Real eState

"People are willing to commute two days a week to get more space": We asked a realtor about recent market trends – Toronto Life

“People are willing to commute two days a week to get more space”: We asked a realtor about recent market trends

Last month, the city experienced a real estate boom, owing to pent-up demand following months of lockdown. Tom Storey, a Royal LePage realtor with eight years of experience in the Toronto market, had a front-row seat to all of the craziness. The biggest trend he noticed from buyers: people want more square footage and big backyards after being cooped up during Covid-19.

What was the market like when the city started reopening?

April was pretty much silent, and it was the bottom of the market for every real estate asset class, from condos and freeholds to corporate real estate. Since April is normally the busiest time of year for real estate sales, I suspected that the spring market might just be pushed to the summer, and that’s exactly what happened.

The Leslieville and Danforth areas have been doing extremely well, in that houses have been selling for significantly more than their listing price. The same goes for the west end close to the core—Roncesvalles and the Junction. The reason is that these areas have a lot of semi-detached properties, which are the most affordable freehold option for buyers. A lot of people buying those properties had been living in a condo in the core and didn’t want to move too far outside of downtown.

What’s motivating people to buy and sell and right now?

The simple answer is that we had three to four months of pent-up demand that we’ve never seen before, during which people weren’t buying or selling because they were told not to go outside. But also, I think people have been quarantined in their homes and condos. They realize “I’m going nuts and need to move,” or “I’m on Zoom calls all day, I’m cooped up in a space that’s too small and I want a backyard.”

How has the pandemic affected what buyers are looking for and avoiding?

It seems like everyone wants a house right now, and there’s a good amount of people willing to leave the city. They don’t know if a second wave or another lockdown is going to happen, so having more space is a big theme. The request for outdoor space, especially a fenced-in yard for people with dogs, is so common that it’s practically a joke within our team.

People are also asking for levels. For many couples who have been on Zoom calls all day at home, doing that on the same floor as their spouses and kids can be very distracting. So if one family member can make their Zoom calls upstairs, while the other conducts theirs on the main floor, that’s a lot more manageable.

So people are buying houses or moving out of the city altogether?

Exactly. A lot of people have been told things like, “You’re not coming into the office for the rest of 2020, and when you come back in 2021, it’s going to be two days a week.” Many of those people are willing to commute for those two days a week for the sake of more space.

I sold a house for a couple in Little Portugal recently. They had three young kids and decided to move to Milton, to a much larger house, since they both work at the big banks, and were told they’re not coming back into the office this year. They decided to move closer to their families and just commute when they’re allowed to go back to their offices, especially since it’ll probably be for a few days a week for the foreseeable future.

Another couple, who bought a condo from us four years ago, ended up moving to Hamilton. They had pretty much the same thought as that Little Portugal couple. They’re willing to commute in the future, their families are in Hamilton, and right now they just need more space because they don’t know how long this is all going to last.

You mentioned that lots of people are buying freeholds in Toronto. Are you seeing an excess of condo listings, since so many people are trying to move up the property ladder?

It’s true that people are selling their condos and moving into houses, and it’s part of why areas like Leslieville and Roncesvalles are doing so well, but I wouldn’t say there’s an excess of condo listings, even though there is more inventory. It’s more that we’re moving into a more balanced market between buyers and sellers. It still somewhat favors sellers, but not to the extreme degree it has in the past five years.

Condos prices have shot up 51 percent in the past five years, and that kind of double-digit growth isn’t sustainable over a long period. What happened after mid-March is that no new freehold inventory came into the market, so it’s still very low supply, while the condo market nearly doubled in supply. That’s because while there’s typically a low inventory for freehold homes in Toronto, demand for houses was up, so we’re looking at more buyers for the same number of homes. And since people are either leaving the city or wanting more space, and there’s practically no immigration right now, demand for condos went down and the inventory is just piling up. The condo market has slowed for the first time in five years.

Interesting.

One client of mine was renting a condo on King West and realized that the rental market had gone down. Given what she was currently paying, she could have gotten the same place for about $200 less in her building. So first, she thought, Maybe I’ll just move to that unit because it’s cheaper. But then she thought, If I’m going to move anyways, I might as well see if I can afford to buy now. And she ended up buying a one-bedroom condo in the St. Lawrence market area. Typically, the place she bought would have been listed low on purpose and held in the offer stage, and probably would have gotten several offers and sold slightly higher. Whereas now condo sellers are pretty sure they’ll get their listing price because there’s less competition due to space, relocation, and immigration factors. When my client ran the numbers on her mortgage, maintenance fees, and taxes, it wasn’t that much higher than what she was paying for rent.

