Media

Parler is back online; Gamergate 2.0 hits gaming company Sweet Baby – USA TODAY

Parler, the “censorship-free” social media platform extremists used to hype the Jan. 6 insurrection, is back after an almost one-year hiatus. Meanwhile, online trolls are targeting a video game company and calling themselves “Gamergate 2.0.” And lawsuits stemming from a 2022 extremist mass shooting could change the way courts look at social media’s role in mass killings.

It’s the week in extremism.

Plus:Our new USA TODAY report on social-media monitoring in the Air Force

Controversial social media platform Parler is back

About 3½ years ago, a then-new social media platform, Parler, had a moment. The site had become a go-to communication source for extremists who had been kicked off other platforms, often for posts that violated rules against hate speech. It played a role in the prelude to the Jan. 6, 2021, insurrection. Then, last year, it was shut down.

Now, Parler is back. And its new owners are promising the site won’t become what it once was.

- The site is perhaps most famous for its use in the weeks leading up to the Jan. 6 insurrection: USA TODAY compiled Parler posts members of the extremist group the Proud Boys posted on the site before the attack on the Capitol, including one by the group’s leader Enrique Tarrio referring to then-President Donald Trump’s now-infamous message to the group to “stand back and stand by.” Tarrio wrote on Parler: “Standby order has been rescinded.” Other groups including the Oath Keepers, who later saw many top members imprisoned, posted to Parler as well.

- Parler was removed from Apple and Google’s app stores after the insurrection.

- Gizmodo reports Parler was bought by a media conglomerate last year and was shut down for almost a year while the new owners organized the site’s comeback. It relaunched this week and is back on Apple and Google’s app stores.

- Ryan Rhodes, one of the site’s new owners, told WIRED magazine: “Our goal is to make Parler what it could have been, as a true open platform for everybody to have discourse, right or left.”

Online trolls attack gaming company, calling themselves ‘Gamergate 2.0’

Right-wing internet trolls have been targeting the video game consulting company “Sweet Baby,” claiming falsely that it pushes diversity and inclusion principles into games, according to a new report from the progressive analysis group Media Matters for America. People involved in the attacks have branded themselves “Gamergate 2.0,” in reference to a similar harassment campaign against women in gaming that began in 2014.

- Media Matters found that mentions of Sweet Baby on the “Politically Incorrect” message board on 4Chan, where the original Gamergate largely began, have spiked since the beginning of March, with more than 500 mentions since then.

- The report found that videos criticizing the company on YouTube have received millions of views combined, according to the tracking tool BuzzSumo.

- Media Matters says the online critics think Sweet Baby is “pushing a ‘woke’ agenda by working toward greater diversity, equity, and inclusion.”

- Media Matters Senior Researcher Alex Kaplan told USA TODAY: “The recent targeting of Sweet Baby is extremely concerning because it is reminiscent of Gamergate, with some of the same fringe entities and online spaces involved, like 4Chan.”

- Sweet Baby co-founder David Bédard tells The Verge: “The things they say in our inboxes is … the most evil stuff you’ve ever seen in your life.”

Shooting lawsuits against major social media companies advance

A judge cleared the way this week for several lawsuits stemming from the 2022 white supremacist mass shooting at a Tops supermarket in Buffalo, New York, in which 10 people were killed. The lawsuits target large social media companies for allowing hate and extremism on their platforms and for profiting from such posts, alleging they influenced the shooter in the case, Peyton Gendron.

- As CNN reported Tuesday, Erie County Supreme Court Justice Paula Feroleto denied a motion to dismiss the lawsuits filed by attorneys for the tech giants, including Meta, Alphabet and Reddit.

- Attorneys for the social media companies attempted to argue the platforms are akin to message boards, which simply host third-party content. But Feroleto ruled the “plaintiffs contend the defendants’ platforms are more than just message boards … They allege they are sophisticated products designed to be addictive to young users and they specifically directed Gendron to further platforms or postings that indoctrinated him with ‘white replacement theory,’”

- “While we disagree with today’s decision and will be appealing, we will continue to work with law enforcement, other platforms, and civil society to share intelligence and best practices,” a YouTube spokesperson told CNN in a statement.

Tech companies have previously managed to avoid legal responsibility for hosting extremist and hateful content or for platforming mass killers. Recently, however, plaintiffs have brought successful lawsuits against firearms manufacturers and prosecutors have successfully tried a mass shooter’s parents. The New York State lawsuits could open a new front in the fight to hold accountable companies and individuals who fail to recognize or stop mass shooters.

Statistic of the week: Life in prison

That was the sentence handed down this week to Robert Justus, a convicted former member of the extremist “Boogaloo” movement, for the 2020 drive-by shooting of a security guard in Oakland.

