Business

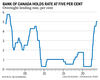

Posthaste: Bank of Canada’s 4 inflation ‘pillars’ no longer flashing red, analyst says

The “four pillars” the Bank of Canada says it will use to measure progress against inflation and guide interest rate decisions have already fallen into line, argues one analyst, blunting the central bank’s hawkish warning that it will hike again if price pressures don’t relent.

In its Sept. 6 decision to hold rates at five per cent, the central bank warned further hikes depended on “excess demand, inflation expectations, wage growth and corporate pricing power.”

“Well, excess demand has been eliminated, five-year inflation break-evens are well-anchored around two per cent, sequential momentum in wage growth has come to a screeching halt, and margins continued to compress throughout Q2,” said Jay Zhao-Murray, an analyst with commercial foreign exchange company Monex Canada, in a note following the release of the central bank’s decision.

Zhao-Murray broke down each of the measures to make the case that the Bank of Canada has achieved its goal of slowing the economy and inflation with its previous 10 rate increases.

Excess demand

Zhao-Murray said the case that “excess demand” persists is a hard sell given that second-quarter GDP contracted 0.2 per cent, well below the central bank’s projections in July for 1.5 per cent growth.

The Monex Canada analyst also noted that growth is currently running well below of the central bank’s estimated range for potential GDP growth of between 1.4 per cent and three per cent.

“The BoC will undoubtedly need to downgrade its growth forecasts in the next Monetary Policy Report, and it will struggle to argue that excess demand still lingers in the economy,” Zhao-Murray said.

Inflation expectations

The picture is a bit “murkier” when it comes to inflation expectations, Zhao-Murray said, noting that the most recent readings from the central bank date back to the first quarter.

In the absence of other data, the analyst pointed to the break-even inflation rate — the difference between the yield of a nominal bond and an inflation-linked bond of the same maturity — to get a read on expectations around pricing.

The most recent break-even reading is 2.05 per cent, just slightly off the Bank of Canada’s target inflation rate of two per cent.

“Its relative stability throughout 2023, suggests that inflation expectations are firmly anchored and on target,” Zhao-Murray said.

Wage growth

The Bank of Canada cited year-over-year wage growth, currently at four to five per cent, to sound the alarm on pay inflation.

However, there are signs gains in wages are slowing.

Zhao-Murray said the three-month moving average for wages contracted an average of 1.7 per cent annualized. Actual wages, he said, are also running below their April peak of $38.33 per hour.

That led to the unemployment rate rising in July to 5.5 per cent.

“With population growth being abnormally high and hiring intentions declining, we anticipate wages to come under further pressure from both the supply and demand sides of the labour market,” the analyst said.

Corporate margins

The operating and profit margins of TSX-listed companies are declining, argued Zhao-Murray.

While acknowledging there is no data showing what is happening at private companies, he said he expects more pressure on margins as consumer demand slows.

To be sure, margins remain historically elevated.

The profit margin for TSX companies was 11.7 per cent on Sept. 5, off a high of 14.3 per cent in June 2022. The average profit margin for the period from March 2010 to now is roughly 10.4 per cent.

“The trend is encouraging for core inflation given that price competition for market share will become an even more prevalent theme as we round out the end of the year,” Zhao-Murray said.

Data galore

In the wake of the Bank of Canada’s hold, several economists expect the next decision, scheduled for Oct. 25, to be data dependent.

From now to the end of next month, the calendar is chock-a-block with economic releases including another GDP report and two inflation and two jobs reports. Also, the central bank will release new editions of its Business Outlook Survey and Canadian Survey of Consumer Expectations for the second quarter.

“We continue to expect no further hikes this year, but the risks to our call tilt to the upside and are concentrated around the October meeting,” Zhao-Murray said.

Canada’s slowing real estate sector has been granted something of a reprieve by the Bank of Canada, after the central bank chose to hold its policy interest rate at five per cent after casting a chill over the housing market with two consecutive rate hikes to start the summer.

Mortgage strategist Robert McLister cautioned that the Bank of Canada’s warning should not be dismissed.

“If consumer inflation expectations tick meaningfully higher, I have no doubt the Bank of Canada will hammer them back down with at least another quarter-point hike, despite a shrinking economy,” McLister said in an email. “That’s not my prediction, but it’s a distinct possibility.”

Business

Japan’s SoftBank returns to profit after gains at Vision Fund and other investments

TOKYO (AP) — Japanese technology group SoftBank swung back to profitability in the July-September quarter, boosted by positive results in its Vision Fund investments.

Tokyo-based SoftBank Group Corp. reported Tuesday a fiscal second quarter profit of nearly 1.18 trillion yen ($7.7 billion), compared with a 931 billion yen loss in the year-earlier period.

Quarterly sales edged up about 6% to nearly 1.77 trillion yen ($11.5 billion).

SoftBank credited income from royalties and licensing related to its holdings in Arm, a computer chip-designing company, whose business spans smartphones, data centers, networking equipment, automotive, consumer electronic devices, and AI applications.

The results were also helped by the absence of losses related to SoftBank’s investment in office-space sharing venture WeWork, which hit the previous fiscal year.

WeWork, which filed for Chapter 11 bankruptcy protection in 2023, emerged from Chapter 11 in June.

SoftBank has benefitted in recent months from rising share prices in some investment, such as U.S.-based e-commerce company Coupang, Chinese mobility provider DiDi Global and Bytedance, the Chinese developer of TikTok.