Smaller condos—that is, those under $800,000—are still selling really well. Those at the higher range are still selling, but they’re taking a longer time to sell and have fewer offers. If you buy a condo between $800,000 and $1 million—with your mortgage, your maintenance fees, and your taxes—your total carrying cost per month to own that property is very similar to buying a $1 million or $1.1 million house, because the house doesn’t have the guaranteed maintenance fees. For the house, you have to put down a bigger deposit, cause it’s a bigger purchase price, but your actual cost per month of living is similar.

People are saying, “Instead of buying this $850,000 two-bedroom condo, I’m going to buy the $1 million smaller house because it’s going to cost me the same per month.” The price of a condo is getting closer and closer to the price of a townhouse. When that happens, people are going to go, “Why don’t I just buy a house?” Especially now that everyone’s looking for more space.

What’s happening in the rental market?

There are way more listings than normal. I checked recently, and in the core of downtown, there were 6,000 rentals available. This time last year, there would be maybe 2,000.

There are a variety of factors here. First, the rental market already slowed down before COVID because of the new Airbnb rules that say people can only host short-term rentals in their principal residence. And mid-Covid, the city banned short term rentals altogether. They’re allowed again now, but those new laws contributed to the increase in inventory, since former Airbnbs moved to the long-term rental market.

The other obvious reason is that we’ve had practically no immigration for four and a half months. Also, all the universities or colleges that have condo buildings around them typically rent out a lot. But if those students don’t have to come back to class, why are they going to rent a place beside the university?

Do you think the trend of people moving up the property ladder is going to last?

Not necessarily. The housing market is going up in price, and it’s extremely competitive. I think there will come a time in the next six to eight months, if the housing prices keep moving up at this pace, where people will start thinking, I’m just going to buy a condo because it’s more affordable.

That said, everything is so uncertain right now, and if anyone tells you they know 100 percent what’s going to happen in the real estate market, they’re lying. We can look at the trends and make predictions—but that’s it.

Lastly, it’s amazing to me that the condo market hasn’t gone down in value, given the lack of immigration post-Covid. People say the prices have gone up because of foreign buyers, but right now, it’s local people buying homes and the prices are still going crazy. So whatever way you cut it, Toronto has a shortage of housing based on our population.

Real eState

Surreal Estate: $15 million for a turnkey Muskoka resort with 41 guest rooms

|

|

Location: Port Severn, Muskoka

Price: $14,999,000

Size: 17 acres of land with 41 guest rooms and a three-bedroom cottage

Real estate agent: Ali Booth, Sotheby’s International Realty

The place

A fully operational vacation escape sitting on 17 acres of land on Little Lake in Muskoka. The property comes with 41 guest rooms, a three-bedroom cottage, a private island accessible by helicopter and more than 600 metres of shoreline. It’s a short drive from Highway 400 and several neighbouring resorts.

The history

This getaway was originally built in the 1950s. The current owners purchased the place in 2021 and immediately invested $1 million to replace the roof and rebuild the guest cottage. After serving as a filming location for Bachelor in Paradise Canada, it reopened for business in July of 2022. The owners are now taking on a new venture and looking to sell the resort to a wealthy investor.

Related: $11.9 million for a Muskoka compound perched atop its own peninsula

The tour

To begin, here’s an aerial view of the peninsula, with its many docks, green spaces and lodges. That’s Port Severn North Road just beyond the parking lot.

And here’s the main entrance. The original hotel was renovated around Y2K, and the current owners bought it in 2021.

In the lobby: guest check-in, a lounge and doric columns.

The full-service restaurant overlooks the lake and includes a café and lounge.

This reverse angle shows off the bar and dramatic circular ceiling.

There’s also a nail salon down the hall.

The indoor pool and hot tub are open year-round.

The shiplap ceilings and wall of windows add warmth to the massive space.

Here’s the 24-hour gym, with rubber floors.

Now for a peek inside one of the European-style suites, which are larger than traditional hotel rooms. This one is outfitted with hardwood floors, a stone fireplace, a floor-to-ceiling walkout and gold accents throughout.

The hotel also rents out its 90-seat conference centre for weddings and corporate retreats.

Here’s another look at the cavernous conference centre.

