Listing agents often snub an unacceptable offer with a dismissive, “I don’t think this property is for them.”

New properties landed on the market in September, but inventory was light compared with some previous years.

Mr. Jelinek notes that parents were busy getting children back to school and signed up for fall activities. In some areas of midtown, he expects more listings to land on the market following the Jewish holidays of Rosh Hashanan and Yom Kippur.

“A lot of people wait until the holidays are over,” he says. “I have clients that are holding off until October.”

When the time comes to set an asking price, Mr. Jelinek shows sellers recent sale prices for comparable properties, he says. In a declining market, they should not expect to exceed those recent benchmarks.

Unrealistic sellers, however, face the risk of the property becoming stale if they go through a series of reductions, he points out.

“It can sometimes lead to death by 1,000 slashes. It’s not fun to go down that path,” Mr. Jelinek says.

In an unforgiving market, by the time the sellers realize they’re not getting the $1.5-million they were aiming for, they may find the $1.3-million they could have received has slipped to $1.2-million, he points out.

Farah Omran, economist at Bank of Nova Scotia, says the national market – heavily tilted in favour of sellers in the past – is now in balanced territory. The recalibration in the housing market has so far been a reasonably orderly and welcome process, in Ms. Omran’s opinion.

According to the Canadian Real Estate Association, the national average sale price in August stood at $637,673 after hitting a high water mark of $816,720 in February.

Higher mortgage rates and other factors have led to less demand for homes, Ms. Omran says, pointing to buyers who advanced their plans to buy in 2021.

She expects housing markets across the country to continue to moderate into next year.

“The speed at which the moderation is occurring might seem alarming right now,” she says, but once attitudes adjust, she predicts a less disquieting pace of adjustment.

Tanya Rocca, agent with Royal LePage Burloak Real Estate Services, says an increase in inventory is giving buyers more selection in the Burlington, Ont., area, but many are still hesitant.

A flurry of sales at the end of August gave way to a more steady pace in September, she says.

According to the Realtors Association of Hamilton-Burlington, sales increased 11.7 per cent in August from July. Compared with August, 2021, sales fell 24 per cent.

The average price in the region was $858,405 in August, which marks a 2.3-per-cent dip from July and a 2-per-cent increase from the same month last year.

Ms. Rocca says many of the transactions in August came as buyers tried to use their pre-approved mortgage agreements before they expired and interest rates continued to rise.

Early in September, the Bank of Canada raised its key interest rate by three-quarters of a percentage point to 3.25 per cent. Bay Street economists are forecasting another hike this month.

Ms. Rocca says some buyers are waiting for a further reduction in prices but she doesn’t anticipate a large crash. So far the decrease in prices has not offset the increase in rates for most people.

“It’s not like if you wait you’re going to get some massive deal,” she says. “The problem is whether you have the ability anymore.”

Ms. Rocca points out that many buyers who purchased homes in recent years did so with gifts from family.

Some aspiring first-time buyers today may have help, but also anxiety about making mortgage payments.

“It’s one thing to have the down payment. It’s a whole other thing to carry the home,” Ms. Rocca says.

Another cohort is worried about renewing a mortgage at a higher rate when the current term is up.

“It’s a scary notion for some people.”

Ms. Rocca says many potential sellers have a negative mindset when they hear that prices have dropped between 25 and 30 per cent over the past six months. But the market had an unsustainable run-up with a gain of about 60 per cent in some areas over the past couple of years.

Many sellers are accepting that giving up some of the gain isn’t so bad given the longer-term appreciation, she says.

“They’re calling because they want to talk. They want to understand what’s going on,” she says. “They are making plans.”

Real eState

Judge Approves $418 Million Settlement That Will Change Real Estate Commissions

|

|

A settlement that will rewrite the way many real estate agents are paid in the United States has received preliminary approval from a federal judge.

On Tuesday morning, Judge Stephen R. Bough, a United States district judge, signed off on an agreement between the National Association of Realtors and home sellers who sued the real estate trade group over its longstanding rules on commissions to agents that they say forced them to pay excessive fees.

