Business

Peel and Toronto's top doctors want to be placed in lockdown level of Ontario's framework for coronavirus restrictions – CP24 Toronto's Breaking News

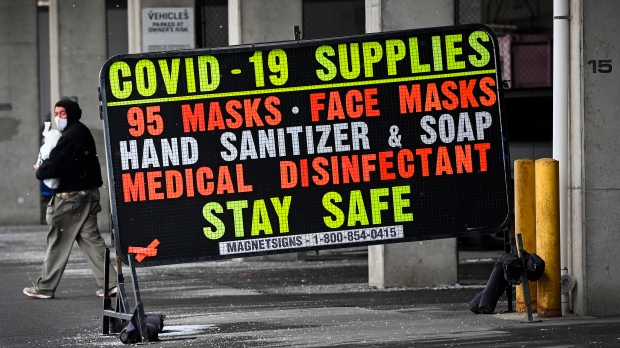

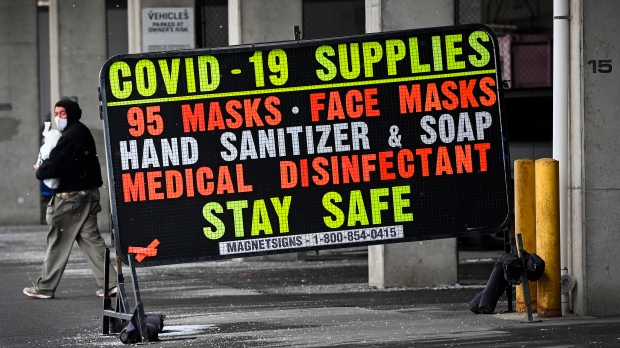

Toronto’ top doctor is asking the province to place the city in the grey lockdown category of its framework for COVID-19 restrictions as of Monday, allowing non-essential retail stores to reopen while keeping most other businesses closed.

Medical Officer of Health Dr. Eileen de Villa shared her recommendation during a briefing at city hall on Wednesday, calling it a “modest step towards more flexibility in daily life.”

If approved by the provincial government the designation would allow non-essential retail stores to reopen across the city, including those located in shopping malls.

Most stores, however, will be limited to no more than 25 per cent of their regular capacity. Grocers, convenience stores and other businesses that primarily sell food will be allowed up to 50 per cent of their regular capacity.

“Based on the data in front of us it is clear that reopening widely such as under the red category of the provincial framework is not advisable at this time given our case counts,” de Villa said, noting that the number of samples that have screened positive for a variant of concern in Toronto have doubled over the last week. “Moving out of the stay-at home order is a reasonable course of action for Toronto although I will add that while there are evident reasons for a change in status there remains reasons or risks that underscore how moving back into grey status is, or will be, a delicate balance.”

The province lifted its state of emergency order last month and began gradually moving regions back into its framework, with the exception of Toronto, Peel and North Bay which have remained under an extended stay-at-home order.

As part of Toronto’s potential move back into the grey zone, de Villa has issued a Section 22 order that will establish a series of additional requirements for workplaces with active outbreaks, including the mandatory wearing of masks at all times by employees.

De Villa said that she has also asked the Ministry of Labour to conduct a “workplace inspection blitz” in the city.

“Returning to the province’s framework represents a modest step towards more flexibility in daily life which can be taken because we all worked to limit the spread of COVID-19 but it is important that we all act in ways that do not squander these hard earned small steps forward,” she told reporters. “It is a question of preserving what we have gained.”

Wednesday was Toronto’s 100th consecutive day under a lockdown but the recommendation made by de Villa could represent a slight loosening of restrictions for the first time since this summer.

Of course, restaurants and bars will remain takeout-only and other businesses like gyms and hair salons won’t be able to reopen for at least two weeks.

Indoor gatherings of people from different households will also continue to be prohibited, though outdoor gatherings of up to 10 people will be allowed.

“I am very sympathetic to those who will not be able to reopen going into grey but I think the best way in which we can avoid that further lockdown later on, which I think everybody to a person says would be the worst case scenario, is to take these cautious steps one at a time and to follow public health advice and keep doing what we have been doing in many respects and then the day may not be too far down the road where we can do more,” Mayor John Tory said during Wednesday’s briefing.

Peel’s top doctor has also asked for region to be kept in grey

De Villa’s announcement on Wednesday afternoon came hours after Peel’s Medical Officer of Health Dr. Lawrence Loh confirmed that he would also be advocating for his region to be placed under the grey lockdown category in the province’s framework.

