MEXICO CITY (AP) — Schools in Mexico will have six months to implement a government-sponsored ban on junk food or else face heavy fines, officials said Monday.

The rules, published on Sept. 30, target products that have become staples for two or three generations of Mexican schoolkids: sugary fruit drinks sold in triangular cardboard cartons, chips, artificial pork rinds and soy-encased, salty peanuts with chile. School administrators who violate the order will face fines equivalent to between $545 and $5,450, which could double for a second offense, amounting to nearly a year’s wages for some of them.

Mexico’s children have the highest consumption of junk food in Latin America and many get 40% of their total caloric intake from it, according to the U.N. Children’s Fund which labeled child obesity there an emergency.

The new ban targets products that have become staples for two or three generations of Mexican schoolkids: sugary fruit drinks sold in triangular cardboard cartons, chips, artificial pork rinds and soy-encased, salty peanuts with chile.

Previous attempts to implement laws against so-called ‘junk food’ have met with little success.

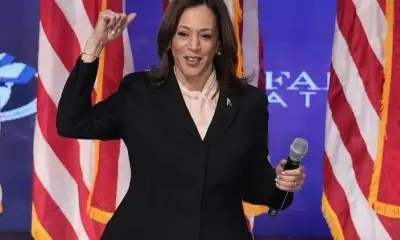

President Claudia Sheinbaum said Monday schools would have to offer water fountains and alternative snacks, like bean tacos.

“It is much better to eat a bean taco than a bag of potato chips,” Sheinbaum said. “It is much better to drink hibiscus flower water than soda.”

However, the vast majority of Mexico’s 255,000 schools nationwide do not have free drinking water available to students. According to a report in 2020, the effort to install drinking fountains succeeded in only about 10,900 of the country’s schools, or about 4% of them. Many Schools are located in areas so poor or remote that they struggle to maintain acceptable bathrooms, internet connection or electricity.

Also the most common recipes for beans, refried beans, usually contain a significant dose of lard, which would violate rules against saturated fats.

Mexico instituted front-of-package warning labels for foods between 2010 and 2020, to advise consumers about high levels of salt, added sugar, excess calories and saturated fats. Some snack foods carry all four of the black, octagonal warning labels.

But under the new rules, schools will have to phase out any product containing even a single warning label from school snack stands. It wasn’t immediately clear how the government would enforce the ban on the sidewalks outside schools, where vendors usually set up tables of goods to sell to kids at recess.

Mexican authorities say the country has the worst childhood obesity problem in the world, with about one-third of children overweight or obese.