SoftBank’s financial results tend to swing wildly, partly because of its sprawling investment portfolio that includes search engine Yahoo, Chinese retailer Alibaba, and artificial intelligence company Nvidia.

SoftBank makes investments in a variety of companies that it groups together in a series of Vision Funds.

The company’s founder, Masayoshi Son, is a pioneer in technology investment in Japan. SoftBank Group does not give earnings forecasts.

___

Yuri Kageyama is on X:

The Canadian Press. All rights reserved.

Business

Trump campaign promises unlikely to harm entrepreneurship: Shopify CFO

Shopify Inc. executives brushed off concerns that incoming U.S. President Donald Trump will be a major detriment to many of the company’s merchants.

“There’s nothing in what we’ve heard from Trump, nor would there have been anything from (Democratic candidate) Kamala (Harris), which we think impacts the overall state of new business formation and entrepreneurship,” Shopify’s chief financial officer Jeff Hoffmeister told analysts on a call Tuesday.

“We still feel really good about all the merchants out there, all the entrepreneurs that want to start new businesses and that’s obviously not going to change with the administration.”

Hoffmeister’s comments come a week after Trump, a Republican businessman, trounced Harris in an election that will soon return him to the Oval Office.

On the campaign trail, he threatened to impose tariffs of 60 per cent on imports from China and roughly 10 per cent to 20 per cent on goods from all other countries.

If the president-elect makes good on the promise, many worry the cost of operating will soar for companies, including customers of Shopify, which sells e-commerce software to small businesses but also brands as big as Kylie Cosmetics and Victoria’s Secret.

These merchants may feel they have no choice but to pass on the increases to customers, perhaps sparking more inflation.

If Trump’s tariffs do come to fruition, Shopify’s president Harley Finkelstein pointed out China is “not a huge area” for Shopify.

However, “we can’t anticipate what every presidential administration is going to do,” he cautioned.

He likened the uncertainty facing the business community to the COVID-19 pandemic where Shopify had to help companies migrate online.

“Our job is no matter what comes the way of our merchants, we provide them with tools and service and support for them to navigate it really well,” he said.

Finkelstein was questioned about the forthcoming U.S. leadership change on a call meant to delve into Shopify’s latest earnings, which sent shares soaring 27 per cent to $158.63 shortly after Tuesday’s market open.

The Ottawa-based company, which keeps its books in U.S. dollars, reported US$828 million in net income for its third quarter, up from US$718 million in the same quarter last year, as its revenue rose 26 per cent.

Revenue for the period ended Sept. 30 totalled US$2.16 billion, up from US$1.71 billion a year earlier.

Subscription solutions revenue reached US$610 million, up from US$486 million in the same quarter last year.

Merchant solutions revenue amounted to US$1.55 billion, up from US$1.23 billion.

Shopify’s net income excluding the impact of equity investments totalled US$344 million for the quarter, up from US$173 million in the same quarter last year.

Daniel Chan, a TD Cowen analyst, said the results show Shopify has a leadership position in the e-commerce world and “a continued ability to gain market share.”

In its outlook for its fourth quarter of 2024, the company said it expects revenue to grow at a mid-to-high-twenties percentage rate on a year-over-year basis.

“Q4 guidance suggests Shopify will finish the year strong, with better-than-expected revenue growth and operating margin,” Chan pointed out in a note to investors.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:SHOP)

The Canadian Press. All rights reserved.

Business

RioCan cuts nearly 10 per cent staff in efficiency push as condo market slows

TORONTO – RioCan Real Estate Investment Trust says it has cut almost 10 per cent of its staff as it deals with a slowdown in the condo market and overall pushes for greater efficiency.

The company says the cuts, which amount to around 60 employees based on its last annual filing, will mean about $9 million in restructuring charges and should translate to about $8 million in annualized cash savings.

The job cuts come as RioCan and others scale back condo development plans as the market softens, but chief executive Jonathan Gitlin says the reductions were from a companywide efficiency effort.

RioCan says it doesn’t plan to start any new construction of mixed-use properties this year and well into 2025 as it adjusts to the shifting market demand.

The company reported a net income of $96.9 million in the third quarter, up from a loss of $73.5 million last year, as it saw a $159 million boost from a favourable change in the fair value of investment properties.

RioCan reported what it says is a record-breaking 97.8 per cent occupancy rate in the quarter including retail committed occupancy of 98.6 per cent.

This report by The Canadian Press was first published Nov. 12, 2024.

Companies in this story: (TSX:REI.UN)

The Canadian Press. All rights reserved.

-

News24 hours ago

News24 hours agoChrystia Freeland says carbon rebate for small businesses will be tax-free

-

News24 hours ago

News24 hours agoFACT FOCUS: Election officials knock down Starlink vote rigging conspiracy theories

-

News24 hours ago

News24 hours agoNova Scotia election promise tracker: What has been promised by three main parties?

-

News24 hours ago

News24 hours agoFormer B.C. premier John Horgan, who connected with people, dies at 65

-

News24 hours ago

News24 hours agoSuncor Energy earnings rise to $2.02 billion in third quarter

-

News24 hours ago

News24 hours agoSwearing-in ceremonies at B.C. legislature mark start of new political season

-

News24 hours ago

News24 hours agoNew Brunswick premier confirms her Liberal government will draft carbon pricing plan

-

News24 hours ago

News24 hours agoB.C. teen with bird flu is in critical care, infection source unknown: health officer