The recommendation from Loh comes despite a vocal campaign from Mississauga Bonnie Crombie to have the region moved into the red zone, which would have allowed indoor dining to resume at bars and restaurants with capacity limits.

“From five cases just two weeks ago we now have over 100 confirmed case of variants in our community and 600 that have screened positive and these numbers give me pause,” Loh said earlier in the day. “Our hospitals are also seeing admissions related to spread of variants and while ICU occupancy has improved from the peak of the second wave it still remains at levels similar to what e saw in wave one in the spring of 2020. Reopening too quickly risks eliminating the gains we have made and putting lives and wellbeing at risk.”

Peel’s rolling-seven day average of new cases has risen from 194 at the this time last week to 213.

It also has the highest weekly incidence rate of any public health unit when adjusted for population.

Loh said that if conditions were different he would “absolutely recommend loosening measures more quickly,” as he did in July but can’t do so while cases are rising.

Speaking with reporters during a subsequent news conference on Wednesday afternoon, Crombie conceded that she was “extremely disappointed” by the decision but said that she understands the reasoning behind it.

Nonetheless, Crombie said that she wants the data reviewed on a weekly basis so that Peel can be moved to the red zone as soon as possible.

The province has typically said that it will not move regions to a new level in its framework until it has two weeks worth of data.

“It is extremely unfair that businesses in neighbouring regions have been allowed to reopen more fully. Think about this for just a moment if you will. If you are standing at Dundas Street at Winston Churchill Boulevard restaurants and stores on the south side of the street are open for business for in-person shopping and dining while on the north side of the street they are closed because the north side of the street is in Mississauga. That is simply unfair and also inequitable,” Crombie said.

Business

Why the Bank of Canada decided to hold interest rates in April – Financial Post

Article content

Divisions within the Bank of Canada over the timing of a much-anticipated cut to its key overnight interest rate stem from concerns of some members of the central bank’s governing council that progress on taming inflation could stall in the face of stronger domestic demand — or even pick up again in the event of “new surprises.”

“Some members emphasized that, with the economy performing well, the risk had diminished that restrictive monetary policy would slow the economy more than necessary to return inflation to target,” according to a summary of deliberations for the April 10 rate decision that were published Wednesday. “They felt more reassurance was needed to reduce the risk that the downward progress on core inflation would stall, and to avoid jeopardizing the progress made thus far.”

Article content

Others argued that there were additional risks from keeping monetary policy too tight in light of progress already made to tame inflation, which had come down “significantly” across most goods and services.

Some pointed out that the distribution of inflation rates across components of the consumer price index had approached normal, despite outsized price increases and decreases in certain components.

“Coupled with indicators that the economy was in excess supply and with a base case projection showing the output gap starting to close only next year, they felt there was a risk of keeping monetary policy more restrictive than needed.”

In the end, though, the central bankers agreed to hold the rate at five per cent because inflation remained too high and there were still upside risks to the outlook, albeit “less acute” than in the past couple of years.

Despite the “diversity of views” about when conditions will warrant cutting the interest rate, central bank officials agreed that monetary policy easing would probably be gradual, given risks to the outlook and the slow path for returning inflation to target, according to the summary of deliberations.

Article content

They considered a number of potential risks to the outlook for economic growth and inflation, including housing and immigration, according to summary of deliberations.

The central bankers discussed the risk that housing market activity could accelerate and further boost shelter prices and acknowledged that easing monetary policy could increase the likelihood of this risk materializing. They concluded that their focus on measures such as CPI-trim, which strips out extreme movements in price changes, allowed them to effectively look through mortgage interest costs while capturing other shelter prices such as rent that are more reflective of supply and demand in housing.

Recommended from Editorial

They also agreed to keep a close eye on immigration in the coming quarters due to uncertainty around recent announcements by the federal government.

“The projection incorporated continued strong population growth in the first half of 2024 followed by much softer growth, in line with the federal government’s target for reducing the share of non-permanent residents,” the summary said. “But details of how these plans will be implemented had not been announced. Governing council recognized that there was some uncertainty about future population growth and agreed it would be important to update the population forecast each quarter.”

• Email: bshecter@nationalpost.com

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Share this article in your social network

Business

Meta shares sink after it reveals spending plans – BBC.com

Shares in US tech giant Meta have sunk in US after-hours trading despite better-than-expected earnings.

The Facebook and Instagram owner said expenses would be higher this year as it spends heavily on artificial intelligence (AI).