The agreement is still subject to a hearing for final court approval, which is expected to be held on Nov. 22. But that hearing is largely a formality, and Judge Bough’s action in U.S. District Court for the Western District of Missouri now paves the way for N.A.R. to begin implementing the sweeping rule changes required by the deal. The changes will likely go into full effect among brokerages across the country by Sept. 16.

N.A.R., in a statement from spokesman Mantill Williams, welcomed the settlement’s preliminary approval.

“It has always been N.A.R.’s goal to resolve this litigation in a way that preserves consumer choice and protects our members to the greatest extent possible,” he said in an email. “There are strong grounds for the court to approve this settlement because it is in the best interests of all parties and class members.”

N.A.R. reached the agreement in March to settle the lawsuit, and a series of similar claims, by making the changes and paying $418 million in damages. Months earlier, in October, a jury had reached a verdict that would have required the organization to pay at least $1.8 billion in damages, agreeing with homeowners who argued that N.A.R.’s rules on agent commissions forced them to pay excessive fees when they sold their property.

The group, which is based in Chicago and has 1.5 million members, has wielded immense influence over the real estate industry for more than a century. But home sellers in Missouri, whose lawsuit against N.A.R. and several brokerages was followed by multiple copycat claims, successfully argued that the group’s rule that a seller’s agent must make an offer of commission to a buyer’s agent led to inflated fees, and that another rule requiring agents to list homes on databases controlled by N.A.R. affiliates stifled competition.

By mandating that commission be split between agents for the seller and buyer, N.A.R., and brokerages who required their agents to be members of N.A.R., violated antitrust laws, according to the lawsuits. Such rules led to an industrywide standard commission that hovers near 6 percent, the lawsuits said. Now, agents will be essentially blocked from making those commission offers, a shift that will, some industry analysts say, lower commissions across the board and eventually force down home prices as a result.

Real estate agents are bracing for pain.

“We are concerned for buyers and potentially how we will get paid for working with buyers moving forward,” said Karen Pagel Guerndt, a Realtor in Duluth, Minn. “There’s a lot of ambiguity.”

The preliminary approval of the settlement comes as the Justice Department reopens its own investigation into the trade group. Earlier this month, the U.S. Court of Appeals for the District of Columbia overturned a lower-court ruling from 2023 that had quashed the Justice Department’s request for information from N.A.R. about broker commissions and how real estate listings are marketed. They now have the green light to scrutinize those fees and other N.A.R. rules that have long confounded consumers.

“This is the first step in bringing about the long awaited change,” said Michael Ketchmark, the lawyer who represented the home sellers in the main lawsuit. “Later this summer, N.A.R. will begin changing the way that homes are bought and sold in our country and this will eventually lead to billions of dollars and savings for homeowners.”

Under the settlement, homeowners who sold homes in the last seven years could be eligible for a small piece of a consolidated class-action payout. Depending on how many homeowners file claims by the deadline of May 9, 2025, that could mean tens of millions of Americans.