The shooting happened in the midst of civil unrest following the murder of George Floyd. Another adherent of the “Boogaloo Boys,” a meme-focused movement built on hatred of the federal government, was sentenced to 41 years in prison for the shooting in 2022.

Will Carless is a national correspondent covering extremism and emerging issues. Contact him at wcarless@usatoday.com. Follow him on X @willcarless.

Media

Trump could cash out his DJT stock within weeks. Here’s what happens if he sells

Former President Donald Trump is on the brink of a significant financial decision that could have far-reaching implications for both his personal wealth and the future of his fledgling social media company, Trump Media & Technology Group (TMTG). As the lockup period on his shares in TMTG, which owns Truth Social, nears its end, Trump could soon be free to sell his substantial stake in the company. However, the potential payday, which makes up a large portion of his net worth, comes with considerable risks for Trump and his supporters.

Trump’s stake in TMTG comprises nearly 59% of the company, amounting to 114,750,000 shares. As of now, this holding is valued at approximately $2.6 billion. These shares are currently under a lockup agreement, a common feature of initial public offerings (IPOs), designed to prevent company insiders from immediately selling their shares and potentially destabilizing the stock. The lockup, which began after TMTG’s merger with a special purpose acquisition company (SPAC), is set to expire on September 25, though it could end earlier if certain conditions are met.

Should Trump decide to sell his shares after the lockup expires, the market could respond in unpredictable ways. The sale of a substantial number of shares by a major stakeholder like Trump could flood the market, potentially driving down the stock price. Daniel Bradley, a finance professor at the University of South Florida, suggests that the market might react negatively to such a large sale, particularly if there aren’t enough buyers to absorb the supply. This could lead to a sharp decline in the stock’s value, impacting both Trump’s personal wealth and the company’s market standing.

Moreover, Trump’s involvement in Truth Social has been a key driver of investor interest. The platform, marketed as a free speech alternative to mainstream social media, has attracted a loyal user base largely due to Trump’s presence. If Trump were to sell his stake, it might signal a lack of confidence in the company, potentially shaking investor confidence and further depressing the stock price.

Trump’s decision is also influenced by his ongoing legal battles, which have already cost him over $100 million in legal fees. Selling his shares could provide a significant financial boost, helping him cover these mounting expenses. However, this move could also have political ramifications, especially as he continues his bid for the Republican nomination in the 2024 presidential race.

Trump Media’s success is closely tied to Trump’s political fortunes. The company’s stock has shown volatility in response to developments in the presidential race, with Trump’s chances of winning having a direct impact on the stock’s value. If Trump sells his stake, it could be interpreted as a lack of confidence in his own political future, potentially undermining both his campaign and the company’s prospects.

Truth Social, the flagship product of TMTG, has faced challenges in generating traffic and advertising revenue, especially compared to established social media giants like X (formerly Twitter) and Facebook. Despite this, the company’s valuation has remained high, fueled by investor speculation on Trump’s political future. If Trump remains in the race and manages to secure the presidency, the value of his shares could increase. Conversely, any missteps on the campaign trail could have the opposite effect, further destabilizing the stock.

As the lockup period comes to an end, Trump faces a critical decision that could shape the future of both his personal finances and Truth Social. Whether he chooses to hold onto his shares or cash out, the outcome will likely have significant consequences for the company, its investors, and Trump’s political aspirations.