Outside, it’s all about the amenities: a tennis court, a patio, a private beach, many docks for water sports and a private island accessible by helicopter.

Speaking of water sports, guests are free to explore Little Lake and its seemingly endless waterways.

Here’s the tropical-themed beach.

Finally, another bird’s eye view of the compound, highlighting the ample space for expansion. While there have been no formal approvals for development, the town has provided zoning guidelines on what could be built here.

Have a home that’s about to hit the market? Send your property to realestate@torontolife.com.

Real eState

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

Like many of her clients, realtor Jenny Celly and her family moved from southern Ontario to southeast New Brunswick to find a more affordable home.

The slower pace and quality of Maritime life was very appealing.

“There’s less traffic. People, because they’re not as stressed out, they are friendlier, in my opinion, so that attracts a lot of people,” said Celly.

Moneysense.ca and Zoocasa, a consumer real estate search platform, have ranked Moncton as the top place in Canada to buy real estate for the third straight year.

Forty-five neighbourhoods and municipalities were ranked using factors such as the average price of a home, price growth over time and neighbourhood characteristics.

According to the rankings, the Greater Moncton area is highest in value and best buying conditions and has a seen a growth of 69 per cent over the past three years.

Celly said the region is still seeing buyers from Ontario and British Columbia purchasing homes sight unseen using Zoom or FaceTime – something that was very popular during the pandemic.

“I put myself in their shoes. So I’m saying, ‘OK, it smells kind of funny,’ because you are being their eyes and they will put in an offer after seeing the home via video. Most of the buyers are seeing their home for the first time on closing day,” said Celly.

One of realtor Tracy Gunter’s homes in north end Moncton recently sold in less than two weeks.

Gunter said it’s a seller’s market here, but there isn’t a lot of inventory.

“We don’t have a lot to sell. So, our buyers are coming in, they want to spend their money, but we don’t have the homes for them to buy. There is a house shortage,” said Gunter.

Gunter said what is selling are semi-detached homes and properties under $400,000 to people from outside the province and the country.

The average price of a home in the Greater Moncton area last year was $328,383.

“Things are slowing down a little bit, but people are still coming,” said Gunter. “Right now, it’s just finding homes for the people that need them.”

Moncton Mayor Dawn Arnold said the city’s appeal is its lifestyle and residents.

“We have kind, compassionate, collaborative people that want to work together that are engaged. They want to be a part of it all. There’s a real feeling of positive energy in our community right now,” said Arnold. “There’s really amazing people in our community.”

Celly said the area is attracting many families, retirees, and investors.

The main reason: the prices.

“We’re looking at bigger markets, bigger cities where prices are two to three times more than what you find in Moncton,” said Celly. “A lot of people who are looking at the Maritimes are also looking at the quality of life.”

Saint John was ranked second for best places to buy real estate, Fredericton fourth and Halifax/Dartmouth was sixth.

For more New Brunswick news visit our dedicated provincial page.

Real eState

Sask. real estate company that lost investors’ millions reaches settlement

|

|

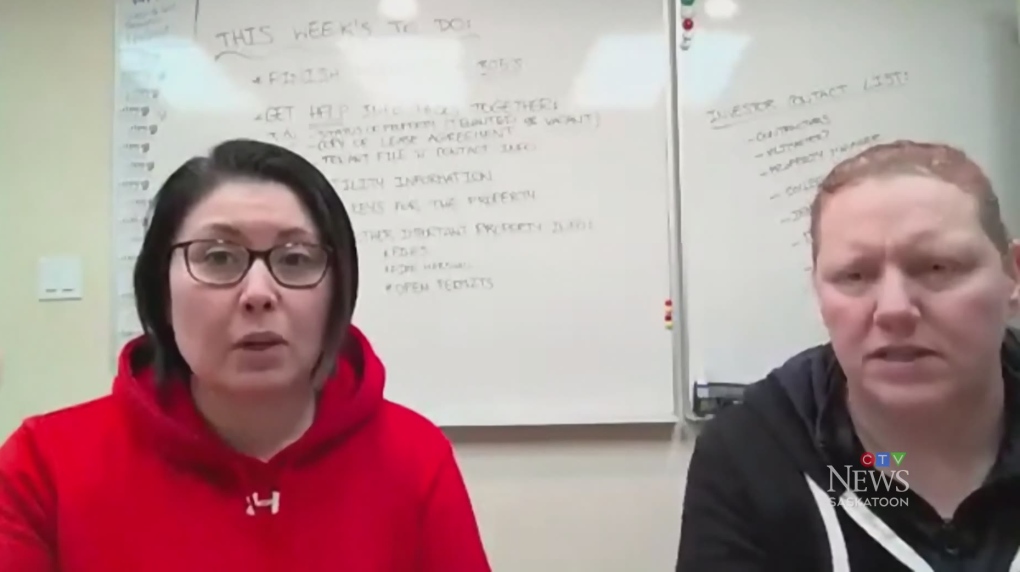

The founders of a Saskatoon real estate investment company that left investors with millions of dollars in losses have reached a settlement with Saskatchewan’s financial and consumer watchdog.