Real eState

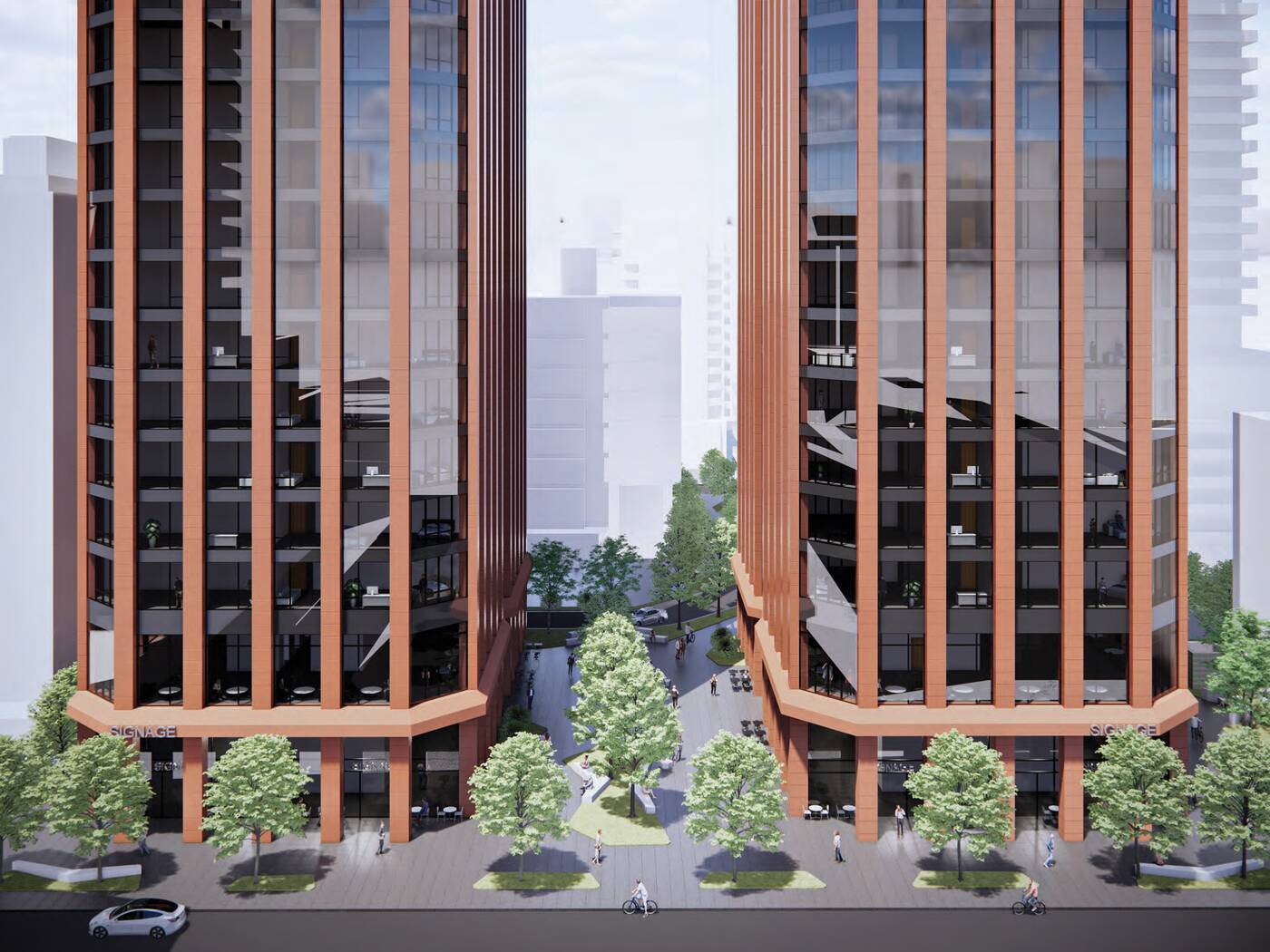

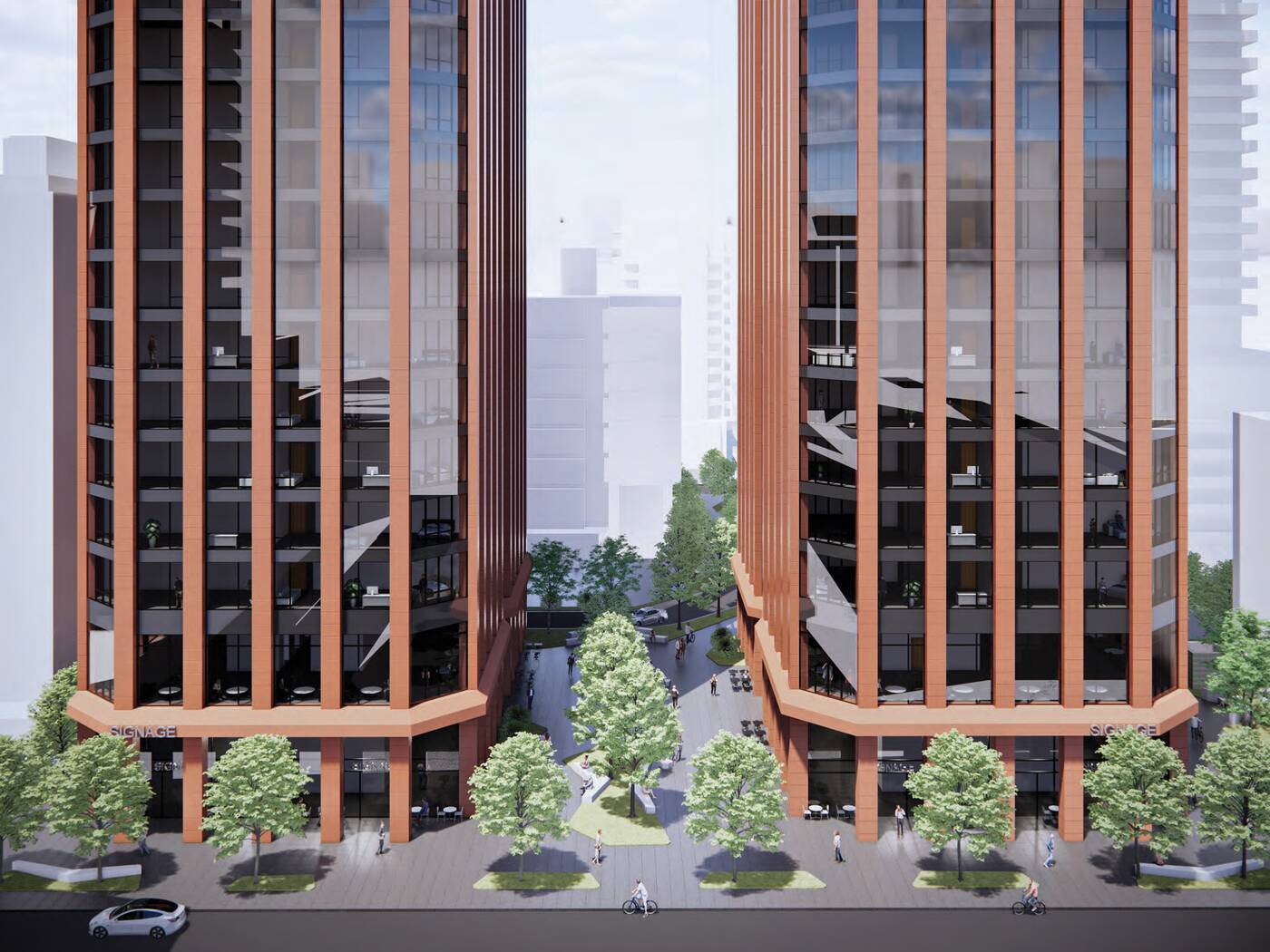

Two matching megacomplexes to totally transform Toronto neighbourhood

|

|

A pair of twinned proposals aim to completely redefine the skyline of Toronto’s midtown area with an architectural statement that would set the neighbourhood apart from other high-rise clusters in the city.

Two separate proposals from developer Madison Group at 110 and 150 Eglinton Avenue East have been resubmitted to city planners, calling for two pairs of mixed-use condominium towers with standout designs unlike anything that exists in the city today.

In a surprising twist from a developer not exactly known for breaking the bank on architecture, the proposals now boast brand-new complementary designs from acclaimed firm Rafael Viñoly Architects.

The 110 Eglinton site, currently home to a pair of mid-rise office buildings, would be demolished and built out with two 58-storey towers.

A few doors to the east, the 150 Eglinton site includes a handful of mid-rise and low-rise commercial buildings along Eglinton, wrapping around Redpath Avenue. These buildings would also be demolished and replaced with a pair of 61-storey towers.

All four towers will feature matching designs boasting red aluminum cladding forming vertical piers that accentuate the towers’ heights, though there will be some key differences between the pairs at 110 and 150 Eglinton.

150 Eglinton East

The 58-storey towers at 110 Eglinton East will be linked via an enormous floating bridge spanning levels five through 10, framing a large open public space below and supporting an elevated residential amenity floor above.

The 61-storey towers lack a skybridge, but will also feature amenity levels with panoramic views, including spaces on the 28th and 40th floors.