Media

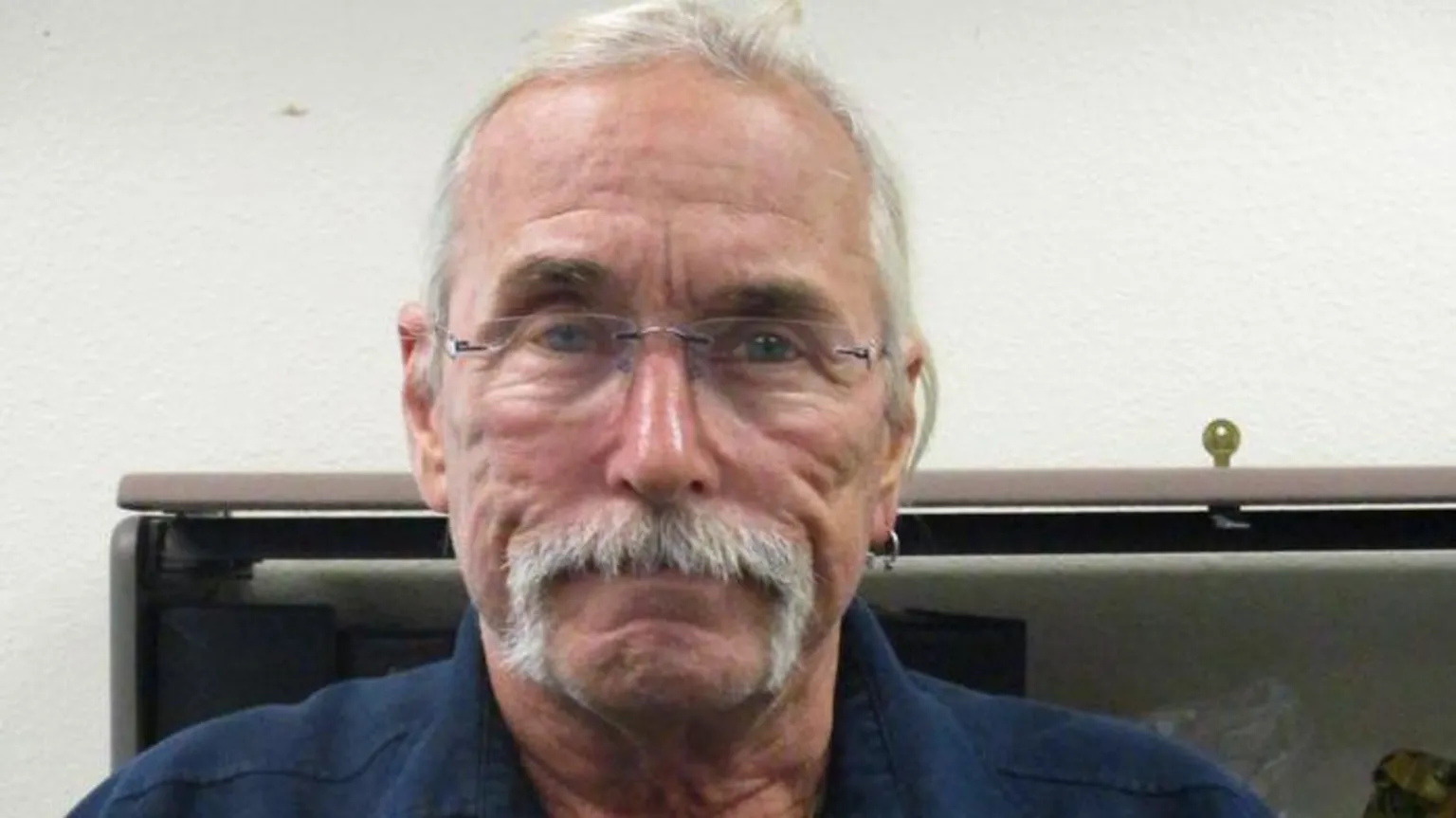

Arizona man accused of social media threats to Trump is arrested

Cochise County, AZ — Law enforcement officials in Arizona have apprehended Ronald Lee Syvrud, a 66-year-old resident of Cochise County, after a manhunt was launched following alleged death threats he made against former President Donald Trump. The threats reportedly surfaced in social media posts over the past two weeks, as Trump visited the US-Mexico border in Cochise County on Thursday.

Syvrud, who hails from Benson, Arizona, located about 50 miles southeast of Tucson, was captured by the Cochise County Sheriff’s Office on Thursday afternoon. The Sheriff’s Office confirmed his arrest, stating, “This subject has been taken into custody without incident.”

In addition to the alleged threats against Trump, Syvrud is wanted for multiple offences, including failure to register as a sex offender. He also faces several warrants in both Wisconsin and Arizona, including charges for driving under the influence and a felony hit-and-run.

The timing of the arrest coincided with Trump’s visit to Cochise County, where he toured the US-Mexico border. During his visit, Trump addressed the ongoing border issues and criticized his political rival, Democratic presidential nominee Kamala Harris, for what he described as lax immigration policies. When asked by reporters about the ongoing manhunt for Syvrud, Trump responded, “No, I have not heard that, but I am not that surprised and the reason is because I want to do things that are very bad for the bad guys.”

This incident marks the latest in a series of threats against political figures during the current election cycle. Just earlier this month, a 66-year-old Virginia man was arrested on suspicion of making death threats against Vice President Kamala Harris and other public officials.

Media

Trump Media & Technology Group Faces Declining Stock Amid Financial Struggles and Increased Competition

Trump Media & Technology Group’s stock has taken a significant hit, dropping more than 11% this week following a disappointing earnings report and the return of former U.S. President Donald Trump to the rival social media platform X, formerly known as Twitter. This decline is part of a broader downward trend for the parent company of Truth Social, with the stock plummeting nearly 43% since mid-July. Despite the sharp decline, some investors remain unfazed, expressing continued optimism for the company’s financial future or standing by their investment as a show of political support for Trump.

One such investor, Todd Schlanger, an interior designer from West Palm Beach, explained his commitment to the stock, stating, “I’m a Republican, so I supported him. When I found out about the stock, I got involved because I support the company and believe in free speech.” Schlanger, who owns around 1,000 shares, is a regular user of Truth Social and is excited about the company’s future, particularly its plans to expand its streaming services. He believes Truth Social has the potential to be as strong as Facebook or X, despite the stock’s recent struggles.