In a settlement with the Financial and Consumer Affairs Authority (FCAA) approved earlier this month, Rochelle Laflamme and Alisa Thompson, the founders of the now-defunct company Epic Alliance, have agreed to pay fines totalling $300,000, and are restricted from selling and promoting investment products for 20 years.

In 2022, a court-ordered investigation found that $211.9 million dollars invested in the company by multiple investors were mostly gone.

The meltdown of Epic Alliance resulted in significant financial losses for more than 120 investors, mainly from British Columbia and Ontario.

The company offered a “hassle-free” landlord program — offering to manage homes for out-of-province investors.

Under the landlord program, the investor would take out the mortgage on the home and Epic Alliance would assume responsibility for finding tenants and maintaining the property.

Many of the homes actually sat vacant as the company promised the investor a 15 per cent guaranteed rate of return on their investment.

A Saskatoon attorney representing some of the investors told CTV News in 2022 the pair were “using new money to pay old money.”

“Investment products should generate returns on (their) own, not by acquiring new money,” Mike Russell said.

The company also offered a “fund-a-flip” program, where investors could buy homes through Epic Alliance — which would oversee improvements and upgrades — and then sell for a profit, often advertised as a 10 per cent return on a one-year investment.

In their settlement with the FCAA, Laflamme and Thompson admit to selling investments when they were not licenced to do so, and continuing to raise investment money after the FCAA had ordered them to stop.

What the settlement doesn’t address are any allegations of fraud.

“The settlement agreement is silent on the issue of misrepresentations and / or fraud,” the FCAA panel wrote in its April 5 decision.

“There are no facts before the panel to evaluate whether the respondents engaged in misrepresentations or fraud vis-à-vis their investors. Furthermore, the statement of allegations did not allege the respondents’ conduct was fraudulent … the respondents’ culpability is limited to these specific violations of the Securities Act.”

Because there was no finding of fraud, the FCAA ruled it was not necessary to permanently ban Laflamme and Thompson from the investment industry.

“A permanent ban is not appropriate in these circumstances given that there is no agreement or finding that the respondents were fraudulent,” the decision says.

“A 20-year prohibition from involvement in the capital markets of Saskatchewan is significant.”

While the FCAA acknowledges the effect Laflamme and Thompson’s conduct had on their investors, the settlement does not include any compensation for them.

According to the FCAA, 96 investors paid an estimated $4.3 million to Epic Alliance over six years.

In January 2022, Laflamme and Thompson hosted a Zoom meeting to inform investors of the company’s imminent demise.

According to a transcript of the call included in a court filing, the company’s financial situation was described as a “s–t sandwich.”

“Unfortunately, anybody who had any unsecured debts … it’s all gone. Everything is gone. There is no business left and that’s what it is,” the transcription said.

Laflamme and Thompson started Epic Alliance in 2013.

—With files from Keenan Sorokan

-

Sports11 hours ago

Sports11 hours agoTeam Canada’s Olympics looks designed by Lululemon

-

Real eState19 hours ago

Search platform ranks Moncton real estate high | CTV News – CTV News Atlantic

-

Tech18 hours ago

Motorola's Edge 50 Phone Line Has Moto AI, 125-Watt Charging – CNET

-

Science22 hours ago

Science22 hours agoSpace exploration: A luxury or a necessity? – Phys.org

-

Sports22 hours ago

Sports22 hours agoRECAP: Red Wings' 5-4 comeback OT victory against Canadiens the result of belief, resiliency | Detroit Red Wings – NHL.com

-

News20 hours ago

Former mayor appealing sexual assault conviction dies of cancer

-

Business10 hours ago

Firefighters battle wildfire near Edson, Alta., after natural gas line rupture – CBC.ca

-

Media22 hours ago

Trump Media shares fall more than 10%, company says Truth Social to launch TV streaming – CNBC