At heights of just over 236 metres, these four towers all stand taller than anything that exists in the neighbourhood as of 2024.

The combined proposals would add a staggering 3,364 condominium units to the neighbourhood, along with new retail and office space to maintain employment uses along this evolving corridor.

One standout of the proposals is a series of privately-owned publicly accessible spaces measuring over 5,000 square metres across the combined sites.

Among the publicly-accessible spaces proposed are the aforementioned area below the bridge at 110 Eglinton, along with pedestrian walkways that will allow foot traffic to filter through the block between Eglinton and Roehampton Avenue to the north.

It’s the type of proposal one would expect to be met with significant local backlash. However, early feedback from the neighbourhood is surprisingly positive.

Local city councillor Josh Matlow took to X to voice his support for the project, calling it “genuinely exciting.”

“The architecture is beautifully designed,” said Matlow, hyping up locals with a promise that renderings of the new public space would wow the community. It’s remarkable for our community and city — like bringing Rockefeller Center to midtown Toronto,” said Matlow.

Real eState

This Toronto home is a ’90s decor trip but a steal at only $600K

|

|

If you’re a millennial and grew up in the ’90s, you’ll probably remember a fair amount of ’90s home decor trends that might still haunt you to this day.

There were sponge-painted walls, all-beige everything, wallpaper borders, oak cabinets, carpets in places where there shouldn’t be carpets, bedroom sets from big-box stores, Southwestern or Tuscan decor in homes that weren’t in Arizona or Italy, and the list goes on.

We thought we’d left those troubling times in the past, but 39 Hatherley Rd. really brings back all those memories.

The front porch.

Somehow this two-bedroom, one-bathroom house hit almost every ’90s trend, except for carpets in the bathroom (phew!).

The entryway.

What’s weird is this house has changed ownership a few times since the 90s. In fact, it was most recently purchased in 2010 for $250,000.

The living room.

So it’s somewhat surprising that when you look at past listing photos, almost nothing has changed. In fact, it seems they added the sponge-painted walls in 2010.

The kitchen.

But despite 39 Hartherley Rd. being a total throwback, this house is, as the listing says, “a diamond in the rough.”

The backyard.

First off, it’s a detached house with a 125-foot deep lot in a good location.

The kitchen has plenty of storage but, sadly, no dishwasher.

The main floor has a living room and kitchen with enough space for a dining table.

The main floor.

The layout is a bit awkward but the Dutch door off the kitchen is too cute.

The back patio.

Off the kitchen is a laundry room/mud room that leads to the spacious backyard.

The primary bedroom.

Upstairs, there are two decently sized rooms and a small bathroom.

The second bedroom.

The house definitely needs some updating but the roof was done in 2015, the furnace is only a few years old, the electrical has been updated, and there’s room for expansion.

A fireplace in the living room.

Also, a coat of paint will do wonders to brighten up the all-beige ’90s aesthetic.

The small bathroom.

However, the biggest selling point of this home is the price point.

The back of the house.

39 Hatherley Rd. is listed for only $599,999, which is almost unheard of in Toronto, even if this place will probably go for closer to $700K.

-

Health14 hours ago

Health14 hours agoRemnants of bird flu virus found in pasteurized milk, FDA says

-

Art20 hours ago

Mayor's youth advisory council seeks submissions for art gala – SooToday

-

Health18 hours ago

Health18 hours agoBird flu virus found in grocery milk as officials say supply still safe

-

Investment19 hours ago

Investment19 hours agoTaxes should not wag the tail of the investment dog, but that’s what Trudeau wants

-

Science23 hours ago

Science23 hours agoiN PHOTOS: Nature lovers celebrate flora, fauna for Earth Day in Kamloops, Okanagan | iNFOnews | Thompson-Okanagan's News Source – iNFOnews

-

News19 hours ago

Peel police chief met Sri Lankan officer a court says ‘participated’ in torture – Global News

-

Media14 hours ago

Vaughn Palmer: B.C. premier gives social media giants another chance

-

Art20 hours ago

An exhibition with a cause: Montreal's 'Art by the Water' celebrates 15 years – CityNews Montreal