However, Truth Social’s stock performance is deeply tied to Trump’s political influence and the company’s ability to generate sustainable revenue, which has proven challenging. An earnings report released last Friday showed the company lost over $16 million in the three-month period ending in June. Revenue dropped by 30%, down to approximately $836,000 compared to $1.2 million during the same period last year.

In response to the earnings report, Truth Social CEO Devin Nunes emphasized the company’s strong cash position, highlighting $344 million in cash reserves and no debt. He also reiterated the company’s commitment to free speech, stating, “From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing.”

Despite these assurances, investors reacted negatively to the quarterly report, leading to a steep drop in stock price. The situation was further complicated by Trump’s return to X, where he posted for the first time in a year. Trump’s exclusivity agreement with Trump Media & Technology Group mandates that he posts personal content first on Truth Social. However, he is allowed to make politically related posts on other social media platforms, which he did earlier this week, potentially drawing users away from Truth Social.

For investors like Teri Lynn Roberson, who purchased shares near the company’s peak after it went public in March, the decline in stock value has been disheartening. However, Roberson remains unbothered by the poor performance, saying her investment was more about supporting Trump than making money. “I’m way at a loss, but I am OK with that. I am just watching it for fun,” Roberson said, adding that she sees Trump’s return to X as a positive move that could expand his reach beyond Truth Social’s “echo chamber.”

The stock’s performance holds significant financial implications for Trump himself, as he owns a 65% stake in Trump Media & Technology Group. According to Fortune, this stake represents a substantial portion of his net worth, which could be vulnerable if the company continues to struggle financially.

Analysts have described Truth Social as a “meme stock,” similar to companies like GameStop and AMC that saw their stock prices driven by ideological investments rather than business fundamentals. Tyler Richey, an analyst at Sevens Report Research, noted that the stock has ebbed and flowed based on sentiment toward Trump. He pointed out that the recent decline coincided with the rise of U.S. Vice President Kamala Harris as the Democratic presidential nominee, which may have dampened perceptions of Trump’s 2024 election prospects.

Jay Ritter, a finance professor at the University of Florida, offered a grim long-term outlook for Truth Social, suggesting that the stock would likely remain volatile, but with an overall downward trend. “What’s lacking for the true believer in the company story is, ‘OK, where is the business strategy that will be generating revenue?'” Ritter said, highlighting the company’s struggle to produce a sustainable business model.

Still, for some investors, like Michael Rogers, a masonry company owner in North Carolina, their support for Trump Media & Technology Group is unwavering. Rogers, who owns over 10,000 shares, said he invested in the company both as a show of support for Trump and because of his belief in the company’s financial future. Despite concerns about the company’s revenue challenges, Rogers expressed confidence in the business, stating, “I’m in it for the long haul.”

Not all investors are as confident. Mitchell Standley, who made a significant return on his investment earlier this year by capitalizing on the hype surrounding Trump Media’s planned merger with Digital World Acquisition Corporation, has since moved on. “It was basically just a pump and dump,” Standley told ABC News. “I knew that once they merged, all of his supporters were going to dump a bunch of money into it and buy it up.” Now, Standley is staying away from the company, citing the lack of business fundamentals as the reason for his exit.

Truth Social’s future remains uncertain as it continues to struggle with financial losses and faces stiff competition from established social media platforms. While its user base and investor sentiment are bolstered by Trump’s political following, the company’s long-term viability will depend on its ability to create a sustainable revenue stream and maintain relevance in a crowded digital landscape.

As the company seeks to stabilize, the question remains whether its appeal to Trump’s supporters can translate into financial success or whether it will remain a volatile stock driven more by ideology than business fundamentals.

-

News13 hours ago

News13 hours agoB.C. to scrap consumer carbon tax if federal government drops legal requirement: Eby

-

News13 hours ago

News13 hours agoA linebacker at West Virginia State is fatally shot on the eve of a game against his old school

-

Sports14 hours ago

Sports14 hours agoLawyer says Chinese doping case handled ‘reasonably’ but calls WADA’s lack of action “curious”

-

Sports8 hours ago

Sports8 hours agoCanada’s Marina Stakusic advances to quarterfinals at Guadalajara Open

-

News13 hours ago

News13 hours agoHall of Famer Joe Schmidt, who helped Detroit Lions win 2 NFL titles, dies at 92

-

News14 hours ago

News14 hours agoRCMP say 3 dead, suspects at large in targeted attack at home in Lloydminster, Sask.

-

News23 hours ago

Local Toronto business story – Events Industry : new national brand, Element Event Solutions

-

News14 hours ago

News14 hours agoProvinces decry Ottawa’s plan to resettle asylum seekers across the country