Its shares fell more than 15% after it said it expected to spend billions of dollars more than it had previously predicted in 2024.

Meta has been updating its ad-buying products with AI tools to boost earnings growth.

It has also been introducing more AI features on its social media platforms such as chat assistants.

The firm said it now expected to spend between $35bn and $40bn, (£28bn-32bn) in 2024, up from an earlier prediction of $30-$37bn.

Its shares fell despite it beating expectations on its earnings.

First quarter revenue rose 27% to $36.46bn, while analysts had expected earnings of $36.16bn.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown, said its spending plans were “aggressive”.

She said Meta’s “substantial investment” in AI has helped it get people to spend time on its platforms, so advertisers are willing to spend more money “in a time when digital advertising uncertainty remains rife”.

More than 50 countries are due to have elections this year, she said, “which hugely increases uncertainty” and can spook advertisers.

She added that Meta’s “fortunes are probably also being bolstered by TikTok’s uncertain future in the US”.

Meta’s rival has said it will fight an “unconstitutional” law that could result in TikTok being sold or banned in the US.

President Biden has signed into law a bill which gives the social media platform’s Chinese owner, ByteDance, nine months to sell off the app or it will be blocked in the US.

Ms Lund-Yates said that “looking further ahead, the biggest risk [for Meta] remains regulatory”.

Last year, Meta was fined €1.2bn (£1bn) by Ireland’s data authorities for mishandling people’s data when transferring it between Europe and the US.

And in February of this year, Meta chief executive Mark Zuckerberg faced blistering criticism from US lawmakers and was pushed to apologise to families of victims of child sexual exploitation.

Ms Lund-Yates added that the firm has “more than enough resources to throw at legal challenges, but that doesn’t rule out the risks of ups and downs in market sentiment”.

Business

Oil Firms Doubtful Trans Mountain Pipeline Will Start Full Service by May 1st

|

|

Oil companies planning to ship crude on the expanded Trans Mountain pipeline in Canada are concerned that the project may not begin full service on May 1 but they would be nevertheless obligated to pay tolls from that date.

In a letter to the Canada Energy Regulator (CER), Suncor Energy and other shippers including BP and Marathon Petroleum have expressed doubts that Trans Mountain will start full service on May 1, as previously communicated, Reuters reports.

Trans Mountain Corporation, the government-owned entity that completed the pipeline construction, told Reuters in an email that line fill on the expanded pipeline would be completed in early May.

After a series of delays, cost overruns, and legal challenges, the expanded Trans Mountain oil pipeline will open for business on May 1, the company said early this month.

“The Commencement Date for commercial operation of the expanded system will be May 1, 2024. Trans Mountain anticipates providing service for all contracted volumes in the month of May,” Trans Mountain Corporation said in early April.

The expanded pipeline will triple the capacity of the original pipeline to 890,000 barrels per day (bpd) from 300,000 bpd to carry crude from Alberta’s oil sands to British Columbia on the Pacific Coast.

The Federal Government of Canada bought the Trans Mountain Pipeline Expansion (TMX) from Kinder Morgan back in 2018, together with related pipeline and terminal assets. That cost the federal government $3.3 billion (C$4.5 billion) at the time. Since then, the costs for the expansion of the pipeline have quadrupled to nearly $23 billion (C$30.9 billion).

The expansion project has faced continuous delays over the years. In one of the latest roadblocks in December, the Canadian regulator denied a variance request from the project developer to move a small section of the pipeline due to challenging drilling conditions.

The company asked the regulator to reconsider its decision, and received on January 12 a conditional approval, avoiding what could have been another two-year delay to start-up.

-

News22 hours ago

Amid concerns over ‘collateral damage’ Trudeau, Freeland defend capital gains tax change

-

Art19 hours ago

The unmissable events taking place during London’s Digital Art Week

-

Politics24 hours ago

Politics24 hours agoHow Michael Cohen and Trump went from friends to foes

-

News23 hours ago

U.K. tabloids abuzz with Canadian’s ‘Loch Ness monster’ photo

-

Politics23 hours ago

Politics23 hours agoPolitics Briefing: Saskatchewan residents to get carbon rebates despite province’s opposition to pricing program

-

News21 hours ago

What is a halal mortgage? How interest-free home financing works in Canada

-

Economy20 hours ago

German Business Outlook Hits One-Year High as Economy Heals

-

Politics15 hours ago

Politics15 hours agoOpinion: Fear the politicization of pensions, no matter the politician